To Get More Information on Workspace as a Service (WaaS) Market - Request Sample Report

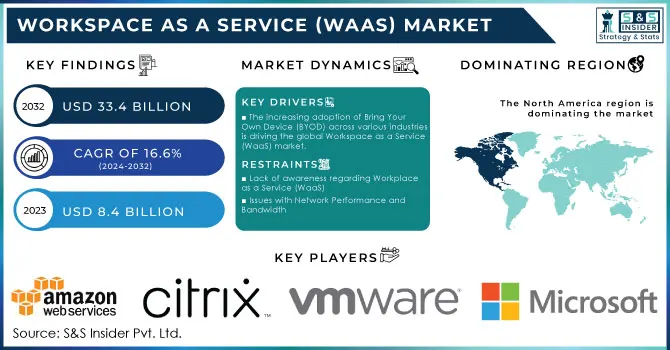

Workspace as a Service (WaaS) Market Size was valued at USD 8.4 Billion in 2023 and is expected to reach USD 33.4 Billion by 2032 and grow at a CAGR of 16.6% by 2024-2032

The Workspace as a Service (WaaS) market is driven by rising demand for flexible, cost-effective remote work solutions. Across the globe, governments support digital transformation in workplaces to meet changing labor requirements and technology changes. The BLS states that around 25% of jobs could be performed remotely as of 2023, resulting in greater public and private sector investments in WaaS solutions. Similarly, the European Union's Digital Decade Policy aims to have at least 90% of small and medium-sized enterprises (SMEs) adopt digital technologies by 2030, which is incentivizing businesses across member states to adopt WaaS solutions. Cybersecurity also is an essential aspect of the WaaS, due to imposing strict regulations from governments. The General Data Protection Regulation (GDPR) of the European Union, has increased demand for privacy and compliance-oriented secure WaaS solutions. The global push for remote and hybrid work models is thus a significant driver for the WaaS market, which is projected to grow as businesses adopt advanced, scalable solutions in line with governmental digital mandates and security regulations.

The increasing digitization in industries such as banking, financial services and insurance (BFSI), retail, manufacturing, healthcare, and education is also driving the growth of the workspace as a service market. These industries are embracing digital transformation, and WaaS systems provide the necessary infrastructure to support this transition. The market expansion is fuelled by the rising demand for cost-effective virtual desktop virtualization and automation solutions. Businesses can log in many users to a virtual server using WaaS systems, which also offer efficient resource provisioning, load balancing, and network management capabilities.

Technological improvements, such as the integration of linked devices with the Internet of Things (IoT) and cloud computing platforms, are expected to further fuel the expansion of the overall market. These advancements enhance the capabilities of WaaS systems and enable organizations to leverage the benefits of a connected and scalable workspace. Additionally, businesses are using digital business channels more frequently to provide mobile employees with scalable workplace solutions. This approach improves overall operational efficiency and allows for seamless collaboration and communication. Intensive research and development activities, along with considerable advancements in information technology (IT) infrastructure, are expected to boost the market during the forecast period. These efforts contribute to the continuous improvement and innovation of WaaS systems, making them more efficient and secure.

Market Dynamics

Drivers

The global workspace as a service market is experiencing significant growth due to a growing adoption of Bring Your Own Device (BYOD) policies across various industries. This trend allows employees to use their personal devices for work purposes, increasing flexibility and productivity. There is a surging demand for affordable desktop virtualization solutions. This technology enables users to access their desktops and applications from any device, reducing the need for expensive hardware upgrades.

This trend has become increasingly popular due to its ease of deployment, scalability, and quick availability. Additionally, there is a rising need for affordable virtual desktop virtualization. Major corporations, including Intel, SAP, and Blackstone, have recognized the benefits of BYOD and have started investing in these efforts. For instance, SAP has effectively utilized BYOD to increase employee flexibility while decreasing capital expenditures (CAPEX). The company has developed a unique mobile platform that comes pre-loaded with critical applications, enabling employees to work from anywhere as long as they have their mobile devices. Enterprises with multiple users registered on the same virtual Windows server can greatly benefit from WaaS solutions. By outsourcing resource provisioning, load balancing, and network difficulties to WaaS providers, organizations can reduce the additional maintenance tasks and expenses associated with virtual desktop environments. Consequently, WaaS has emerged as a cost-effective option that fulfills organizations' desktop virtualization needs.

