Get more information on Waterborne Coatings Market - Request Sample Report

The Waterborne Coatings Market Size was USD 72.3 billion in 2023 and is expected to reach USD 119.6 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

Increasing construction activities due to rapid urbanization and infrastructure development in developing countries are contributing a lot to the demand for waterborne coatings in architectural and decorative applications. With growing residential, commercial, and industrial populations in urban areas, demand for eco-friendly durable coatings is expected to drive the global coating market. Water-based paint and water-based paint will produce low VOC emissions and suit your interior and exterior surfaces, so the use of waterborne coatings is preferred for coatings, as they perform better. Furthermore, government initiatives supporting sustainable construction practices and green building certifications are also driving demand for these coatings. In particular, their ease of use, rapid drying speeds, and visually attractive choices make waterborne coatings the ideal solution to satisfy the wide range of requirements in modern infrastructure projects, ensuring they will continue as a mainstay of the construction industry.

Governments globally have set stringent regulations to limit Volatile Organic Compound (VOC) emissions. For example, the U.S. Environmental Protection Agency (EPA) regulates coatings under its National Emission Standards for Hazardous Air Pollutants (NESHAP). VOC levels in coatings must comply with limits to reduce air quality impacts.

Industrial applications of waterborne coatings are increasing, due to their excellent properties including excellent adhesion and corrosion resistance, as well as easy application. These coatings work especially well to protect equipment and machinery against extreme environmental conditions like moisture, chemicals, and temperature fluctuations. Their low VOC emissions make them sustainable options in compliance with the strictest international environmental regulations. In addition, the combined advantages when dry alongside compatibility to many substrates, provide waterborne coatings with utility in industrial manufacturing and maintenance. Such coatings are increasingly being embraced by the automotive, aerospace, and heavy equipment industries to ensure longevity and compliance with environmental specifications. For waterborne coatings, both performance benefits and environmental considerations are leading to this evolution in industrial coatings.

In August 2023, PPG collaborated with one of China’s largest automakers to create an innovative waterborne coating for automotive parts. This new formulation aims to offer performance comparable to traditional solvent-based coatings while being more environmentally sustainable.

Drivers

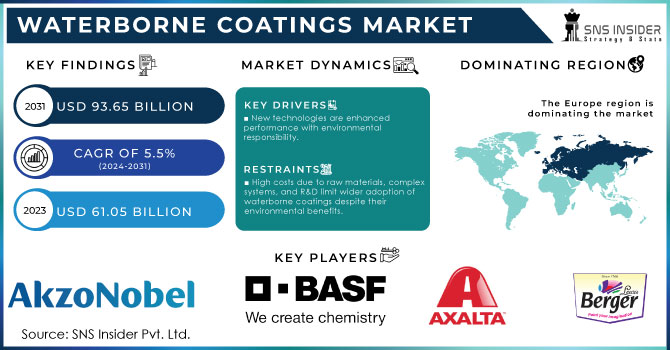

New technologies are enhanced performance with environmental responsibility.

New technologies continue to penetrate the waterborne coatings industry increasing performance and performance while meeting environmentally responsible requirements. These innovations aim to enhance the durability, adhesion, and resistance of coatings while minimizing harmful emissions. Using advanced resins and polymers, such as acrylics and polyurethanes, have had an impact in improving the coatings' performance, making them dirt-resistant in industrial and architectural applications. And with this we minimize VOC emissions, which are a fundamental issue in regulatory framework like those applied in U.S. and EU. In efforts to further reduce material use and waste, manufacturers are also focusing on technologies such as nano-coatings that provide higher performance at less thickness. Additionally, the industry focus on waterborne solutions coupled with adoption in eco-sensitive segments, wherein waterborne coatings are positioned as substitutes to solvent-based ones, has further boosted growth. They are pushing the market growth with high capital performance features combined with a lower environmental footprint, responding to consumer and regulatory needs.

Restraint

High costs due to raw materials, complex systems, and R&D limit wider adoption of waterborne coatings hamper the market growth.

