Get More Information on Weight Loss Devices Market - Request Sample Report

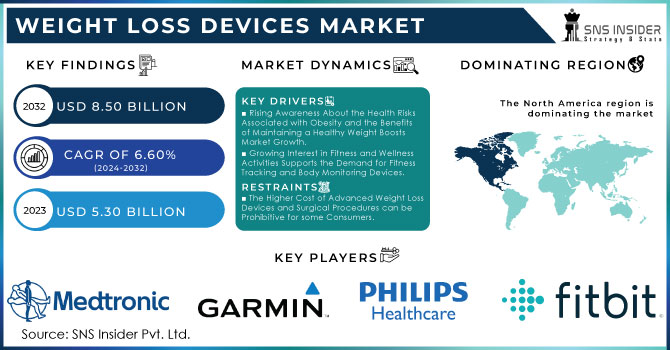

The Weight Loss Devices Market Size was valued at USD 5.30 Billion in 2023, and is expected to reach USD 8.50 Billion by 2032, and grow at a CAGR of 6.60% over the forecast period 2024-2032.

Increasing consciousness about obesity-related health-related problems and weight management benefits will corner the market growth. With the global prevalence of obesity almost tripling between 1975 and 2016 according to the World Health Organization (WHO), recent data suggests that in terms of adults, there are more than an estimated third of overweight followed by over a tenth classified as obese with new figures published for this year at just over 39% being overweight which increases by around another half to approximately. In the U.S., 2020 was an extremely bad year as Centers for Disease Control and Prevention (CDC) data showed that more than four in ten adults were obese, this represented a significant increase from other years. The CDC also notes that obesity-related conditions such as heart disease, stroke, type 2 diabetes, and certain types of cancer are some of the leading causes of preventable premature death.

Both governments and health organizations are promoting proactive measures targeted toward preventive health as well as weight management programs to counteract this ever-expanding predicament. As an example, the U.S. government's Healthy People 2030 initiative is looking to tackle obesity at the population level through strategies like public health approaches and community-based interventions. The increasing relevance of health and wellness which is coupled with burgeoning consumer realization about the perils associated with obesity has been a major driver for weight loss devices. Therefore, there is an upsurge in demand for weight loss devices as modern individuals are very keen to manage their weights by using the latest products and ultimately stay healthy the growth of the weight-loss market.

MARKET DYNAMICS:

KEY DRIVERS:

Rising Awareness About the Health Risks Associated with Obesity and the Benefits of Maintaining a Healthy Weight Boosts Market Growth.

Growing Interest in Fitness and Wellness Activities Supports the Demand for Fitness Tracking and Body Monitoring Devices.

RESTRAINTS:

The Higher Cost of Advanced Weight Loss Devices and Surgical Procedures can be Prohibitive for some Consumers.

Overreliance on Devices Without Proper Lifestyle Changes Can Lead to Suboptimal Results That Affect Consumer Satisfaction.

OPPORTUNITY:

Increasing Demand for Personalized Health and Fitness Solutions Presents Opportunities for Developing Customized Weight Loss Devices and Programs.

Development Of New Technologies Such as AI And Machine Learning for More Effective Weight Loss Solutions.

By Devices

Among weight loss devices, non-invasive body contouring has the largest share of 32% in 2023 due to its recent popularity among consumers looking for efficient and risk-free weight-loss solutions without surgery. Cryolipolysis (CoolSculpting), laser lipolysis, and ultrasound cavitation are some of the technologies that have come to promise tissue-selective adipocyte disruption with minimal downtime and discomfort. This is a fast-growing segment and demand for aesthetic treatments increases with advancements in technology. Safer alternatives are attractive to apprehensive customers when non-invasive body contouring devices offer fewer complications and are virtually in and out.

Their efficacy and patient comfort have been increased over time due to continuous innovations making them an even more popular tool. Moreover, there continues to be an increasing focus on aesthetic looks and body image that has driven even more people into these aesthetic treatments. Weight Loss Devices Market: Non-invasive body contouring is the Largest Segment - Fitness devices and wearables target general well-being but are not very effective; surgical devices have a higher risk profile with significant complications and recovery time when compared to non-surgical options.

