Get more information on Web 3.0 blockchain Market - Request Free Sample Report

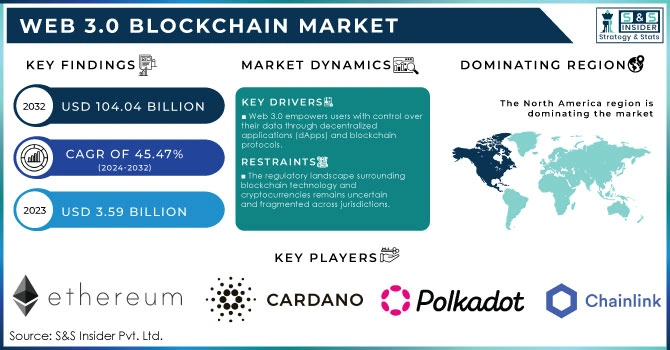

The Web 3.0 Blockchain Market was valued at USD 3.59 billion in 2023 and is expected to reach USD 104.04 Billion by 2032, growing at a CAGR of 45.47% over the forecast period 2024-2032.

The Web 3.0 blockchain market is emerging as a transformative sector that leverages decentralized technologies to reshape how digital interactions occur. One prominent application of Web 3.0 blockchain technology is in the financial services sector, particularly through decentralized finance (DeFi). As of January 2024, the decentralized finance (DeFi) market holds approximately USD 55.95 billion in total value locked (TVL). Global blockchain spending is projected to reach USD 19 billion by 2024, highlighting the growth and adoption of blockchain solutions. The cryptocurrency landscape has expanded rapidly, with 8,992 different cryptocurrencies available for trade as of January 2024, a substantial increase from 5,840 cryptocurrencies in September 2021. Bitcoin remains the dominant player in the market, boasting a market cap of around USD 892 billion and a price of USD 45,505.81 per BTC. Following closely is Wrapped Bitcoin (WBTC) at USD 45,456.18. In terms of trading volume, Tether (USDT) leads with a 24-hour trade value of USD 51.69 billion, while Bitcoin and Ethereum follow with approximately USD 32.73 billion and USD 11 billion, respectively. DeFi platforms utilize blockchain technology to offer financial services such as lending, borrowing, and trading without traditional banking intermediaries. This democratization of finance allows users from diverse backgrounds to access capital and financial products, fostering financial inclusion. The DeFi landscape has seen exponential growth, with the total value locked (TVL) in these protocols reaching billions of dollars, reflecting a significant shift towards alternative financial systems.

The Web 3.0 blockchain market also holds potential in the realm of digital identity and personal data management. Traditional identity verification processes often rely on centralized databases, making them vulnerable to data breaches and misuse. Web 3.0 allows individuals to manage their own digital identities through decentralized identity solutions, where users control their personal information and share it selectively with service providers. This shift not only enhances privacy and security but also empowers users with ownership of their data, aligning with the ethos of the decentralized web.

Drivers

Web 3.0 empowers users with control over their data through decentralized applications (dApps) and blockchain protocols.

This change is essential because it enables users to have more control over their digital identities and assets, empowering them. In Web 3.0, people can participate in direct transactions without middlemen, cutting costs and improving confidentiality. For instance, In 2022, DappRadar reached 50 blockchain integrations tracking almost 13,000 dapps and more than 13,500 NFT collections. This decentralized method reduces the dangers linked to centralized data breaches and censorship, promoting a safer and more durable digital space. Ownership is especially influential in sectors like finance, social media, and content creation. Individuals can profit from their input, resulting in novel opportunities for creativity and revenue generation. For instance, artists can distribute their creations as non-fungible tokens (NFTs), maintaining rights to earn royalties from subsequent sales, a practice that was difficult in conventional methods. Moreover, decentralized finance (DeFi) has gained traction in Web 3.0, enabling individuals to participate in lending, borrowing, and trading without relying on traditional banks or financial institutions. This opening up of financial services benefits unbanked populations by giving them access to important financial tools and resources. As more people recognize the advantages of decentralization, an increasing number of users and developers are drawn to Web 3.0 solutions, leading to a rise in adoption and investment in the blockchain market. This pattern is predicted to persist as technologies develop and regulatory frameworks adjust to support decentralized systems.

Internet users are increasingly concerned about privacy and security due to rising cyber threats and regulations regarding data privacy.

Web 3.0 blockchain technologies provide improved security through cryptographic methods to protect user information. In the conventional web framework, users frequently need to sacrifice their privacy to use services, resulting in data being sold to third parties or vulnerable to unauthorized access. Web 3.0 solves these problems by allowing users to engage in anonymous or pseudonymous interactions while maintaining ownership of their data. The permanent nature of blockchain guarantees that data cannot be changed or removed without agreement from the network, lowering the chances of tampering and fraudulent activity. This is especially important for use in industries like healthcare, finance, and supply chain management, where maintaining data integrity is crucial. Furthermore, the growing adoption of privacy-centered protocols like ZK-SNARKs enables transactions to be validated without exposing the data underneath. This ability is changing how sensitive information is managed, making sure it follows rules like the General Data Protection Regulation (GDPR).

Restraints

The regulatory landscape surrounding blockchain technology and cryptocurrencies remains uncertain and fragmented across jurisdictions.

The unpredictability creates major obstacles for the Web 3.0 blockchain market, as businesses deal with diverse regulations that can affect their activities, adherence needs, and overall market sustainability. Several countries are in the process of establishing regulations for blockchain and cryptocurrency, resulting in uncertainties about taxation, securities regulations, and protecting consumers. This uncertainty may discourage businesses and investors from participating in the market, impeding the progress of Web 3.0 solutions. Furthermore, strict regulations may be enforced by regulatory agencies on blockchain applications, especially those about finance, data privacy, and consumer protection. Adhering to these rules can be expensive and time-intensive for companies, shifting focus from creativity and growth. Potential regulatory crackdowns or bans on specific blockchain activities may lead to fear and uncertainty among developers and users. Consequently, numerous stakeholders might have reservations about investing in or embracing Web 3.0 technologies, which could impede growth and innovation.

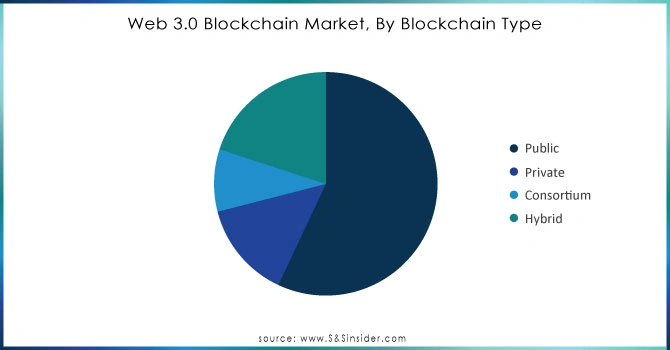

By Blockchain Type

Public blockchains dominated the market with a 57% market share in 2023, due to their decentralized nature and transparency. They enable all individuals to take part in the network, increasing security and trust between users. Public blockchains such as Bitcoin and Ethereum demonstrate this concept by allowing direct transactions between peers without requiring middlemen. Their open-source characteristic promotes creativity, enabling developers to design decentralized applications (dApps) for a range of sectors, including finance and supply chain management. Prominent examples consist of decentralized finance (DeFi) platforms like Uniswap and Aave, built on Ethereum, providing financial services without reliance on traditional banking institutions.

The hybrid blockchain is projected to grow at a faster rate during 2023-2032 in the Web 3.0 blockchain market. Hybrid blockchains mix elements of public and private blockchains, providing versatility, scalability, and improved privacy. This section is designed for companies that want the advantages of decentralization while still having control of sensitive information. For example, businesses can utilize hybrid blockchains to conduct transactions privately but share certain data publicly. Companies such as IBM have utilized hybrid blockchain technology through their IBM Blockchain Platform to enable secure and effective supply chain management.

Need any customization research on Web 3.0 blockchain Market - Enquiry Now

By Application

The cryptocurrency sector led the market in 2023 with over 37% market share, representing a considerable portion of the market's total worth. This supremacy is a result of the rising popularity of digital currencies such as Bitcoin, Ethereum, and others, which are transforming the financial industry by facilitating decentralized transactions without middlemen. Companies like Coinbase and Binance have become key figures, offering platforms for purchasing, selling, and exchanging different cryptocurrencies. These platforms utilize blockchain technology to guarantee safe, clear, and effective transactions.

Smart Contracts are expected to become the fastest-growing segment during 2024-2032, providing automatic contracts that execute on their own based on specific rules and conditions. This technology increases confidence, minimizes the necessity for middlemen, and simplifies operations in different sectors such as finance, real estate, and supply chain management. Ethereum and Chainlink are at the forefront, with Ethereum offering a strong foundation for creating and implementing smart contracts, and Chainlink concentrating on linking smart contracts to real-world information.

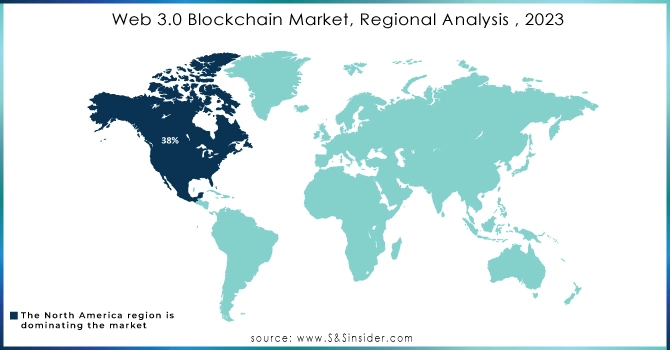

North America dominated the market with a 38% market share in 2023, driven by a robust technological infrastructure, significant investment, and a growing number of blockchain startups. The United States is at the forefront of innovation in decentralized applications and smart contracts, led by major players such as Ethereum and ConsenSys. Additionally, regulations are changing to encourage the usage of blockchain technology, creating a secure space for companies to function. Businesses such as Coinbase and BlockFi lead the way in incorporating blockchain technology into financial services, improving user experience with decentralized finance (DeFi) solutions.

The Asia-Pacific is anticipated to become the fastest-growing in the web 3.0 blockchain market during 2024-2032, fueled by increasing digitalization, rapid urbanization, and a young, tech-savvy population. China, India, and Singapore are all adopting blockchain technology in multiple industries such as finance, supply chain, and healthcare. China has become an important participant with its Blockchain Service Network (BSN), which seeks to simplify the creation and implementation of blockchain applications. In India, firms such as Polygon are making progress in improving Ethereum scalability, while ventures like WazirX are testing the limits of crypto exchanges.

The major key players in the Web 3.0 Blockchain Market are:

Ethereum (ETH, Solidity)

Cardano (ADA, Plutus)

Polkadot (DOT, Substrate)

Chainlink (LINK, Chainlink VRF)

Filecoin (FIL, Filecoin Network)

Tezos (XTZ, Michelson)

Solana (SOL, Solana Program Library)

Ripple (XRP, RippleNet)

Polygon Technology (MATIC, Polygon SDK)

Hedera (HBAR, Hedera Consensus Service)

Avalanche (AVAX, Avalanche Subnets)

Cosmos (ATOM, Cosmos SDK)

Algorand (ALGO, Algorand Standard Assets)

Arweave (AR, Arweave Permaweb)

EOS (EOS, EOSIO)

Near Protocol (NEAR, NEAR SDK)

Kusama (KSM, Parachains)

Waves (WAVES, Waves DEX)

Stellar (XLM, Stellar Network)

Zilliqa (ZIL, Zilliqa Smart Contracts)

Suppliers of Services/Platforms:

Infura (Ethereum infrastructure services)

Alchemy (Blockchain development platform)

Moralis (Web3 backend development services)

ChainSafe (Web3 libraries and tools)

Blockdaemon (Node infrastructure and deployment solutions)

Fleek (Decentralized hosting and development tools)

October 2024: Sui, the blockchain platform recognized for its top-notch performance and scalability, revealed today the launch of its initial SuiHub in partnership with Ghaf Group, the prominent blockchain ally in the MENA area.

May 2024: Alchemy Pay, a company that offers payment solutions for fiat and cryptocurrencies, is getting ready to introduce its digital bank for Web 3.0. This new initiative is designed to offer Web 3.0 businesses worldwide a compliant and efficient solution for managing multiple fiat accounts, optimizing cash flows, and simplifying conversions between fiat and cryptocurrency.

June 2024: XMint, the gaming platform of Web 3.0, will be officially released on the Solana blockchain on June 20th. XMint's objective is to bring together different kinds of games such as casual, adventure, role-playing, and turn-based ones to provide gamers with a wide variety of gaming options.

| Report Attribute | Details |

|---|---|

| Market Size in 2023 | USD 3.59 Billion |

| Market Size by 2032 | USD 104.04 Billion |

| CAGR | CAGR of 45.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Blockchain Type (Public, Private, Consortium, Hybrid) • By Application (Cryptocurrency, Conversational AI, Data & Transaction Storage, Payments, Smart Contracts, Others) • By End User (BFSI, Retail & E-commerce, Media & Entertainment, Pharmaceuticals, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ethereum, Cardano, Polkadot, Chainlink, Filecoin, Tezos, Solana, Ripple, Polygon, Hedera, Avalanche, Cosmos, Algorand, Arweave, EOS, Near Protocol, Kusama, Waves, Stellar, Zilliqa |

| Key Drivers | • Web 3.0 empowers users with control over their data through decentralized applications (dApps) and blockchain protocols. • Internet users are increasingly concerned about privacy and security due to rising cyber threats and regulations regarding data privacy. |

| RESTRAINTS | • The regulatory landscape surrounding blockchain technology and cryptocurrencies remains uncertain and fragmented across jurisdictions. |

Ans. The Compound Annual Growth rate for Web 3.0 blockchain Market over the forecast period is 45%.

Ans: North America dominated the Web 3.0 Blockchain Market in 2023.

Ans. challenges of using blockchain technology in web 3.0 including complexity, security concerns, regulatory concerns, technology requirements, and lack of interoperability with Web 2.0.

Ans. Various uses of blockchain technologies like decentralized apps smart contracts, and non-fungible tokens will become more popular once Web 3.0 is widely accepted. Cryptocurrency is expected to hold the largest share in the global web 3.0 blockchain market

Ans. blockchain technology provides several benefits when used in Web 3.0, including decentralization, improved security, ownership of data, transparency, cryptocurrency enabled, and smart contracts.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Web 3.0 Blockchain Adoption Rates by Region

5.2 Compliance and Risk Metrics, by Region (2023)

5.3 Transaction Volumes

5.4 Regulatory Developments

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Web 3.0 Blockchain Market Segmentation, by Blockchain Type

7.1 Chapter Overview

7.2 Public

7.2.1 Public Market Trends Analysis (2020-2032)

7.2.2 Public Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Private

7.3.1 Private Market Trends Analysis (2020-2032)

7.3.2 Private Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Consortium

7.4.1 Consortium Market Trends Analysis (2020-2032)

7.4.2 Consortium Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Hybrid

7.5.1 Hybrid Market Trends Analysis (2020-2032)

7.5.2 Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Web 3.0 Blockchain Market Segmentation, by Application

8.1 Chapter Overview

8.2 Cryptocurrency

8.2.1 Cryptocurrency Market Trends Analysis (2020-2032)

8.2.2 Cryptocurrency Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Conversational AI

8.3.1 Conversational AI Market Trends Analysis (2020-2032)

8.3.2 Conversational AI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Data & Transaction Storage

8.4.1 Data & Transaction Storage Market Trends Analysis (2020-2032)

8.4.2 Data & Transaction Storage Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Payments

8.6.1 Payments Market Trends Analysis (2020-2032)

8.6.2 Payments Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Smart Contracts

8.7.1 Smart Contracts Market Trends Analysis (2020-2032)

8.7.2 Smart Contracts Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Web 3.0 Blockchain Market Segmentation, by End User

9.1 Chapter Overview

9.2 BFSI

9.2.1 BFSI Market Trends Analysis (2020-2032)

9.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Retail & E-commerce

9.3.1 Retail & E-commerce Market Trends Analysis (2020-2032)

9.3.2 Retail & E-commerce Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Media & Entertainment

9.4.1 Media & Entertainment Market Trends Analysis (2020-2032)

9.4.2 Media & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Pharmaceuticals

9.5.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.5.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 IT & Telecom

9.6.1 IT & Telecom Market Trends Analysis (2020-2032)

9.6.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.2.4 North America Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.2.6.2 USA Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.2.7.2 Canada Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.7.2 France Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.6.2 China Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.7.2 India Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.8.2 Japan Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.12.2 Australia Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.2.4 Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.6.4 Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by Blockchain Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Web 3.0 Blockchain Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Ethereum

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Cardano

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Polkadot

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Chainlink

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Filecoin

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Tezos

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Solana

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Avalanche

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Cosmos

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Algorand

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Blockchain Type

Public

Private

Consortium

Hybrid

By Application

Cryptocurrency

Conversational AI

Data & Transaction Storage

Payments

Smart Contracts

Others

By End User

BFSI

Retail & E-commerce

Media & Entertainment

Pharmaceuticals

IT & Telecom

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Utility Locator Market was valued at USD 859.79 million in 2023 and will reach USD 1482.51 million by 2032, growing at a CAGR of 6.28% by 2032.

The Edge Computing Market size was valued at USD 16.21 Billion in 2023 and is expected to reach USD 245.30 Billion in 2032 and grow at a CAGR of 35.24% over the forecast period 2024-2032.

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

The Crowdfunding Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 5.4 Billion by 2032, growing at a CAGR of 15.4% by 2032.

Decentralized Identity Market size was valued at USD 1.15 Billion in 2023. It is expected to Reach USD 371.08 Billion by 2032 and grow at a CAGR of 90% over the forecast period of 2024-2032.

Blockchain IoT Market was valued at USD 557.3 million in 2023 and is expected to reach USD 35424.6 million by 2032, growing at a CAGR of 58.64% over 2024-2032.

Hi! Click one of our member below to chat on Phone