Waterborne coatings are unable to address the high prices of raw materials, intricate production systems, and extensive research and development (R&D) costs, these are tougher barriers to the use of waterborne coatings and restrict the market growth. Ingredients for waterborne coatings, like resins and polymers, may be higher in price compared to standard solvent-based components, thus increasing production prices. Additionally, the new formulations must comply with both performance criteria and environmental legislation which demands significant investment in R&D when developing them, thus, such technology is expensive for smaller manufacturers or new entrants. Moreover, the specialized equipment and infrastructure required to generate and utilize waterborne coatings add to these significant expenses.

Opportunity

These economies are experiencing significant investments in infrastructure development and other long-term projects, fueling a surge in demand for construction materials. The construction spending in emerging markets is projected to grow at a rate exceeding that of North America and Western Europe. This rapid expansion presents a significant opportunity for resin and waterborne coating manufacturers. The Asia Pacific region, particularly China and India, is at the forefront of this growth, with these markets creating substantial demand for these products. This confluence of factors positions emerging economies as a key driver for the future of the waterborne coatings market.

By Resin Type

The acrylic sub-segment dominated the industry with the highest revenue share of 24% in 2023 by type. Growing demand from infrastructure and automotive industries regarding glossy color retention in outdoor exposure is anticipated to propel the demand for acrylic waterborne coatings. The demand for acrylic resin-based coatings will likely grow substantially over the foreseeable future owing to increasing applications in radiation curing and electrodeposition. Growing demand in the transportation industry for aircraft, autos, ships, railroads, and truck refinishes is expected to drive the demand for Polyurethane (PU) coatings. They are widely used owing to properties, such as abrasion resistance, toughness, and chemical & weather resistance. Stringent government regulations regarding reducing VOC emissions and consistent odors along with shifting consumer preference towards waterborne coatings over their solvent-borne counterparts are expected to remain a major factor driving product demand.

By Application

The architectural sub-segment dominated the waterborne coatings market in 2023, capturing a staggering 20% share. Increase in stringent VOC regulations and a construction boom in developing economies fueled by rising disposable incomes. However, the market landscape extends beyond the walls of buildings. The growing adoption of acrylic-based coatings in industrial applications signifies a promising diversification trend. Furthermore, innovative new offerings like insulation and sound-damping coatings hint at exciting growth prospects across the entire waterborne coatings market, underscoring its potential to cater to a wider range of applications.

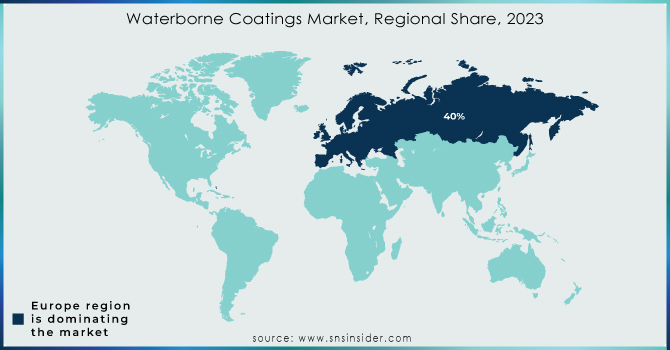

Europe held the largest market share around 40% in 2023. The region has also been considerably impacted by the EU’s VOC (Volatile Organic Compounds) directives requiring stricter compliance with stringent environmental regulations again, encouraging a move toward more sustainable and eco-friendly solutions, and waterborne over solvent-based coating systems. It tessellates with the state goal of limiting pollution and carbon emissions by promoting the use of more environmentally friendly products.

In addition to this, industry-specific coatings, such as high-performance marine, automotive, industrial machinery, and architecture, drive the demand for such coatings majorly in Europe due to the strong manufacturing base. In addition, major industry participants such as BASF and AkzoNobel are based in Europe, contributing to advancements and investments in waterborne technologies. These players have focused on investing a lot of money into R&D to develop advanced waterborne coatings that not only meet performance and sustainability standards but help the region's dominance in this market.