Restrains

The global workspace as a service (WaaS) market is poised for tremendous growth, but there are significant hurdles that must be overcome. One of the most pressing challenges is network performance and bandwidth issues. These obstacles can create difficulties for users attempting to access their workspace from remote locations. While the WaaS provider may have access to high-speed internet at their office, the user's home internet connection may not possess the same capacity to handle large amounts of data. Consequently, this can result in a subpar user experience and is projected to impede the expansion of the global workspace as a service market during the analysis period.

Opportunities

Segment analysis

By Organizational Size

The Large Enterprises accounted for the largest revenue share about 72% in 2023, owing to their ability to invest in digital infrastructure. According to government data in 2023, more than 65% of all corporate investments in WaaS are made by enterprises with more than 500 employees. WaaS is becoming a growing priority for large national and multinational businesses focused on expanding operational efficiency in geographically diverse teams. Digital workspace solutions certainly scale to keep your people productive, secure, and compliant wherever they work and this aligns with the European Commission’s recommendations for strengthening the digital resilience of large enterprises. Moreover, big enterprises are adopting WaaS to minimize their IT management in one place and reduce operational expenditures concerning traditional office infrastructure. Growing adoption of WaaS in large organizations is driven not only by ease of use but also from the perspective of broader economic resilience strategies the government is progressively focusing on enterprise digitalization which has augmented the demand for Workspaces-as-a-Service (WaaS).

By Component

In 2023, the Solution segment accounted 64% share of the WaaS market as more businesses adopted software platforms that offer an integrated digital workspace. According to government data, digital solutions which range from connected devices through comprehensive software platforms composed of various integrated applications accounted for 65% of total WaaS spending in 2023 as enterprises sought out end-to-end apps rather than siloed services. This segment is set to experience a significant rise owing to the growing demand for packaged solutions that procure virtual desktops, application access, cybersecurity, and cloud at a single resolution. Cybersecurity regulations established by several government bodies such as the National Institute of Standards and Technology (NIST) in the U.S. are compelling businesses to adopt secure end-to-end WaaS solutions. Consequently, the Solution segment continues to dominate due to the regulatory emphasis on data protection and the appeal of consolidated, manageable digital workspace ecosystems.

By Industry Vertical

In 2023, the WaaS market led by the Telecom and IT sector accounted for a 25% market share. This leadership is due to the sector's requirement for uninterrupted connectivity, security, and scalable solutions for remote and hybrid work models. According to the U.S. Department of Labor, remote work is most common in IT and telecommunications companies with a remarkable 62% of employees working remotely at least partially. This is a global trend, but especially true in tech-forward regions such as North America and Western Europe. Growth in cloud services Within IT and Telecom industries, there is an increased reliance on cloud services that sync with the model of WaaS to offer access such as desktop virtualization for more ease as well resulting in virtual desktops, software applications, and also security tools for remote workforces. In addition, government mandates like the U.S. Federal Information Security Management Act (FISMA) have also led telecom companies to opt for secure, compliant WaaS solutions, further driving market growth within this sector.

