Wireless Testing Market Report Scope & Overview:

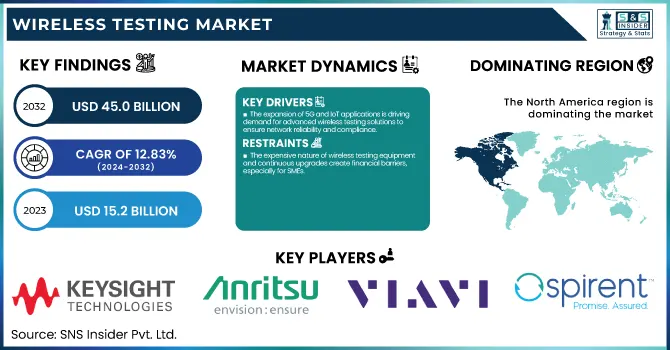

The Wireless Testing Market was valued at USD 15.2 Billion in 2023 and is expected to reach USD 45.0 Billion by 2032, growing at a CAGR of 12.83% from 2024-2032.

To Get more information on Wireless Testing Market - Request Free Sample Report

The Wireless Testing Market is witnessing significant growth due to the rising adoption of wireless testing solutions across industries such as telecommunications, automotive, and healthcare. The expansion of 5G and IoT infrastructure globally is driving demand for advanced testing solutions, with North America and Asia-Pacific leading the way. Certification and compliance testing for wireless devices have become more stringent between 2020-2023, ensuring regulatory adherence. Additionally, the demand for Over-the-Air (OTA) and RF testing services is surging, especially in consumer electronics and network equipment. The report also highlights trends such as AI-driven test automation, increasing focus on cybersecurity testing, and the growing role of software-defined testing solutions.

Wireless Testing Market Dynamics

Drivers

-

The expansion of 5G and IoT applications is driving demand for advanced wireless testing solutions to ensure network reliability and compliance.

The Wireless Testing Market is primarily driven by the fast rollout of 5G networks and the rapidly-growing adoption of Internet of Things devices. The increasing dependency of 5G infrastructure on reliability, low latency, and high-speed connectivity is creating an unnecessary demand for advanced testing solutions for 5G networks all over the world. Furthermore, wireless testing has gained significant importance in various IoT applications as they are used in sectors like healthcare, automotive, and smart homes, which often mandate that the technology satisfy various industry standards. Because of the increasing consumer need for connectivity devices and the stringent government regulations of wireless communication, it is one of the fastest-growing markets due to its crucial role in the design and deployment of the next-gen wireless technologies.

Restraints

-

The expensive nature of wireless testing equipment and continuous upgrades create financial barriers, especially for SMEs.

High cost of wireless testing solutions is a major factor restraining the growth of the market. Costly Infrastructure – Sophisticated testing tools like Over-the-Air chambers, Radio Frequency analyzers, and network emulators need a lot of investment. In addition, businesses will need to invest in testing infrastructure upgrades for the ever-evolving wireless standards. SMEs, due to their inherent high TCO and maintenance costs, usually tend to be low on penetration. Moreover, operating and maintaining a wireless testing lab and meeting the international applicable regulations comes with significant expenses for organizations to bear.

Opportunity

-

AI and software-defined testing enhance efficiency, reduce costs, and accelerate wireless testing processes.

The wireless testing market is also expected to witness significant growth due to the penetration of Artificial Intelligence and machine learning. Automated fault detection, predictive maintenance, and real-time analytics are provided with AI-driven testing solutions with minimum manual intervention, with automated testing, which in turn enhances the overall efficiency of testing. In addition, software-defined testing is increasingly adopted, providing organizations with the ability to virtualize testing without requiring costly hardware configurations. Such innovations not only lower prices, but also speed testing times, making them appealing to industries ranging from automotive to telecommunications to consumer electronics. With the evolution of wireless networks, the way AI-powered testing will remain plays a vital role for an efficient, accurate, and in due time validation of the network.

Challenges

-

The evolution of 6G, Wi-Fi 7, and mmWave technologies increases interoperability challenges and requires continuous R&D investments.

The ever-evolving landscape of wireless technologies , such as 6G, Wi-Fi 7, and mmWave communication, creates a massive challenge for wireless testing companies. Diverse global standards and regulations must be adhered to through extensive testing. Multi-band and multi-radio All-in-One systems. Wireless networks are growing into increasingly complex systems whose complexity makes accurate interoperability testing among devices, frequencies, and communication protocols increasingly difficult. Moreover, the advent of, along with network function virtualization, is creating further complexity, necessitating the need for flexible and scalable testing methods. These innovations require heavy investment into R&D, resulting in a major barrier to entry for smaller players.

Wireless Testing Market Segmentation Analysis

By Offering

In 2023, the equipment segment dominated the market and accounted for significant revenue share. With the advent of wireless technologies like 5G and IoT, developing advanced testing equipment is essential when it comes to testing performance, reliability, and compliance. As wireless systems become increasingly complex by shuttling between radio frequencies and protocols, designers seek test solutions that are not only highly accurate but also multi-functional.

The combination of increased connectivity, tighter timeframes, and stringent regulatory requirements across industries such as telecommunications, automotive, and aerospace is driving the need for advanced testing tools to ensure compliance with ever-evolving standards. The inclination towards automation in the testing process, the operational activities have also given impetus towards the utilization of technologically advanced equipment providing better accuracy, repeatability, and efficiency. Moreover, expensiveness and long lifecycle of testing instruments will support continuous investments in this segment.

BY Technology

The 4G LTE segment dominated the market and accounted for significant revenue share. Based on technology, the market is segmented into Wi-Fi, Bluetooth, 2G/3G, 4G/LTE, and 5G technologies. Broadly, the Fourth Global Adoption and Further Extension of 4G/LTE Networks Fuels the Ongoing Requirement for Testing Solutions. 4G/LTE still forms the backbone of mobile communications in many parts of the world, justifying continuous testing and optimization, even with the coming of 5G. Due to the maturity of 4G/LTE technology, a robust ecosystem of devices and infrastructure already exists, requiring thorough testing to verify that diverse implementations work properly with each other and function at the expected levels.

Also, as LTE-Advanced and LTE-Advanced Pro have evolved to carrier aggregation and higher-order MIMO, the testing methods needed have become very complex. With 4G/LTE being used in critical applications such as public safety networks and in IoT, the need for reliable and coverage testing has increased.

By Application

In 2023, the Consumer Electronics segment dominated the market and accounted for significant revenue share. With the widespread availability of devices with wireless capabilities such as mobile phones, tablets, smartwatches, smart home appliances, etc., testing solutions for this emerging market are increasing sharply. Widely known for their short release cycles and high production volumes, consumer electronics require extensive and rapid testing to meet quality assurance and compliance standards.

Comprehensive testing protocols are also required based on regulatory compliance from across the globe. As we see more boost for IoT inside the consumer environment, it also extends the objects and connectivity situations of wireless testing. In addition, as consumer products quickly adopt new wireless standards like Wi-Fi 6 and Bluetooth 5.0, the need for more sophisticated testing capabilities continues to grow.

Regional Analysis

North America dominated the market and accounted for 36% of revenue share in 2023, with growing wireless testing data, coupled with growing wireless testing development. Leading the way in wireless technology with 5G deployments and IoT integrations, the region ranks among the best. This leadership role demands robust testing solutions to ensure and verify the next-gen wireless systems quality and performance.

The Asia Pacific is expected to register the fastest CAGR during the forecast period. Rapid urbanization and digital transformation initiatives across nations such as China, India, Japan, and South Korea, are resulting in increased demand for wireless technologies and testing solutions. A booming population and increasing middle class in the region are driving up smartphone adoption and the penetration of other connected devices, creating a strong need for testing infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Keysight Technologies – UXM 5G Wireless Test Platform

-

Rohde & Schwarz – R&S CMW500 Wideband Radio Communication Tester

-

Anritsu Corporation – MT8821C Radio Communication Analyzer

-

Viavi Solutions Inc. – OneAdvisor-800 Wireless Test System

-

Spirent Communications – Spirent Landslide Wireless Core Network Testing

-

DEKRA SE – DEKRA Wireless Device Testing Services

-

Bureau Veritas – Smartworld Wireless Testing Solutions

-

Intertek Group plc – Intertek Wireless Compliance Testing

-

TÜV Rheinland – TÜV Rheinland OTA & RF Testing

-

TÜV SÜD – TÜV SÜD Mobile Device Certification Testing

-

Eurofins Scientific – Eurofins Wireless Performance Testing

-

SGS SA – SGS Wireless Network Testing Services

-

Element Materials Technology – Element RF & Microwave Testing

-

COMPRION GmbH – COMPRION Network Simulators

-

Ansys Inc. – Ansys HFSS Wireless Simulation

Recent Developments

-

March 2024: Keysight Technologies acquired UK's Spirent Communications for $1.5 billion, enhancing its wireless testing capabilities.

-

May 2024: SGS expanded its wireless testing services in North America by acquiring ArcLight Wireless, a leader in wireless engineering services.

-

October 2024: Viavi Solutions launched NITRO Wireless, a portfolio designed to accelerate 5G and 6G technology development through smart and automated performance validation

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 15.2 Billion |

|

Market Size by 2032 |

USD 45.0 Billion |

|

CAGR |

CAGR of 12.83% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Offering (Equipment, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Viavi Solutions Inc., Spirent Communications, DEKRA SE, Bureau Veritas, Intertek Group plc, TÜV Rheinland, TÜV SÜD, Eurofins Scientific, SGS SA, Element Materials Technology, COMPRION GmbH, Ansys Inc. |