Get more information on Zigbee Market - Request Sample Report

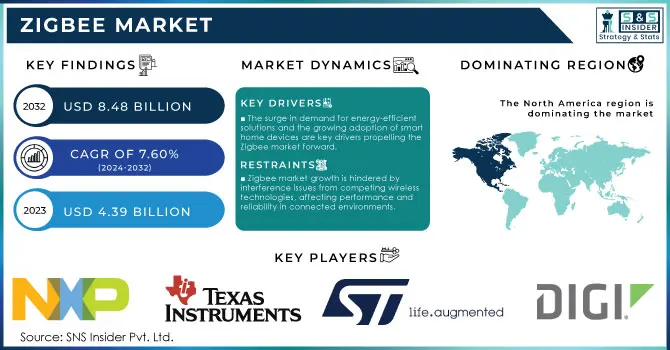

The Zigbee Market Size was valued at USD 4.39 Billion in 2023 and is expected to reach USD 8.48 Billion by 2032 and grow at a CAGR of 7.60% over the forecast period 2024-2032.

The Zigbee market is witnessing robust growth, driven primarily by the increasing adoption of smart home technologies. With the rising popularity of smart devices such as lighting, security systems, and HVAC controls, there is a burgeoning demand for reliable communication protocols, and Zigbee stands out due to its energy efficiency and interoperability. According to the Connectivity Standards Alliance (CSA), the number of Zigbee devices has grown to over 400 million by 2021, with a record of 66 million Zigbee devices shipped in 2020 alone. Additionally, the CSA reported that there were 1,823 Zigbee-certified products available in 2021, reflecting a growing ecosystem of compatible devices.

The emergence of platforms like Matter, which aims to unify smart home devices and improve interoperability across different ecosystems, has further strengthened Zigbee's position in the market. Wired emphasizes that Zigbee's established ecosystem provides a reliable foundation for smart home applications, ensuring devices can work together effectively. The technology’s low power consumption makes it an ideal choice for battery-operated devices, supporting longer operational lifetimes crucial for maintaining smart home functionality. According to a report by ABI Research, the Zigbee market is expected to grow significantly, with an anticipated 75% increase in smart lighting installations utilizing Zigbee technology by 2025.

The market is also expanding in industrial automation and healthcare sectors, where Zigbee’s robustness is leveraged for efficient monitoring and control of connected devices. However, Zigbee faces competition from other wireless protocols like Z-Wave and Wi-Fi, which offer different advantages depending on the application. Electronic Design notes that Zigbee is critical for ensuring the success of smart homes, as its reliability supports the increasing number of connected devices. Despite this competition, Zigbee continues to thrive, particularly as consumer awareness of smart home technologies grows and as more manufacturers embrace its capabilities. As Zigbee technology evolves and adapts to new demands, it is poised to play a pivotal role in shaping the future of connected living environments, solidifying its status as a leader in the Internet of Things (IoT) landscape.

Drivers

The surge in demand for energy-efficient solutions and the growing adoption of smart home devices are key drivers propelling the Zigbee market forward.

ZigBee’s low power consumption is a significant market driver, making it an ideal choice for battery-operated devices and supporting longer operational lifetimes. As energy efficiency becomes increasingly critical in today’s technology landscape, Zigbee stands out for its ability to minimize energy usage while maintaining reliable connectivity. This is especially important for smart home devices, where users seek to reduce their carbon footprint and energy bills. According to Science Daily, energy-efficient technologies could save the world 70% of energy costs by 2050, underscoring the urgent need for solutions like Zigbee in combating climate change. Moreover, research indicates that 74% of consumers prefer energy-efficient products, further fueling the demand for Zigbee-enabled devices. The appeal of smart lighting systems, which can seamlessly integrate with Zigbee networks, exemplifies this trend, offering substantial energy savings of up to 80% compared to traditional lighting options. As highlighted by Bangalore Mirror, the shift towards energy-efficient devices is not just a consumer preference but a necessity in the broader context of sustainable living. With the ongoing growth of the Internet of Things (IoT) expected to reach USD 1.1 trillion by 2026, Zigbee's energy efficiency positions it favorably in a competitive market, driving its adoption across various applications and sectors.

Restraints

Zigbee market growth is hindered by interference issues from competing wireless technologies, affecting performance and reliability in connected environments.

Zigbee technology operates primarily in the 2.4 GHz frequency band, a spectrum shared with many other wireless communication protocols such as Wi-Fi and Bluetooth. This overcrowding can lead to significant interference, which can negatively impact the performance and reliability of Zigbee networks. As Zigbee devices communicate over a limited bandwidth, the presence of competing signals from Wi-Fi routers or Bluetooth devices can cause packet loss, reduced range, and slower communication speeds. This interference is particularly problematic in densely populated areas, where multiple devices are in use simultaneously. Zigbee networks may suffer from over 50% packet loss in scenarios with heavy interference, leading to frustration among users seeking reliable smart home solutions. To mitigate these interference issues, users can implement various strategies, such as optimizing their Zigbee network setup by adding routers or repeaters, which help extend the range and stability of the network. Additionally, separating Zigbee devices from Wi-Fi routers and minimizing the number of active devices in close proximity can improve performance. Despite these potential solutions, the inherent challenge of interference remains a significant restraint for the Zigbee market, potentially limiting its adoption in environments saturated with wireless technologies. As consumers and businesses increasingly seek reliable smart home and IoT solutions, overcoming interference challenges will be crucial for Zigbee's growth and sustainability in the market.

by Device

In the Zigbee market, Zigbee Home Automation holds a dominant share, accounting for 47% of total revenue in 2023. This significant share reflects the growing demand for smart home solutions that enhance convenience, energy efficiency, and security. Zigbee home automation encompasses a variety of devices, including smart lighting systems, thermostats, security cameras, door locks, and sensors, enabling users to control and monitor their home environments remotely. Recent product developments have further fueled this growth; for example, Philips Hue has expanded its range with Zigbee-compatible bulbs that improve interoperability, while Samsung SmartThings has introduced new Zigbee-enabled sensors for enhanced security and energy management. Amazon has also integrated Zigbee into its Echo devices, facilitating seamless control of various smart home products via voice commands. Increased consumer awareness of energy conservation and the convenience of automation has driven the adoption of Zigbee-enabled devices. As smart home technology becomes more mainstream, the demand for seamless interoperability between devices solidifies Zigbee's position as a preferred communication protocol. Ongoing innovations in IoT technology allow manufacturers to incorporate Zigbee capabilities into new products, aligning with consumer expectations for smarter, more connected homes, ensuring Zigbee home automation's leading position in the market for years to come.

by Application

In the Zigbee market, the Home Automation application segment captured the largest share of revenue, accounting for approximately 50% in 2023. This substantial share is primarily driven by the increasing consumer demand for smart home solutions that enhance convenience, security, and energy efficiency. Home automation encompasses a wide range of devices and applications, including smart lighting, thermostats, security systems, and various sensors that work together to create an interconnected home environment. The growing popularity of smart lighting systems is a key contributor to this segment's success, as these systems allow homeowners to customize lighting based on their preferences and energy usage. For instance, Philips has expanded its Hue line with new Zigbee-compatible smart bulbs that provide enhanced interoperability with other Zigbee devices, allowing users to control their lighting seamlessly through voice commands and mobile apps. Similarly, Samsung SmartThings has introduced new Zigbee-enabled sensors that enhance home security and energy management, including door/window sensors and motion detectors that can integrate with existing smart home ecosystems. The integration of Zigbee into Amazon's Echo devices has also been pivotal, as it enables users to manage their Zigbee-compatible devices via voice commands, making home automation more accessible and user-friendly. Security systems also play a vital role in the Home Automation segment. Zigbee-compatible security cameras, door locks, and motion sensors offer homeowners real-time monitoring and control over their property. Recent product launches, such as August's Zigbee-enabled smart locks, illustrate the trend toward integrating advanced security features with user-friendly smart home technology.

Furthermore, the increasing awareness of energy conservation and the desire for sustainable living solutions are propelling the adoption of home automation technologies. As smart home technology continues to gain traction, the Home Automation application segment is expected to maintain its dominant position in the Zigbee market, driven by innovations and advancements that meet consumer demands for enhanced connectivity and automation.

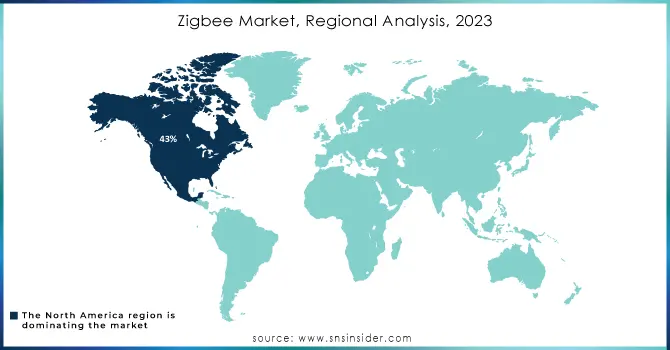

In 2023, North America emerged as the dominant region in the Zigbee market, capturing approximately 43% of the total revenue. This leadership can be attributed to several factors, including the high adoption rate of smart home technologies, robust investments in the Internet of Things (IoT), and a growing emphasis on energy efficiency and automation. The United States, in particular, has seen a surge in consumer demand for smart home devices, driving the growth of Zigbee-enabled solutions across various applications. The proliferation of smart lighting, security systems, and HVAC controls has significantly contributed to the region's market share. Major players, such as Philips and Amazon, have played a pivotal role by introducing Zigbee-compatible products that enhance interoperability and ease of use. For instance, Amazon's integration of Zigbee into its Echo devices has facilitated seamless control of smart home products, making it easier for consumers to adopt these technologies. Additionally, the presence of well-established technology companies and a strong manufacturing base further bolsters the Zigbee market in North America. Companies are increasingly focusing on product development and innovation, launching new Zigbee-enabled devices to cater to evolving consumer preferences. This trend is evidenced by recent product launches from brands like Samsung and Signify, which enhance home automation and security features, creating a more cohesive smart home experience. The region's strong regulatory support for energy-efficient solutions, coupled with heightened consumer awareness regarding sustainability, is also driving the adoption of Zigbee technology. As energy conservation becomes a priority for many households, Zigbee's low power consumption and reliable connectivity make it an attractive choice for smart home applications. North America is poised for continued growth in the Zigbee market, with increasing investment in smart home infrastructure and advancements in IoT technologies. The anticipated expansion of the smart home market, combined with the ongoing development of innovative Zigbee-enabled devices, is expected to solidify North America’s leadership position in the global Zigbee market.

Asia Pacific is rapidly establishing itself as the second fastest-growing region in the Zigbee market, driven by strong demand for smart home and IoT applications. This growth is fueled by several factors, including swift urbanization, rising disposable incomes, and an expanding middle class eager to embrace advanced technologies. Leading countries such as China, India, and Japan are at the forefront of this trend, supported by government initiatives aimed at promoting smart cities and enhancing digital infrastructure.

The region is witnessing significant growth in the adoption of smart home devices, including lighting, security systems, and energy management solutions. For example, Xiaomi has launched various Zigbee-enabled products, such as smart sensors and lighting options, to cater to the increasing need for interconnected home environments. Similarly, Philips is broadening its range of Zigbee-compatible offerings, emphasizing its dedication to innovation in smart lighting. Key regional players like Samsung and TP-Link are also developing Zigbee-enabled devices to enhance the interoperability of smart home ecosystems. Samsung's new Zigbee-enabled smart appliances promote seamless integration with its SmartThings platform, while TP-Link's expanded Kasa Smart line includes Zigbee products, providing consumers with more choices.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the Major Key Players in Zigbee Market who provide product and offering:

NXP Semiconductors (Zigbee transceivers, microcontrollers)

Texas Instruments (Zigbee system-on-chips (SoCs), wireless connectivity modules)

Silicon Laboratories (Zigbee modules, SoCs, development kits)

STMicroelectronics (Zigbee chips, wireless connectivity solutions)

Digi International (Zigbee gateways, routers, modules)

Qualcomm (Zigbee chipsets, IoT connectivity platforms)

Microchip Technology (Zigbee RF transceivers, wireless modules)

Cypress Semiconductor (Zigbee wireless solutions, microcontrollers)

Honeywell International (Zigbee-enabled smart thermostats, sensors)

Schneider Electric (Zigbee smart energy management systems)

Philips Lighting (Signify) (Zigbee-enabled smart lighting solutions, bulbs)

Belkin International (Zigbee-enabled smart home devices, smart plugs)

Osram Licht AG (Zigbee smart lighting solutions)

Johnson Controls (Zigbee-enabled building automation systems)

Legrand (Zigbee-connected smart switches, lighting systems)

Amazon (Zigbee-enabled Echo devices, smart home controllers)

Samsung Electronics (Zigbee-enabled smart home hubs, appliances)

Huawei Technologies (Zigbee IoT solutions, smart home systems)

Xiaomi (Zigbee-enabled smart home devices, sensors)

Bosch (Zigbee-enabled security systems, sensors)

List of Zigbee raw material suppliers, focusing on companies that provide materials for the semiconductors and electronic components used in Zigbee modules and devices:

Dupont

BASF

Dow Inc.

3M

Shin-Etsu Chemical Co., Ltd.

Sumitomo Chemical

Applied Materials

Evonik Industries

Linde Group

Air Liquide

Recent Development

October 14, 2024: Samsung has released a firmware update for the SmartThings hub that enhances Zigbee connectivity and resolves known issues with device pairing, significantly improving the overall user experience and stability of smart home devices. Users are encouraged to install the update to optimize performance.

September 28, 2024): Aqara has launched its latest Zigbee hub models, including the Hub M2 and the Camera Hub G2H, in the UK market, expanding its smart home ecosystem and enhancing HomeKit compatibility for a broader range of devices. This launch follows the gradual introduction of Aqara products to various regions since the original hub's debut in 2018.

October 4, 2024: Mouser Electronics has announced the availability of the WBZ350 module, which integrates Bluetooth and Zigbee radios with a secure microcontroller from Microchip. This module is built on the PIC32CX-BZ family, featuring a 64MHz Arm Cortex M4F processor, enhancing connectivity and security for IoT applications.

August 23, 2024: A new Zigbee wrapper library has been added to the Arduino Core for ESP32 by an Espressif engineer, enhancing support for Zigbee on newer ESP32-H2 and ESP32-C6 wireless SoCs. This development simplifies integration, allowing these chips to function as standalone Zigbee nodes or as radio co-processors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.39 Billion |

| Market Size by 2032 | USD 8.48 Billion |

| CAGR | CAGR of 7.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Standard Type (Zigbee RF4CE, Zigbee, Zigbee PRO, Zigbee 3.0, Zigbee Remote Control 2.0, Zigbee IP) • By Device Type (Zigbee Home Automation, Zigbee Smart Energy, Zigbee Light Link, Others) • By Application (Home Automation, Industrial Automation, Telecommunication Services, Healthcare, and others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NXP Semiconductors, Texas Instruments, Silicon Laboratories, STMicroelectronics, Digi International, Qualcomm, Microchip Technology, Cypress Semiconductor, Honeywell International, Schneider Electric, Philips Lighting (Signify), Belkin International, Osram Licht AG, Johnson Controls, Legrand, Amazon, Samsung Electronics, Huawei Technologies, Xiaomi, and Bosch are key players in the Zigbee market. |

| Key Drivers | • The surge in demand for energy-efficient solutions and the growing adoption of smart home devices are key drivers propelling the Zigbee market forward. |

| RESTRAINTS | • Zigbee market growth is hindered by interference issues from competing wireless technologies, affecting performance and reliability in connected environments. |

Ans: The Zigbee Market Size was valued at USD 4.39 Billion in 2023 and is expected to reach USD 8.48 Billion by 2032

Ans: Low level of energy consumption and IOT technology are the drivers of ZigBee Market.

Ans: North America is dominating in Zigbee Market in 2023

Ans: Zigbee Home Automation is dominating in Zigbee Market in 2023

Ans : The Expected CAGR in Zigbee is 7.60%

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Zigbee Device Production and Sales Volumes, 2020-2032, by Region

5.2 Compliance with IoT Standards, by Region

5.3 Adoption of Zigbee Technology, by Region

5.4 Consumer Preferences for Zigbee-Enabled Solutions, by Region

5.5 Aftermarket Trends in Zigbee Solutions

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Zigbee Market Segmentation, by Standard

7.1 Chapter Overview

7.2 ZigBee RF4CE

7.2.1 ZigBee RF4CE Market Trends Analysis (2020-2032)

7.2.2 ZigBee RF4CE Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 ZigBee

7.3.1 ZigBee Market Trends Analysis (2020-2032)

7.3.2 ZigBee Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 ZigBee PRO

7.4.1 ZigBee PRO Market Trends Analysis (2020-2032)

7.4.2 ZigBee PRO Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 ZigBee 3.0

7.5.1 ZigBee 3.0 Market Trends Analysis (2020-2032)

7.5.2 ZigBee 3.0 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 ZigBee remote control 2.0

7.5.1 ZigBee remote control 2.0 Market Trends Analysis (2020-2032)

7.5.2 ZigBee remote control 2.0 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 ZigBee IP

7.5.1 ZigBee IP Market Trends Analysis (2020-2032)

7.5.2 ZigBee IP Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Zigbee Market Segmentation, by Device

8.1 Chapter Overview

8.2 Zigbee Home Automation

8.2.1 Zigbee Home Automation Market Trends Analysis (2020-2032)

8.2.2 Zigbee Home Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Zigbee Smart Energy

8.3.1 Zigbee Smart Energy Market Trends Analysis (2020-2032)

8.3.2 Zigbee Smart Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Zigbee Light Link

8.4.1 Zigbee Light Link Market Trends Analysis (2020-2032)

8.4.2 Zigbee Light Link Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Zigbee Market Segmentation, by Application

9.1 Chapter Overview

9.2 Home Automation

9.2.1 Home Automation Market Trends Analysis (2020-2032)

9.2.2 Home Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Industrial Automation

9.3.1 Industrial Automation Market Trends Analysis (2020-2032)

9.3.2 Industrial Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Telecommunication Services

9.4.1 Telecommunication Services Market Trends Analysis (2020-2032)

9.4.2 Telecommunication Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Healthcare

9.5.1 Healthcare Market Trends Analysis (2020-2032)

9.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.2.4 North America Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.2.5 North America Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.2.6.2 USA Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.2.6.3 USA Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.2.7.2 Canada Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.2.7.3 Canada Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.2.8.2 Mexico Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.2.8.3 Mexico Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.6.2 Poland Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.6.3 Poland Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.7.2 Romania Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.7.3 Romania Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.4 Western Europe Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.5 Western Europe Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.6.2 Germany Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.6.3 Germany Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.7.2 France Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.7.3 France Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.8.2 UK Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.8.3 UK Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.9.2 Italy Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.9.3 Italy Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.10.2 Spain Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.10.3 Spain Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.13.2 Austria Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.13.3 Austria Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.6.2 China Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.6.3 China Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.7.2 India Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.7.3 India Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.8.2 Japan Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.8.3 Japan Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.9.2 South Korea Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.9.3 South Korea Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.10.2 Vietnam Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.10.3 Vietnam Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.11.2 Singapore Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.11.3 Singapore Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.12.2 Australia Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.12.3 Australia Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.4 Middle East Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.5 Middle East Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.6.2 UAE Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.6.3 UAE Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.2.4 Africa Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.2.5 Africa Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Zigbee Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.6.4 Latin America Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.6.5 Latin America Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.6.6.2 Brazil Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.6.6.3 Brazil Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.6.7.2 Argentina Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.6.7.3 Argentina Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.6.8.2 Colombia Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.6.8.3 Colombia Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Zigbee Market Estimates and Forecasts, by Standard (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Zigbee Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Zigbee Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 NXP Semiconductors

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Texas Instruments

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Silicon Laboratories

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 STMicroelectronics

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Digi International

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Qualcomm

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Microchip Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Cypress Semiconductor

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Honeywell International

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Schneider Electric

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Standard Type

ZigBee RF4CE

ZigBee

ZigBee PRO

ZigBee 3.0

ZigBee remote control 2.0

ZigBee IP

By Device Type

Zigbee Home Automation

Zigbee Smart Energy

Zigbee Light Link

Others

By Application

Home Automation

Industrial Automation

Telecommunication Services

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Light Field Market Size was valued at USD 1.44 Billion in 2023 and is expected to reach USD 4.92 Billion by 2032 and grow at a CAGR of 14.62% over the forecast period 2024-2032.

The Wet Chemicals for Electronics and Semiconductor Applications Market was valued as USD 3.9 Billion in 2023, Growing at a CAGR of 3.68% During 2024-2032

The Light Sensor Market Size was valued at USD 4.09 Billion in 2023 and is expected to grow at a CAGR of 9.4% to reach USD 11.30 Billion by 2032.

The Grow Lights Market Size was valued at USD 4.30 billion in 2023 and is expecting to grow at a CAGR of 16.37% to reach USD 16.38 billion by 2032.

The Drone Sensor Market Size was valued at USD 1.26 Billion in 2023 and is expected to grow at a CAGR of 11.12% to reach USD 3.25 Billion by 2032.

The Board-to-Board Connectors Market was valued at USD 11.25 billion in 2023 and is expected to reach USD 18.14 billion by 2032, growing at a CAGR of 5.49% over the forecast period 2024-2032

Hi! Click one of our member below to chat on Phone