Get more information on Women’s Wearable Fertility Monitors Market - Request Free Sample Report

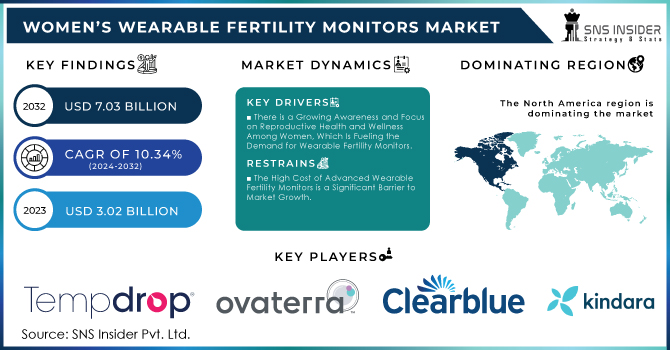

The Women’s Wearable Fertility Monitors Market Size was valued at USD 3.02 Billion in 2023, and is expected to reach USD 7.03 Billion by 2032, and grow at a CAGR of 10.34% over the forecast period 2024-2032.

The rise of awareness and attention on women's reproductive health & wellness continues to surge, thus adding a glow to the demand for wearable fertility monitors as well. As women take more control of their health, personalized family planning, and fertility management have found broad appeal. The issue is more common than one might think: the CDC estimates that up to 12% of women aged 15-44 in the United States have trouble getting pregnant or carrying a pregnancy to term - which means there lays an abundance of solutions that can be both accessible and reliable. Increased demand for accurate and easy-to-use fertility tracking devices is fueled by efforts to improve education, and stories both in the media and online content about reproductive health. Typically, this can influence them, however public awareness and support by governments that hold up women who are suffering has shown incredible change. For instance, activities such as National Women's Health Week launched by the U.S. Department of Health and Human Services which emphasizes reproductive health; encourage women to be responsible for their health by becoming informed about how they can improve or maintain it in great condition and avoid accidents that could lead to unintentional bankrupting decomposition.

Alongside governmental efforts, numerous NGOs and advocacy groups are hard at work fighting for reproductive health education. These organizations offer invaluable resources about fertility, menstrual health, and family planning that give women a resource to use when making important decisions regarding their reproductive system. Media plays a huge part as well in spreading the word and making conversations about fertility tracking devices more normalized, which then makes it easier for women to find out where they can use this kind of information. Advanced wearable fertility monitors have been game-changers and help women take control of their reproductive health. These devices provide real-time data about fertility cycles, using advanced sensors and algorithms to track important biomarkers: basal body temperature (BBT), hormone residues in saliva or cervical mucus changes throughout the menstrual cycle, as well heart rate variability. Combining wearable devices with mobile applications makes it even more comfortable for women to track down their fertility data and personalized recommendations.

So, it should come as no surprise that wearable fertility monitors are being adopted with increasing frequency. Educational initiatives and increased awareness, paired with technological advancements in the past decade have fostered a supportive culture for women to reclaim their reproductive health. There is increasing evidence to suggest this trend will continue, as efforts are made on an ongoing basis for more public education and increasingly user-friendly fertility tracking solutions hit the market. At its core, this increased attention to reproductive health and wellness suggests that wearable fertility monitors helping women plan their family planning goals better or be more proactive in monitoring reproductive well-being are an important tool for both purposes.

KEY DRIVERS:

The Integration of Wearable Fertility Monitors with Telemedicine Services and Digital Health Platforms Is Boosting the Growth of The Women’s Wearable Fertility Monitors Market.

There is a Growing Awareness and Focus on Reproductive Health and Wellness Among Women, Which Is Fueling the Demand for Wearable Fertility Monitors.

RESTRAINTS:

The High Cost of Advanced Wearable Fertility Monitors is a Significant Barrier to Market Growth.

Wearable Fertility Monitors Collect Sensitive Personal Health Data Which Raises Concerns about Data Privacy and Security and can Hinder Market Growth.

