Waterproof Adhesives & Sealants Market Report Scope & Overview:

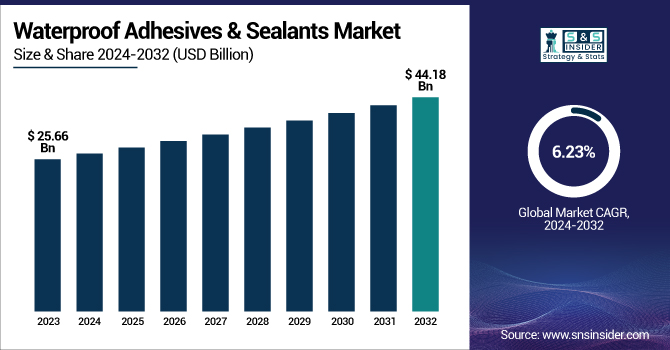

The Waterproof Adhesives & Sealants Market Size was valued at USD 25.66 Billion in 2023 and is expected to reach USD 44.18 Billion by 2032, growing at a CAGR of 6.23% over the forecast period of 2024-2032.

To Get more information on Waterproof Adhesives & Sealants Market - Request Free Sample Report

The Waterproof Adhesives & Sealants Market is evolving with rising demand from construction, automotive, and industrial applications. Investment trends reflect a surge in funding for advanced, eco-friendly formulations, reshaping competitive strategies. Meanwhile, raw material price fluctuations in silicones, polyurethanes, and acrylics impact production costs and pricing dynamics. The market also exhibits distinct preferences in consumer-grade versus industrial-grade products, where household users seek convenience while industries demand high durability. However, supply chain disruptions have intensified, causing raw material shortages and extended delivery timelines. Our report explores these pivotal factors, offering a comprehensive analysis of investment shifts, pricing volatility, product segmentation, and logistics challenges to help businesses adapt to the evolving market landscape.

The US Waterproof Adhesives & Sealants Market Size was valued at USD 4.53 Billion in 2023 and is expected to reach USD 7.77 Billion by 2032, growing at a CAGR of 6.19% over the forecast period of 2024-2032.

The U.S. Waterproof Adhesives & Sealants Market is experiencing steady growth, driven by rising construction activities, stringent environmental regulations, and advancements in material science. Organizations like the American Chemical Society (ACS) and the Adhesive and Sealant Council (ASC) highlight increasing demand for high-performance, eco-friendly adhesives in infrastructure and automotive sectors. The Department of Energy (DOE) promotes energy-efficient buildings, fueling the adoption of durable sealants for insulation. Additionally, U.S.-based companies like Henkel Corporation and 3M are developing innovative polyurethane and silicone-based waterproof solutions for industrial and consumer applications. Our report provides an in-depth analysis of these trends shaping the U.S. market.

Waterproof Adhesives & Sealants Market Dynamics

Drivers

-

Rising Demand for Advanced Waterproofing in High-Rise and Smart Building Construction Drives the Waterproof Adhesives & Sealants Market Growth

The increasing construction of high-rise buildings and smart infrastructure globally is a key driver for the Waterproof Adhesives & Sealants Market. Urbanization has led to the need for innovative materials that ensure long-term durability, leak-proof structures, and energy efficiency. High-rise buildings, particularly in cities like New York, Chicago, and Los Angeles, require strong bonding solutions to withstand harsh weather conditions, wind pressure, and structural movements. Additionally, smart buildings integrate advanced materials for energy efficiency, with silicone and polyurethane sealants playing a crucial role in window glazing, roofing, and façade applications. Organizations such as the National Association of Home Builders (NAHB) emphasize the importance of moisture-resistant materials to prevent structural degradation, boosting the demand for waterproof adhesives and sealants. With the adoption of green building certifications such as LEED (Leadership in Energy and Environmental Design), manufacturers are focusing on developing low-VOC, solvent-free adhesives. This trend is pushing market players like 3M, Dow, and Henkel to innovate products that align with sustainability standards, fueling the industry's expansion.

