Wireless Display Market Size & Growth:

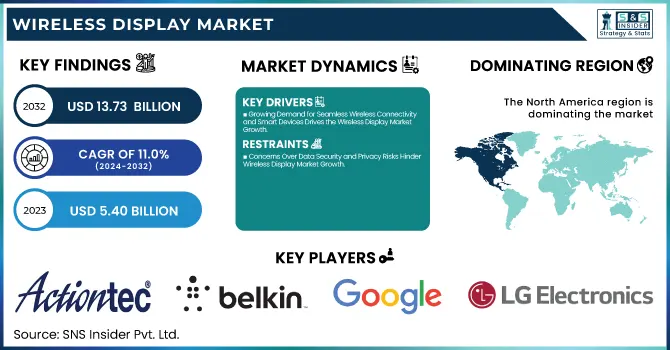

The Wireless Display Market Size was valued at USD 5.40 Billion in 2023 and is expected to reach USD 13.73 Billion by 2032 and grow at a CAGR of 11.0% over the forecast period 2024-2032. The Market is experiencing rapid growth driven by increasing demand for seamless content streaming, advancements in display technologies, and rising adoption across residential and commercial sectors. The proliferation of smart TVs, laptops, and mobile devices, coupled with improved internet connectivity, has fueled market expansion. Key technologies like AirPlay, Miracast, and Google Cast are gaining traction, offering high-quality screen mirroring and streaming solutions. The market is further influenced by rising demand for remote work solutions, smart classrooms, and digital signage applications. Additionally, growing investments in 5G, Wi-Fi 6, and ultra-low latency streaming are expected to drive further innovation, enhancing user experience and connectivity.

To Get more information on Wireless Display Market - Request Free Sample Report

Wireless Display Market Dynamics

Key Drivers:

-

Growing Demand for Seamless Wireless Connectivity and Smart Devices Drives the Wireless Display Market Growth

The increasing adoption of smart devices such as smartphones, tablets, laptops, and smart TVs is a key driver for the Wireless Display Market. Consumers and businesses seek seamless screen mirroring and content-sharing solutions for entertainment, presentations, and remote collaboration. The rise of remote work, online education, and digital signage applications has further fueled demand for wireless display technologies like Miracast, AirPlay, and Google Cast. Additionally, advancements in Wi-Fi 6, 5G, and ultra-low latency streaming are enhancing performance, enabling high-definition video transmission with minimal lag. The gaming industry is also contributing to market growth as gamers prefer wireless screen mirroring solutions for an immersive experience. Furthermore, businesses are increasingly investing in wireless conferencing solutions, eliminating the need for cables and enhancing efficiency. As technology advances, wireless display solutions are expected to become more affordable and widely adopted, further driving market expansion.

Restrain:

-

Concerns Over Data Security and Privacy Risks Hinder Wireless Display Market Growth

The Wireless Display Market is the rising concern over data security and privacy risks. Since wireless display solutions rely on Wi-Fi, Bluetooth, and internet-based streaming technologies, they are vulnerable to cyber threats, unauthorized access, and data breaches. Businesses, educational institutions, and individuals are increasingly cautious about sharing sensitive information over wireless networks due to risks like hacking, malware attacks, and screen hijacking. Additionally, compatibility issues between different operating systems and wireless display protocols further complicate security measures. Many corporate environments and government institutions hesitate to adopt wireless display solutions due to strict compliance and data protection regulations. To overcome this challenge, manufacturers and technology providers must invest in advanced encryption, authentication, and secure network protocols to ensure data protection. Addressing these concerns effectively will be crucial in boosting adoption rates and enhancing consumer confidence in wireless display technology.

Opportunities:

-

Expansion of 5G Networks and Wi-Fi 6 Adoption Creates Lucrative Opportunities for Wireless Display Market Growth

The rapid deployment of 5G networks and the adoption of Wi-Fi 6 present a significant growth opportunity for the Wireless Display Market. These advanced wireless technologies enable faster data transmission, lower latency, and improved network reliability, making wireless streaming and screen mirroring more efficient. With 5G connectivity, users can experience seamless high-definition video streaming, real-time gaming, and lag-free remote collaboration, driving demand for wireless display solutions in entertainment, education, and corporate environments. Additionally, Wi-Fi 6 technology enhances network capacity and efficiency, allowing multiple devices to connect simultaneously without compromising performance. The increasing availability of smart TVs, projectors, and wireless display adapters integrated with 5G and Wi-Fi 6 capabilities is expected to boost adoption across residential and commercial sectors. As these technologies continue to evolve, businesses and consumers will embrace wireless display solutions for enhanced user experiences, connectivity, and productivity.

