Women's Health Diagnostics Market Size:

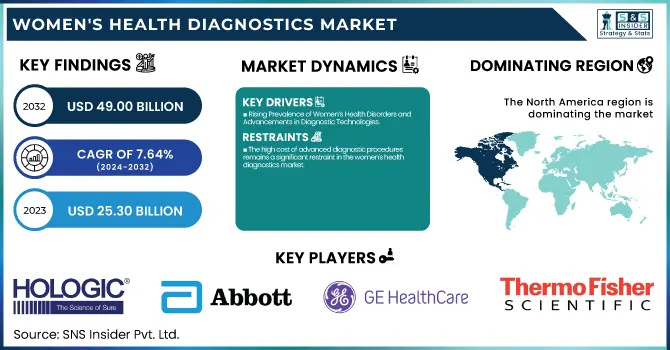

The Women's Health Diagnostics Market Size was valued at USD 25.30 billion in 2023 and is projected to reach USD 49.00 billion by 2032 and grow at a CAGR of 7.64% over the forecast period 2024-2032.

To Get more information on Women's Health Diagnostics Market - Request Free Sample Report

This report identifies the growing incidence and prevalence of women's health conditions worldwide, as well as the rising uptake of early screening programs and preventive diagnostics. Advances in technology are revolutionizing the landscape, with developments in imaging, molecular diagnostics, and AI-based screening tools improving early detection rates. The research investigates the increasing demand for home-based and point-of-care testing solutions driven by convenience and accessibility. Moreover, it delves into the influence of regulatory policies on market forces, determining product approvals, compliance requirements, and reimbursement models, all of which play a role in the dynamic women's health diagnostics market.

Women's Health Diagnostics Market Dynamics

Drivers

-

Rising Prevalence of Women’s Health Disorders and Advancements in Diagnostic Technologies

The rising incidence of women's health-related diseases like breast cancer, cervical cancer, polycystic ovary syndrome (PCOS), osteoporosis, and infertility is the major growth driver for the market of women's health diagnostics. Breast cancer, as per the WHO, is the most frequent cancer in women, with 2.3 million new cases every year. The increasing need for early disease identification and preventive care has driven the uptake of newer diagnostic technologies like 3D mammography, liquid biopsy, and AI imaging. Furthermore, the expansion of non-invasive prenatal testing (NIPT) and point-of-care diagnostics has enhanced convenience and accessibility for patients. Regular cervical cancer screening and HPV vaccination initiatives by government and private healthcare agencies also contribute to market growth. The growing emphasis on individualized medicine and genetic screening, including BRCA1 and BRCA2 gene testing for assessing breast cancer risk, is also driving the market growth. The advent of telemedicine and home-based diagnostic technologies has further improved access to diagnostic services, especially in underserved communities. Due to ongoing technological improvement and increasing consciousness, the requirement for women's health diagnostics will increase substantially over the coming years.

Restraints

-

The high cost of advanced diagnostic procedures remains a significant restraint in the women's health diagnostics market.

Imaging technologies like 3D mammography, genetic testing, and high-resolution ultrasound equipment have huge costs and hence are beyond the reach of the majority of the population. A single BRCA gene test to assess the risk of breast cancer, for example, costs between USD 300 and USD 5,000, thereby inhibiting universal acceptance. Also, reimbursement policies by healthcare institutions are highly varied by region, and most insurance companies provide partial or limited reimbursement for preventive and genetic testing. In low- and middle-income nations, access to specialized diagnostic centers is limited because of poor healthcare infrastructure and a lack of trained personnel. As per a WHO report, almost 70% of cervical cancer-related deaths take place in resource-constrained environments because of the absence of screening and early detection programs. In addition, regulatory issues and long approval times for new diagnostic equipment and tests hinder market growth. The hospital-based diagnostic center dependence also restricts access, especially for women in rural or underserved areas. Resolution of these affordability and accessibility issues through cost-effective diagnostic products and enhanced insurance coverage will be imperative to drive market growth.

Opportunities

-

The growing adoption of home-based and point-of-care diagnostic solutions presents a significant opportunity for the women’s health diagnostics market.

Growing demand for pregnancy self-testing kits, fertility tracking, HPV screening, and STIs is fueling growth in this sector. For instance, global demand for over-the-counter pregnancy testing kits has witnessed a massive jump, with the market set to grow consistently based on increased awareness and accessibility. Moreover, the onset of telehealth and online health platforms has allowed remote diagnostic interpretation and consultations, enhancing healthcare accessibility for women in far-flung places. The creation of AI-based mobile apps that monitor menstrual health, fertility cycles, and hormonal cycles further increases diagnostic accuracy and user interaction. Firms are increasingly investing in wearable health devices that monitor ovulation, hormonal cycles, and early warning signs of pregnancy complications. In addition, growing collaborations between medical professionals and diagnostic firms are broadening the range of low-cost and fast diagnostic tests. The use of lab-on-a-chip technology and smartphone-enabled diagnostic equipment is likely to disrupt the market, as diagnostics become cheaper and more accessible. With the increasing requirement for easy and real-time health monitoring by consumers, the growth of in-home diagnostic products is likely to contribute to strong market growth.

Challenges

-

Stringent regulatory requirements and data privacy concerns pose significant challenges for the women’s health diagnostics market.

The process of approval for new medical devices and diagnostic tests is usually lengthy and complicated, hindering market entry. For example, regulatory agencies like the FDA (U.S.), EMA (Europe), and CFDA (China) have stringent requirements for the approval of new diagnostic technologies, especially genetic and biomarker-based tests. The requirement for large-scale clinical trials and adherence to regulatory requirements raises costs and slows innovation. Moreover, data privacy issues are an emerging problem with the greater adoption of digital health records, AI-based diagnostics, and wearable health monitoring technology. Women's health information, such as genetic test results, pregnancy tracking, and fertility monitoring, is sensitive, and there are issues of data security and abuse. Poor cybersecurity practices can result in data breaches, unauthorized access, and ethical issues related to the commercialization of individual health data. In addition, differences in regulation between nations cause difficulties in extending markets globally due to the necessity of adapting diverse compliance needs and approval procedures. Resolving regulatory and data protection issues through simpler guidelines, standard policies, and improved cybersecurity initiatives is crucial to the further growth of the market for women's health diagnostics.

Women's Health Diagnostics Market Segmentation Analysis

By Application

Cancer diagnostics captured the highest revenue share of 33.03% in 2023, with the rising incidence of breast, cervical, and ovarian cancers. Increased awareness and adoption of early screening programs, combined with technological improvements in imaging and biomarker-based diagnostic tests, have greatly driven this segment's leadership. Routine cancer screenings encouraged by governments and technological advancements, including AI-based diagnostics, have also accelerated market growth.

Prenatal diagnostics is poised to register the highest growth owing to growing maternal age, awareness of prenatal screening, and growing uptake of non-invasive prenatal testing (NIPT). The growing prevalence of chromosomal abnormalities and the emergence of sophisticated diagnostic tools, including next-generation sequencing (NGS) for fetal testing, are fueling demand in this category. Favorable healthcare policies and growth in insurance coverage for prenatal screening are also primary drivers.

By End-Use

Hospitals dominated the highest revenue share in 2023 due to their positioning as key sites for women's health diagnostics such as high-end imaging, laboratory procedures, and all-encompassing healthcare services. Access to state-of-the-art diagnostic machinery, specialized medical practitioners, and large numbers of patient visits have made hospitals dominate the sector. Furthermore, government and private investments in hospitals' infrastructure improved access to state-of-the-art diagnostic options.

Home care diagnostics is also anticipated to witness the most rapid growth from 2024 to 2032, with the rise in the demand for at-home testing products and the trend of self-monitoring solutions. The use of home-based pregnancy tests, fertility tracking kits, and at-home HPV and STI screening kits has increased significantly because of convenience, cost-effectiveness, and increasing telehealth integration. The growth of digital health platforms and the movement towards decentralized models of healthcare further attest to the fast-paced expansion of this sector.

Women's Health Diagnostics Market Regional Insights

The North American region led the women's health diagnostics market, with 44.31% of the world's market revenue in 2023. The region is propelled by superior healthcare infrastructure, superior awareness levels, and robust government support for early disease detection. The availability of major market players, the growing adoption of sophisticated diagnostic technologies, and the growing prevalence of diseases like breast and cervical cancer also contribute to regional growth. The United States of America has the highest market share owing to high health expenditure, positive reimbursement policies, and an emphasis on women's health research.

Europe is next, with well-established healthcare systems and an increasing focus on preventive care. Germany, the UK, and France are key contributors to market growth, led by government-funded screening programs and increasing investments in diagnostic technologies. The rising uptake of personalized medicine and AI-based diagnostic solutions is also transforming the regional market.

The Asia-Pacific region is likely to experience the highest growth driven by growing awareness, enhanced healthcare infrastructure, and growing demand for affordable diagnostic products. China, India, and Japan are growing rapidly in the market due to increased cases of gynecological disorders, an increase in medical tourism, and government initiatives for improving women's health services. Growing insurance coverage and public health programs also promote regional market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Women's Health Diagnostics Market

-

F. Hoffmann-La Roche Ltd. – cobas HPV Test, cobas Mammography Solutions, Elecsys Anti-Müllerian Hormone (AMH) Test, Ventana HER2 Assay

-

Hologic, Inc. – ThinPrep Pap Test, Genius 3D Mammography System, Aptima HPV Assay, Panther System

-

Quest Diagnostics Incorporated – BRCAvantage (BRCA1/BRCA2 Testing), HPV and Pap Co-testing, Comprehensive Hormone Panel for Women's Health, MaterniT 21 PLUS (NIPT)

-

Abbott – Alinity m HPV Assay, ARCHITECT Estradiol Assay, i-STAT Total β-hCG Test, RealTime High-Risk HPV Test

-

BD (Becton, Dickinson, and Company) – BD SurePath Liquid-based Pap Test, BD Onclarity HPV Assay, BD MAX Vaginal Panel, BD Affirm VPIII Microbial Identification

-

GE Healthcare – Senographe Pristina Mammography System, Invenia ABUS (Automated Breast Ultrasound System), Voluson Ultrasound Series

-

Koninklijke Philips N.V. – Affiniti Ultrasound System, Epiq Women's Health Ultrasound, MicroDose SI Mammography

-

Aspira Women's Health – OVA1 Test, OVERA Test

-

Thermo Fisher Scientific Inc. – Ion Torrent NGS for Women's Health, ProFlex PCR System, SureTect Real-Time PCR Assays

-

Cardinal Health, Inc. – Women’s Health Point-of-Care Testing Solutions, Pregnancy & Fertility Test Kits

-

Siemens AG – Mammomat Revelation Mammography System, ADVIA Centaur HPV Assay, Atellica IM Estradiol Assay

-

PerkinElmer Inc. – DELFIA Xpress hCG Test, Vanadis NIPT, Eeva Test for IVF

Recent Developments

In Feb 2025, Aspira Women's Health Inc. announced executive leadership changes, with President Dr. Sandra Milligan resigning for personal reasons, effective February 21, 2025. Jamie Sullivan and Todd Pappas will take over her responsibilities, ensuring continuity in leadership and operations.

In Jan 2025, PinkDx, an early-stage women’s health diagnostics company, raised an additional USD 5 million in its Series A extension, bringing the total funding to USD 45 million. The new investment came from Blue Venture Fund, Sandbox Clinical Ventures, and BEVC, following earlier backing from Catalio Capital Management, The Production Board, Mountain Group Partners, Byers Capital, and Mayo Clinic.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.30 billion |

| Market Size by 2032 | USD 49.00 billion |

| CAGR | CAGR of 7.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Cancer, Infectious Diseases, Osteoporosis, Pregnancy & Fertility, Prenatal)

• By End-Use (Hospitals, Laboratory, Home Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alere Inc., Abbott, Bristol-Myers Squibb Company, Janssen Global Services, LLC, Gilead Sciences, Inc., Merck & Co., Inc., ViiV Healthcare, BD (Becton, Dickinson, and Company), Beckman Coulter, Inc., PointCare, F. Hoffmann-La Roche Ltd., Siemens Healthcare GmbH, QIAGEN, OraSure Technologies, DiaSorin. |