By Indication

The obesity & weight management segment accounted for the largest share of 31% in 2023 owing to a global increase in obesity rates-with over 720 million adults classified as obese according to WHO figures as of October, 2021-has fueled strong demand for effective weight management solutions. Obesity also increases the risk of co-morbid metabolic conditions like type 2 diabetes, cardiovascular diseases, and some types of cancer motivating people to undertake weight loss programs for better health outcomes. To combat obesity and chronic disease prevention, governmental as well as healthcare initiatives such as the National Diabetes Prevention Program by CDC which propagates the use of weight management devices in not only curbing but also preventing health hazards caused due to being overweight drive demand across the global public domain constituting these individuals.

By Distribution Channel

In terms of the weight loss devices market, the online platforms segment was observed as the largest sales channel in 2023 and accounted for around 46%. The rise of e-commerce powers this dominance in a customer-first context. This is the trend when it comes to shopping for weight loss devices as well since online platforms offer consumers a whole library of them ready at hand from the safety and convenience of their homes. Recent analyses show growing online sales of weight loss, which is poised to account for a large market share in the next few years. Their global reach, detailed product information, and customer reviews available to consumers on their website as well as competitive pricing drive volumes. The COVID-19 pandemic also expedited the transition to online shopping so e-commerce has become even more powerful in this area. Retail stores, direct sales, and healthcare providers continue to remain leading channels although they cannot match the wider reach and convenience of online platforms which is why e-commerce is expected to be the largest and fastest-growing segment in the weight loss devices market.

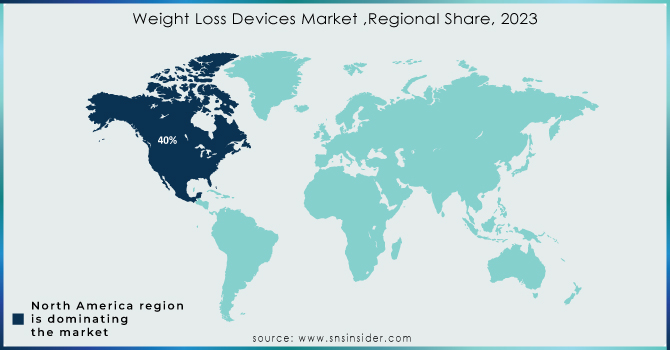

REGIONAL ANALYSIS:

The North American weight loss devices market accounted for 40% of revenue in 2023. The factors responsible for this growth are a proliferation in obesity, more sedentary lifestyles, and expanded fitness demands among individuals. As of June 2021, the NIH presented a report according to which adult obesity rose from 41.9% to serious obesity reaching about 14.8%, and diabetes was increased to be as high. According to the CDC, obesity is a cause of preventable death and one of its leading causes of chronic diseases globally and in America. Comorbidities Bothersome Morbidity Accidental, Coincidence High-risk illnesses: cardiovascular diseases, type 2 diabetes, musculoskeletal disorders, and some cancers.

At the same time, weight management devices are designed to combat chronic diseases such as obesity and other critical issues enhancing the growth of the market in Canada. According to an article published in BMC in April 2021, one-third of the participants had multimorbidity for chronic diseases, and obesity or overweight was associated with a higher prevalence. Accordingly, increased rates of obesity and associated chronic diseases continue to drive the need for weight loss programs as well as other forms of obesity management. The market growth is attributed to increasing health concerns, high disposable income, and technical advancements.

Furthermore, fitness centers are established in this region which is predicted to increase the demand for sophisticated weight loss devices from health-conscious people, and thus demands for advanced products used in obesity treatment will drive this market. For example, the very first Mini Planet Fitness opened in Canada in July 2022. The gift of the fitness center included 28 pieces of cardio equipment including high-end treadmills and others.

Need any customization research on Weight Loss Devices Market - Enquiry Now

The key market players include Fitbit Inc., Garmin Ltd., Philips Healthcare, Medtronic plc, Johnson & Johnson, Obalon Therapeutics, Inc., InBody Co., Ltd., iFit Health & Fitness Inc., Hologic, Inc., Nuvasive, Inc. & other players.

RECENT DEVELOPMENTS

In November 2022, Powermax Fitness introduced Tech-Advanced fitness equipment in India, during November 2022. The latest release covers the premium elliptical cross trainers, Powermax EH 760, and commercial as well as semi-commercial motorized treadmills including all-new - for India market -Powermax TAC-3000, Powermax TAC-3500, TAC550 and TAC585.

In March 2021, Matrix Launched a trio of cardio line-ups for Cardiovascular workouts and weight management; the performance series, endurance series & lifestyle series.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 5.30 Billion |

|

Market Size by 2032 |

US$ 8.50 Billion |

|

CAGR |

CAGR of 6.60% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Devices (Fitness Devices, Wearables, Surgical Devices & Non-Invasive Body Contouring Devices) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Fitbit Inc., Garmin Ltd., Philips Healthcare, Medtronic plc, Johnson & Johnson, Obalon Therapeutics, Inc., InBody Co., Ltd., iFit Health & Fitness Inc., Hologic, Inc., Nuvasive, Inc. & other players |

|

Key Drivers |

•Rising Awareness About the Health Risks Associated with Obesity and the Benefits of Maintaining a Healthy Weight Boosts Market Growth. |

|

RESTRAINTS |

•The Higher Cost of Advanced Weight Loss Devices and Surgical Procedures can be Prohibitive for some Consumers. |

Ans: The U.S. led the Weight Loss Devices in the North American region with the highest revenue share in 2023.

Ans: Factors such as the higher cost of advanced weight loss devices and surgical procedures can be prohibitive for some consumers. Overreliance on devices without proper lifestyle changes can lead to suboptimal results that affect consumer satisfaction can limit the growth of weight loss devices.

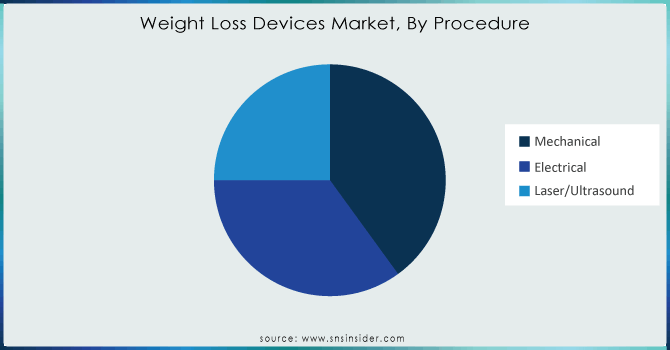

Ans The Mechanical Procedure held the largest share in the Weight Loss Devices Market in 2023.

Ans: The expected CAGR of the Global Weight Loss Devices Market during the forecast period is 6.60%.

Ans: The Weight Loss Devices Market was valued at USD 5.30 Billion in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Weight Loss Devices Market Segmentation, By Devices

7.1 Introduction

7.2 Fitness Devices

7.2.1 Treadmills

7.2.2 Exercise bikes

7.2.3 Elliptical trainers

7.2.4 Weightlifting Devices

7.2.5 Home Gym Devices

7.2.6 Others

7.3 Wearables

7.3.1 Smartwatches

7.3.2 Fitness trackers

7.3.3 Others

7.4 Surgical Devices

7.4.1 Bariatric surgery

7.4.2 Liposuction

7.4.3 Others

7.5 Non-Invasive Body Contouring Devices

7.5.1 CoolSculpting

7.5.2 Ultrasound cavitation

7.5.3 Radiofrequency devices

7.5.4 Electromagnetic field (EMF) devices

8. Weight Loss Devices Market Segmentation, By Indication

8.1 Introduction

8.2 Body Contouring & Body Toning

8.3 Obesity Management

8.4 Chronic Disease Management

8.5 Obesity & Weight Management

8.6 Fitness & Performance Enhancement

8.7 Others

9. Weight Loss Devices Market Segmentation, By Procedure

9.1 Introduction

9.2 Mechanical

9.3 Electrical

9.4 Laser/Ultrasound

10. Weight Loss Devices Market Segmentation, By Distribution Channel

10.1 Introduction

10.2 Retail Stores

10.3 Online Platforms

10.4 Direct Sales

10.5 Healthcare Providers

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Weight Loss Devices Market by Country

11.2.3 North America Weight Loss Devices Market By Devices

11.2.4 North America Weight Loss Devices Market By Indication

11.2.5 North America Weight Loss Devices Market By Procedure

11.2.6 North America Weight Loss Devices Market By Distribution Channel

11.2.7 USA

11.2.7.1 USA Weight Loss Devices Market By Devices

11.2.7.2 USA Weight Loss Devices Market By Indication

11.2.7.3 USA Weight Loss Devices Market By Procedure

11.2.7.4 USA Weight Loss Devices Market By Distribution Channel

11.2.8 Canada

11.2.8.1 Canada Weight Loss Devices Market By Devices

11.2.8.2 Canada Weight Loss Devices Market By Indication

11.2.8.3 Canada Weight Loss Devices Market By Procedure

11.2.8.4 Canada Weight Loss Devices Market By Distribution Channel

11.2.9 Mexico

11.2.9.1 Mexico Weight Loss Devices Market By Devices

11.2.9.2 Mexico Weight Loss Devices Market By Indication

11.2.9.3 Mexico Weight Loss Devices Market By Procedure

11.2.9.4 Mexico Weight Loss Devices Market By Distribution Channel

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Weight Loss Devices Market by Country

11.3.2.2 Eastern Europe Weight Loss Devices Market By Devices

11.3.2.3 Eastern Europe Weight Loss Devices Market By Indication

11.3.2.4 Eastern Europe Weight Loss Devices Market By Procedure

11.3.2.5 Eastern Europe Weight Loss Devices Market By Distribution Channel

11.3.2.6 Poland

11.3.2.6.1 Poland Weight Loss Devices Market By Devices

11.3.2.6.2 Poland Weight Loss Devices Market By Indication

11.3.2.6.3 Poland Weight Loss Devices Market By Procedure

11.3.2.6.4 Poland Weight Loss Devices Market By Distribution Channel

11.3.2.7 Romania

11.3.2.7.1 Romania Weight Loss Devices Market By Devices

11.3.2.7.2 Romania Weight Loss Devices Market By Indication

11.3.2.7.3 Romania Weight Loss Devices Market By Procedure

11.3.2.7.4 Romania Weight Loss Devices Market By Distribution Channel

11.3.2.8 Hungary

11.3.2.8.1 Hungary Weight Loss Devices Market By Devices

11.3.2.8.2 Hungary Weight Loss Devices Market By Indication

11.3.2.8.3 Hungary Weight Loss Devices Market By Procedure

11.3.2.8.4 Hungary Weight Loss Devices Market By Distribution Channel

11.3.2.9 Turkey

11.3.2.9.1 Turkey Weight Loss Devices Market By Devices

11.3.2.9.2 Turkey Weight Loss Devices Market By Indication

11.3.2.9.3 Turkey Weight Loss Devices Market By Procedure

11.3.2.9.4 Turkey Weight Loss Devices Market By Distribution Channel

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Weight Loss Devices Market By Devices

11.3.2.10.2 Rest of Eastern Europe Weight Loss Devices Market By Indication

11.3.2.10.3 Rest of Eastern Europe Weight Loss Devices Market By Procedure

11.3.2.10.4 Rest of Eastern Europe Weight Loss Devices Market By Distribution Channel

11.3.3 Western Europe

11.3.3.1 Western Europe Weight Loss Devices Market by Country

11.3.3.2 Western Europe Weight Loss Devices Market By Devices

11.3.3.3 Western Europe Weight Loss Devices Market By Indication

11.3.3.4 Western Europe Weight Loss Devices Market By Procedure

11.3.3.5 Western Europe Weight Loss Devices Market By Distribution Channel

11.3.3.6 Germany

11.3.3.6.1 Germany Weight Loss Devices Market By Devices

11.3.3.6.2 Germany Weight Loss Devices Market By Indication

11.3.3.6.3 Germany Weight Loss Devices Market By Procedure

11.3.3.6.4 Germany Weight Loss Devices Market By Distribution Channel

11.3.3.7 France

11.3.3.7.1 France Weight Loss Devices Market By Devices

11.3.3.7.2 France Weight Loss Devices Market By Indication

11.3.3.7.3 France Weight Loss Devices Market By Procedure

11.3.3.7.4 France Weight Loss Devices Market By Distribution Channel

11.3.3.8 UK

11.3.3.8.1 UK Weight Loss Devices Market By Devices

11.3.3.8.2 UK Weight Loss Devices Market By Indication

11.3.3.8.3 UK Weight Loss Devices Market By Procedure

11.3.3.8.4 UK Weight Loss Devices Market By Distribution Channel

11.3.3.9 Italy

11.3.3.9.1 Italy Weight Loss Devices Market By Devices

11.3.3.9.2 Italy Weight Loss Devices Market By Indication

11.3.3.9.3 Italy Weight Loss Devices Market By Procedure

11.3.3.9.4 Italy Weight Loss Devices Market By Distribution Channel

11.3.3.10 Spain

11.3.3.10.1 Spain Weight Loss Devices Market By Devices

11.3.3.10.2 Spain Weight Loss Devices Market By Indication

11.3.3.10.3 Spain Weight Loss Devices Market By Procedure

11.3.3.10.4 Spain Weight Loss Devices Market By Distribution Channel

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Weight Loss Devices Market By Devices

11.3.3.11.2 Netherlands Weight Loss Devices Market By Indication

11.3.3.11.3 Netherlands Weight Loss Devices Market By Procedure

11.3.3.11.4 Netherlands Weight Loss Devices Market By Distribution Channel

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Weight Loss Devices Market By Devices

11.3.3.12.2 Switzerland Weight Loss Devices Market By Indication

11.3.3.12.3 Switzerland Weight Loss Devices Market By Procedure

11.3.3.12.4 Switzerland Weight Loss Devices Market By Distribution Channel

11.3.3.13 Austria

11.3.3.13.1 Austria Weight Loss Devices Market By Devices

11.3.3.13.2 Austria Weight Loss Devices Market By Indication

11.3.3.13.3 Austria Weight Loss Devices Market By Procedure

11.3.3.13.4 Austria Weight Loss Devices Market By Distribution Channel

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Weight Loss Devices Market By Devices

11.3.3.14.2 Rest of Western Europe Weight Loss Devices Market By Indication

11.3.3.14.3 Rest of Western Europe Weight Loss Devices Market By Procedure

11.3.3.14.4 Rest of Western Europe Weight Loss Devices Market By Distribution Channel

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Weight Loss Devices Market by Country

11.4.3 Asia-Pacific Weight Loss Devices Market By Devices

11.4.4 Asia-Pacific Weight Loss Devices Market By Indication

11.4.5 Asia-Pacific Weight Loss Devices Market By Procedure

11.4.6 Asia-Pacific Weight Loss Devices Market By Distribution Channel

11.4.7 China

11.4.7.1 China Weight Loss Devices Market By Devices

11.4.7.2 China Weight Loss Devices Market By Indication

11.4.7.3 China Weight Loss Devices Market By Procedure

11.4.7.4 China Weight Loss Devices Market By Distribution Channel

11.4.8 India

11.4.8.1 India Weight Loss Devices Market By Devices

11.4.8.2 India Weight Loss Devices Market By Indication

11.4.8.3 India Weight Loss Devices Market By Procedure

11.4.8.4 India Weight Loss Devices Market By Distribution Channel

11.4.9 Japan

11.4.9.1 Japan Weight Loss Devices Market By Devices

11.4.9.2 Japan Weight Loss Devices Market By Indication

11.4.9.3 Japan Weight Loss Devices Market By Procedure

11.4.9.4 Japan Weight Loss Devices Market By Distribution Channel

11.4.10 South Korea

11.4.10.1 South Korea Weight Loss Devices Market By Devices

11.4.10.2 South Korea Weight Loss Devices Market By Indication

11.4.10.3 South Korea Weight Loss Devices Market By Procedure

11.4.10.4 South Korea Weight Loss Devices Market By Distribution Channel

11.4.11 Vietnam

11.4.11.1 Vietnam Weight Loss Devices Market By Devices

11.4.11.2 Vietnam Weight Loss Devices Market By Indication

11.4.11.3 Vietnam Weight Loss Devices Market By Procedure

11.4.11.4 Vietnam Weight Loss Devices Market By Distribution Channel

11.4.12 Singapore

11.4.12.1 Singapore Weight Loss Devices Market By Devices

11.4.12.2 Singapore Weight Loss Devices Market By Indication

11.4.12.3 Singapore Weight Loss Devices Market By Procedure

11.4.12.4 Singapore Weight Loss Devices Market By Distribution Channel

11.4.13 Australia

11.4.13.1 Australia Weight Loss Devices Market By Devices

11.4.13.2 Australia Weight Loss Devices Market By Indication

11.4.13.3 Australia Weight Loss Devices Market By Procedure

11.4.13.4 Australia Weight Loss Devices Market By Distribution Channel

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Weight Loss Devices Market By Devices

11.4.14.2 Rest of Asia-Pacific Weight Loss Devices Market By Indication

11.4.14.3 Rest of Asia-Pacific Weight Loss Devices Market By Procedure

11.4.14.4 Rest of Asia-Pacific Weight Loss Devices Market By Distribution Channel

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Weight Loss Devices Market by Country

11.5.2.2 Middle East Weight Loss Devices Market By Devices

11.5.2.3 Middle East Weight Loss Devices Market By Indication

11.5.2.4 Middle East Weight Loss Devices Market By Procedure

11.5.2.5 Middle East Weight Loss Devices Market By Distribution Channel

11.5.2.6 UAE

11.5.2.6.1 UAE Weight Loss Devices Market By Devices

11.5.2.6.2 UAE Weight Loss Devices Market By Indication

11.5.2.6.3 UAE Weight Loss Devices Market By Procedure

11.5.2.6.4 UAE Weight Loss Devices Market By Distribution Channel

11.5.2.7 Egypt

11.5.2.7.1 Egypt Weight Loss Devices Market By Devices

11.5.2.7.2 Egypt Weight Loss Devices Market By Indication

11.5.2.7.3 Egypt Weight Loss Devices Market By Procedure

11.5.2.7.4 Egypt Weight Loss Devices Market By Distribution Channel

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Weight Loss Devices Market By Devices

11.5.2.8.2 Saudi Arabia Weight Loss Devices Market By Indication

11.5.2.8.3 Saudi Arabia Weight Loss Devices Market By Procedure

11.5.2.8.4 Saudi Arabia Weight Loss Devices Market By Distribution Channel

11.5.2.9 Qatar

11.5.2.9.1 Qatar Weight Loss Devices Market By Devices

11.5.2.9.2 Qatar Weight Loss Devices Market By Indication

11.5.2.9.3 Qatar Weight Loss Devices Market By Procedure

11.5.2.9.4 Qatar Weight Loss Devices Market By Distribution Channel

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Weight Loss Devices Market By Devices

11.5.2.10.2 Rest of Middle East Weight Loss Devices Market By Indication

11.5.2.10.3 Rest of Middle East Weight Loss Devices Market By Procedure

11.5.2.10.4 Rest of Middle East Weight Loss Devices Market By Distribution Channel

11.5.3 Africa

11.5.3.1 Africa Weight Loss Devices Market by Country

11.5.3.2 Africa Weight Loss Devices Market By Devices

11.5.3.3 Africa Weight Loss Devices Market By Indication

11.5.3.4 Africa Weight Loss Devices Market By Procedure

11.5.3.5 Africa Weight Loss Devices Market By Distribution Channel

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Weight Loss Devices Market By Devices

11.5.3.6.2 Nigeria Weight Loss Devices Market By Indication

11.5.3.6.3 Nigeria Weight Loss Devices Market By Procedure

11.5.3.6.4 Nigeria Weight Loss Devices Market By Distribution Channel

11.5.3.7 South Africa

11.5.3.7.1 South Africa Weight Loss Devices Market By Devices

11.5.3.7.2 South Africa Weight Loss Devices Market By Indication

11.5.3.7.3 South Africa Weight Loss Devices Market By Procedure

11.5.3.7.4 South Africa Weight Loss Devices Market By Distribution Channel

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Weight Loss Devices Market By Devices

11.5.3.8.2 Rest of Africa Weight Loss Devices Market By Indication

11.5.3.8.3 Rest of Africa Weight Loss Devices Market By Procedure

11.5.3.8.4 Rest of Africa Weight Loss Devices Market By Distribution Channel

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Weight Loss Devices Market by Country

11.6.3 Latin America Weight Loss Devices Market By Devices

11.6.4 Latin America Weight Loss Devices Market By Indication

11.6.5 Latin America Weight Loss Devices Market By Procedure

11.6.6 Latin America Weight Loss Devices Market By Distribution Channel

11.6.7 Brazil

11.6.7.1 Brazil Weight Loss Devices Market By Devices

11.6.7.2 Brazil Weight Loss Devices Market By Indication

11.6.7.3 Brazil Weight Loss Devices Market By Procedure

11.6.7.4 Brazil Weight Loss Devices Market By Distribution Channel

11.6.8 Argentina

11.6.8.1 Argentina Weight Loss Devices Market By Devices

11.6.8.2 Argentina Weight Loss Devices Market By Indication

11.6.8.3 Argentina Weight Loss Devices Market By Procedure

11.6.8.4 Argentina Weight Loss Devices Market By Distribution Channel

11.6.9 Colombia

11.6.9.1 Colombia Weight Loss Devices Market By Devices

11.6.9.2 Colombia Weight Loss Devices Market By Indication

11.6.9.3 Colombia Weight Loss Devices Market By Procedure

11.6.9.4 Colombia Weight Loss Devices Market By Distribution Channel

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Weight Loss Devices Market By Devices

11.6.10.2 Rest of Latin America Weight Loss Devices Market By Indication

11.6.10.3 Rest of Latin America Weight Loss Devices Market By Procedure

11.6.10.4 Rest of Latin America Weight Loss Devices Market By Distribution Channel

12. Company Profiles

12.1 Fitbit Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Garmin Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 Philips Healthcare

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Medtronic plc

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Johnson & Johnson

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 Obalon Therapeutics, Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 InBody Co., Ltd.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 iFit Health & Fitness Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 Hologic, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 Nuvasive, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Devices

Fitness Devices

Treadmills

Exercise bikes

Elliptical trainers

Weightlifting Devices

Home gym Devices

Others

Wearables

Smartwatches

Fitness trackers

Others

Surgical Devices

Bariatric surgery

Liposuction

Others

Non-Invasive Body Contouring Devices:

CoolSculpting

Ultrasound cavitation

Radiofrequency devices

Electromagnetic field (EMF) devices

By Indication

Body Contouring & Body Toning

Obesity Management

Chronic Disease Management

Obesity & Weight Management

Fitness & Performance Enhancement

Others

By Procedure

Mechanical

Electrical

Laser/Ultrasound

Request for Segment Customization as per your Business Requirement: Segment Customization Request

By Distribution Channel

Retail Stores

Online Platforms

Direct Sales

Healthcare Providers

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Conversational AI in Healthcare Market Size was valued at USD 10.80 Billion in 2023 and is expected to reach USD 80.50 Billion by 2032 and grow at a CAGR of 25.02%.

The Rosacea Treatment Market size was valued at USD 2.07 billion in 2023 and is expected to reach USD 3.70 billion by 2032, growing at a CAGR of 6.64% from 2024 to 2032.

The Antibody Production Market size was estimated at USD 14.33 billion in 2023 and is expected to reach USD 36.49 billion by 2032 at a CAGR of 10.95% during the forecast period of 2024-2032.

Precision Medicine Software Market Size was valued at USD 1.6 Billion in 2023 and is expected to reach USD 4.3 Billion by 2032, growing at a CAGR of 11.6% over the forecast period 2024-2032

The Augmented and Virtual Reality Contact Lenses Market size was valued at USD 21.60 Million in 2023 and is expected to grow to USD 71.80 Million by 2031 and grow at a CAGR of 16.2 % over the forecast period of 2024-2031.

The Protein Engineering Market Size was USD 2.15 billion in 2023 and is expected to reach USD 7.39 billion by 2032 at a CAGR of 14.72% by 2024-2032.

Hi! Click one of our member below to chat on Phone