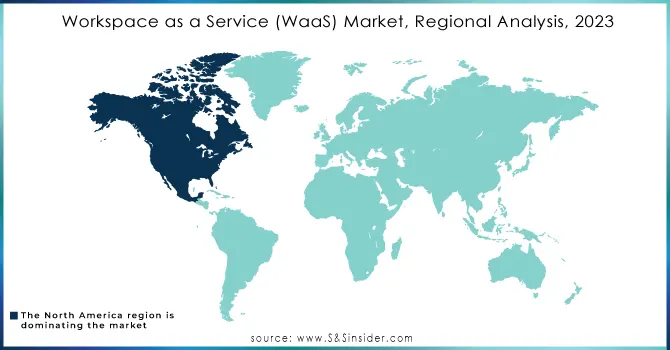

Regional Analysis

North America led the market in 2023, owing to the rapid rate of digital infrastructure adoption, supportive government policies, and tech-oriented corporate culture. The market share in the region was estimated to be around 38%, supported by various initiatives such as the Federal Government’s Modernizing Government Technology (MGT) Act and others, which promote cloud solutions, including WaaS among federal agencies to provide them with improved efficiency and security. The significant increase in the adoption rates of the Bring Your Own Device (BYOD) trend. This can be attributed to the growing need for securing enterprise data and finding cost-efficient ways to manage IT deployment in the region. As a result, the North American Workspace as a Service (WaaS) Market is being driven forward. The economic development in North America is expected to lead to an expansion of enterprises across the region. This presents a great opportunity for vendors in the market to capitalize on the growing trend of adopting WaaS and the subsequent enterprise growth. One of the key advantages of WaaS models is the ability to provide remote access, allowing employees to remain productive even in the face of technological challenges. With WaaS, users have the flexibility to switch to a different device if they encounter technical issues, without losing any valuable time waiting for repairs. This is made possible by the option to log on to their desktop from any device, ensuring uninterrupted workflow.

Asia-Pacific is witnessing the highest growth rate in terms of CAGR, where countries such as India, China, and Singapore are adopting Wheeled Authorized Shopping (WaaS) solutions at a rapid pace. The Asia Pacific region has witnessed an unprecedented adoption of mobile devices, with a substantial portion of the population relying on smartphones and tablets for their daily activities. However, this surge in mobile usage also brings forth concerns regarding system security. To address these apprehensions, businesses are increasingly turning to WaaS solutions, which offer robust security measures to safeguard sensitive data and protect against cyber threats.

Do You Need any Customization Research on Workspace as a Service (WaaS) Market - Enquire Now

Key Players

Key Service Providers/Manufacturers:

Amazon Web Services (AWS) (Amazon WorkSpaces, Amazon AppStream 2.0)

Citrix Systems, Inc. (Citrix Workspace, Citrix Virtual Apps and Desktops)

VMware, Inc. (VMware Horizon, VMware Workspace ONE)

Microsoft Corporation (Microsoft Azure Virtual Desktop, Microsoft 365)

Google LLC (Google Workspace, Google Cloud Virtual Desktops)

Cisco Systems, Inc. (Cisco Webex, Cisco Virtual Desktops)

Dell Technologies (Dell Cloud Client Workspace, Wyse Thin Clients)

IBM Corporation (IBM Cloud Virtual Server for VDI, IBM MaaS360)

Oracle Corporation (Oracle Virtual Desktop Infrastructure, Oracle Workspace Cloud)

Key Users of WaaS Services and Products

Deloitte

JPMorgan Chase & Co.

Accenture

Pfizer Inc.

Walmart Inc.

General Electric (GE)

Ford Motor Company

Siemens AG

Unilever

Ernst & Young (EY)

Recent Developments in the WaaS Market

In March 2023, The U.S. General Services Administration (GSA) released new directives on the adoption of cloud-based workspaces as part of its modernization efforts that triggered increased interest in WaaS from federal agencies.

Salesforce expanded its partnership with Google in September 2023, integrating generative AI assistants to allow secure collaboration between platforms. It enables users to create personalized content in Google Workspace, update records, and automate workflows from Salesforce. Through these integrations, they fortify the alliance between Salesforce Data Cloud and Google Cloud with connected generative AI experiences across Salesforce Customer 360 and Google Workspace.

In July 2023, India's Ministry of Electronics and Information Technology (MeitY) announced increased funding for SMEs adopting digital workspace solutions, bolstering the WaaS market in the country.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 |

USD 8.4 Billion |

| Market Size by 2032 |

USD 33.4 Billion |

| CAGR | CAGR of 16.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Organizational Size (Large Enterprises, Small and Medium Enterprises) • By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) • By Industry Vertical (BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Travel and Hospitality, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Citrix Systems, Inc., VMware, Inc., Microsoft Corporation, Google LLC, Cisco Systems, Inc., Dell Technologies, IBM Corporation, Oracle Corporation, Nutanix, Inc. |

| Key Drivers | •The increasing adoption of Bring Your Own Device (BYOD) across various industries is driving the global Workspace as a Service (WaaS) market. |

| RESTRAINTS | •Lack of awareness regarding Workplace as a Service (WaaS) •Issues with Network Performance and Bandwidth |

Ans- Challenges in the Workplace as a Service (WaaS) Market are

Ans: The solutions component segment dominated the Workspace as a Service (WaaS) Market.

Ans- In 2023, North America dominated the market and held a significant revenue share.

Ans- the CAGR of the Workspace as a Service (WaaS) Market during the forecast period is of 16.6% from 2024-2032.

Ans- Workspace as a Service (WaaS) Market Size was valued at USD 8.4 Billion in 2023 and is expected to reach USD 33.4 Billion by 2032 and grow at a CAGR of 16.6% by 2024-2032

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making5.4 Consumer Preferences, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Workspace as a Service (WaaS) Market Segmentation, By component

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Workspace as a Service (WaaS) Market Segmentation, By Organizational Size

8.1 Chapter Overview

8.2 Large Enterprises

8.2.1 Large Enterprises Market Trends Analysis (2020-2032)

8.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 SMEs

8.3.1 SMEs Market Trends Analysis (2020-2032)

8.3.2 SMEs Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Workspace as a Service (WaaS) Market Segmentation, By Deployment Mode

9.1 Chapter Overview

9.2 Public Cloud

9.2.1 Public Cloud Market Trends Analysis (2020-2032)

9.2.2 Public Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Private Cloud

9.3.1 Private Cloud Market Trends Analysis (2020-2032)

9.3.2 Private Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Hybrid Cloud

9.4.1 Hybrid Cloud Market Trends Analysis (2020-2032)

9.4.2 Hybrid Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Workspace as a Service (WaaS) Market Segmentation, By Industry Vertical

10.1 Chapter Overview

10.2 IT & Telecommunication

10.2.1 IT & Telecommunication Market Trends Analysis (2020-2032)

10.2.2 IT & Telecommunication Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 BFSI

10.3.1 BFSI Market Trends Analysis (2020-2032)

10.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Retail

10.5.1 Retail Market Trends Analysis (2020-2032)

10.5.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Manufacturing

10.6.1 Manufacturing Market Trends Analysis (2020-2032)

10.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Travel and Hospitality

10.7.1 Travel and Hospitality Market Trends Analysis (2020-2032)

10.7.2 Travel and Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Government

10.8.1 Government Market Trends Analysis (2020-2032)

10.8.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

10.9 Education

10.9.1 Education Market Trends Analysis (2020-2032)

10.9.2 Education Market Size Estimates and Forecasts to 2032 (USD Billion)

10.10 Others

10.10.1 Others Market Trends Analysis (2020-2032)

10.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.2.4 North America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.2.5 North America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.6 North America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.2.7.2 USA Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.2.7.3 USA Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.7.4 USA Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.2.7 Canada

11.2.7.1 Canada Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.2.7.2 Canada Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.2.7.3 Canada Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.7.3 Canada Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.2.8 Mexico

11.2.8.1 Mexico Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.2.8.2 Mexico Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.2.8.3 Mexico Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.8.3 Mexico Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.1.6 Poland

11.3.1.6.1 Poland Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.6.2 Poland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.6.3 Poland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.6.3 Poland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.1.7 Romania

11.3.1.7.1 Romania Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.7.2 Romania Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.7.3 Romania Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.7.3 Romania Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.8.2 Hungary Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.9.2 Turkey Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.5 Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.5 Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.6 Germany

11.3.2.6.1 Germany Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.6.2 Germany Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.6.3 Germany Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.6.3 Germany Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.7 France

11.3.2.7.1 France Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.7.2 France Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.7.3 France Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.7.3 France Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.8 UK

11.3.2.8.1 UK Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.8.2 UK Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.8.3 UK Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.8.3 UK Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.9 Italy

11.3.2.9.1 Italy Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.9.2 Italy Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.9.3 Italy Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.9.3 Italy Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.11.3 Spain Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.11.3 Spain Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.11.2 Netherlands Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.12.2 Switzerland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.13 Austria

11.3.2.13.1 Austria Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.13.2 Austria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.13.3 Austria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.13.3 Austria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.3.2.14.2 Rest of Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.5 Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.5 Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.6 China

11.4.6.1 China Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.6.2 China Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.6.3 China Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.6.3 China Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.7 India

11.4.7.1 India Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.7.2 India Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.7.3 India Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.7.3 India Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.8 Japan

11.4.8.1 Japan Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.8.2 Japan Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.8.3 Japan Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.8.3 Japan Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.9 South Korea

11.4.9.1 South Korea Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.9.2 South Korea Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.9.3 South Korea Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.9.3 South Korea Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.11.3 Vietnam Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.11.3 Vietnam Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.11 Singapore

11.4.11.1 Singapore Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.11.2 Singapore Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.11.3 Singapore Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.11.3 Singapore Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.12 Australia

11.4.12.1 Australia Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.12.2 Australia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.12.3 Australia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.12.3 Australia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.4.13.2 Rest of Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.4 Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.5 Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.5 Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.1.6 UAE

11.5.1.6.1 UAE Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.6.2 UAE Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.6.3 UAE Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.6.3 UAE Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.7.2 Egypt Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.8.2 Saudi Arabia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.9.2 Qatar Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.2.4 Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.2.5 Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.3 Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.2.6.2 South Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.2.6.3 South Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.3 South Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.2.7.2 Nigeria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.2.7.3 Nigeria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.5.2.8.2 Rest of Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.6.4 Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.6.5 Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.5 Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.6.6 Brazil

11.6.6.1 Brazil Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.6.6.2 Brazil Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.6.6.3 Brazil Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.6.3 Brazil Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.6.7 Argentina

11.6.7.1 Argentina Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.6.7.2 Argentina Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.6.7.3 Argentina Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.7.3 Argentina Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.6.8 Colombia

11.6.8.1 Colombia Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.6.8.2 Colombia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.6.8.3 Colombia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.8.3 Colombia Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, by component (2020-2032) (USD Billion)

11.6.9.2 Rest of Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Workspace as a Service (WaaS) Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

12. Company Profiles

12.1 Amazon Web Services (AWS)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Citrix Systems, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 VMware, Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Microsoft Corporation.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Google LLC

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Cisco Systems, Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Dell Technologies

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 IBM Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Oracle Corporation

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Nutanix, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Solution

Services

By Organizational Size

Large Enterprises

Small and Medium Enterprises

By Deployment Mode

Public Cloud

Private Cloud

Hybrid Cloud

By Industry Vertical

BFSI

IT and Telecom

Retail

Healthcare

Manufacturing

Government

Travel and Hospitality

Education

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Web Content Filtering Market is anticipated to develop at a CAGR of 12.8% from 2024 to 2031.

The Unified Communication as a Service Market size was valued at USD 70.43 billion in 2023 and is expected to grow to USD 377.26 billion by 2032 and grow at a CAGR of 20.5% over the forecast period of 2024-2032.

The Managed Learning Service Market size was valued at USD 3.59 Billion in 2023 and is expected to Reach USD 8.79 Billion by 2032 and growing at a CAGR of 10.46% over the forecast period of 2024-2032.

The Intelligent Roadways Transportation System Market size was recorded at USD 23.89 billion in 2023 and is expected to reach USD 47.43 billion by 2032, growing at a CAGR of 8.05 % over the forecast period of 2024-2032.

The Artificial Intelligence in Accounting Market size was valued at USD 3.35 billion in 2023 and is expected to reach USD 93.30 billion by 2032, growing at a CAGR of 44.77% Over the Forecast Period of 2024-2032.

The Restaurant Management Software Market size was valued at $5240 Mn in 2023 & will reach $20554.5 million by 2032 & grow at a CAGR of 16.4% by 2024-2032.

Hi! Click one of our member below to chat on Phone