Weight Loss Drugs Market Report Scope & Overview:

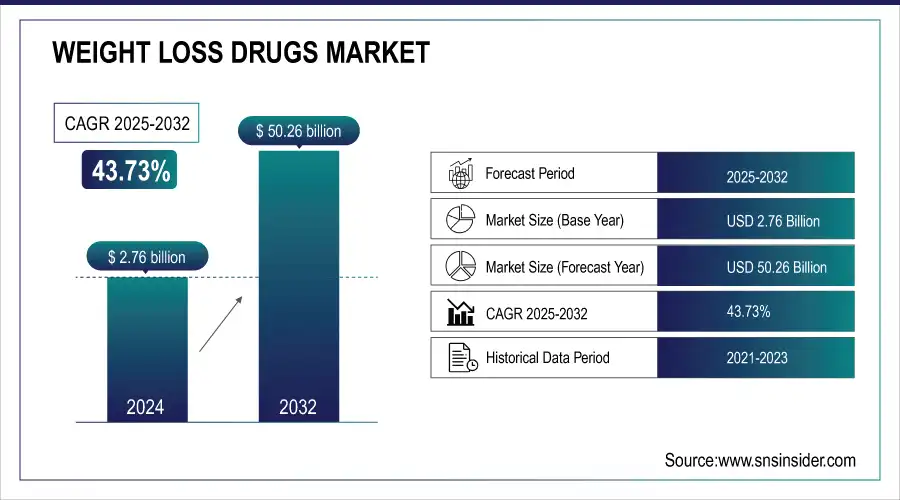

The Weight Loss Drugs Market Size was valued at USD 2.76 Billion in 2024 and is expected to reach USD 50.26 Billion by 2032, growing at a CAGR of 43.73% over the forecast period of 2025-2032.

Get More Information on Weight Loss Drugs Market- Request Sample Report

The Weight Loss Drugs Market is expanding rapidly, driven by rising obesity rates and the increasing need for effective solutions. Pricing strategies of leading manufacturers are key to market accessibility, with companies adopting different approaches to balance cost and competition. The clinical trial landscape is evolving, with new therapies progressing through rigorous testing phases. The economic impact of obesity on healthcare systems is significant, prompting both public and private sectors to explore weight loss drugs as part of the solution. Patient demographics reveal varied preferences, influenced by factors such as age and income, shaping treatment choices. Moreover, ethical considerations in drug development focus on safety, long-term effects, and environmental impact, making it a critical area of concern. Our report explores these insights in detail, offering a comprehensive market overview.

The US Weight Loss Drugs Market is experiencing significant growth, driven by rising obesity rates and increasing consumer awareness about health. According to the Centers for Disease Control and Prevention (CDC), more than 40% of US adults are obese, pushing demand for effective weight management solutions. Factors such as the availability of prescription drugs like Wegovy (Novo Nordisk) and Contrave (Currax Pharmaceuticals) are contributing to market expansion. Additionally, rising healthcare costs and initiatives by organizations like the American Obesity Association are fueling interest in pharmaceutical interventions. Increased focus on digital health platforms is also driving consumer engagement with weight loss treatments.

Key Weight Loss Drugs Trends:

-

Rising obesity rates across age groups increasing demand for weight loss drugs.

-

Growing prevalence of comorbidities such as heart disease, diabetes, and hypertension driving treatment adoption.

-

Increased awareness and acceptance of prescription drugs like Wegovy and Saxenda for obesity management.

-

Shift toward preventative healthcare encouraging early use of weight loss drugs.

-

Opportunity for pharmaceutical companies to integrate drugs into broader health and wellness strategies.

Weight Loss Drugs Growth Drivers:

-

Rising Prevalence of Obesity and Related Health Complications Drives Market Demand for Weight Loss Drugs

The growing rates of obesity across various age groups are a primary factor driving the demand for weight loss drugs. As highlighted by the Centers for Disease Control and Prevention (CDC), more than 40% of U.S. adults are obese, contributing to a surge in weight-related comorbidities such as heart disease, diabetes, and hypertension. These conditions further increase the need for weight management solutions, including pharmaceutical treatments. As healthcare providers and patients look for effective, doctor-prescribed interventions, the market for weight loss drugs is poised for growth. The rise in these health concerns has not only led to a higher demand for weight loss drugs but has also resulted in increased awareness about the effectiveness of these solutions. This growing focus on health and wellness is also reflected in the increased approval and popularity of prescription drugs such as Wegovy and Saxenda in the United States, which offer promising results in managing obesity and reducing the risk of associated health conditions.

Weight Loss Drugs Restraints:

-

Concerns Over the Long-Term Safety and Side Effects of Weight Loss Drugs Hinder Consumer Adoption

While weight loss drugs show promise in helping patients manage obesity, concerns regarding their long-term safety and potential side effects present a significant challenge. Many patients are hesitant to commit to pharmaceutical weight loss treatments due to fears of adverse effects such as gastrointestinal issues, heart problems, or other severe health risks. For example, the FDA's approval of certain weight loss drugs has been met with scrutiny due to potential cardiovascular risks. These concerns often lead to a lack of confidence among patients and healthcare providers, restricting market growth. Although regulatory bodies like the U.S. Food and Drug Administration (FDA) ensure that approved drugs meet safety standards, ongoing monitoring of these medications' long-term effects remains a concern for both consumers and healthcare providers. Consequently, these safety issues could deter widespread adoption of weight loss drugs.

Weight Loss Drugs Opportunities:

-

Growing Focus on Preventative Healthcare Creates New Market Opportunities for Weight Loss Drugs

The shift toward preventative healthcare presents an opportunity for weight loss drugs to be integrated into early obesity management programs. As health organizations and governments, including the World Health Organization (WHO), increasingly emphasize prevention, weight loss drugs can play a critical role in helping individuals prevent the onset of obesity-related comorbidities. With an increased focus on preventing chronic diseases, there is an opportunity for pharmaceutical companies to position weight loss drugs as essential components of broader health strategies aimed at improving overall population health. In particular, early-stage intervention with weight loss drugs could reduce the burden on healthcare systems by preventing the need for more expensive treatments related to diseases like diabetes and cardiovascular conditions. This growing trend toward prevention opens doors for innovative weight loss solutions to enter the market and drive further growth.

Weight Loss Drugs Segment Analysis:

By Drug Type

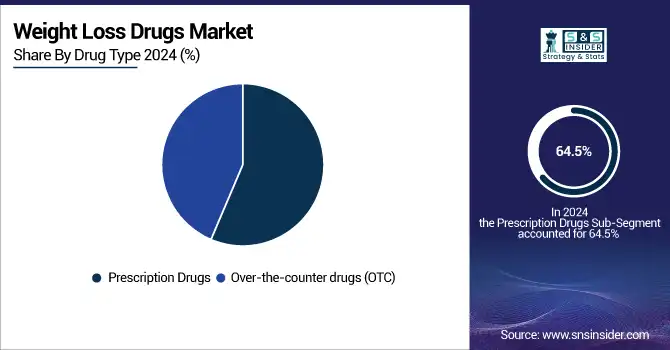

In 2024, the prescription drugs segment dominated the weight loss drugs market, with a market share of 64.5%. Prescription medications like Wegovy (semaglutide) and Saxenda (liraglutide), which are prescribed by healthcare professionals, are the leading contributors to this dominance. These drugs are not only clinically proven but are also supported by regulatory bodies such as the U.S. Food and Drug Administration (FDA), making them highly trusted by consumers and healthcare providers. The growing prevalence of obesity and related health issues, along with a shift toward medically supervised weight management solutions, has boosted demand for prescription drugs. Additionally, organizations such as the American Medical Association (AMA) and Centers for Disease Control and Prevention (CDC) emphasize the importance of medical intervention in combating obesity, further driving the prescription market. With advanced formulations and clinical evidence, prescription drugs are considered more effective, leading to their dominance in the market.

By Mechanism of Action

The appetite suppressants segment dominated the Weight Loss Drugs market in 2024, capturing a market share of 51.2%. These drugs function by reducing hunger, promoting satiety, and thus helping individuals consume fewer calories. Popular appetite suppressants like Contrave (naltrexone and bupropion) and Phentermine are widely prescribed, as they are effective in reducing food intake and are backed by substantial clinical evidence. Appetite suppressants dominate the weight loss drugs market because they offer a more direct and manageable approach to controlling calorie intake compared to other mechanisms like fat absorption inhibitors. The National Institutes of Health (NIH) and FDA have consistently supported appetite suppressants for short-term obesity management, reinforcing their widespread usage. As obesity rates continue to rise globally, particularly in North America, the appetite suppressant segment is expected to maintain its dominance, further aided by increasing approval of new formulations by regulatory bodies.

By Distribution Channel

In 2024, hospital pharmacies dominated and accounted for the largest share of the weight loss drugs market, with a market share of 46.1%. Hospital pharmacies are a key distribution channel for prescription-based weight loss drugs due to the controlled environment they offer for prescribing and monitoring patients. Hospitals typically provide specialized care, particularly for individuals with severe obesity or other comorbid conditions like diabetes. Drugs such as Wegovy and Saxenda are primarily distributed through hospitals under the supervision of healthcare professionals. Furthermore, hospitals have the necessary infrastructure to offer long-term monitoring and medical oversight, which appeals to patients seeking medically supervised weight loss programs. Regulatory bodies like the FDA have also recognized the critical role of hospitals in administering these treatments, which strengthens the position of hospital pharmacies in the distribution network.

Weight Loss Drugs Regional Analysis:

North America Weight Loss Drugs Insights

In 2024, North America dominated the weight loss drugs market with a market share of 42.8%. The high prevalence of obesity in the region, with over 40% of adults in the U.S. classified as obese according to the Centers for Disease Control and Prevention (CDC), is a key driver of this dominance. The United States, in particular, is home to numerous pharmaceutical companies developing and marketing weight loss drugs such as Wegovy, Saxenda, and Contrave, contributing significantly to the region’s market share. Healthcare policies and initiatives by the U.S. Food and Drug Administration (FDA) also provide support for the prescription weight loss drugs segment. Additionally, Canada's growing healthcare awareness and increasing approval of weight loss drugs have contributed to the market's growth. The significant investment in R&D by major pharmaceutical companies further strengthens the region's dominance. With a supportive healthcare infrastructure, the U.S. is expected to maintain its leading position in the weight loss drugs market.

Need any customization research on Weight Loss Drugs Market - Enquiry Now

Asia Pacific Weight Loss Drugs Insights

The Asia Pacific region emerged as the fastest-growing in the weight loss drugs market, with a significant CAGR during the forecast period. The rise in obesity rates, particularly in countries like China, India, and Japan, is a major factor driving this growth. According to the World Health Organization (WHO), the region is seeing an increase in lifestyle diseases associated with obesity, such as diabetes and hypertension, prompting a demand for weight management solutions. With a growing middle class and higher disposable incomes in countries like China and India, consumers are now more inclined to seek effective weight loss solutions, including pharmaceutical treatments. Additionally, the increasing prevalence of obesity among urban populations, the adoption of Western dietary habits, and a rise in sedentary lifestyles further propel the demand for weight loss drugs in the region. As healthcare systems improve and access to medications becomes more widespread, the Asia Pacific region is expected to continue its rapid growth in the weight loss drugs market.

Europe Weight Loss Drugs Insights

Europe’s weight loss drugs market is expanding due to rising obesity rates, supportive healthcare policies, and growing awareness of obesity-related health risks. Governments and healthcare providers emphasize preventive care, driving demand for prescription therapies. Increasing approvals, strong reimbursement frameworks, and lifestyle-related health concerns support the region’s market growth across major economies.

Latin America (LATAM) and Middle East & Africa (MEA) Weight Loss Drugs Insights

LATAM and MEA are witnessing steady growth in weight loss drugs, fueled by rising obesity prevalence, urbanization, and dietary changes. Limited healthcare resources are prompting governments to promote preventive strategies, boosting demand for prescription treatments. Brazil, Mexico, UAE, and South Africa are emerging as key markets, supported by growing awareness and expanding access to therapies.

Weight Loss Drugs Key Players:

-

Amgen Inc.

-

AstraZeneca

-

Boehringer Ingelheim International GmbH

-

Currax Pharmaceuticals LLC

-

Eisai Co., Ltd.

-

Eli Lilly and Company

-

F. Hoffmann-La Roche Ltd (Roche Holding AG)

-

GlaxoSmithKline plc

-

Ionis Pharmaceuticals, Inc.

-

Johnson & Johnson

-

Merck & Co., Inc.

-

Novartis AG

-

Novo Nordisk A/S

-

Pfizer Inc.

-

Rhythm Pharmaceuticals, Inc.

-

Sanofi S.A.

-

Takeda Pharmaceutical Company Limited

-

Teva Pharmaceutical Industries Ltd.

-

VIVUS, Inc.

-

Zafgen, Inc.

Competitive Landscape for Weight Loss Drugs:

VIVUS, Inc. is a biopharmaceutical company specializing in the development and commercialization of therapies for obesity and related health conditions. Its key product, Qsymia, is an FDA-approved prescription drug for chronic weight management. By addressing obesity and associated comorbidities, VIVUS contributes to improving patient outcomes and supporting healthier lifestyles.

-

March 2025: VIVUS launched QSYMIA in the UAE to combat rising obesity rates. The collaboration with PharmaAccess and Alphamed Drug Store marks the drug's Middle Eastern debut, aimed at addressing obesity's increasing health and economic burden, projected to affect 7.5 million people by 2035

| Report Attributes | Details |

| Market Size in 2024 | USD 2.76 Billion |

| Market Size by 2032 | USD 50.26 Billion |

| CAGR | CAGR of 43.73% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Prescription Drugs, Over-the-counter drugs (OTC)) • By Mechanism of Action (Appetite Suppressants, Fat Absorption Inhibitors, Combination Drugs) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amgen Inc., AstraZeneca, Boehringer Ingelheim International GmbH, Currax Pharmaceuticals LLC, Eisai Co., Ltd., Eli Lilly and Company, F. Hoffmann-La Roche Ltd (Roche Holding AG), GlaxoSmithKline plc, Ionis Pharmaceuticals, Inc., Johnson & Johnson, Merck & Co., Inc., Novartis AG, Novo Nordisk A/S, Pfizer Inc., Rhythm Pharmaceuticals, Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., VIVUS, Inc., Zafgen, Inc. |