Get Customized Report as per your Business Requirement - Request For Customized Report

AkzoNobel NV (Dulux, Sikkens)

BASF SE (BASF Waterborne Coatings, MasterProtect)

Axalta Coating Systems LLC (Alesta, Imron)

Berger Paints India Ltd. (Luxol, Silk Glamor)

Kansai Paint Co. (Platinum, Opal)

Nippon Paint Holdings Co. Ltd (Supermatex, Weatherbond)

PPG Industries Inc. (Pitt-Char, PPG Aquapon)

RPM International Inc. (Rust-Oleum, Zinsser)

Sherwin-Williams Company (ProMar, Emerald)

The Valspar Corp. (Valspar Duramax, Valspar Medallion)

Tikkurila Oyj (Temalac, Joker)

Henkel AG & Co. KGaA (Loctite, Teroson)

Hempel A/S (Hempel Decorative, Hempel Premium)

Jotun A/S (Jotun Essence, Jotun Super)

Sika AG (Sikafloor, Sikagard)

Futura Coatings Ltd. (Futura Eco, Futura Flex)

Valspar Corp. (Valspar Wood, Valspar Metal)

Bolidt (Bolidt Flooring, Bolidt Protective Coatings)

Kraton Polymers (Kraton Polymers - Waterborne, Kraton Polymers - Base)

Eastman Chemical Company (Eastman Waterborne Coatings, Eastman Tetrashield)

In May 2023: AkzoNobel NV company's Coatings business is making waves with its new AccelstyleTM line. These coatings, designed for the outside of aluminum beverage cans, are the first to be free of bisphenols, styrene, and PFAS. This eco-friendly launch follows their success with AccelshieldTM 700, the first BPA-free internal coating for can ends, compliant with both US and EU regulations.

In May 2024: Axalta, a major coatings company, joined forces with Solera, a leader in vehicle lifecycle management. This partnership integrates Axalta's paint systems with Solera's platform, allowing body shops to estimate their carbon footprint per repair. This considers factors like chosen repair methods, paint application, and drying conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 61.05 Billion |

| Market Size by 2032 | US$ 93.65 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acrylic, Polyurethane, Epoxy, Alkyd, Polyester, PTFE, PVDC, PVDF, Others), • By Application (Architectural, General Industrial, Automotive OEM, Metal Packaging, Protective Coatings, Automotive Refinish, Industrial Wood, Marine, Coil, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AkzoNobel NV, BASF SE, Axalta Coating Systems LLC, Berger Paints India Ltd., Kansai Paint Co., Nippon Paint Holdings Company Ltd., PPG Industries Inc., RPM International Inc., The Sherwin-Williams Company, The Valspar Corp., Tikkurila Oyj |

| Drivers | • New technologies are enhanced performance with environmental responsibility. |

| Restraints | • High costs due to raw materials, complex systems, and R&D limit wider adoption of waterborne coatings despite their environmental benefits. |

Ans: The Waterborne Coatings Market is expected to grow at a CAGR of 5.1%.

Ans: The Waterborne Coatings Market Size was USD 72.3 billion in 2023

Ans: Increasing Environmental concerns and a focus on sustainability are driving the growth of the Waterborne Coatings Market.

Ans: High costs due to raw materials, complex systems, and R&D limit wider adoption of waterborne coatings despite their environmental benefits.

Ans: Europe is expected to hold the largest market share in the global Waterborne Coatings Market during the forecast period.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Resin Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Type Benchmarking

6.3.1 By Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion Plans and new By Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Waterborne Coatings Market Segmentation, By Resin Type

7.1 Chapter Overview

7.2 Acrylic

7.2.1 Acrylic Market Trends Analysis (2020-2032)

7.2.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyurethane

7.3.1 Polyurethane Market Trends Analysis (2020-2032)

7.3.2 Polyurethane Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Epoxy

7.4.1 Epoxy Market Trends Analysis (2020-2032)

7.4.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Alkyd

7.5.1 Alkyd Market Trends Analysis (2020-2032)

7.5.2 Alkyd Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polyester

7.6.1 Polyester Market Trends Analysis (2020-2032)

7.62 Polyester Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 PTFE

7.7.1 PTFE Market Trends Analysis (2020-2032)

7.7.2 PTFE Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 PVDC

7.8.1 PVDC Market Trends Analysis (2020-2032)

7.8.2 PVDC Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 PVDF

7.9.1 PVDF Market Trends Analysis (2020-2032)

7.9.2 PVDF Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Others

710.1 Others Market Trends Analysis (2020-2032)

7.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Waterborne Coatings Market Segmentation, by Application