Challenge;

-

Compatibility Issues Across Devices and Operating Systems Pose a Significant Challenge for Wireless Display Market

The Wireless Display Market is the lack of standardization and compatibility across different devices and operating systems. Various wireless display technologies, such as Miracast, AirPlay, and Google Cast, operate on different platforms, leading to interoperability issues. Users often face difficulties in seamlessly connecting devices from different manufacturers, requiring additional adapters or third-party software. Businesses and consumers demand a universal wireless display standard to ensure smooth connectivity across multiple devices, including smartphones, tablets, laptops, and smart TVs. Additionally, software updates and firmware changes can sometimes disrupt connectivity and performance, causing frustration among users. These compatibility challenges hinder mass adoption and require industry players to collaborate on standardization efforts. Addressing this issue through cross-platform compatibility solutions, firmware updates, and open-source wireless display standards will be critical to overcoming this challenge and expanding the market.

Wireless Display Market Segments Analysis

By Offering

The Hardware segment led the Wireless Display Market in 2023, accounting for 53% of total revenue, driven by the widespread adoption of wireless display adapters, streaming devices, smart TVs, and projectors. The demand for high-definition and seamless screen-sharing solutions has surged across residential and commercial applications, including smart homes, corporate boardrooms, education, and digital signage. Leading players like Google LLC, Roku, Inc., and Microsoft Corporation have played a significant role in driving hardware adoption.

For instance, Google launched Chromecast with Google TV (HD) in September 2022, offering enhanced streaming quality, Google Assistant integration, and compatibility with multiple devices. Similarly, Microsoft's Wireless Display Adapter continues to be a preferred choice for professionals seeking hassle-free screen mirroring solutions.

Additionally, NETGEAR’s Push2TV and Actiontec’s ScreenBeam adapters have further strengthened the hardware segment by enabling wireless presentations and home entertainment experiences. The increasing penetration of smart TVs integrated with Miracast, AirPlay, and Google Cast has also fueled market dominance.

The Software segment within the Wireless Display Market is expected to grow at the highest CAGR of 12.4% during the forecast period, driven by rising demand for screen-sharing applications, cloud-based collaboration tools, and AI-powered streaming solutions. The increasing adoption of wireless display software for business meetings, remote education, and entertainment applications has accelerated market expansion. Companies are investing heavily in software innovations to enhance connectivity, security, and user experience.

Additionally, Apple’s iOS 17 update in September 2023 brought enhanced AirPlay functionality, allowing seamless wireless content sharing across multiple Apple devices. The growing integration of AI-driven screen optimization, multi-device synchronization, and real-time collaboration tools is further propelling software adoption.

By Technology

In 2023, the AirPlay segment led the Wireless Display Market, accounting for the largest revenue share, driven by the widespread adoption of Apple devices and seamless integration within the Apple ecosystem. AirPlay enables high-quality wireless streaming and screen mirroring across iPhones, iPads, MacBooks, Apple TVs, and select smart TVs, making it a preferred choice for consumers and professionals. Apple has continuously enhanced AirPlay technology, improving latency, multi-room audio synchronization, and cross-device compatibility.

Additionally, LG, Samsung, and Sony have integrated AirPlay 2 into their latest smart TVs, enabling direct wireless content sharing without additional hardware. The increasing demand for wireless home entertainment, corporate presentations, and smart home connectivity has further solidified AirPlay’s dominance.

The Google Cast segment is expected to grow at the highest CAGR during the forecasted period, driven by the rising adoption of Android-powered streaming devices, smart TVs, and cross-platform compatibility. Google Cast technology, integrated into Chromecast devices, Android TVs, and third-party smart displays, allows users to wirelessly stream content from smartphones, tablets, and Chrome browsers to larger screens. The demand for affordable, user-friendly wireless display solutions has accelerated the adoption of Google Cast in both residential and commercial applications.

Additionally, brands like Sony, TCL, and Hisense continue to embed Google Cast in their smart TVs, expanding its reach. The growing use of Google Cast in conference rooms, remote learning, and gaming applications further drives market growth. As Google enhances Cast technology with AI-powered recommendations, 5G connectivity, and ultra-low latency streaming, the segment is poised for significant expansion.

By End-use

The Residential segment led the Wireless Display Market in 2023, capturing the largest revenue share, driven by the increasing adoption of smart TVs, streaming devices, and wireless entertainment solutions. Consumers are increasingly relying on wireless display technology for seamless content streaming, gaming, and home theater experiences, fueling demand for devices like Apple TV, Chromecast, Roku, and Miracast-enabled smart TVs.

Additionally, Roku introduced its Roku Ultra 2023 model, featuring Dolby Vision, faster performance, and expanded wireless range, further enhancing the home streaming experience. Apple’s iOS 17 update in 2023 also improved AirPlay capabilities, making wireless screen mirroring across Apple devices smoother than ever. The rise of 4K and 8K streaming, gaming consoles, and AI-enhanced home entertainment has further driven segment growth.

The Commercial segment is projected to grow at the highest CAGR during the forecast period, driven by increasing adoption in corporate offices, educational institutions, healthcare facilities, and digital signage applications. Businesses are transitioning to wireless display solutions for seamless presentations, video conferencing, and collaborative workspaces, eliminating the need for complex cable setups. In January 2023, Microsoft introduced enhanced wireless display features in Windows 11, improving screen mirroring capabilities for corporate users.

Additionally, LG launched its latest series of Miracast-enabled smart projectors, enabling wireless business presentations with high-resolution streaming. The demand for wireless digital signage solutions in retail, hospitality, and healthcare sectors is also accelerating growth.

Wireless Display Market Regional Overview

In 2023, North America led the Wireless Display Market, holding the largest market share, driven by high consumer demand for smart home entertainment, corporate adoption of wireless conferencing solutions, and strong technological infrastructure. The region’s dominance is fueled by widespread adoption of wireless streaming devices like Chromecast, Apple TV, Roku, and Miracast-enabled smart TVs, along with increasing investments in 5G and Wi-Fi 6 technologies.

Additionally, businesses are rapidly integrating wireless display solutions for video conferencing, with Microsoft expanding its Wireless Display Adapter offerings for hybrid work environments. The presence of leading tech companies, including Google, Apple, Microsoft, and Roku, has further strengthened market growth.

The Asia Pacific region is experiencing the fastest growth in the Wireless Display Market, with an estimated highest CAGR, driven by rapid digital transformation, increasing smartphone penetration, and rising demand for smart home entertainment solutions. Countries like China, India, Japan, and South Korea are leading this growth, fueled by expanding internet connectivity, adoption of 5G networks, and rising disposable incomes.

Additionally, Google expanded its Chromecast product line in India and Southeast Asia, making wireless display solutions more accessible. The corporate sector is also embracing wireless conferencing solutions, with businesses and educational institutions shifting to hybrid work and e-learning models. The rapid deployment of Wi-Fi 6, AI-powered screen-sharing, and affordable wireless display devices is expected to drive continued market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Wireless Display Market are:

-

Actiontec Electronics, Inc. (ScreenBeam Wireless Display Adapter, ScreenBeam Mini 2)

-

Apple Inc. (Apple TV, AirPlay)

-

Belkin (Belkin ScreenCast, Belkin Miracast Video Adapter)

-

Google LLC (Chromecast, Google Cast)

-

IOGEAR (IOGEAR Wireless HD Transmitter, IOGEAR Share Pro)

-

Intel Corporation (Intel WiDi, Intel Unite)

-

Lattice Semiconductor (Lattice Miracast Solutions, Lattice WirelessHD)

-

LG Electronics (LG Smart Share, LG Miracast TV)

-

Marvell (Marvell AVASTAR Wireless Chipset, Marvell 88W8997 Wi-Fi)

-

MediaTek Inc. (MediaTek Wi-Fi Display, MediaTek SmartView)

-

Microsoft Corporation (Microsoft Wireless Display Adapter, Miracast on Windows)

-

MiraScreen (MiraScreen G-Series, MiraScreen Wireless HDMI Dongle)

-

NETGEAR (NETGEAR Push2TV, NETGEAR Nighthawk Pro Streaming)

-

Roku, Inc. (Roku Streaming Stick, Roku Screen Mirroring)

-

StarTech.com (StarTech Wireless Display Adapter, StarTech HDMI Over Wi-Fi)

Recent Trends

-

In December 2024, Belkin introduced the Auto-Tracking Stand Pro with DockKit, a versatile accessory designed to enhance video calls and content creation on iPhones. This stand features a 360-degree rotating base and motorized 90-degree auto-tilt, automatically tracking face and body movements to maintain optimal framing. It includes a built-in battery for untethered use and a MagSafe charging pad capable of 15-watt wireless charging.

-

In April 2023, Google announced it would discontinue software updates for several third-party smart displays, including Lenovo, JBL, and LG models. This decision indicates a shift away from supporting Assistant-enabled products from these manufacturers. While existing functionalities on these devices continue to operate, users may experience a decline in the quality of video calls and meetings due to the lack of ongoing support and updates.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.40 Billion |

| Market Size by 2032 | USD 13.73 Billion |

| CAGR | CAGR of 11.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Technology (Airplay, Miracast, Google Cast, Others) • By End-use (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Actiontec Electronics, Inc., Apple Inc., Belkin, Google LLC, IOGEAR, Intel Corporation, Lattice Semiconductor, LG Electronics, Marvell, MediaTek Inc., Microsoft Corporation, MiraScreen, NETGEAR, Roku, Inc., StarTech.com. |