Workforce Analytics Market Size & Overview:

To Get More Information on Workforce Analytics Market - Request Sample Report

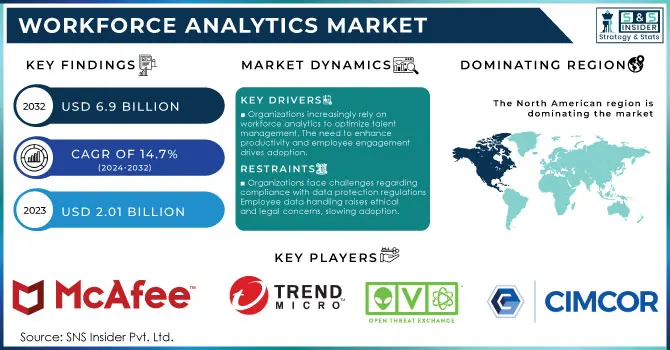

Workforce Analytics Market size was valued at USD 2.01 billion in 2023 and is expected to reach USD 6.9 billion by 2032, while growing at a CAGR of 14.7% by 2024-2032.

The workforce analytics market is growing rapidly due to the increasing importance of workforce optimization and enhancement of organizational productivity. Government reports workforce-related data analytics are being heavily utilized to streamline labour force management, particularly in regions with high employment rates and talent shortages. For example, as the U.S. Bureau of Labor Statistics noted in 2023, the U.S. labour force participation rate was only 62.7%, leading to an increasing need for efficient workforce management tools to exercise operational efficiency within a tight job market.

The new statistics issued by the European Commission additionally emphasized that digital transition initiatives in Europe, where the Digital Economy and Society Index (DESI) reports that 75% of enterprises in the EU have adopted some form of workforce analytics in 2023, are boosting the demand for these solutions. Government-driven initiatives to enhance digital workforce training have further catalyzed the adoption of workforce analytics in the Asia Pacific region. The National Skill Development Mission of India alone has trained more than 20 million individuals in 2023, with new standards created around improving workforce analytics solutions to manage these growing workforces successfully. Also, the increased utilization of cloud technology and big data analytics recognized by several government authorities across the globe stimulates workforce analytics market growth. Governments globally are pushing for digitization, as seen in policy efforts like China's "Digital China" initiative, where modernization of workforce management practices through data-driven insights is being sought.

The workforce analytics market is growing due to greater accessibility and affordability of highly sophisticated tools made possible because of constant advancements in technology. Emerging technologies such as artificial intelligence (AI), machine learning, and advanced data visualization have dramatically improved workforce analytics platforms enabling organizations to analyse massive datasets quickly for useful insights. The increasing popularity of cloud-based solutions however has made scalable and flexible analytics possible for all types of businesses. The capabilities of workforce analytics tools are expected to continue expanding as technology advances, which further propels the growth of this market.

Workforce Analytics Market Market Dynamics

Drivers

-

Organizations increasingly rely on workforce analytics to optimize talent management, The need to enhance productivity and employee engagement drives adoption.

-

The shift to remote work has spurred demand for tools that track workforce performance as companies seek solutions to manage dispersed teams efficiently.

-

AI enhances workforce analytics with predictive capabilities and automation. Advanced analytics helps in forecasting workforce trends and reducing attrition.

The major driver for the growth in workforce analytics market is the rising need for data-driven decisions. Analyzing the workforce is gradually becoming a popular concept among organizations for better talent management, employee engagement, and productivity. Workforce analytics empowers HR leaders and managers to base their decisions on data rather than instincts in a business environment where talent is the main source of competitive advantage. According to recent data, 71% of companies now view people analytics as a top priority for their organizations. This shift reflects the growing recognition that understanding workforce dynamics through data can directly improve outcomes like employee retention and overall performance. For example, workforce analytics platforms identify turnover trends, isolate drivers of high attrition, and develop predictive models for future staffing requirements.

Companies like Google and IBM have been pioneers in leveraging analytics to optimize their workforce strategies. Google, for instance, uses people analytics to assess hiring practices and understand the characteristics of high-performing employees. This data-driven approach has helped them refine recruitment strategies and improve team efficiency. In addition to using data from enterprise systems for timely workplace analytics, AI-powered workforce analytical tools are also gaining momentum. Recent reports state that 86% of HR professionals believe workforce analytics are crucial for enhancing workforce planning with a holistic perspective of employee performance, engagement, and development requirements. This change of paradigm in HR is now witnessing the shift from a people-centric model to a data-based system.

Restraints:

-

Organizations face challenges regarding compliance with data protection regulations. Employee data handling raises ethical and legal concerns, slowing adoption.

-

Small and mid-sized enterprises (SMEs) struggle with the high costs of workforce analytics solutions. Limited budgets and expertise hinder widespread deployment among smaller companies.

Data privacy and security concerns is one of the major restraining factors for workforce analytics market. With the rise of workforce analytics, organizations are placing a growing focus on collecting and analysing employee data, which raises concerns regarding data breaches and unauthorized access. The concern surrounding data responsibility is further amplified by the presence of regulations such as the General Data Protection Regulation (GDPR) and several regional data protection laws, enforcing rigid rules on personal data processing. Legal concerns might prevent corporations from embracing workforce analytics tools. Similarly, entrusting their data to be observed and analyzed may leave employees feeling uncomfortable. This would also lower morale and further diminish trust between the employer and employee. As a result, organizations need to put in place proper cybersecurity measures and be transparent with their data governance policies to relieve these challenges that could hinder the adoption of workforce analytics solutions.

Workforce Analytics Market Segment analysis

By Component

The solutions segment dominated and accounted for 68% of the total market in 2023. This dominance can be owing to a high demand for end-to-end solutions enabling businesses to analyze employee performance, optimize their workforce planning, and enhance recruitment capabilities. The dynamic nature of the current business environment has made access to real-time information a crucial element of sound decision-making, and solutions such as predictive analytics and cloud-based workforce management systems are increasingly being used because they enable that. The annual requirement for organizations with over 500 people to report on their workforce composition has led to the adoption of complex workforce analytics solutions to meet these regulatory requirements according to U.S. government data. In addition, government subsidies in sectors such as manufacturing and healthcare for digital transformation have also encouraged companies to adopt workforce analytics solutions. Horizon Europe, the EU's funding program for research and innovation, had set aside €1.2 billion in 2023 to invest in digital technologies, a portion of which is targeted at tools aimed at workforce optimization.

By Enterprise Size

In 2023, the largest market revenue share in the workforce analytics market was held by large enterprises. These organizations often contain highly complex and heterogeneous employees that require analytical tools for effective management. According to government statistics, enterprises above 1,000 employees accounted for more than 70% of total revenue in this sector. A U.S. Small Business Administration report showed larger corporations tend to take up advanced workforce analytics solutions more owing to their need for labour cost monitoring, employee engagement improvement, and meeting compliance regulations within the organization. Similarly, creating a workforce analytics framework is as much about maintaining local differentiation as it is about global standardization because large enterprises span multiple geographies. In Europe, for example, large enterprises have been rewarded with tax credits on digital solutions, further driving their dominance in the market.

By End Use

The healthcare sector accounted for the largest market revenue share in 2023, due to the growing complexities related to healthcare labour management, which is already driven by a surge in patients, changing regulations, and the requirement for highly skilled personnel. Amid a post-pandemic recovery that has seen an industrywide workforce shortage, healthcare organizations have faced increasing pressure to optimize staffing and improve operational efficiency based on government data from the U.S. Department of Health and Human Services. The use of workforce analytics tools has been key to scheduling and compliance, as well as resource allocation in hospitals and clinics. Moreover, the adoption of electronic health records (EHRs) and telemedicine has increased the need for workforce analytics to support the operational backend of healthcare institutions.

Workforce Analytics Market Regional Insights

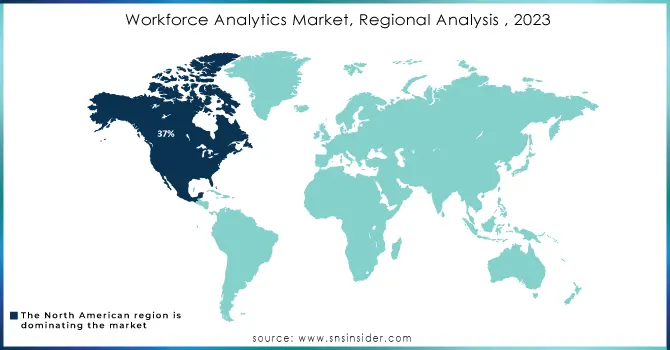

North America region dominated with the largest revenue share 37% in the workforce analytics market in 2023. This dominance is attributed to the high importance of digital transformation in the region and huge investments in workforce management technologies. This is largely driven by the U.S. government itself, stimulating demand for these features and boosted by advanced technologies in the labour market as envisioned in its Digital Strategy 2023 which seeks to improve labour productivity through automation and data analytics. Additionally, the presence of key market players in North America has accelerated the adoption of workforce analytics solutions.

However, the Asia-Pacific region is experiencing the highest CAGR owing to government policies that encourage developing a modernizing the labour market and enhancing digital infrastructure. In 2023, the region accounted for 25% of the market. Countries like China and India have been investing heavily in their workforce, with the Chinese government's “Digital China” initiative and India’s Skill India Mission, which saw the training of millions of individuals to enter the workforce. Such initiatives have increased the need for workforce analytics solution, particularly in manufacturing, IT and healthcare industries.

On the other hand, Europe secured the second-highest share of the global market. This can be attributed to the mounting concerns surrounding the management of vast amounts of data, the need to reduce labour costs, enhance operational efficiencies, and the development of digital technologies such as cloud computing Big Data, 5G, mobile platforms, and advanced analytics platforms.

Do You Need any Customization Research on Workforce Analytics Market - Enquire Now

Recent News and Developments in the Workforce Analytics Market

-

The U.S. Department of Labor in April 2023 partnered with technology corporations to create workforce analytics tools for better job placement of veterans. The effort is under WIOA ("Workforce Innovation and Opportunity Act") and provides an investment of $100 million to improve digital workforce platforms.

-

In April 2023, Workday, Inc. partnered with Alight, Inc., to provide a seamless integrated payroll experience for HR and pay leaders globally.

-

In June 2023, the European Commission created the "Skills for Jobs" flagship initiative with a budget of €500 million to deploy workforce analytics technologies that directly improve labour market forecasting and job-matching processes across Europe. It is intended to accelerate the adoption of workforce analytics across Europe.

Key Players

Key Service Providers/Manufacturers:

-

McAfee, LLC (McAfee Total Protection, McAfee MVISION Insights)

-

Trend Micro Inc. (Trend Micro Apex One, Trend Micro Cloud One)

-

AlienVault, Inc. (AlienVault Unified Security Management, AlienVault OSSIM)

-

TrustWave Holdings, Inc. (Trustwave Managed Security Services, Trustwave Threat Detection and Response)

-

Cimcor, Inc. (CimTrak, Cimcor File Integrity Monitoring)

-

Lonx Solutions LLP (Lonx Cybersecurity Framework, Lonx Threat Intelligence)

-

Qualys, Inc. (Qualys Cloud Platform, Qualys Vulnerability Management)

-

Securonix Inc. (Securonix Security Analytics, Securonix SOAR)

-

AT&T (AT&T Cybersecurity Insights, AT&T Managed Security Services)

-

Software Diversified Services (SDI File Integrity Monitor, SDI Log Management)

Key Users of Workforce Analytics Services:

-

Amazon

-

Deloitte

-

Walmart

-

Accenture

-

Cognizant

-

UnitedHealth Group

-

Coca-Cola

-

Bank of America

-

Pfizer

-

Siemens

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.01 Bn |

| Market Size by 2032 | US$ 6.9 Bn |

| CAGR | CAGR of 14.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (Cloud, On-premise) • By Enterprise Size (Large Enterprises, SMEs) • By End-Use (Healthcare, IT & Telecommunication, BFSI, Manufacturing, Retail, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | McAfee, LLC, Trend Micro Inc., AlienVault, Inc., TrustWave Holdings, Inc., Cimcor, Inc., Lonx Solutions LLP, Qualys, Inc., Securonix Inc., AT&T, Software Diversified Services, SolarWinds Worldwide, LLC. |

| Key Drivers | • Organizations increasingly rely on workforce analytics to optimize talent management, The need to enhance productivity and employee engagement drives adoption. • The shift to remote work has spurred demand for tools that track workforce performance, Companies seek solutions to manage dispersed teams efficiently. • AI enhances workforce analytics with predictive capabilities and automation. Advanced analytics helps in forecasting workforce trends and reducing attrition. |

| Market Restraints | • Organizations face challenges regarding compliance with data protection regulations. Employee data handling raises ethical and legal concerns, slowing adoption. • Small and mid-sized enterprises (SMEs) struggle with the high costs of workforce analytics solutions. Limited budgets and expertise hinder widespread deployment among smaller companies. |