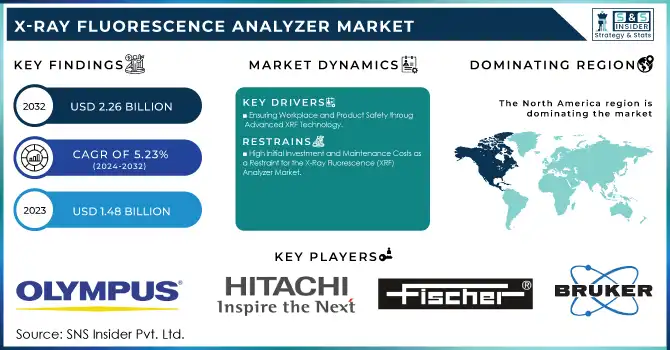

X-Ray Fluorescence Analyzer Market Size & Overview:

The X-Ray Fluorescence Analyzer Market size was valued at USD 1.48 billion in 2023 and is expected to grow to USD 2.26 billion by 2032 and grow at a CAGR of 5.23% over the forecast period of 2024-2032.

To get more information on X-Ray Fluorescence (XRF) Analyzer market - Request Free Sample Report

The X-Ray Fluorescence (XRF) Analyzer market is experiencing significant growth driven by the increasing demand for accurate, rapid, and non-destructive testing across industries such as metals, mining, and environmental monitoring. XRF analyzers are crucial for delivering precise elemental analysis without damaging samples, with major applications in quality control for metal production and mining. XRF technology analyzes materials, including precious metals like gold, through the interaction of X-rays with atoms, emitting secondary X-rays that are unique to each element. This method is widely used in environmental testing, detecting contaminants like heavy metals in soil, water, and air, contributing to better compliance with environmental regulations. XRF technology is used to detect toxic substances such as lead, mercury, and cadmium. Moreover, XRF is increasingly used in fields such as archaeology and forensic investigations, including identifying ivory based on a calcium to phosphorus ratio of 1.2–4.0 and a light element percentage range of 27%–76%. It effectively identifies 97% of ivory items and eliminates 83% of non-ivory items. The market is growing due to advancements in portability, accuracy, and speed, with handheld XRF analyzers gaining popularity for field-testing. These handheld devices provide immediate results, making them essential in jewelry stores, precious metal dealerships, and on-site quality control. The demand for XRF analyzers is also expanding due to their ability to conduct on-site analyses without sending samples to labs. The continued growth of non-destructive testing methods and the increasing adoption of XRF technology in diverse industries further propel the market. With continuous advancements in XRF technology, including improved portability and precision, the market for X-ray Fluorescence Analyzers is poised for strong expansion in the coming years.

X-Ray Fluorescence Analyzer Market Dynamics

Drivers

-

Ensuring Workplace and Product Safety through Advanced XRF Technology

The increasing focus on product quality and safety is a key driver for the X-ray Fluorescence (XRF) Analyzer market. XRF analyzers are integral in quality control across various industries, enabling the detection of impurities and contaminants, thereby ensuring product consistency, especially in sectors like pharmaceuticals, food safety, and construction. As regulatory standards become more stringent, especially in industries where safety is paramount, XRF technology plays an indispensable role. In pharmaceuticals, XRF ensures that medications are free from harmful substances, while in food safety, it is used to detect toxic elements like heavy metals, ensuring consumer safety. In the construction industry, XRF helps verify materials for compliance, such as detecting lead in paints and construction materials to meet safety regulations. Beyond consumer products, XRF analyzers are also vital in occupational safety. Portable X-ray Fluorescence Spectrometers (PXRF), equipped with miniaturized X-ray tubes, are now used to screen for lead exposure in workplace environments. Studies show that PXRF provides rapid and real-time detection of lead in dust and fumes, with high correlation (R² > 0.99) to traditional lab methods, ensuring the protection of workers from hazardous exposure. PXRF can immediately quantify removable lead residues from surfaces, demonstrating strong accuracy (R² ~ 0.88) when compared to off-site wet chemistry analysis. As the demand for workplace safety, regulatory compliance, and environmental protection rises, the market for XRF analyzers continues to expand. With continuous technological advancements, including increased portability and precision, XRF analyzers are becoming increasingly essential across industries, driving the growth of the market and reinforcing the importance of ensuring product quality and safety.

Restraints

-

High Initial Investment and Maintenance Costs as a Restraint for the X-Ray Fluorescence (XRF) Analyzer Market

One of the key restraints for the X-ray Fluorescence (XRF) analyzer market is the high initial investment and ongoing maintenance costs associated with these instruments. XRF analyzers, especially portable and advanced models, come with significant upfront costs that can be prohibitive for smaller businesses and organizations with limited financial resources. For example, the purchase price of a new XRF analyzer can range from tens of thousands to over a hundred thousand dollars, depending on the complexity and features of the model. In addition to the initial cost, maintenance and calibration can add substantial ongoing expenses, as regular servicing is necessary to ensure accuracy and performance. These costs often include the replacement of components such as X-ray tubes, which can be expensive to replace. Furthermore, the need for specialized personnel to operate and maintain the equipment adds another layer of cost, requiring training or hiring skilled staff. Such financial burdens can limit the adoption of XRF technology, particularly in industries where budgets are constrained or where alternative, lower-cost analytical methods are available. The challenge of balancing the high capital and operational costs with the need for reliable, precise testing may hinder the widespread adoption of XRF technology, especially in smaller organizations or in developing markets where resources are limited. As a result, companies may delay purchasing or opt for cheaper alternatives, thus slowing down the overall market growth. These factors contribute to the restraint of the XRF analyzer market, despite its potential benefits for quality control and elemental analysis in various industries.

X-Ray Fluorescence Analyzer Market Segment Analysis

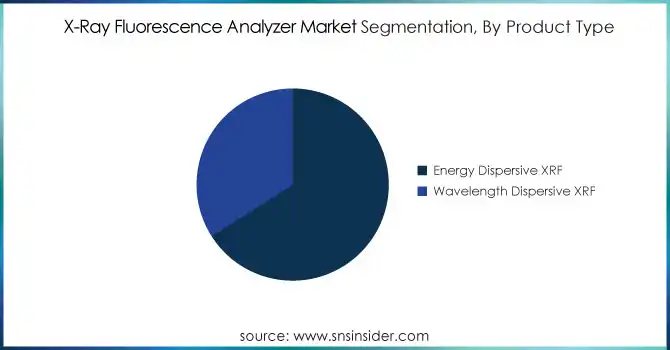

By Product Type

The Energy Dispersive XRF (EDXRF) segment is dominating the X-ray Fluorescence analyzer market, accounting for around 65% of the market share in 2023. This technology is preferred for its high-speed analysis, ease of use, and ability to provide quick, accurate results without the need for complex sample preparation. EDXRF systems are versatile and can be used for a wide range of applications, from elemental analysis in materials science and environmental testing to quality control in manufacturing. The ability to conduct non-destructive testing makes EDXRF a valuable tool across various industries such as pharmaceuticals, mining, and food safety. Furthermore, advancements in EDXRF technology have improved its sensitivity, portability, and cost-effectiveness, contributing to its dominant market share and continued growth in demand.

By Modularity Type

The Benchtop segment is leading the X-ray Fluorescence analyzer market, holding approximately 69% of the market share in 2023. Benchtop XRF analyzers are widely favored for their superior performance, precision, and high sensitivity in laboratory and industrial settings. These instruments offer excellent analytical capabilities, making them ideal for applications that require detailed elemental analysis, such as environmental monitoring, quality control, and material characterization. Their larger size and stable configuration allow for more advanced features, such as higher resolution detectors and more powerful X-ray tubes, ensuring accurate and reliable results. Despite being less portable than handheld models, benchtop systems provide enhanced accuracy and versatility, making them suitable for a broad range of industries including pharmaceuticals, mining, and manufacturing, further driving their dominance in the market.

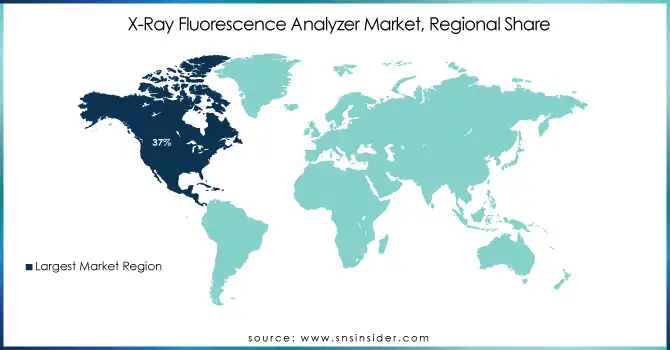

X-Ray Fluorescence Analyzer Market Regional Outlook

North America's dominance in the X-ray Fluorescence (XRF) analyzer market, with a 37% share in 2023, is largely driven by the region's economic development, advanced infrastructure, and robust technological advancements. The United States, as a global leader in industrial and technological innovation, plays a pivotal role in the adoption and integration of XRF technology across various sectors, including pharmaceuticals, food safety, construction, and environmental testing. The U.S. has a significant number of industries that require precise elemental analysis for regulatory compliance, ensuring product safety and quality. Additionally, the region’s well-established research and development ecosystem accelerates innovation in XRF technology, making it more efficient and accurate. Canada is rapidly expanding mining and natural resource sectors contribute to the growth, where XRF analyzers are widely used for mineral analysis. With stringent environmental regulations, such as those enforced by the EPA, North America is poised to maintain its leadership in the global XRF analyzer market.

The Asia-Pacific region is poised to be the fastest-growing market for X-ray Fluorescence (XRF) analyzers from 2024 to 2032, driven by rapid industrialization, increased infrastructure development, and a growing focus on quality control across various industries. Countries like China, India, Japan, and South Korea are leading this growth due to the rising demand for XRF technology in sectors such as mining, manufacturing, construction, and electronics. In particular, China’s thriving manufacturing and electronics sectors heavily rely on XRF analyzers for material testing, quality assurance, and environmental compliance. Additionally, the growing adoption of XRF analyzers in mining industries, especially in Australia and India, is contributing significantly to the market's expansion. The rapid pace of urbanization and industrial growth, coupled with the increasing need for efficient, non-destructive testing methods, ensures that Asia-Pacific will continue to dominate in the coming years. Furthermore, the region’s rising environmental concerns and regulatory enforcement regarding product safety and quality are further driving the demand for XRF analyzers. With increasing investments in R&D and technological advancements, the Asia-Pacific region is expected to maintain a significant share of the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the Major Players in X-Ray Fluorescence Analyzer Market with their product:

-

Olympus Corporation (Portable XRF Analyzers)

-

SUZHOU LANScientific Co., Ltd. (Portable XRF Analyzers)

-

Hefei Jingpu Sensor Technology Co., Ltd. (XRF Spectrometers)

-

HORIBA, Ltd. (Benchtop and Portable XRF Analyzers)

-

Hitachi, Ltd. (XRF Instruments)

-

Fischer Technology Inc. (XRF Coating Thickness Gauges)

-

Dandong Dongfang Measurement & Control Technology Co., Ltd. (XRF Analyzers)

-

The British Standards Institution (BSI) (XRF Calibration Standards)

-

Bruker (Benchtop and Handheld XRF Analyzers)

-

Bourevestnik (XRF Systems)

-

SPECTRO Analytical Instruments GmbH (XRF Spectrometers)

-

Applied Rigaku Technologies, Inc. (Benchtop XRF Analyzers)

-

FAST ComTec GmbH (XRF Detection Systems)

-

Malvern Panalytical Ltd. (XRF Analytical Instruments)

-

Thermo Fisher Scientific (Portable and Benchtop XRF Analyzers)

-

XOS (Handheld and Laboratory XRF Analyzers)

-

SciAps (Handheld XRF Analyzers)

-

TESCAN (Benchtop XRF Spectrometers)

-

Panasonic Corporation (XRF Test Equipment)

-

GeoCorp Inc. (Handheld XRF Analyzers)

List of companies that supply raw materials and components related to the X-ray Fluorescence (XRF) analyzer market:

-

Tungsten Corporation

-

Varex Imaging Corporation

-

Xenemetrix Ltd.

-

Toshiba Electron Tubes & Devices Co., Ltd.

-

Thermo Fisher Scientific

-

Fujifilm Corporation

-

Hitachi High-Tech Corporation

-

Panalytical (Malvern Panalytical)

-

Advanced Photon Source (APS)

-

Allied Electronics & Automation

-

Raytheon Technologies

-

EMD Millipore

-

GE Healthcare

-

Sharp Corporation

-

Rigaku Corporation

-

XOS

-

WDXRF

-

Bruker Corporation

-

PerkinElmer

-

SciAps, Inc.

Recent Development

-

November 2024, HORIBA Advanced Techno launched the CS-1000, a system for real-time measurement of concentration, conductivity, and pH in semiconductor manufacturing, offering improved performance and reduced maintenance for higher productivity.

-

October 2024, Fischer Technology, Inc. highlighted the importance of XRF measurement for controlling costs in fashion jewelry and accessories, ensuring accurate plating thickness and alloy composition for quality and cost-reduction benefits.

-

May 2024, Thermo Fisher Scientific discussed using XRF spectrometry for rapid QA/QC of cathode powders in battery production, ensuring precise control of battery chemistry for optimal performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.43 Billion |

| Market Size by 2032 | USD 2.26 Billion |

| CAGR | CAGR of 5.23 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Energy Dispersive XRF, Wavelength Dispersive XRF) • By Modularity Type (Portable/ Handheld, Benchtop) • By Application (Cement, Mining and Metals, Petroleum, Chemicals, Environmental, Food and Pharmaceutical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olympus Corporation, SUZHOU LANScientific Co., Ltd., Hefei Jingpu Sensor Technology Co., Ltd., HORIBA, Ltd., Hitachi, Ltd., Fischer Technology Inc., Dandong Dongfang Measurement & Control Technology Co., Ltd., The British Standards Institution (BSI), Bruker, Bourevestnik, SPECTRO Analytical Instruments GmbH, Applied Rigaku Technologies, Inc., FAST ComTec GmbH, Malvern Panalytical Ltd., Thermo Fisher Scientific, XOS, SciAps, TESCAN, Panasonic Corporation, and GeoCorp Inc. are key players in the X-ray fluorescence (XRF) analyzer market. |

| Key Drivers | • Ensuring Workplace and Product Safety through Advanced XRF Technology. |

| Restraints | • High Initial Investment and Maintenance Costs as a Restraint for the X-Ray Fluorescence (XRF) Analyzer Market. |