Get More Information on Wearable Payments Market - Request Sample Report

The Wearable Payments Market was valued at USD 632.50 billion in 2023 and is projected to reach USD 3622.66 billion by 2032, growing at a remarkable CAGR of 21.4% from 2024 to 2032.

The most popular wearables are smartwatches and fitness trackers. Smartwatches, Augmented and Virtual Reality technologies, smart jackets, and a slew of other gadgets are all urging us to live in a more connected world.

Rising demand for host card encryption and growing adoption of cashless transactions are driving growth in the Wearable Payment Market. HCE allows an imitation of a card to be made available on NFC enabled mobile or wearable devices without requiring access to the authentication element.

By using advanced technology embedded in the wearables, Wearable Payments are a secure way for consumers to buy products or services. Moreover, in order to provide retailers with more secure and error free payment methods, it is known as the tap-and-go payment method by various retailers and organisations.

Additionally, for executive payments, it allows the tapping of contactless cards or payment enabled devices. In addition, because of the benefits offered by this technology such as reducing transaction times, increasing convenience and leveraging customer experience at POS terminals during transactions, contactless payments are being used in BFSI, retails, energy & utilities, more than one sector.

Key Drivers:

Increasing adoption of cashless payments throughout the world.

The market is being driven by increased investment in digital payment processes and increasing adoption of wearable and cashless payments technology across governments all over the world. Due to the increase in the demand for salary increases by employees and the decrease in the profitability of banks, which is driving the growth of the market, banks and the FinTech sector around the world are finding it difficult to manage cash transactions on a daily basis. Moreover, owing to their benefits, such as the formalisation of transactions and the reduction of human errors, various banks and commercial sectors are using wearable payment devices and cashless payment services.

Increasing the volume of financial transactions

Restraints:

High costs of wireless devices

The adoption of these wearable payment devices is hampering the business growth. The services relating to wearable devices and contactless payments are subject to a number of charges including maintenance, integration or upgrade. In addition, the initial cost of production of wearable devices is high and incurs additional costs, which hampers the growth of the market.

Limited Production

Opportunities:

Increasing the use of NFC, RFID and Host Card Emulation Technology to Pay by Wireless Device

NFC and RFID are the basic components of different types of payment devices, such as wristwatch payments or contactless payments. A number of manufacturers, including Apple, Samsung and Huawei, are using NFC and RFID technology to develop their smart cards and wireless devices which is expected to give them a valuable opportunity for growth worldwide.

Increased internet penetration has led to an increase in the adoption of connected devices.

Challenges:

Increasing competition in the market and low awareness about the product

The need for secure and safer payment transactions is growing with the emergence of wearable devices and contactless payments.

During an economic slowdown, consumers tend to become more cautious with their spending. They may prioritize essential purchases over discretionary spending, which could affect the adoption and usage of wearable payment devices. Wearable payments might see a decline if consumers are cutting back on non-essential expenses. Airlines, tourism, hospitality, hotels, entertainment and e commerce are experiencing a decline in digital payment volumes (non-essentials) and restaurants, among other sectors. In addition, due to the temporary closure of borders resulting in a limited movement of goods, remittances from B2B or C2B countries have considerably declined. This has also had an impact on and decreased remittances from abroad. Various financial and industrial sectors such as energy, oil and gas, transport and logistics, manufacturing and aviation have had a significant economic impact. As a result of the trillion-dollar loss, it is estimated that the world's economy will be in recession. Economic activity is decreasing, which would have a negative effect on the world economy as more countries place restrictions and extend them.

In order to provide and receive real-time information on COVID-19, each individual and government of the United States, State, Central, Local or Provinces have been in constant contact with one another.

Russia's market leader is in the wearables technology sector of Central and Eastern Europe, so war will have a major impact on the markets. In Central and Eastern Europe, Russia has a 38% market share and more than 70% of smartwatches are made by Apple and Samsung. Russia will suffer from inflation, sanctions and companies leaving the region in 2023, which is expected to lead to a loss of $1.2 billion on the wearables market.

Ukraine is a key bridge between Western Europe and Eastern Europe, with many companies having distribution partners in the country. The war has forced many businesses to shut down and many Ukrainians to seek refuge abroad. This will lead to a fall of more than 90% in the market for wearable devices this year. Further uncertainty on market supply will be added by the seasonal lockdown of warehouses and COVID-19's impact, limiting growth over the next few years. The payments sector became a tool used to punish Russia for its invasion of Ukraine. For the rest of the world, Russia's exclusion from SWIFT and suspension of operations by International Card Schemes have been a warning sign. The payment provider sector was inevitably affected by this event, but not necessarily in an obvious way. The impact of the war in Ukraine on the payment industry in Russia and around the world is summarised in this briefing.

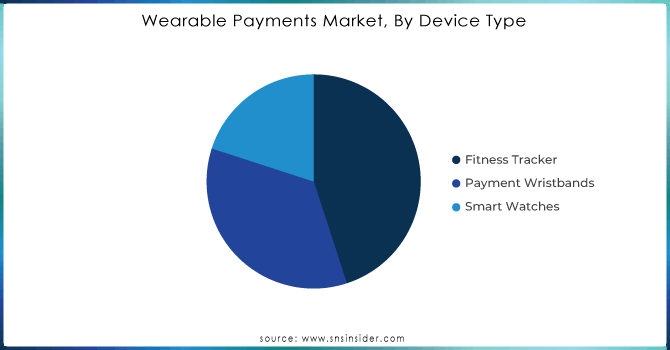

By Device Type

Fitness Tracker

Payment Wristbands

Smart Watches

In 2023, the fitness tracker segment accounted for more than 43.4% of global sales. Increasing use of a variety of fitness equipment and the growing number of people who are interested in exercise across the globe have led to an increased demand for fitness trackers.

Need any customization research on Wearable Payments Market - Ask For Customization

By Technology

Barcodes

Contactless Point of Sale (POS) Terminals

Near Field Communication (NFC)

Quick Response (QR) Codes

Radio Frequency Identification (RFID)

In 2023, the barcode segment dominated the Wearable Payments Market, accounting for more than 30.4% of worldwide sales. To improve the overall customer experience, retailers focus on removing friction at the checkout. The barcode scanners incorporate scan-and-go technology are embedded in the wearable payment devices.

By Application

Festival & Life Events

Fitness

Healthcare

Retail

Transportation

Others

In 2023, the Wearable Payments Market was dominated by retailers, accounting for more than 29.6% of total revenue. The growing demand for cashless payments in markets, local stores and online shopping can be attributed to the growth of this segment. By survey 72% of consumers believe that wearable payment devices will be the future of in store shopping.

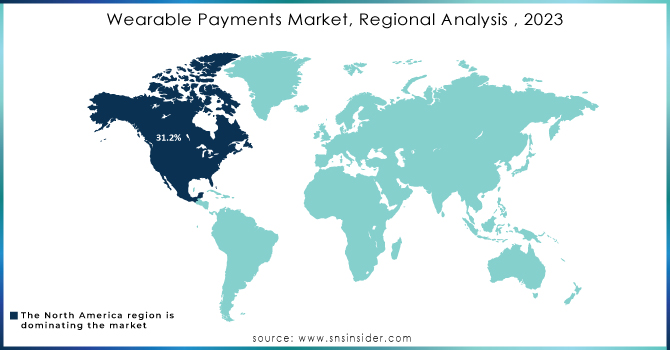

In 2023, North America dominated the market with over 31.2% of total revenue. The presence of key players such as Apple, Inc.; Google, LLC; Mastercard, Inc.; and Visa, Inc. The growth of the region's market is also expected to be supported by trends such as growing technical dependence on timing and tracking, while fitness enthusiasts are increasingly adopting wearable device. Moreover, the production of smart devices with tracking and payment features in North America has increased significantly. During the forecast period, Asia Pacific is expected to be the fastest growing region in terms of growth. The presence of a large population and the growing demand for electronic devices in this region can be attributed to market increase. Market growth is expected to be supported by factors such as steady growth in the development of a cashless economy and the transformation of payment technologies. An important trend in the market is also an increasing number of competitors.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Alibaba group holding limited, apple inc., Barclays plc, Fitbit, inc., google LLC, jawbone, inc., MasterCard, Samsung electronics co., ltd., visa, inc., PayPal inc. & Other Players

July 2022 Alibaba Cloud, the digital technology and intellectual backbone of the Alibaba Group, announced the global launch of Energy Expert, a sustainability platform to help customers worldwide measure, analyze and manage their carbon emissions from their business activities and products. The software, which is a service that provides customers with transformational insight and energy saving recommendations to speed up their sustainability journeys, also offers solutions in this area.

In August 2022, Samsung Electronics announced Galaxy Watch4 and Galaxy Watch 4 Classic. These smartwatches are equipped with the new Wear OS powered by Samsung, developed in collaboration with Google, which offers advanced hardware performance and a connected user experience.

| Report Attributes | Details |

| Market Size in 2023 | US$ 632.5 Billion |

| Market Size by 2032 | US$ 3622.66 Billion |

| CAGR | CAGR of 21.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Fitness Tracker, Payment Wristbands, Smart Watches) • By Technology (Barcodes, Contactless Point of Sale (POS) Terminal, Near Field Communication (NFC), Quick Response (QR) Codes, Radio Frequency Identification (RFID)) • By Application (Festival & Life Events, Fitness, Healthcare, Retail, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alibaba group holding limited, apple inc., Barclays plc, Fitbit, inc., google LLC, jawbone, inc., MasterCard, Samsung electronics co., ltd., visa, inc., PayPal inc. |

| Key Drivers |

• Increasing adoption of cashless payments throughout the world. • Increasing the volume of financial transactions |

| Market Challenges | • Increasing competition in the market and low awareness about the product |

Ans: The Wearable Payments Market size is expected to grow to USD 2984.1 Billion by 2031

Ans: APAC region dominated the Wearable Payments market.

Ans: The growth rate of the Wearable Payments market is 14.6% during the forecast period.

Ans: Alibaba group holding limited, apple inc., Barclays plc, Fitbit, inc., google LLC, jawbone, inc., MasterCard, Samsung electronics co., ltd., visa, inc., and PayPal inc. are leading players in the Wearable Payments market.

Ans: Wearable Payments market is segmented into 3 categories: By Device Type, By Technology, and By Application.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia war

4.3 Impact of ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Wearable Payments Market Segmentation, by Device Type

8.1 Fitness Tracker

8.2 Payment Wristbands

8.3 Smart Watches

9. Wearable Payments Market Segmentation, by Technology

9.1 Barcodes

9.2 Contactless Point of Sale (POS) Terminal

9.3 Near Field Communication (NFC)

9.4 Quick Response (QR) Codes

9.5 Radio Frequency Identification (RFID)

10. Wearable Payments Market Segmentation, by Application

10.1 Festival & Life Events

10.2 Fitness

10.3 Healthcare

10.4 Retail

10.5 Transportation

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 USA

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 The Netherlands

11.3.7 Rest of Europe

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 South Korea

11.4.3 China

11.4.4 India

11.4.5 Australia

11.4.6 Rest of Asia-Pacific

11.5 The Middle East & Africa

11.5.1 Israel

11.5.2 UAE

11.5.3 South Africa

11.5.4 Rest

11.6 Latin America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Rest of Latin America

12. Company Profiles

12.1 ALIBABA GROUP HOLDING LIMITED

12.1.1 Financial

12.1.2 Products/ Services Offered

12.1.3 SWOT Analysis

12.1.4 The SNS view

12.2 APPLE INC.

12.3 BARCLAYS PLC

12.4 Fitbit, Inc.

12.5 GOOGLE LLC

12.6 Jawbone, Inc.

12.7 MASTERCARD

12.8 SAMSUNG ELECTRONICS CO., LTD.

12.9 VISA, INC.

12.10 PAYPAL INC.

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

STEM Education In K-12 Market was valued at USD 51.42 billion in 2023 and is expected to reach USD 168.63 billion by 2032, growing at a CAGR of 14.17% from 2024-2032.

The Industrial Wireline Networking Market was valued at USD 6.5 Billion in 2023 and will reach USD 14.4 Billion by 2032, growing at a CAGR of 9.18% by 2032.

The Service Virtualization Market Share was USD 745.8 Million in 2023 and will reach USD 2853.1 Million by 2032, growing at a CAGR of 16.1% by 2024-2032.

The Digital Farming Market size was valued at USD 23.9 Billion in 2023 and is expected to grow to USD 74.70 Billion by 2032 and grow at a CAGR of 13.5% by 2032.

The Satellite Antenna Market was valued at USD 4.7 billion in 2023 and is expected to reach USD 42.2 billion by 2032, growing at a CAGR of 27.49% by 2032.

Digital Banking Platform Market was valued at USD 30.3 billion in 2023 and is expected to reach USD 164.7 billion by 2032, growing at a CAGR of 20.7% by 2032.

Hi! Click one of our member below to chat on Phone