Restraints

-

Fluctuating Raw Material Costs and Supply Chain Disruptions Hamper the Waterproof Adhesives & Sealants Market Growth

The Waterproof Adhesives & Sealants Market faces a significant restraint due to fluctuating raw material costs and frequent supply chain disruptions. Key ingredients such as polyurethanes, silicones, and acrylics are derived from petrochemical sources, making them vulnerable to crude oil price volatility. The Russia-Ukraine conflict, trade restrictions, and natural disasters have caused severe disruptions in the global supply chain, leading to increased production costs and inconsistent material availability. Additionally, rising energy prices and labor shortages in manufacturing hubs such as China and the United States have further complicated logistics and distribution. The U.S. Bureau of Labor Statistics has reported a substantial increase in transportation and logistics costs, making procurement and delivery more expensive for manufacturers. To mitigate these issues, companies are exploring local sourcing and alternative materials, but sudden price hikes continue to challenge profit margins. These factors, combined with uncertainty in global trade policies, hinder the seamless growth of the Waterproof Adhesives & Sealants Market, creating instability in supply and demand dynamics.

Opportunities

-

Growing Investments in Bio-Based and Sustainable Waterproof Adhesives & Sealants Propel Market Growth

The increasing shift towards bio-based and sustainable adhesives is creating lucrative opportunities in the Waterproof Adhesives & Sealants Market. Companies are focusing on plant-derived polymers, water-based formulations, and biodegradable materials to meet environmental compliance standards and reduce carbon footprints. Regulatory initiatives like the U.S. Green Building Council’s LEED certification and the European Union’s Circular Economy Action Plan encourage the adoption of low-VOC and solvent-free adhesives. Leading manufacturers such as Ashland and Arkema have introduced bio-polyurethane and soy-based adhesives that offer comparable performance to traditional synthetic counterparts. Additionally, the demand for recyclable and compostable packaging solutions in food and beverage, pharmaceuticals, and e-commerce is driving innovation in sustainable adhesive technologies. The rising consumer awareness of eco-friendly home improvement products and energy-efficient building materials is further accelerating market growth. As industries transition towards green chemistry and sustainable production methods, the demand for bio-based waterproof adhesives & sealants is expected to surge, presenting significant opportunities for manufacturers.

Challenge

-

Intensifying Competition from Alternative Bonding Technologies Challenges the Market Expansion of Waterproof Adhesives & Sealants

The Waterproof Adhesives & Sealants Market faces increasing competition from alternative bonding technologies, such as mechanical fasteners, welding, and advanced adhesive tapes. High-performance bonding tapes, developed by companies like Avery Dennison and 3M, offer instant adhesion, solvent-free application, and enhanced durability, making them a preferred choice in industries like construction, packaging, and automotive assembly. Additionally, ultrasonic and laser welding techniques are gaining traction in aerospace and medical devices, reducing reliance on liquid adhesives. The growing demand for recyclable and reworkable fastening solutions in sustainable manufacturing is further shifting market preferences toward non-adhesive bonding technologies. While traditional adhesives still dominate many applications, the rising popularity of next-generation bonding methods poses a long-term challenge for adhesive manufacturers, necessitating continuous innovation to stay competitive in the evolving market landscape.

Waterproof Adhesives & Sealants Market Segmental Analysis

By Type

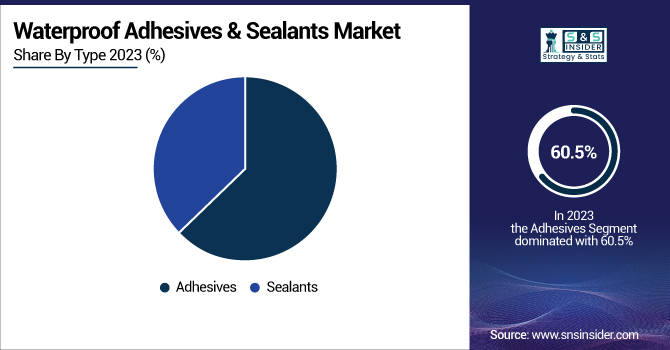

Adhesives dominated the Waterproof Adhesives & Sealants Market in 2023, capturing a 60.5% market share, with polyurethane adhesives emerging as the leading subsegment. Polyurethane adhesives are widely used in construction, automotive, and marine applications due to their high flexibility, moisture resistance, and strong adhesion to diverse substrates. According to the U.S. Green Building Council, the increasing adoption of LEED-certified buildings has driven demand for low-VOC polyurethane adhesives in waterproofing applications. Additionally, the National Association of Home Builders (NAHB) reported a 7% increase in residential construction projects in 2023, further fueling the demand. In the automotive sector, polyurethane adhesives are extensively utilized for bonding windshields, sealing panels, and improving vehicle durability, particularly in electric vehicle manufacturing. The U.S. Department of Energy has highlighted the growing need for lightweight, high-strength bonding solutions in EV assembly, contributing to the dominance of adhesives in the Waterproof Adhesives & Sealants Market.

By Base Material

Polyurethanes dominated and held a 30.9% market share in 2023, dominating the Waterproof Adhesives & Sealants Market due to their exceptional elasticity, chemical resistance, and superior bonding strength. The demand for polyurethane-based adhesives and sealants has surged, particularly in the construction and automotive industries, where durability and waterproofing are crucial. The U.S. Environmental Protection Agency (EPA) has promoted low-VOC polyurethane formulations, driving adoption in eco-friendly infrastructure projects. Additionally, the Federal Highway Administration (FHWA) has reported an increase in bridge and road maintenance projects, which require high-performance polyurethane sealants for waterproofing expansion joints and concrete structures. In marine applications, polyurethane sealants are preferred for boat manufacturing and deck sealing due to their resistance to saltwater, UV exposure, and extreme weather conditions. Leading manufacturers such as Dow and Henkel have invested in bio-based polyurethane adhesives, further strengthening the material’s dominance in the Waterproof Adhesives & Sealants Market.

By End-Use Industry

The Building & Construction segment dominated the Waterproof Adhesives & Sealants Market in 2023, accounting for a 40.3% market share. The rapid expansion of residential, commercial, and infrastructure projects, particularly in urban development and smart city initiatives, has fueled demand for high-performance waterproof adhesives and sealants. The National Association of Home Builders (NAHB) reported that construction spending in the U.S. exceeded $1.8 trillion in 2023, significantly boosting the market. Additionally, the American Society of Civil Engineers (ASCE) emphasized the need for waterproofing solutions in aging infrastructure rehabilitation, driving adoption in bridge repair and tunnel sealing. With government-backed initiatives such as the Bipartisan Infrastructure Law, increased investment in transportation and water management projects has further solidified the segment's dominance. Sustainable and energy-efficient buildings are also contributing to market expansion, with waterproof adhesives playing a key role in green roofing, façade sealing, and insulation panel bonding.

Waterproof Adhesives & Sealants Market Regional Outlook

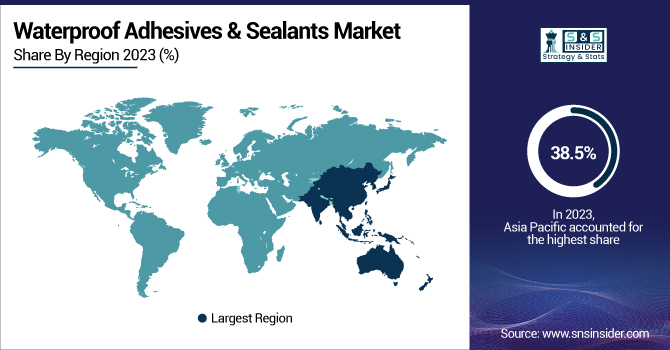

The Asia Pacific region dominated the Waterproof Adhesives & Sealants Market in 2023, holding a 38.5% market share, driven by rapid industrialization, infrastructure development, and growing automotive production. China emerged as the dominant country, fueled by massive investments in construction and smart city projects. According to the China Ministry of Housing and Urban-Rural Development, government initiatives such as the "New Urbanization Plan" have accelerated demand for waterproof adhesives in high-rise buildings and urban infrastructure. India also played a significant role, with the Indian Government's Smart Cities Mission increasing the use of waterproof sealants in urban construction. Additionally, Japan’s automotive industry witnessed rising adoption of polyurethane adhesives in electric vehicle (EV) manufacturing, as highlighted by the Japan Automobile Manufacturers Association (JAMA). Southeast Asian countries, including Vietnam and Indonesia, saw an uptick in demand due to growing marine and packaging industries, further boosting the region's dominance. The presence of key manufacturers such as Sika, BASF, and Henkel in the region has strengthened supply chains, enhancing market expansion.

Moreover, North America emerged as the fastest-growing region in the Waterproof Adhesives & Sealants Market, with a significant CAGR during the forecast period of 2024 to 2032. The United States dominates the region, driven by increasing investments in sustainable construction, automotive advancements, and infrastructure rehabilitation. According to the U.S. Department of Transportation, over $110 billion has been allocated for bridge repairs and highway expansions, boosting demand for waterproof adhesives and sealants in road maintenance. The rising adoption of EVs is also fueling market growth, with General Motors and Tesla increasing production of electric vehicles, where advanced bonding solutions are essential. Canada is the fastest-growing country, propelled by government policies promoting energy-efficient buildings under the Net-Zero Emissions by 2050 Plan. Mexico, with its expanding automotive and aerospace manufacturing sectors, has also witnessed increased demand for polyurethane-based adhesives for lightweight vehicle assembly. The presence of major players such as 3M, Dow, and H.B. Fuller in North America is further accelerating innovation and market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

3M Company (3M Marine Adhesive Sealant 5200, 3M Scotch-Weld Urethane Adhesive, 3M Fastbond Contact Adhesive)

-

Ashland (Pliogrip Structural Adhesives, Aroset Emulsion Adhesive, Isogrip Adhesive)

-

Avery Dennison Corporation (S7000 Adhesive, C4500 Waterproof Adhesive, Fasson Waterproof Label Adhesive)

-

BASF SE (MasterSeal NP1, MasterSeal 700, MasterEmaco ADH 327)

-

Bostik SA (Arkema Group) (Bostik 940 FS, Bostik MSP 107 Sealant, Simson ISR 70-03)

-

DAP Products Inc. (Dynaflex 230, Alex Plus Acrylic Latex Sealant, Kwik Seal Ultra)

-

Dow Chemical Company (DOWSIL 795 Silicone Sealant, DOWSIL 790, DOWSIL 991)

-

H.B. Fuller Company (Swift Lock Adhesive, GorillaPro Sealant, Advantra Adhesive)

-

Henkel AG & Co. KGaA (LOCTITE PL S40, TEROSON MS 939, Pritt Waterproof Adhesive)

-

Huntsman Corporation (Araldite 2021, Araldite 2050, Renshape Adhesives)

-

MAPEI SpA (Mapeflex PU45, Mapesil AC, Ultrabond Eco 995)

-

PPG Industries, Inc. (SIGMASHIELD 880, Pitt-Guard Epoxy Sealant, Envirobase Waterproof Adhesive)

-

Royal Adhesives & Sealants (H.B. Fuller Subsidiary) (Silaprene Adhesive, Supreme Seal 900, Fastbond Sealant)

-

RPM International Inc. (Tremco Dymonic 100, Rust-Oleum LeakSeal, Euclid Flexolith)

-

Sika AG (Sikaflex-221, Sikasil WS-305, SikaBond T-55)

-

Solvay (Omnix Waterproof Adhesive, Conapoxy Adhesive, Reactsol Sealant)

-

Uniseal, Inc. (Auto-Seal 400, Uniseal Bond, FlexSeal 700)

-

Wacker Chemie AG (GENIOSIL XB 502, ELASTOSIL N 2199, Silres BS 280)

-

Westlake Corporation (Westlake Epoxy Sealant, POLYBOND Adhesive, TUF-BOND)

-

Worcester Adhesives & Sealants (WorcoBond 250, AquaSeal Pro, Duraseal 500)

Recent Developments

-

August 2024: H.B. Fuller acquired HS Butyl Limited, a UK-based butyl tapes manufacturer, strengthening its position in specialty construction tapes and engineering adhesive solutions. HS Butyl exports to over 50 countries, serving industries like construction, automotive, and renewable energy.

-

March 2025: Nobelus launched thermal polyethylene (PE) sealants for flexible packaging in digital printing. These multilayer sealants improve efficiency and adhesion in digital converters, enhancing flexible packaging applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.66 Billion |

| Market Size by 2032 | USD 44.18 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Adhesives [UV curing adhesives, Anaerobic adhesives, Epoxy adhesives, Cross linking PVA glue, Polyurethane adhesives, Epoxy glue, Construction glue, Others], Sealants [Silicone, Polyurethane, Bituminous, Others]) •By Base Material (Silicones, Polyurethanes, Acrylics, Epoxy, Polysulfide, Others) •By End-Use Industry (Building & Construction, Transportation, Electrical & Electronics, Packaging , Medical, Consumer, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Bostik SA (Arkema Group), RPM International Inc., Wacker Chemie AG, MAPEI SpA, DAP Products Inc., Uniseal, Inc. and other key players |