OPPORTUNITY:

There is Significant Growth Potential in Emerging Markets Such as Asia-Pacific, Latin America, and the Middle East and Africa Offer Significant Growth Opportunities.

The Continuous Development of Advanced Technologies in Wearable Devices Is a Key Driver for The Women’s Wearable Fertility Monitors Market.

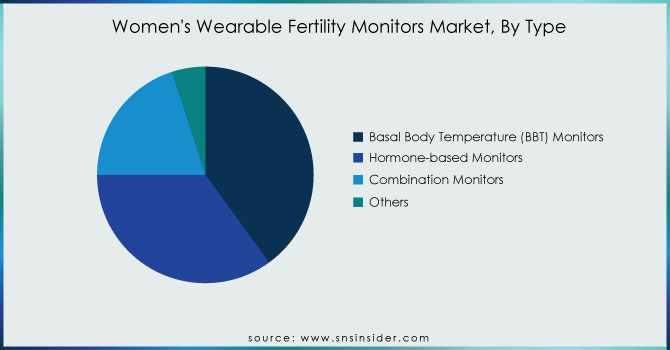

By Type

BBT monitor segment accounted for the largest share i.e. 40% of women's wearable fertility monitors market in 2023. Their large market share is explained by their accuracy and reliability in monitoring fertility cycles with a BBT monitor. The National Institutes of Health (NIH) report states that basal body temperature is a reliable tool to know when ovulation will take place since there's an increase in female corporal temperature during this period. For this reason, many women who are trying to understand and regulate their cycles prefer BBT monitors. Government and health organizations are only adding fuel to the fire by recommending BBT monitors. For example, the CDC states that using fertility awareness methods (FAMs) - including monitoring BBT - to track ovulation is a natural and non-invasive approach. More women are seeing the value of BBT monitoring and incorporating these devices into their reproductive health routines, helped by educational campaigns and resources from public health institutions that increase awareness.

BBT monitors are also popular because of their ease of use and accuracy. Each modern BBT monitor now features more advanced and sensitive sensors, along with digital interfaces providing exact temperature readings versus paper records. It is often accompanied by its integration with mobile applications, which show reading results via a graph and can include data on menstrual cycles - women may receive personalized tips + notifications. In addition, the low cost and user-friendliness of BBT monitors also account for their preponderance.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Technology

The top segment of women's wearable fertility monitors by technology in 2023 encompasses devices with advanced sensors and accounts for the majority of sales which is 48%. This dominance is due to the importance of high-precision sensors in both measuring and predicting fertility cycles. The accuracy of fertility tracking depends on high-quality physiological data, according to NIH (National Institutes of Health). The second part here is played by the sensors - they measure the basal body temperature (BBT), hormone level, and HRV. These metrics are needed for determining ovulation and fertility periods. Therefore, as the NIH points it is also vital to have a proper ovulation prediction that can improve family planning and fertility management making reliable sensor technology a crucial part of wearable fertility monitors that meet these clinical threshold levels.

Sensors and sensor-based devices get support from government and health organizations since their effectiveness is well-proven. The Centers for Disease Control and Prevention (CDC), on the other hand, recommends using fertility awareness methods that are based on quantifiably accurate physiological measurements. The use of sensor-based devices works perfectly with these algorithmic recommendations, delivering reliable information for each individual to decide on his or her better course when it comes to reproductive health. Additionally, the increased sensor accuracy and sensitivity are also a major reason for the higher prevalence of sensor-based fertility monitors in the global market. Small variations in temperature, hormone levels, and other physiological markers can be sensed with very high accuracy by today's sensors. It is necessary for accurate fertility tracking, and thus female users as well as healthcare providers prefer devices with high-quality sensors.

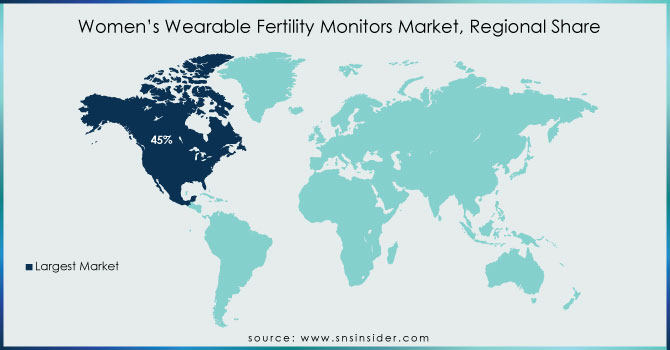

The women's wearable fertility monitors market in North America hold a significant 45% share in 2023. The dominance is expected to be supported by several factors such as high consumer awareness, abundant healthcare infrastructure, and greater investment in health technology. A study conducted by the CDC revealed that around 12% of women aged between 15 and 44 in the country have difficulty getting pregnant, further reinforcing how there is a market for reliable fertility monitoring technologies. With a strong healthcare system in the region coupled with proactive public health programs and awareness initiatives, fertility monitors are being increasingly used. Moreover, the high disposable income levels of North America make it possible for more women to invest in these sophisticated health devices. Having this awareness, infrastructure, and economic capacity cement North America as the leader in that market.

KEY PLAYERS:

The key market players include Tempdrop, Ovaterra, Ava Science, kegg, Clearblue, Food Freedom Fertility, Kindara, OvuSense, Proov, Natural Cycles & Other players.

In October 2023, A team of scientists at the California Institute of Technology made a wearable sensor capable of accurately detecting sweat for estradiol in October 2023. A wearable estrogen sensor might also help women on hormone replacement therapy (HRT).

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 3.02 Billion |

|

Market Size by 2032 |

US$ 7.03 Billion |

|

CAGR |

CAGR of 10.34% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Basal Body Temperature (BBT) Monitors, Hormone-based Monitors, Combination Monitors & Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Tempdrop, Ovaterra, Ava Science, kegg, Clearblue, Food Freedom Fertility, Kindara, OvuSense, Proov, Natural Cycles & Other players |

|

Key Drivers |

•The Integration of Wearable Fertility Monitors with Telemedicine Services and Digital Health Platforms Is Boosting the Growth of The Women’s Wearable Fertility Monitors Market. |

|

RESTRAINTS |

•The High Cost of Advanced Wearable Fertility Monitors is a Significant Barrier to Market Growth. |

Ans: The Women’s Wearable Fertility Monitors Market is expected to reach at USD 7.03 Billion in 2032.

Ans: The U.S. led the Women’s Wearable Fertility Monitors Market in the North American region with the highest revenue share in 2023.

Ans Basal Body Temperature (BBT) Monitors held the largest share in the Women’s Wearable Fertility Monitors Market in 2023.

Ans: The expected CAGR of the Global Women's Hormonal Balance Supplements Market during the forecast period is 10.34%.

Ans: The Women’s Wearable Fertility Monitors Market was valued at USD 3.02 Billion in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Women’s Wearable Fertility Monitors Market Segmentation, By Type

7.1 Introduction

7.2 Basal Body Temperature (BBT) Monitors

7.3 Hormone-based Monitors

7.4 Combination Monitors

7.5 Others

8. Women’s Wearable Fertility Monitors Market Segmentation, By Technology

8.1 Introduction

8.2 Sensors

8.3 Connectivity

8.4 Data Analysis Capabilities

9. Women’s Wearable Fertility Monitors Market Segmentation, By Distribution Channel

9.1 Introduction

9.2 E-Commerce

9.3 Pharmacies

9.4 Fertility clinics

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Women’s Wearable Fertility Monitors Market by Country

10.2.3 North America Women’s Wearable Fertility Monitors Market By Type

10.2.4 North America Women’s Wearable Fertility Monitors Market By Technology

10.2.5 North America Women’s Wearable Fertility Monitors Market By Distribution Channel

10.2.6 USA

10.2.6.1 USA Women’s Wearable Fertility Monitors Market By Type

10.2.6.2 USA Women’s Wearable Fertility Monitors Market By Technology

10.2.6.3 USA Women’s Wearable Fertility Monitors Market By Distribution Channel

10.2.7 Canada

10.2.7.1 Canada Women’s Wearable Fertility Monitors Market By Type

10.2.7.2 Canada Women’s Wearable Fertility Monitors Market By Technology

10.2.7.3 Canada Women’s Wearable Fertility Monitors Market By Distribution Channel

10.2.8 Mexico

10.2.8.1 Mexico Women’s Wearable Fertility Monitors Market By Type

10.2.8.2 Mexico Women’s Wearable Fertility Monitors Market By Technology

10.2.8.3 Mexico Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Women’s Wearable Fertility Monitors Market by Country

10.3.2.2 Eastern Europe Women’s Wearable Fertility Monitors Market By Type

10.3.2.3 Eastern Europe Women’s Wearable Fertility Monitors Market By Technology

10.3.2.4 Eastern Europe Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.2.5 Poland

10.3.2.5.1 Poland Women’s Wearable Fertility Monitors Market By Type

10.3.2.5.2 Poland Women’s Wearable Fertility Monitors Market By Technology

10.3.2.5.3 Poland Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.2.6 Romania

10.3.2.6.1 Romania Women’s Wearable Fertility Monitors Market By Type

10.3.2.6.2 Romania Women’s Wearable Fertility Monitors Market By Technology

10.3.2.6.4 Romania Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.2.7 Hungary

10.3.2.7.1 Hungary Women’s Wearable Fertility Monitors Market By Type

10.3.2.7.2 Hungary Women’s Wearable Fertility Monitors Market By Technology

10.3.2.7.3 Hungary Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.2.8 Turkey

10.3.2.8.1 Turkey Women’s Wearable Fertility Monitors Market By Type

10.3.2.8.2 Turkey Women’s Wearable Fertility Monitors Market By Technology

10.3.2.8.3 Turkey Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Women’s Wearable Fertility Monitors Market By Type

10.3.2.9.2 Rest of Eastern Europe Women’s Wearable Fertility Monitors Market By Technology

10.3.2.9.3 Rest of Eastern Europe Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3 Western Europe

10.3.3.1 Western Europe Women’s Wearable Fertility Monitors Market by Country

10.3.3.2 Western Europe Women’s Wearable Fertility Monitors Market By Type

10.3.3.3 Western Europe Women’s Wearable Fertility Monitors Market By Technology

10.3.3.4 Western Europe Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.5 Germany

10.3.3.5.1 Germany Women’s Wearable Fertility Monitors Market By Type

10.3.3.5.2 Germany Women’s Wearable Fertility Monitors Market By Technology

10.3.3.5.3 Germany Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.6 France

10.3.3.6.1 France Women’s Wearable Fertility Monitors Market By Type

10.3.3.6.2 France Women’s Wearable Fertility Monitors Market By Technology

10.3.3.6.3 France Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.7 UK

10.3.3.7.1 UK Women’s Wearable Fertility Monitors Market By Type

10.3.3.7.2 UK Women’s Wearable Fertility Monitors Market By Technology

10.3.3.7.3 UK Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.8 Italy

10.3.3.8.1 Italy Women’s Wearable Fertility Monitors Market By Type

10.3.3.8.2 Italy Women’s Wearable Fertility Monitors Market By Technology

10.3.3.8.3 Italy Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.9 Spain

10.3.3.9.1 Spain Women’s Wearable Fertility Monitors Market By Type

10.3.3.9.2 Spain Women’s Wearable Fertility Monitors Market By Technology

10.3.3.9.3 Spain Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Women’s Wearable Fertility Monitors Market By Type

10.3.3.10.2 Netherlands Women’s Wearable Fertility Monitors Market By Technology

10.3.3.10.3 Netherlands Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Women’s Wearable Fertility Monitors Market By Type

10.3.3.11.2 Switzerland Women’s Wearable Fertility Monitors Market By Technology

10.3.3.11.3 Switzerland Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.12 Austria

10.3.3.12.1 Austria Women’s Wearable Fertility Monitors Market By Type

10.3.3.12.2 Austria Women’s Wearable Fertility Monitors Market By Technology

10.3.3.12.3 Austria Women’s Wearable Fertility Monitors Market By Distribution Channel

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Women’s Wearable Fertility Monitors Market By Type

10.3.3.13.2 Rest of Western Europe Women’s Wearable Fertility Monitors Market By Technology

10.3.3.13.3 Rest of Western Europe Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Women’s Wearable Fertility Monitors Market by Country

10.4.3 Asia-Pacific Women’s Wearable Fertility Monitors Market By Type

10.4.4 Asia-Pacific Women’s Wearable Fertility Monitors Market By Technology

10.4.5 Asia-Pacific Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.6 China

10.4.6.1 China Women’s Wearable Fertility Monitors Market By Type

10.4.6.2 China Women’s Wearable Fertility Monitors Market By Technology

10.4.6.3 China Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.7 India

10.4.7.1 India Women’s Wearable Fertility Monitors Market By Type

10.4.7.2 India Women’s Wearable Fertility Monitors Market By Technology

10.4.7.3 India Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.8 Japan

10.4.8.1 Japan Women’s Wearable Fertility Monitors Market By Type

10.4.8.2 Japan Women’s Wearable Fertility Monitors Market By Technology

10.4.8.3 Japan Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.9 South Korea

10.4.9.1 South Korea Women’s Wearable Fertility Monitors Market By Type

10.4.9.2 South Korea Women’s Wearable Fertility Monitors Market By Technology

10.4.9.3 South Korea Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.10 Vietnam

10.4.10.1 Vietnam Women’s Wearable Fertility Monitors Market By Type

10.4.10.2 Vietnam Women’s Wearable Fertility Monitors Market By Technology

10.4.10.3 Vietnam Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.11 Singapore

10.4.11.1 Singapore Women’s Wearable Fertility Monitors Market By Type

10.4.11.2 Singapore Women’s Wearable Fertility Monitors Market By Technology

10.4.11.3 Singapore Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.12 Australia

10.4.12.1 Australia Women’s Wearable Fertility Monitors Market By Type

10.4.12.2 Australia Women’s Wearable Fertility Monitors Market By Technology

10.4.12.3 Australia Women’s Wearable Fertility Monitors Market By Distribution Channel

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Women’s Wearable Fertility Monitors Market By Type

10.4.13.2 Rest of Asia-Pacific Women’s Wearable Fertility Monitors Market By Technology

10.4.13.3 Rest of Asia-Pacific Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Women’s Wearable Fertility Monitors Market by Country

10.5.2.2 Middle East Women’s Wearable Fertility Monitors Market By Type

10.5.2.3 Middle East Women’s Wearable Fertility Monitors Market By Technology

10.5.2.4 Middle East Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.2.5 UAE

10.5.2.5.1 UAE Women’s Wearable Fertility Monitors Market By Type

10.5.2.5.2 UAE Women’s Wearable Fertility Monitors Market By Technology

10.5.2.5.3 UAE Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.2.6 Egypt

10.5.2.6.1 Egypt Women’s Wearable Fertility Monitors Market By Type

10.5.2.6.2 Egypt Women’s Wearable Fertility Monitors Market By Technology

10.5.2.6.3 Egypt Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Women’s Wearable Fertility Monitors Market By Type

10.5.2.7.2 Saudi Arabia Women’s Wearable Fertility Monitors Market By Technology

10.5.2.7.3 Saudi Arabia Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.2.8 Qatar

10.5.2.8.1 Qatar Women’s Wearable Fertility Monitors Market By Type

10.5.2.8.2 Qatar Women’s Wearable Fertility Monitors Market By Technology

10.5.2.8.3 Qatar Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Women’s Wearable Fertility Monitors Market By Type

10.5.2.9.2 Rest of Middle East Women’s Wearable Fertility Monitors Market By Technology

10.5.2.9.3 Rest of Middle East Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.3 Africa

10.5.3.1 Africa Women’s Wearable Fertility Monitors Market by Country

10.5.3.2 Africa Women’s Wearable Fertility Monitors Market By Type

10.5.3.3 Africa Women’s Wearable Fertility Monitors Market By Technology

10.5.3.4 Africa Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Women’s Wearable Fertility Monitors Market By Type

10.5.3.5.2 Nigeria Women’s Wearable Fertility Monitors Market By Technology

10.5.3.5.3 Nigeria Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.3.6 South Africa

10.5.3.6.1 South Africa Women’s Wearable Fertility Monitors Market By Type

10.5.3.6.2 South Africa Women’s Wearable Fertility Monitors Market By Technology

10.5.3.6.3 South Africa Women’s Wearable Fertility Monitors Market By Distribution Channel

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Women’s Wearable Fertility Monitors Market By Type

10.5.3.7.2 Rest of Africa Women’s Wearable Fertility Monitors Market By Technology

10.5.3.7.3 Rest of Africa Women’s Wearable Fertility Monitors Market By Distribution Channel

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Women’s Wearable Fertility Monitors Market by country

10.6.3 Latin America Women’s Wearable Fertility Monitors Market By Type

10.6.4 Latin America Women’s Wearable Fertility Monitors Market By Technology

10.6.5 Latin America Women’s Wearable Fertility Monitors Market By Distribution Channel

10.6.6 Brazil

10.6.6.1 Brazil Women’s Wearable Fertility Monitors Market By Type

10.6.6.2 Brazil Women’s Wearable Fertility Monitors Market By Technology

10.6.6.3 Brazil Women’s Wearable Fertility Monitors Market By Distribution Channel

10.6.7 Argentina

10.6.7.1 Argentina Women’s Wearable Fertility Monitors Market By Type

10.6.7.2 Argentina Women’s Wearable Fertility Monitors Market By Technology

10.6.7.3 Argentina Women’s Wearable Fertility Monitors Market By Distribution Channel

10.6.8 Colombia

10.6.8.1 Colombia Women’s Wearable Fertility Monitors Market By Type

10.6.8.2 Colombia Women’s Wearable Fertility Monitors Market By Technology

10.6.8.3 Colombia Women’s Wearable Fertility Monitors Market By Distribution Channel

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Women’s Wearable Fertility Monitors Market By Type

10.6.9.2 Rest of Latin America Women’s Wearable Fertility Monitors Market By Technology

10.6.9.3 Rest of Latin America Women’s Wearable Fertility Monitors Market By Distribution Channel

11. Company Profiles

11.1 Tempdrop

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Ovaterra

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Ava Science

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 kegg

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Clearblue

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Food Freedom Fertility

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Kindara

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 OvuSense

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Proov

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Natural Cycles

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Basal Body Temperature (BBT) Monitors

Hormone-based Monitors

Combination Monitors

Others

By Technology

Sensors

Connectivity

Data Analysis Capabilities

By Distribution Channel

E-Commerce

Pharmacies

Fertility clinics

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Preeclampsia Diagnostics Market size was valued at USD 1.22 Billion in 2023 and is expected to reach USD 1.59 Billion By 2032 with a growing CAGR of 2.98% over the forecast period of 2024-2032.

Epilepsy Drugs Market was valued at USD 7.6 billion in 2023 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 4.06% from 2024-2032.

The Hearing Aids Market Size was valued at USD 7.98 Billion in 2023, and is expected to reach USD 14.25 Billion by 2032, and grow at a CAGR of 6.95%.

The Medical Consumables Market Size was valued at USD 430.42 Billion in 2023 and is expected to reach USD 1194.52 Billion by 2032 and grow at a CAGR of 12.05% over the forecast period 2024-2032.

The Medical Holography Market was USD 1.57 billion in 2023 and is expected to reach USD 11.35 billion by 2032, growing at a CAGR of 23.81% by 2024-2032.

The Radiation Oncology Treatment Planning Software Market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 4.75 billion by 2032 at a CAGR of 9.04% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone