Get more information on Wealth Management Platform Market - Request Sample Report

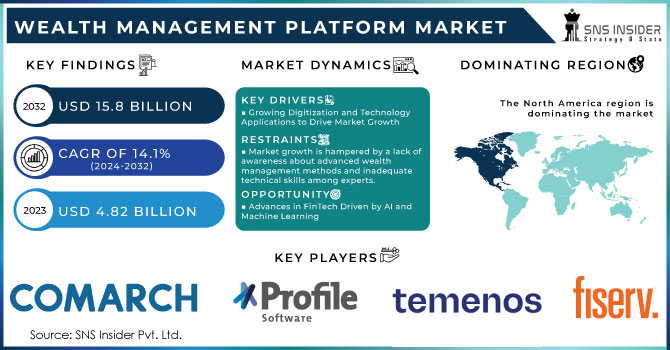

Wealth Management Platform Market was valued at USD 4.49 Billion in 2023 and is expected to reach USD 13.1 Billion by 2032, growing at a CAGR of 12.67% from 2024-2032.

The Wealth Management Platform Market is witnessing significant growth, with the rise of digital transformation in the financial services industry coupled with the increasing demand for personalized investment solutions. From 2024 onwards, platforms are begin to deploy advanced technologies like AI and big data analysis to provide bespoke advisory, risk control, and portfolio management. The low-cost, automated financial advice offered by AI-powered robo-advisors tends to attract younger, tech-oriented investors in droves. These platforms are also improving customer experiences by leveraging data to provide personalized financial products in addition to dynamic portfolio management.

The changing regulatory landscape is one of the major growth factors. The increasing focus on compliance with regulations such as MiFID II and GDPR urges the need for an advanced wealth management platform which aids in ensuring regulatory compliance along with operational efficiency handshake. In addition, the low interest rates for deposits and the growing number of high-net-worth (HNWIs), as well as ultra-high-net-worth individuals (UHNWIs) around the world, are providing a fillip to the market as these clients seek complex wealth management services.

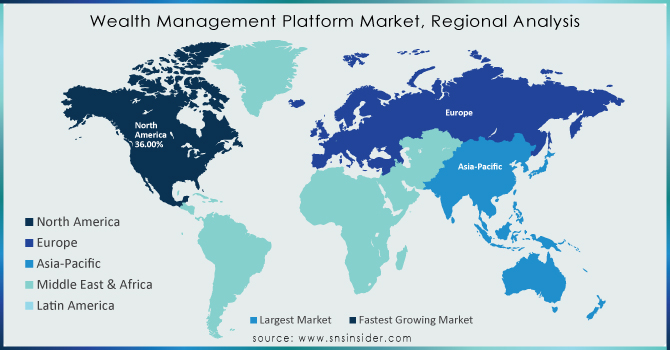

The wealth management platform market is especially increasing in North America and corresponds to the high concentration of wealth and rapid adoption of digital technologies in this area, in particular, the United States. Europe — with its stringent regulatory system and increasing desire for sustainable investment opportunities — is a large part of the equation as well.

Looking ahead, it is clear that the market will continue to evolve, largely driven by automation powered increasingly by AI-based and machine learning solutions. They will modernize operations and solve the security and compliance problem with strict data protection laws.

Drivers

The integration of AI, machine learning, and big data analytics enhances decision-making, portfolio management, and risk assessments

Robo-advisors are making wealth management services more accessible and affordable, attracting younger and tech-savvy investors

Rising interest in ESG (Environmental, Social, and Governance) investing is pushing platforms to offer sustainable and socially responsible investment choices

An increase in ESG (Environmental, Social, and Governance) investing is a major trend affecting the wealth management platform market. The demand for sustainable and socially responsible investment options has skyrocketed, as more investors look to align their financial portfolios with their personal values. As a result, wealth management platforms have begun embedding ESG considerations into their investment solutions to offer clients a diverse portfolio of sustainable investments.

Both consumer preference and regulatory starts have been what has principal this shift. A growing number of investors are showing a taste for investments that deliver financial value but also create a measurable social or environmental benefit, especially millennials and Gen Z. Treadmill, is very aware of global issues and expects financial platforms to meet those expectations around climate, social equity, and governance.

In addition to consumer demand, governments and regulators across the globe are activating policies that promote or mandate enhanced transparency and disclosure on ESG metrics. One example of this is the EU SFDR, Sustainable Finance Disclosure Regulation, which requires financial institutions to report in detail how the ESG requirements are met by their investment products. Such regulations are promoting market conditioning that paves the way for platforms to create/offer ESG-aligned investment products. As platforms for wealth management continually evolve, many already include advanced ESG scoring models to help clients evaluate and select investments by an overall sustainability or social responsibility metric. These can be anything from renewable energy to socially responsible corporations to fair labor or gender equality. In addition, a few platforms are using the power of artificial intelligence and big data analytics to facilitate tracking the real-time impact of ESG investments on lines of ESG events that are beneficial for investors to refine their investment decisions and enhance their value over the years.

The long-lasting effect of increasing term acceptance of ESG factors is changing the way wealth is being managed which inevitably leads to platforms that cater to this demand will take a bigger share of the market. And this trend is rising which has resulted in the growth of the wealth management, wealth management platform market in the upcoming years.

Restraints

The cost of implementing advanced wealth management platforms, especially for small firms, limits market adoption.

The risk of cyber threats and data breaches raises concerns over the security of sensitive financial data.

Integrating new platforms with legacy systems often results in technical and operational difficulties, hindering growth.

The technical and operational complexity of integrating wealth management platforms with legacy systems is one of the main challenges inhibiting market growth. Wealth management firms operate on outdated software and infrastructure, built long before the advent of cloud-based solutions or artificial intelligence (AI) and big data analytics. Migrating away from these legacy systems to more modern platforms requires a significant amount of technical knowledge, time, and money. One of the biggest challenges is realizing backward compatibility across systems. Older platforms might not be compatible with newer technologies, resulting in silos or inconsistencies that can break the seamless operation of wealth management functionalities. They usually involve re-architecting or reconfiguring the existing IT system, making the entire integration process resource-consuming and time-consuming. During the integration phase, or post-integration which can drive customer experience down and they might lose their trust in the platform. Furthermore, the process of data migration from legacy systems and into new platforms is inherently complex and high in occurrences of error. Inaccurate transfer of vast amounts of historical financial data: Old systems may have old formats or utilize databases that are not compatible. This could also pose security risks and complicate to integration process as improper driving of data would put sensitive client data at stake.

A significant problem, of course, is that legacy systems cannot often scale and be flexible enough to support modern wealth management solutions. The demands of customers who want real time insights, personalized recommendations, and ESG (Environmental, Social, and Governance) investment options cannot be met with legacy systems, which might lack the capacity to manage the required data without massive updates, which will push back the implementation of new platforms. But no matter how these challenges manifest themselves, there is a growing desire in the market for solutions that can bridge between those legacy infrastructure stacks and new technology stacks, and help facilitate smoother transitions so that system integration friction is reduced.

By Advisory Mode

The human advisory mode segment dominated the market and held the largest revenue share of 54.28% in 2023. Security concerns are one of the reasons to prefer human advisory over robo-advisory amongst various HNWIs across the world. In addition, human advisory services also make it easier to foster relationships with clients, communicate wealth management strategies, and communicate wealth management plans more effectively. The trends, however, are changing a little slowly, and clients are beginning to believe in the hybrid advisory model than the human advisory model.

The robo-advisory segment is expected to register the highest CAGR during the forecast period. Robo advisors are typically accurate, efficient, and more accessible than other modes. Thus, the robo-advisory platform is slowly but surely evolving into a low-cost alternative for many of the risk & compliance management firms, due to the affordability it provides because of its user-friendly features, low-cost fee model, and low/zero account minimums. Robo advisory segment will also be blessed with new growth opportunities owing to several influencing factors including ever-strengthening competition, changing client needs, and fast changing market scenario.

By Deployment

The cloud segment dominated the market and represented a significant revenue share of 58.0% in 2023. It is expected to grow across at a CAGR which is the fastest among all and will continue to hold its dominance during the prediction timeframe. Many companies across the globe are adopting cloud-based solutions due to the advantages they provide—scalability, agility, 24*7 availability of data, etc. The S-Cloud platform, with its ability to be cost-efficient and scalable, enables firms to build a wealth management platform for the future at an accelerated pace. Moreover, financial advisory firms around the world are now concentrating on implementing cloud-based solutions as part of their strategy to save costs in business operations.

The On-Premise deployment is anticipated to grow at a moderate CAGR of 10.8% during the forecast period. Many organizations are still inclined toward the on-premise deployment of solutions as they want to have maximum control of all the systems and data. The on-premise deployment model also enables organizations to have greater control over how software is implemented. On-premise solutions offer the assurance that business data is kept and taken care of in-house; however, the caveat is that businesses need to hire dedicated, in-house IT personnel as well to handle support and maintenance.

By Application

In 2024, the portfolio, accounting & trading management segment dominated the market and held the largest share of the Market. As the demand for portfolio management & trading solutions is skyrocketing; portfolio, accounting, & trading management solutions are enabling trading managers to focus on collaborative processes and deliver better customer service. Portfolio, accounting & trading managers are feeling extreme pressure to manage the data of their customers and are thus aggressively adopting wealth management solutions. Portfolio, accounting & trading management platforms are also being used by wealth managers for their client's financial data for the best decision-making solution that they can support them with.

The financial advice management segment is estimated to grow at the highest CAGR during the forecast period. The global financial advice & management market is projected to propel in terms of its adoption due to increased focus on digitization, operational optimization, and enriched customer relationships by several businesses across the globe, which is expected to boost the demand for financial advice & management solutions shortly. These days many wealth management firms are leveraging kind of wealth management software to serve their multiple clients in a better manner. Integrated fintech solutions in financial advice and management assist financial managers in collaborating with clients to develop optimal investment proposals, identify and analyze financial goals, and effectively deliver financial advice.

Need any customization research on Wealth Management Platform Market - Enquiry Now

Regional Analysis

In 2023, the North American wealth management software market had the largest share of more than 36.81%. There has been a steady rise in High-Net-Worth Individuals (HNWIs) in the region. These HNWIs are increasingly taking out subscriptions for high-end financial advisory solutions. Some of the main market players are also located in North America. Another factor for the growth in the regional market is digitalization, as many North American countries are digitalizing their financial sector.

The Asia Pacific wealth management software market is expected to grow at the highest CAGR over the forecast period. The growing adoption of digital platforms in the region generally suffices the roi-robo advisors in the region. Novel analytics and sophisticated algorithms have led techno-savvy customers to utilize robo-advisory tools to effectively fulfill their investment requirements. In addition, the growing number of SMEs in emerging economies like China, Japan, and India can provide opportunities for the market to grow. Furthermore, increasing implementation of the new IT infrastructure by the SMEs in the region is anticipated to fuel the demand for digital financial services owing to the need to increase their operating capabilities.

The underlying weight of Japan's wealth management software is anticipated to expand rapidly over the years ahead. Japan is another key driver for the market, as it has seen major growth in demand for retirement planning and wealth preservation strategies due to its aging population. In wealth management, technology-driven solutions are being used more than ever to facilitate service delivery and client engagement. Along with this trend, the cultural background of Japanese people being conscious of investment further backs up the trend where wealthy clients prefer more tailored approaches to wealth management.

Key Players

The major key players along with their products are

Fidelity Investments – Fidelity Wealth Management Platform

Charles Schwab – Schwab Intelligent Portfolios

UBS – UBS SmartWealth

JPMorgan Chase – J.P. Morgan Private Bank Platform

Goldman Sachs – Marcus by Goldman Sachs (Investment Solutions)

BlackRock – Aladdin WealthTech

Morgan Stanley – Morgan Stanley Wealth Management

Vanguard – Vanguard Personal Advisor Services

Addepar – Addepar Wealth Management Platform

Citi Private Bank – Citi Private Bank Wealth Management Services

BNP Paribas Wealth Management – Wealth Management Platform

State Street Global Advisors – State Street Global Advisors Solutions

Santander Private Banking – Santander Wealth Management Platform

Envestnet – Envestnet Wealth Management Solutions

TDAmeritrade – TDAmeritrade Institutional

Cognizant – Wealth Management Platform Solutions

Temenos – Temenos Wealth Management Software

SEI Investments – SEI Wealth Platform

S&P Global – S&P Capital IQ Pro for Wealth Management

Raymond James – Raymond James Private Client Group Services

Recent Developments

In September 2024, KFin Technologies introduced mPower Wealth, a comprehensive platform designed for wealth managers, family offices, and asset managers. The platform integrates front, mid, and back-office functions and is designed to support multi-asset and multi-currency portfolios, with a focus on AI-driven insights and robust compliance features

| Report Attributes | Details |

| Market Size in 2023 | USD 4.49 Billion |

| Market Size by 2032 | USD 13.1 Billion |

| CAGR | CAGR of 12.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

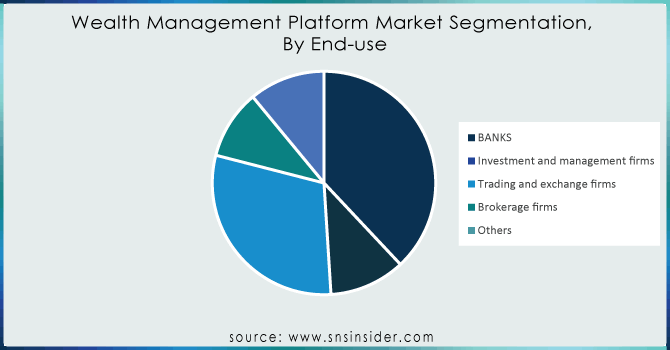

| Key Segments | • By Advisory Mode (Human Advisory, Robo Advisory, Hybrid) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By Application (Financial Advice & Management, Portfolio, Accounting, & Trading Management, Performance Management, Risk & Compliance Management, Reporting, Others) • By Deployment (Cloud, On-premise) • By End-use (Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Fidelity Investments, Charles Schwab, UBS, JPMorgan Chase, Goldman Sachs, BlackRock, Morgan Stanley, Vanguard, Addepar, Citi Private Bank, BNP Paribas Wealth Management, State Street Global Advisors, Santander Private Banking, Envestnet, TDAmeritrade, Cognizant, Temenos, SEI Investments |

| Key Drivers | •The integration of AI, machine learning, and big data analytics enhances decision-making, portfolio management, and risk assessments •Robo-advisors are making wealth management services more accessible and affordable, attracting younger and tech-savvy investors •Rising interest in ESG (Environmental, Social, and Governance) investing is pushing platforms to offer sustainable and socially responsible investment choices |

| Market Restraints | •The cost of implementing advanced wealth management platforms, especially for small firms, limits market adoption. •The risk of cyber threats and data breaches raises concerns over the security of sensitive financial data. •Integrating new platforms with legacy systems often results in technical and operational difficulties, hindering growth. |

Ans- Challenges in the Wealth Management Platform Market are

Ans- one main growth factor for the Wealth Management Platform Market is

Ans- the North America dominated the market and represented a significant revenue share in 2023

Ans- the CAGR of the Wealth Management Platform Market during the forecast period is 12.67% from 2024-2032.

Ans Wealth Management Platform Market was valued at USD 4.49 Billion in 2023 and is expected to reach USD 13.1 Billion by 2032, growing at a CAGR of 12.67% from 2024-2032.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Wealth Management Platform Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Wealth Management Platform Market Segmentation, by Advisory Mode

7.1 Chapter Overview

7.2 Human Advisory

7.2.1 Human Advisory Market Trends Analysis (2020-2032)

7.2.2 Human Advisory Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Robo Advisory

7.3.1 Robo Advisory Market Trends Analysis (2020-2032)

7.3.2 Robo Advisory Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Hybrid

7.4.1 Hybrid Market Trends Analysis (2020-2032)

7.4.2 Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Wealth Management Platform Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 On-premises

8.2.1 On-premises Market Trends Analysis (2020-2032)

8.2.2On-premises Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Wealth Management Platform Market Segmentation, By Application

9.1 Chapter Overview

9.2 Financial Advice & Management

9.2.1 Financial Advice & Management Market Trends Analysis (2020-2032)

9.2.2 Financial Advice & Management Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Portfolio, Accounting, & Trading Management

9.3.1 Portfolio, Accounting, & Trading Management Market Trends Analysis (2020-2032)

9.3.2 Portfolio, Accounting, & Trading Management Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Performance Management

9.4.1 Performance Management Market Trends Analysis (2020-2032)

9.4.2 Performance Management Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Risk & Compliance Management

9.5.1 Risk & Compliance Management Market Trends Analysis (2020-2032)

9.5.2 Risk & Compliance Management Market Size Estimates And Forecasts To 2032 (USD Billion)

9.6 Reporting

9.6.1 Reporting Market Trends Analysis (2020-2032)

9.6.2 Reporting Market Size Estimates And Forecasts To 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Wealth Management Platform Market Segmentation, By Enterprise Size

10.1 Chapter Overview

10.2 Small & Medium Enterprises (SMEs)

10.2.1 Small & Medium Enterprises (SMEs) Market Trends Analysis (2020-2032)

10.2.2 Small & Medium Enterprises (SMEs) Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Large Enterprises

10.3.1 Large Enterprises Market Trends Analysis (2020-2032)

10.3.2 Large Enterprises Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Wealth Management Platform Market Segmentation, By End-Use

11.1 Chapter Overview

11.2Banks

11.2.1 Banks Market Trends Analysis (2020-2032)

11.2.2 Banks Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Investment Management Firms

11.3.1 Investment Management Firms Market Trends Analysis (2020-2032)

11.3.2 Investment Management Firms Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Trading & Exchange Firms

11.4.1 Trading & Exchange Firms Market Trends Analysis (2020-2032)

11.4.2 Trading & Exchange Firms Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Brokerage Firms

11.5.1 Brokerage Firms Market Trends Analysis (2020-2032)

11.5.2 Brokerage Firms Market Size Estimates And Forecasts To 2032 (USD Billion)

11.6 Others

11.6.1 Others Market Trends Analysis (2020-2032)

11.7.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.2.4 North America Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.5 North America Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.6 North America Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.7 North America Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.2.8.2 USA Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.8.3 USA Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.4 USA Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.8.5 USA Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.2.9.2 Canada Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.9.3 Canada Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.4 Canada Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.9.5 Canada Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.2.10.2 Mexico Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.10.3 Mexico Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.4 Mexico Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.10.5 Mexico Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.8.2 Poland Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.8.3 Poland Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.4 Poland Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.8.5 Poland Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.9.2 Romania Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.9.3 Romania Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.4 Romania Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.9.5 Romania Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.4 Western Europe Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.5 Western Europe Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.6 Western Europe Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.7 Western Europe Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.8.2 Germany Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.8.3 Germany Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.4 Germany Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.8.5 Germany Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.9.2 France Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.9.3 France Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.4 France Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.9.5 France Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.10.2 UK Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.10.3 UK Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.4 UK Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.10.5 UK Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.11.2 Italy Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.11.3 Italy Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.4 Italy Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.11.5 Italy Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.12.2 Spain Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.12.3 Spain Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.4 Spain Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.12.5 Spain Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.15.2 Austria Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.15.3 Austria Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.4 Austria Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.15.5 Austria Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.4 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.5 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.6 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.7 Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.8.2 China Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.8.3 China Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.4 China Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.8.5 China Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.9.2 India Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.9.3 India Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.4 India Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.9.5 India Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.10.2 Japan Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.10.3 Japan Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.4 Japan Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.10.5 Japan Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.11.2 South Korea Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.11.3 South Korea Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.4 South Korea Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.11.5 South Korea Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.12.2 Vietnam Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.12.3 Vietnam Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.4 Vietnam Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.12.5 Vietnam Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.13.2 Singapore Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.13.3 Singapore Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.4 Singapore Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.13.5 Singapore Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.14.2 Australia Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.14.3 Australia Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.4 Australia Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.14.5 Australia Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.4 Middle East Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.5 Middle East Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.6 Middle East Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.7 Middle East Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.8.2 UAE Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.8.3 UAE Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.4 UAE Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.8.5 UAE Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.2.4 Africa Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.5 Africa Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.6 Africa Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.7 Africa Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Wealth Management Platform Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.6.4 Latin America Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.5 Latin America Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.6 Latin America Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.7 Latin America Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.6.8.2 Brazil Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.8.3 Brazil Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.4 Brazil Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.8.5 Brazil Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.6.9.2 Argentina Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.9.3 Argentina Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.4 Argentina Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.9.5 Argentina Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.6.10.2 Colombia Wealth Management Platform Market Estimates And Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.10.3 Colombia Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.4 Colombia Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.10.5 Colombia Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Wealth Management Platform Market Estimates And Forecasts, By Advisory Mode (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Wealth Management Platform Market Estimates And Forecasts, Deployment (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Wealth Management Platform Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Wealth Management Platform Market Estimates And Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Wealth Management Platform Market Estimates And Forecasts, By End-Use (2020-2032) (USD Billion)

13. Company Profiles

13.1 Fidelity Investments

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Charles Schwab

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3UBS

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 JPMorgan Chase

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Goldman Sachs

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 BlackRock

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Morgan Stanley

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Vanguard

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Addepar

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Citi Private Bank

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Advisory Mode

Human Advisory

Robo Advisory

Hybrid

By Deployment

Cloud

On-premise

By Enterprise Size

Large Enterprises

Small & Medium Enterprises

By Application

Financial Advice & Management

Portfolio, Accounting, & Trading Management

Performance Management

Risk & Compliance Management

Reporting

Others

By End-Use

Banks

Investment Management Firms

Trading & Exchange Firms

Brokerage Firms

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Fog Computing Market Size was valued at USD 282.59 Million in 2023 and is expected to reach USD 11537.48 Million by 2032 and grow at a CAGR of 51.0% over the forecast period 2024-2032.

The 5G Infrastructure Market was valued at USD 25.89 billion in 2023 and will reach USD 453.53 billion by 2032, growing at a CAGR of 37.48% by 2032.

Digital Accessibility Software Market was valued at USD 670.37 million in 2023 and will reach USD 1373.92 million by 2032, growing at a CAGR of 8.35% by 2032

The Data Preparation Tools Market Size was valued at USD 5.56 Billion in 2023 and is expected to reach USD 21.28 Billion by 2032 and grow at a CAGR of 16.1% over the forecast period 2024-2032.

The Text Analytics Market size was recorded at USD 9.55 billion in 2023 and is expected to reach USD 41.2 billion in 2032, growing at a CAGR of 17.65% Over the Forecast Period of 2024-2032.

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone