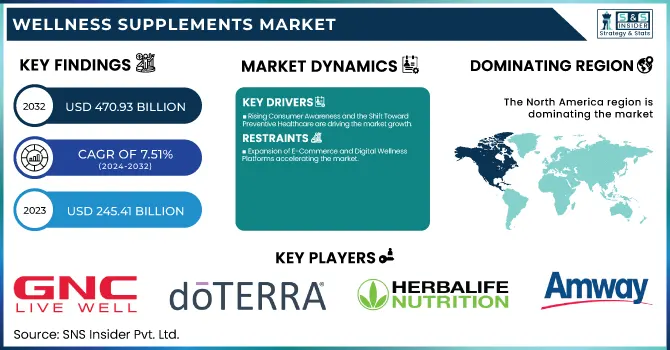

The Wellness Supplements Market was valued at USD 245.41 billion in 2023 and is expected to reach USD 470.93 billion by 2032, growing at a CAGR of 7.51% from 2024 to 2032.

To Get more information on Wellness Supplements Market - Request Free Sample Report

The Wellness Supplements Market report provides insights into consumer adoption and usage patterns, emphasizing demographic trends and lifestyle factors influencing supplement use. The report also includes a comprehensive analysis of sales and distribution patterns by region, differentiating between online and offline channels. Furthermore, the report analyzes product volume and demand projections, providing a long-term outlook for market growth. In addition, it covers healthcare expenditure on preventive nutrition by funding sources, with a focus on regional spending habits. Finally, the market share segmentation by supplement type offers a comparative review of major product categories, providing a fact-based competitive environment.

Drivers

Rising Consumer Awareness and the Shift Toward Preventive Healthcare are driving the market growth.

The growing emphasis on preventive care is a key driver of the Wellness Supplements Market, as consumers increasingly value long-term health over reactive measures. More and more people are incorporating dietary supplements into their daily lives to treat nutritional deficiencies and promote immune function. As per a 2023 survey conducted by the Council for Responsible Nutrition (CRN), 77% of American adults said they consumed dietary supplements, with multivitamins, probiotics, and omega-3s being the top three. Moreover, the trend towards personalized nutrition is on the rise, with Nestlé Health Science and Amway introducing customized supplement programs based on genetic and lifestyle tests. The trend toward organic and clean-label supplements is also influencing consumer decisions, propelling innovations in plant-based, allergen-free, and sustainably sourced wellness products.

Expansion of E-Commerce and Digital Wellness Platforms accelerating the market.

The surge in e-commerce and digital wellness platforms is driving growth in the Wellness Supplements Market, with easy access to a broad variety of products for consumers. E-commerce sales of vitamins and dietary supplements experienced double-digit increases during 2023, with the likes of Amazon, iHerb, and Vitacost leading the segment. Customized supplement plans through subscription models like Persona Nutrition and Care/of are further boosting consumer interaction. Also, the integration of telehealth has encouraged healthcare professionals to prescribe and recommend wellness supplements, fueling demand for products that are clinically supported. A McKinsey 2023 report found that more than 60% of buyers of supplements prefer to buy online, noting ease of access, coupons, and consumer reviews as top choice determinants. Organizations are utilizing AI-facilitated recommendations as well as digital marketing solutions to access the growing DTC market.

Restraint

Regulatory challenges and quality concerns are restraining the market's growth.

One of the key constraints in the Wellness Supplements Market is the absence of uniform regulations and quality control, resulting in product safety and efficacy concerns. In contrast to pharmaceutical medications, dietary supplements tend to be subject to differing rules in different geographies, creating inconsistencies in manufacturing and labeling requirements. In the United States, the FDA oversees supplements under the Dietary Supplement Health and Education Act (DSHEA), which exempts pre-market approval, adding to the danger of adulterated or mislabeled products. A study in JAMA published in 2023 identified that almost 20% of tested supplements contained undeclared ingredients or improper dosages. Also, the growth of counterfeit products on online shopping websites increases the doubt of consumers. These loopholes in regulation and quality issues hinder market growth since tighter controls and third-party assurance become essential to provide product integrity and build consumer confidence.

Opportunities

The growing demand for personalized wellness supplements presents a significant opportunity in the Wellness Supplements Market.

Customers are moving towards individualized health solutions that address their specific nutritional requirements, genetic profiles, and lifestyle habits. Improvements in nutrigenomics and microbiome science enable firms to create customized supplement formulations based on DNA analysis, gut health assessment, and metabolic profiling. More than 60% of supplement users were interested in personalized products, according to a 2023 Council for Responsible Nutrition (CRN) survey. Nestlé Health Science and Persona Nutrition have already launched subscription-based personalized supplement programs. This trend is also driven by AI-recommended products and digital health apps, enabling consumers to monitor and maximize their supplement use. Consequently, brands that invest in precision nutrition are likely to have a competitive advantage in the market.

Challenges

One of the key challenges in the Wellness Supplements Market is the high cost of premium, organic, and clinically validated supplements.

One of the major challenges facing the Wellness Supplements Market is the premium price of high-quality, organic, and clinically tested supplements. Consumers are increasingly seeking clean-label, non-GMO, organic, and plant-based supplements with scientifically supported benefits, but these tend to be at a premium price. The cost of producing such supplements is high because of the sourcing of quality raw materials, third-party testing, and meeting strict certification levels, such as USDA Organic and NSF Certified for Sport. Organic supplements are up to 40% more expensive than traditional supplements, and hence, price-conscious consumers cannot access them. Also, inflation and supply chain issues have further increased costs. These cost restrictions hold back mass adoption, and affordability becomes a primary hindrance to market entry, particularly in emerging areas.

By Supplement Type

The multivitamins and Antioxidants segment dominated the wellness supplements market with 28.32% market share in 2023, driven by growing health consciousness, intensified adoption of preventive healthcare, and expanded consumer interest in immunity-enhancing products. The post-pandemic period elevated immune health support requirements, with consumers looking for supplements that are rich in vitamins C, D, E, and zinc, which have been recognized for their defense against infections and oxidative stress. More than 60% of the people who consume supplements worldwide favor taking multivitamins as their daily health product.

Moreover, an increasing geriatric population and lifestyle-related disorders like cardiovascular diseases, diabetes, and chronic fatigue have created demand for antioxidant formulations that neutralize free radicals and improve cellular health. The extensive product availability of multivitamins in multiple forms, i.e., tablets, capsules, and gummies, coupled with aggressive promotion by major players like GNC, Amway, and Herbalife, further consolidated the dominance of the segment in 2023.

By Application

The Immune Health segment dominated the wellness supplements market with a 30.14% market share in 2023 due to growing consumer interest in immunity-enhancing nutrition, post-pandemic health awareness, and a growing incidence of lifestyle-related immune disorders. The COVID-19 pandemic made immunity strong and even more critical, resulting in an uptick in demand for vitamins C and D, zinc, elderberry, probiotics, and herbal supplements that are known for their immunity-enhancing attributes. Studies reveal that more than 70% of global consumers placed immune health supplements at the top of their daily routines in 2023.

In addition, the growth of aging populations and the rising incidence of autoimmune diseases have spurred higher usage of immune system-supporting supplements. The growing e-commerce and direct-to-consumer sales channels have facilitated easier access to immune health supplements, and product innovation by Garden of Life, Nature's Bounty, and Amway has made the segment market leader.

By Form

The Capsules & Tablets segment dominated the wellness supplements market with a 30.62% market share in 2023 because of its popularity with consumers, convenience, longer shelf life, and precise dosage control. These are traditionally known for their stability, easy storage, and efficacy in delivering vital nutrients. Capsules and tablets are popular across various supplement types, such as multivitamins, antioxidants, minerals, and herbal extracts, which make them the easiest to find and most affordable. Further, the dominance of pharmaceutical and nutraceutical organizations manufacturing these forms in large volumes has also favored their prevalence.

The Gummies & Softgels segment will see the fastest growth in the forecast years due to a growing demand among consumers for chewable, flavored, and convenient-to-swallow supplements. Gummies, specifically, have become popular among millennials, kids, and seniors who have difficulty swallowing pills. They also offer a good taste experience, which makes them a favorite for daily supplementation. The increasing use of plant-based and sugar-free versions is also driving this trend. Softgels also have improved bioavailability for fat-soluble nutrients such as omega-3, vitamin D, and CoQ10, which improves their absorption. Large brands like Nature's Bounty, Olly, and Vitafusion are growing their offerings in this space, fueling fast market growth.

By Distribution Channel

The Offline segment dominated the wellness supplements market because of high consumer confidence, face-to-face consultations, and instant availability of products. Pharmacies, supermarkets, health specialty stores, and direct selling networks have been central to supplement distribution, giving consumers expert advice and product recommendations. Most consumers continue to prefer brick-and-mortar retail stores for their supplement buying because of brand reputation, product authenticity, and visibility of packaging and ingredients before purchase. Moreover, health retailers and pharmacies tend to provide personalized guidance, enhancing customer trust in purchases. Well-established brands like GNC, Herbalife, and Amway continue to command high sales through their large brick-and-mortar footprint, solidifying offline segments' supremacy.

The Online segment is expected to experience the fastest growth with 8.07% CAGR throughout the forecast years, driven by growing digitalization, growth in e-commerce, and the convenience preference among consumers. Health-conscious consumers and direct-to-consumer (DTC) brands have driven the growth in online sales, as Amazon, iHerb, and Vitacost provide easy access to wellness supplements with home delivery. Also, subscription-based platforms, discounts, and recommendations are making online shopping more engaging. The increasing power of social media, influencer marketing, and digital health platforms is also propelling consumer interaction with online supplement buying. With more consumers looking for instant access to specialty and international brands, the online segment is expected to see high growth, and it will be the fastest-growing distribution channel during the forecast period.

North America dominated the wellness supplements market with a 43.22% market share in 2023, driven by strong purchasing power, consumer awareness, and a well-established health and wellness sector. It has a sizeable base of health-conscious individuals who actively engage in the usage of dietary supplements to ensure good health, keep chronic diseases at bay, and lead active lives. As estimated by the Council for Responsible Nutrition (CRN), close to 80% of American adults regularly consume dietary supplements. Moreover, the dominance of industry leaders like Amway, Herbalife, and GNC, along with a strong retail and e-commerce infrastructure, has fortified market penetration. The region is also supported by stringent regulatory requirements of the FDA and Health Canada to ensure product quality and consumer confidence. As the popularity of organic, plant-based, and personalized nutrition supplements continues to grow, North America remains at the forefront of innovation and market share.

Asia Pacific is witnessing the fastest growth in the wellness supplements market with 8.49% CAGR throughout the forecast period, led by growing disposable incomes, health awareness, and an aging population. China, Japan, India, and South Korea are seeing a boom in supplement usage due to lifestyle-related health issues, such as obesity, diabetes, and cardiovascular diseases. China and India together represent more than 30% of the world's functional food and supplement demand. The region is also driven by government policies supporting preventive healthcare and the growth of online sales of supplements through platforms such as Alibaba, Amazon, and Flipkart. In addition, conventional herbal supplements like Ayurvedic and Traditional Chinese Medicine (TCM)-based products are increasing in popularity, thereby driving the market's rapid growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

GNC (Mega Men Multivitamin, Triple Strength Fish Oil)

doTERRA International LLC (Lifelong Vitality Pack, Deep Blue Polyphenol Complex)

Herbalife Nutrition (Formula 1 Nutritional Shake Mix, Herbal Tea Concentrate)

Amway (Nutrilite Double X Multivitamin, Nutrilite Omega-3 Complex)

Garden of Life (Vitamin Code Raw One for Women, Dr. Formulated Probiotics)

New Chapter, Inc. (Every Woman's One Daily Multivitamin, Zyflamend Whole Body)

Swisse (Ultivite Women's Multivitamin, Ultiboost Liver Detox)

By-Health (Protein Powder, Collagen Peptides)

Nature's Bounty (Hair, Skin & Nails Gummies, Vitamin D3 Softgels)

NOW Foods (Omega-3 Fish Oil, Adam Men's Multivitamin)

Optimum Nutrition (Gold Standard 100% Whey Protein, Opti-Men Multivitamin)

USANA Health Sciences (CellSentials Multivitamin, BiOmega Fish Oil)

Nature Made (Vitamin C Tablets, Magnesium Citrate)

Vitacost.com (Synergy Once Daily Multivitamin, Probiotic 10-20)

Bodybuilding.com (Signature Whey Protein Isolate, Signature Multivitamin)

International Vitamin Corporation (Vitamin D3 Tablets, Calcium Citrate)

Abbott Laboratories (Ensure Nutritional Shake, Pedialyte Electrolyte Solution)

Arko Corp (7-Eleven Go!Smart Multivitamin Gummies, 7-Eleven Go!Smart Omega-3 Softgels)

Plexus Worldwide (Slim Hunger Control, ProBio 5)

New U Life (SomaDerm Gel, NeuraVie)

Suppliers (These companies are recognized for their significant contributions to the wellness supplements industry, offering a diverse range of products to cater to various health and wellness needs.) in Wellness Supplements Market.

DSM

BASF SE

Lonza Group

Glanbia PLC

Kerry Group

Archer Daniels Midland (ADM)

Cargill, Incorporated

Nestlé Health Science

Ingredion Incorporated

Balchem Corporation

January 2025 – New scientific evidence suggests that having a balanced gut microbiome can greatly improve overall well-being. To address this, Amway, a global entrepreneur-led health and wellness business, has launched a new wellness program. This program centers on four pillars of wellness, incorporating nutritional supplements aimed at promoting gut health and overall energy.

March 2024 – Garden of Life, a Nestlé Health Science brand, has grown its portfolio of sports nutrition products with new product introductions. These newest products are Non-GMO Project Verified and USDA Organic Certified and contain ingredients that are designed to offer added benefits like skin health, digestive health, and weight management.

June 2023 – GNC Holdings Inc. has fortified its shopper understanding across the Vitamin, Mineral, and Supplement (VMS) category by collaborating with SPINS, a data analytics firm specializing in well-being. Under a multiyear, exclusive agreement, GNC seeks to leverage SPINS' proprietary attribution and product intelligence platform to drive more in-depth consumer connections and trend-based product development.

April 2023 – Herbalife, the world's leading health and wellness company, rolled out 106 new SKUs of products in the first quarter of 2023. All these products were rolled out across the 95 markets the company has worldwide. This expansion speaks volumes about Herbalife's dedication to regularly reinventing its portfolio to respond to consumer demand across different categories of wellness, fuelling healthy and active lifestyles globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 245.41 billion |

| Market Size by 2032 | US$ 470.93 billion |

| CAGR | CAGR of 7.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Supplement Type (Proteins, Carbohydrates, Multi-vitamins and Antioxidants, Fibers, Minerals, Others) • By Application (Inflammatory Bowel Diseases, Metabolic Diseases, Weight Management, Women's Health, Allergic Disorders, Immune Health, Others) • By Form (Gummies & Softgels, Capsules & Tablets, Powder Form, Liquid Form, Others) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GNC, doTERRA International LLC, Herbalife Nutrition, Amway, Garden of Life, New Chapter, Inc., Swisse, By-Health, Nature's Bounty, NOW Foods, Optimum Nutrition, USANA Health Sciences, Nature Made, Vitacost.com, Bodybuilding.com, International Vitamin Corporation, Abbott Laboratories, Arko Corp, Plexus Worldwide, New U Life, and other players. |

Ans: The Wellness Supplements Market is expected to grow at a CAGR of 7.51% during 2024-2032.

Ans: The Wellness Supplements Market was USD 245.41 billion in 2023 and is expected to reach USD 470.93 billion by 2032.

Ans: Rising Consumer Awareness and the Shift Toward Preventive Healthcare are driving the market growth.

Ans: The “Multi-vitamins and Antioxidants” segment dominated the Wellness Supplements Market.

Ans: North America dominated the Wellness Supplements Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Consumer Adoption and Usage Trends (2023)

5.2 Sales and Distribution Trends (2023), by Region

5.3 Product Volume and Demand Forecast, by Region (2020-2032)

5.4 Healthcare Spending on Preventive Nutrition, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

5.5 Market Share by Supplement Type (Proteins, Multi-Vitamins, Minerals, etc.), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Wellness Supplements Market Segmentation, By Supplement Type

7.1 Chapter Overview

7.2 Proteins

7.2.1 Proteins Market Trends Analysis (2020-2032)

7.2.2 Proteins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Carbohydrates

7.3.1 Carbohydrates Market Trends Analysis (2020-2032)

7.3.2 Carbohydrates Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Multi-vitamins and Antioxidants

7.4.1 Multi-vitamins and Antioxidants Market Trends Analysis (2020-2032)

7.4.2 Multi-vitamins and Antioxidants Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Fibers

7.5.1 Fibers Market Trends Analysis (2020-2032)

7.5.2 Fibers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Minerals

7.6.1 Minerals Market Trends Analysis (2020-2032)

7.6.2 Minerals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Wellness Supplements Market Segmentation, by Application

8.1 Chapter Overview

8.2 Inflammatory Bowel Diseases

8.2.1 Inflammatory Bowel Diseases Market Trends Analysis (2020-2032)

8.2.2 Inflammatory Bowel Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Metabolic Diseases

8.3.1 Metabolic Diseases Market Trends Analysis (2020-2032)

8.3.2 Metabolic Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Weight Management

8.4.1 Weight Management Market Trends Analysis (2020-2032)

8.4.2 Weight Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Women’s Health

8.5.1 Women’s Health Market Trends Analysis (2020-2032)

8.5.2 Women’s Health Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Allergic Disorders

8.6.1 Allergic Disorders Market Trends Analysis (2020-2032)

8.6.2 Allergic Disorders Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Immune Health

8.7.1 Immune Health Market Trends Analysis (2020-2032)

8.7.2 Immune Health Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Wellness Supplements Market Segmentation, By Form

9.1 Chapter Overview

9.2 Gummies & Softgels

9.2.1 Gummies & Softgels Market Trends Analysis (2020-2032)

9.2.2 Gummies & Softgels Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Capsules & Tablets

9.3.1 Capsules & Tablets Market Trends Analysis (2020-2032)

9.3.2 Capsules & Tablets Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Powder Form

9.4.1 Powder Form Market Trends Analysis (2020-2032)

9.4.2 Powder Form Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Liquid Form

9.5.1 Liquid Form Market Trends Analysis (2020-2032)

9.5.2 Liquid Form Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Wellness Supplements Market Segmentation, By Distribution Channel

10.1 Chapter Overview

10.2 Online

10.2.1 Online Market Trends Analysis (2020-2032)

10.2.2 Online Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Offline

10.3.1 Offline Market Trends Analysis (2020-2032)

10.3.2 Offline Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.2.4 North America Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.6 North America Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.2.7.2 USA Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.7.4 USA Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.2.8.2 Canada Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.8.4 Canada Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.9.4 Mexico Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.7.4 Poland Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.8.4 Romania Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.6 Western Europe Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.7.4 Germany Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.8.2 France Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.8.4 France Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.9.4 UK Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.10.4 Italy Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.11.4 Spain Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.14.4 Austria Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.6 Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.7.2 China Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.7.4 China Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.8.2 India Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.8.4 India Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.9.2 Japan Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.9.4 Japan Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.10.4 South Korea Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.11.4 Vietnam Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.12.4 Singapore Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.13.2 Australia Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.13.4 Australia Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.6 Middle East Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.7.4 UAE Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.2.4 Africa Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.6 Africa Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Wellness Supplements Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.6.4 Latin America Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.6 Latin America Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.7.4 Brazil Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.8.4 Argentina Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.9.4 Colombia Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Wellness Supplements Market Estimates and Forecasts, by Supplement Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Wellness Supplements Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Wellness Supplements Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Wellness Supplements Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

12. Company Profiles

12.1 GNC

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Herbalife Nutrition

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Amway

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Garden of Life

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Swisse

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 By-Health

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Nature's Bounty

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 NOW Foods

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Optimum Nutrition

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 USANA Health Sciences

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Wellness Supplements Market Key Segments:

By Supplement Type:

Proteins

Carbohydrates

Multi-vitamins and Antioxidants

Fibers

Minerals

Others

By Application:

Inflammatory Bowel Diseases

Metabolic Diseases

Weight Management

Women's Health

Allergic Disorders

Immune Health

Others

By Form:

Gummies & Softgels

Capsules & Tablets

Powder Form

Liquid Form

Others

By Distribution Channel

Online

Offline

Specialty Stores

Drug & Pharmacy Stores

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Advance Directives Market was valued at USD 122.74 billion in 2023 and is anticipated to reach USD 588.40 billion by 2032 with a CAGR of 19.04% over the forecast period 2024-2032.

The Brain Tumor Drugs Market size was estimated at USD 2.27 billion in 2023 and is expected to reach USD 5.25 billion by 2032 at a CAGR of 9.79% during the forecast period of 2024-2032.

Bone Graft and Substitutes Market was valued at USD 3.71 billion in 2023 and is projected to reach USD 6.74 billion by 2032, with a growing CAGR of 6.87%.

The Pediatric Cancer Biomarker Market was valued at USD 830.41 Million in 2023 and is projected to reach USD 1635.68 Million by 2032 with a growing CAGR of 7.84%.

The Urgent Care Apps Market Size was valued at USD 2230.17 million in 2023 and is expected to reach USD 31983.94 million by 2031 and grow at a CAGR of 39.5% over the forecast period 2024-2031.

The Teleradiology Services Market was valued at USD 24.0 billion in 2023 and is projected to reach USD 29.1 billion by 2032, growing at a CAGR of 2.18%.

Hi! Click one of our member below to chat on Phone