8.1 Chapter Overview

8.2 Architectural

8.2.1 Architectural Market Trends Analysis (2020-2032)

8.2.2 Architectural Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 General Industrial

8.3.1 General Industrial Market Trends Analysis (2020-2032)

8.3.2 General Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Automotive OEM

8.4.1 Automotive OEM Market Trends Analysis (2020-2032)

8.4.2 Automotive OEM Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Metal Packaging

8.5.1 Metal Packaging Market Trends Analysis (2020-2032)

8.5.2 Metal Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Protective Coatings

8.6.1 Protective Coatings Market Trends Analysis (2020-2032)

8.6.2 Protective Coatings Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Automotive Refinish

8.7.1 Automotive Refinish Market Trends Analysis (2020-2032)

8.7.2 Automotive Refinish Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Industrial Wood

8.8.1 Industrial Wood Market Trends Analysis (2020-2032)

8.8.2 Industrial Wood Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Marine

8.9.1 Marine Market Trends Analysis (2020-2032)

8.9.2 Marine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Coil

8.10.1 Coil Market Trends Analysis (2020-2032)

8.10.2 Coil Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.2.4 North America Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.2.5.2 USA Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.2.6.2 Canada Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.6.2 France Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.5.2 China Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.5.2 India Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.5.2 Japan Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.9.2 Australia Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.2.4 Africa Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Waterborne Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.6.4 Latin America Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Waterborne Coatings Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Waterborne Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 AkzoNobel NV

10.1.1 Company Overview

10.1.2 Financial

10.1.3 By Product / Services Offered

10.1.4 SWOT Analysis

10.2 BASF SE

10.2.1 Company Overview

10.2.2 Financial

10.2.3 By Product / Services Offered

10.2.4 SWOT Analysis

10.3 Axalta Coating Systems LLC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 By Product / Services Offered

10.3.4 SWOT Analysis

10.4 Berger Paints India Ltd.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 By Product / Services Offered

10.4.4 SWOT Analysis

10.5 Kansai Paint Co.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 By Product / Services Offered

10.5.4 SWOT Analysis

10.6 Nippon Paint Holdings Co. Ltd

10.6.1 Company Overview

10.6.2 Financial

10.6.3 By Product / Services Offered

10.6.4 SWOT Analysis

10.7 PPG Industries Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 By Product / Services Offered

10.7.4 SWOT Analysis

10.8 RPM International Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 By Product / Services Offered

10.8.4 SWOT Analysis

10.9 Sherwin-Williams Company

10.9.1 Company Overview

10.9.2 Financial

10.9.3 By Product / Services Offered

10.9.4 SWOT Analysis

10.10 The Valspar Corp.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 By Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Acrylic

Polyurethane

Epoxy

Alkyd

Polyester

PTFE

PVDC

PVDF

Others

By Application

Architectural

General Industrial

Automotive OEM

Metal Packaging

Protective Coatings

Automotive Refinish

Industrial Wood

Marine

Coil

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Greenhouse Film Market Size was valued at USD 6.76 Billion in 2023 and is expected to reach USD 16.55 Billion by 2032, growing at a CAGR of 10.47% over the forecast period of 2024-2032.

The Emollients Market size was valued at USD 1.70 Billion in 2023. It is expected to grow to USD 2.61 Billion by 2032 & grow at a CAGR of 4.9% by 2024-2032.

The Isoparaffin Solvents Market Size was USD 870 Million in 2023 and will Reach to USD 1185.7 Million by 2032 and grow at a CAGR of 3.5% by of 2024-2032.

The Toluene Market Size was valued at USD 28.6 Billion in 2023. It is expected to grow to USD 40.9 Billion by 2032, growing at a CAGR of 5.4% from 2024-2032.

Fire-resistant Coatings Market was valued at USD 1079.4 million in 2023 and is expected to reach USD 1478.8 million by 2032, at a CAGR of 3.6% from 2024-2032.

Calcined Bauxite Market size was USD 1.7 billion in 2023 and is expected to reach USD 2.5 billion by 2032, growing at a CAGR of 4.1% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone