To get more information on Woodworking Machinery Market - Request Free Sample Report

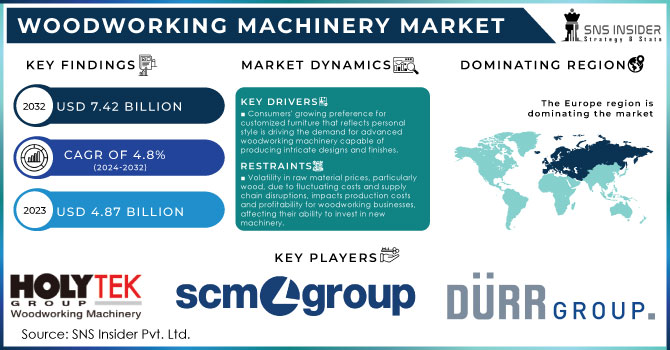

The Woodworking Machinery Market size was estimated at USD 4.87 billion in 2023 and is expected to reach USD 7.42 billion by 2032 at a CAGR of 4.8% during the forecast period of 2024-2032.

The increase in construction projects, especially in housing and business sectors, greatly boosts the need for woodworking machinery. The growing need for top-quality wood products and components for modern construction projects is driving this increased demand. In June 2024, the seasonally adjusted annual rate of construction spending was approximately USD 2.14 trillion, showing a slight drop of 0.3% from the revised May of USD 2.15 trillion. The strong increase in construction expenditure highlights the growing demand for woodworking machinery, with builders and manufacturers looking for more advanced equipment to keep up with the rising need for high-quality wooden components in building projects.

An increase in residential and commercial structures and consumer preference to ensure a pleasant look for their buildings is driving the demand for the woodworking machines market. Further, the consumers in the last few years have replaced their old furniture and they are buying a new wooden furnished so that their home or office would look attractive. As per information provided by Home Furnishings Business, in 2022, the wooden furniture business saw sales rising by 21.8% and profits by 13.2% for traditional retailers.

The growing e-commerce channels, which have enabled customers to have a vast array of furniture products and customers’ changing preference toward home décor products such as wood-based furniture, has increased the demand for these machines. With reference to ComScore Digital Commerce Measurement, one of the most rapidly growing categories in digital commerce in the U.S. in 2021 was furniture and appliances. It is crucial to monitor online sales trends as nearly half (49%) of all furniture purchases in 2022 were done on the internet. In contrast to last year, online furniture purchases have increased to 48%. The aforementioned are some of the key factors expected to boost demand for woodworking machines, thereby providing lucrative market opportunities in the near future.

MARKET DYNAMICS

DRIVERS

Consumers' growing preference for customized furniture that reflects personal style is driving the demand for advanced woodworking machinery capable of producing intricate designs and finishes.

The increasing trend for consumers to buy custom furniture, allowing them to express their own unique style in home decor is predicted be a major factor that amplifies the need advanced woodworking machinery which can produce detailed cuts and finishes. Personalization & Individuality the customization has become one of the main buying buttons prevalent in today's market where consumers want furniture not only to fulfill basic functional requirements but also has to adhere with their aesthetic appeal and individual taste. This behavior is most noticeable among millennials and Gen Z, who place a high value on individuality - they want something that represents their personality similarly to how artwork can define living space. In turn, furniture manufacturers are now making substantial investments in advanced woodworking machinery to accommodate those needs.

CNC (Computer Numerical Control) technology revolutionizes woodworking by enabling precise, complex cutting, drilling, and shaping of wood, leading to high-speed production and consistent quality, thereby driving widespread industry adoption.

Technology like CNC (Computer Numerical Control) has revolutionized woodworking allowing unprecedented precision in previously labor-intensive work. This wonderful technology affords very domain cutting perforation and contouring of the wood, so far which could not easily accomplish before or was on high throughput with traditional resultant technologies. A CNC machine follows a specific set of computer-programmed instructions which enable it to perform precision cutting, crafting and moulding almost exactly the same way every time resulting in uniformity across all products as well. This automation diminishes the likelihood of human error, which expedites production speed exponentially and gives way to mass production with no loss in detail or handcrafted quality. CNC technology is invaluable in the modern woodwork sector as it allows woodworking businesses satisfy consumer demand keeping quality at a high level.

This technology has created many changes in industry so that, the adoption CNC technology. Works of custom woodwork that in the past took brain-numbing manual labor can now be performed quickly and accurately. This is precision cutting become a reality, which might allow for new design ideas and bespoke pieces enriched with complex patterns carvings or joinery. Additionally, the programmable nature of CNC machines enables you to program and reprogram them as necessary for different projects which serves to ensure maximum efficiency while minimizing downtime. These benefits are driving the extensive industry adoption of CNC, as businesses look to gain or hold a competitive edge while fulfilling consumer needs for fine wood products. Computer Numerical Control (CNC) technology enhances production capacities and decreases: material waste, cost of manufacturing and safety hazards from the reduction in manual labor depended on unsafe jobs. In conclusion, CNC is integral to the future of woodworking in general and a way woodworkers can blend their past experience with evolving technology bringing new products to market faster maintaining high quality requirements.

RESTRAIN

Volatility in raw material prices, particularly wood, due to fluctuating costs and supply chain disruptions, impacts production costs and profitability for woodworking businesses, affecting their ability to invest in new machinery.

Volatility in raw material prices, especially wood, significantly impacts production costs and profitability for woodworking businesses. Fluctuating costs, driven by unpredictable supply chain disruptions, make it challenging for these companies to maintain stable pricing strategies and manage budgets effectively. This instability often leads to higher operational expenses and reduced profit margins, hindering the ability of woodworking businesses to invest in new machinery and technology. Consequently, firms may struggle to enhance productivity, innovate, and stay competitive in the market. Moreover, the uncertainty surrounding raw material availability and pricing can lead to inconsistent production schedules, further affecting customer satisfaction and long-term business growth. To mitigate these issues, companies may need to adopt more flexible procurement strategies and explore alternative materials, though these solutions also come with their own set of challenges.

KEY SEGMENTATION ANALYSIS

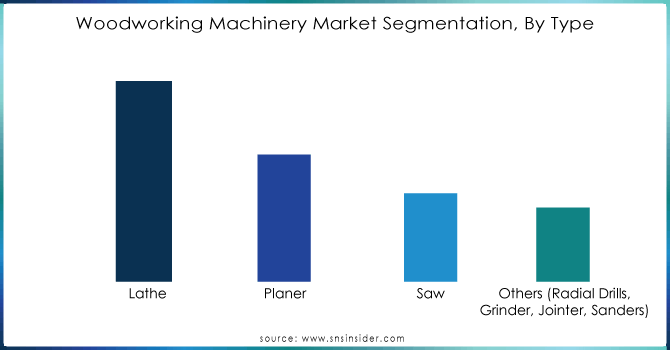

By Type

The lathe segment dominated the market with more than 44% in 2023. Lathe machines have a great reputation for their precision work and versatility. Lathes can carry out various kinds of operations, like turning, boring and threading which are essential in many industries. This generally contributes to the lathe being able to manipulate a wide array of materials such as metals and plastics oriented towards woodworking applications.

The planer segment is projected to grow at the fastest CAGR due to rising popularity of high performance, lightweight planer machines. They have become more efficient and increased in performance. High-efficiency planers in use today are built specifically to deliver fast production rates while providing pinpoint precision. Such efficiency is vital for industries that need to have a reliable and fine finish on their surfaces like woodworking or construction.

Need any customization research on Woodworking Machinery Market - Enquiry Now

By Application

The furniture segment dominated the revenue share of more than 42.06% in 2023 on account of impressive demand for wooden furniture from residential, commercial and institutional applications. This segment is characterized by high production volumes, in addition to the need for specific machinery that cater varying furniture products.

The construction segment is expected to record the highest CAGR during the forecast period. Growth has been driven by the increased use of engineered wood products and other structural lumber in recent construction. With building regulations and the demand for environmentally friendly materials growing, more advanced woodworking machinery is now being used in construction.

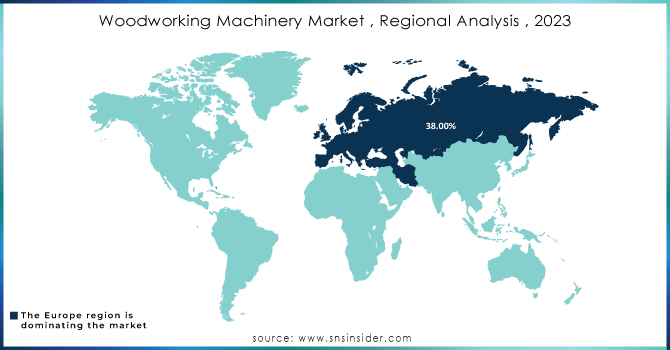

REGIONAL ANALYSIS

Europe dominated the market with more than 38% in 2023. The heavy sustainable and environmental guidelines in place across the region mean businesses are investing to reduce waste any way they can by purchasing some of most advanced technologies that allow them do so while creating carbon neutral solutions. European furniture manufacturers are increasingly turning to modern CNC machines, which help ensure efficiency and precision while also satisfying rigorous sustainability mandates. The segment has witnessed significant growth in Europe, attributed to the rising applications of engineered wood in premium sectors such as building and interior designing that demands for high-quality personlized wood products. The use of woodworking technology, which is at the core here, has seen a rise for the same.

Asia-Pacific is projected to grow at the highest CAGR during the forecast period. This has been driven by expanding population rate, households and demand requirements; the increase in forest products consumption rates of end-users. The benefits of the market have entered India, China and other Southeast markets, by pitching good sales realization for small and mid-sized manufacturers.

The major key players are Biesse Group, HOLYTEK INDUSTRIAL CORP, SCM Group, Durr Group, Gongyou Group Co., Ltd., IMA Schelling Group GmbH, Michael Weinig AG, CKM, Cantek America Inc., KTCC WOODWORKING MACHINERY, Oliver Machinery Company, and others

RECENT DEVELOPMENT

In April 2023: Dezhou Rumao offers even more favourable custom packages for different industries, including a new range of CNC router machine by one of the industry leaders that deliver excellent performance and accuracy specifically for woodworkers. These machines use intuitive interfaces and automation to achieve the best results. These machines being flexible make a promise to suit the needs of woodworkers from different trades whether they work in large-scale or small-scale environments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.87 Bn |

| Market Size by 2032 | US$ 7.47 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lathe, Planer, Saw, Others (Radial Drills, Grinder, Jointer, Sanders) • By Application, (Furniture, Construction, Others (Shipbuilding) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Biesse Group, HOLYTEK INDUSTRIAL CORP, SCM Group, Durr Group, Gongyou Group Co., Ltd., IMA Schelling Group GmbH, Michael Weinig AG, CKM, Cantek America Inc., KTCC WOODWORKING MACHINERY, Oliver Machinery Company |

| Key Drivers |

• Consumers' growing preference for customized furniture that reflects personal style is driving the demand for advanced woodworking machinery capable of producing intricate designs and finishes. |

| Market Opportunity | • Volatility in raw material prices, particularly wood, due to fluctuating costs and supply chain disruptions, impacts production costs and profitability for woodworking businesses, affecting their ability to invest in new machinery. |

Ans: The Woodworking Machinery Market is expected to grow at a CAGR of 4.8%.

Ans: Woodworking Machinery Market size was USD 4.87 Billion in 2023 and is expected to Reach USD 7.42 Billion by 2032.

Ans: Lathe is the dominating segment by type capacity in the Woodworking Machinery Market.

Ans: CNC (Computer Numerical Control) technology revolutionizes woodworking by enabling precise, complex cutting, drilling, and shaping of wood, leading to high-speed production and consistent quality, thereby driving widespread industry adoption.

Ans: Europe is the dominating region in the Woodworking Machinery Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Woodworking Machinery Market Segmentation, By Type

7.1 Introduction

7.2 Lathe

7.3 Planer

7.4 Saw

7.5 Others (Radial Drills, Grinder, Jointer, Sanders)

8. Woodworking Machinery Market Segmentation, By Application

8.1 Introduction

8.2 Furniture

8.3 Construction

8.4 Others (Shipbuilding)

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Woodworking Machinery Market, By Country

9.2.3 North America Woodworking Machinery Market, By Type

9.2.4 North America Woodworking Machinery Market, By Application

9.2.5 USA

9.2.5.1 USA Woodworking Machinery Market, By Type

9.2.5.2 USA Woodworking Machinery Market, By Application

9.2.6 Canada

9.2.6.1 Canada Woodworking Machinery Market, By Type

9.2.6.2 Canada Woodworking Machinery Market, By Application

9.2.7 Mexico

9.2.7.1 Mexico Woodworking Machinery Market, By Type

9.2.7.2 Mexico Woodworking Machinery Market, By Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Woodworking Machinery Market, By Country

9.3.2.2 Eastern Europe Woodworking Machinery Market, By Type

9.3.2.3 Eastern Europe Woodworking Machinery Market, By Application

9.3.2.4 Poland

9.3.2.4.1 Poland Woodworking Machinery Market, By Type

9.3.2.4.2 Poland Woodworking Machinery Market, By Application

9.3.2.5 Romania

9.3.2.5.1 Romania Woodworking Machinery Market, By Type

9.3.2.5.2 Romania Woodworking Machinery Market, By Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Woodworking Machinery Market, By Type

9.3.2.6.2 Hungary Woodworking Machinery Market, By Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Woodworking Machinery Market, By Type

9.3.2.7.2 Turkey Woodworking Machinery Market, By Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Woodworking Machinery Market, By Type

9.3.2.8.2 Rest of Eastern Europe Woodworking Machinery Market, By Application

9.3.3 Western Europe

9.3.3.1 Western Europe Woodworking Machinery Market, By Country

9.3.3.2 Western Europe Woodworking Machinery Market, By Type

9.3.3.3 Western Europe Woodworking Machinery Market, By Application

9.3.3.4 Germany

9.3.3.4.1 Germany Woodworking Machinery Market, By Type

9.3.3.4.2 Germany Woodworking Machinery Market, By Application

9.3.3.5 France

9.3.3.5.1 France Woodworking Machinery Market, By Type

9.3.3.5.2 France Woodworking Machinery Market, By Application

9.3.3.6 UK

9.3.3.6.1 UK Woodworking Machinery Market, By Type

9.3.3.6.2 UK Woodworking Machinery Market, By Application

9.3.3.7 Italy

9.3.3.7.1 Italy Woodworking Machinery Market, By Type

9.3.3.7.2 Italy Woodworking Machinery Market, By Application

9.3.3.8 Spain

9.3.3.8.1 Spain Woodworking Machinery Market, By Type

9.3.3.8.2 Spain Woodworking Machinery Market, By Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Woodworking Machinery Market, By Type

9.3.3.9.2 Netherlands Woodworking Machinery Market, By Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Woodworking Machinery Market, By Type

9.3.3.10.2 Switzerland Woodworking Machinery Market, By Application

9.3.3.11 Austria

9.3.3.11.1 Austria Woodworking Machinery Market, By Type

9.3.3.11.2 Austria Woodworking Machinery Market, By Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Woodworking Machinery Market, By Type

9.3.2.12.2 Rest of Western Europe Woodworking Machinery Market, By Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Woodworking Machinery Market, By Country

9.4.3 Asia Pacific Woodworking Machinery Market, By Type

9.4.4 Asia Pacific Woodworking Machinery Market, By Application

9.4.5 China

9.4.5.1 China Woodworking Machinery Market, By Type

9.4.5.2 China Woodworking Machinery Market, By Application

9.4.6 India

9.4.6.1 India Woodworking Machinery Market, By Type

9.4.6.2 India Woodworking Machinery Market, By Application

9.4.7 Japan

9.4.7.1 Japan Woodworking Machinery Market, By Type

9.4.7.2 Japan Woodworking Machinery Market, By Application

9.4.8 South Korea

9.4.8.1 South Korea Woodworking Machinery Market, By Type

9.4.8.2 South Korea Woodworking Machinery Market, By Application

9.4.9 Vietnam

9.4.9.1 Vietnam Woodworking Machinery Market, By Type

9.4.9.2 Vietnam Woodworking Machinery Market, By Application

9.4.10 Singapore

9.4.10.1 Singapore Woodworking Machinery Market, By Type

9.4.10.2 Singapore Woodworking Machinery Market, By Application

9.4.11 Australia

9.4.11.1 Australia Woodworking Machinery Market, By Type

9.4.11.2 Australia Woodworking Machinery Market, By Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Woodworking Machinery Market, By Type

9.4.12.2 Rest of Asia-Pacific Woodworking Machinery Market, By Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Woodworking Machinery Market, By Country

9.5.2.2 Middle East Woodworking Machinery Market, By Type

9.5.2.3 Middle East Woodworking Machinery Market, By Application

9.5.2.4 UAE

9.5.2.4.1 UAE Woodworking Machinery Market, By Type

9.5.2.4.2 UAE Woodworking Machinery Market, By Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Woodworking Machinery Market, By Type

9.5.2.5.2 Egypt Woodworking Machinery Market, By Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Woodworking Machinery Market, By Type

9.5.2.6.2 Saudi Arabia Woodworking Machinery Market, By Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Woodworking Machinery Market, By Type

9.5.2.7.2 Qatar Woodworking Machinery Market, By Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Woodworking Machinery Market, By Type

9.5.2.8.2 Rest of Middle East Woodworking Machinery Market, By Application

9.5.3 Africa

9.5.3.1 Africa Woodworking Machinery Market, By Country

9.5.3.2 Africa Woodworking Machinery Market, By Type

9.5.3.3 Africa Woodworking Machinery Market, By Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Woodworking Machinery Market, By Type

9.5.2.4.2 Nigeria Woodworking Machinery Market, By Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Woodworking Machinery Market, By Type

9.5.2.5.2 South Africa Woodworking Machinery Market, By Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Woodworking Machinery Market, By Type

9.5.2.6.2 Rest of Africa Woodworking Machinery Market, By Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Woodworking Machinery Market, By Country

9.6.3 Latin America Woodworking Machinery Market, By Type

9.6.4 Latin America Woodworking Machinery Market, By Application

9.6.5 Brazil

9.6.5.1 Brazil Woodworking Machinery Market, By Type

9.6.5.2 Brazil Woodworking Machinery Market, By Application

9.6.6 Argentina

9.6.6.1 Argentina Woodworking Machinery Market, By Type

9.6.6.2 Argentina Woodworking Machinery Market, By Application

9.6.7 Colombia

9.6.7.1 Colombia Woodworking Machinery Market, By Type

9.6.7.2 Colombia Woodworking Machinery Market, By Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Woodworking Machinery Market, By Type

9.6.8.2 Rest of Latin America Woodworking Machinery Market, By Application

10. Company Profiles

10.1 Biesse Group

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 HOLYTEK INDUSTRIAL CORP

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 SCM Group

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Durr Group

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Gongyou Group Co., Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 IMA Schelling Group GmbH

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Michael Weinig AG

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 CKM, Cantek America Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 KTCC WOODWORKING MACHINERY

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Oliver Machinery Company

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Lathe

Planer

Saw

Others (Radial Drills, Grinder, Jointer, Sanders)

By Application

Furniture

Construction

Others (Shipbuilding)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hydronic Control Market was estimated at USD 37.45 billion in 2023 and is expected to reach USD 49.25 billion by 2032, with a growing CAGR of 3.09% over the forecast period 2024-2032.

The Control Towers Market Size was esteemed at USD 8.53 billion in 2023 and is supposed to arrive at USD 51.64 billion by 2032 with a growing CAGR of 22.15% over the forecast period 2024-2032.

The Palletizer Market size was USD 2.77 billion in 2023 and is expected to Reach USD 4.05 billion by 2032 and grow at a CAGR of 4.32% over the forecast period of 2024-2032.

Powder Coating Equipment Market was estimated at USD 2.19 Bn in 2023 and is expected to reach at USD 3.11 Bn by 2032, at a CAGR of 3.99% from 2024 to 2032.

The Industrial Lasers Market size was estimated at USD 8.90 Billion in 2023 and is expected to reach USD 26.90 Billion by 2032 at a CAGR of 13.08% during the forecast period of 2024-2032.

The 3D Printing Construction Market Size was valued at USD 36.71 million in 2023 and it is expected to reach USD 20556 million by 2032, growing at a compounded annual growth rate (CAGR) of 102% between 2024 and 2032.

Hi! Click one of our member below to chat on Phone