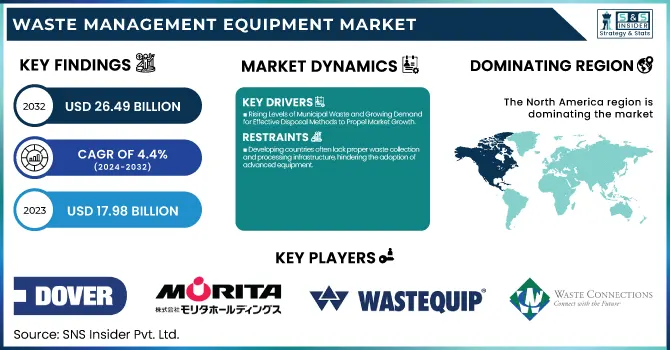

The Waste Management Equipment Market was valued at USD 17.98 billion in 2023, and it is expected to reach USD 26.49 billion by 2032, registering a CAGR of 4.4% during the forecast period of 2024-2032.

To Get more information on Waste Management Equipment Market - Request Free Sample Report

Waste management equipment is crucial for the efficient and proper gathering, handling, and processing of both regular and industrial or hazardous waste. Such equipment is designed to handle solid, liquid, and gaseous waste types. Any individual and modern buildings that praise themselves to be ‘green’, cannot be called sustainable without this type of equipment. Major waste management equipment covers waste disposal equipment and waste recycling and sorting equipment. The first one incorporates dumpers, dumpsters, and trucks, which allow the transportation, loading, and discharging of waste. The second category includes conveyors, shredders, and screeners, designed to treat and separate waste from waste.

In the 2022 Global Waste Index by Sensoneo, Turkey is the least environmentally friendly country. They recycle 47 kg and per person and throw away 176 Kg in illegal dumps each year. The United States is the most wasteful country producing 811 kg of waste per capita with half of waste thrown into landfills.

Furthermore, according to the Food and Agriculture Organization of per United Nations, global food wastage is about 1.6 billion of food produced each year, of which 1.3 billion is still wasted. The carbon footprint is about 3.3 billion tonnes of CO2 equivalent. Home composting could cut household food waste and up to 150 kg per year per household, is likely to be located in the more fertile regions and delivered to local collection authorities. Developing countries experience higher food losses during agricultural production, while in more developed countries, food waste is higher at the retail and consumer levels, leading to an economic loss of about USD 750 billion annually.

MARKET DYNAMICS

DRIVERS

Rising Levels of Municipal Waste and Growing Demand for Effective Disposal Methods to Propel Market Growth.

Among all countries waste generation from municipal, as well as lower industrial sector is a major issue that is prevailing in all most all-over developing countries and in some developed countries. In addition to city population is increasing. As the population increases waste is also increasing in amount so the waste managing equipment are in high demand which helps the transfer the day to a more compact form and reusable form. According to the World Bank Group found that in 2021 globally 1.3 billion ton of waste is generated in which it is expected to increase to 2.2 billion tons of waste by 2025, generating transferring waste into most of the compactors and dumping system.

According to the Global Waste Index 2022, South Korea ranked first, which generated around 400 kg of waste generated. Around 60.8% of the waste is recycled from these countries and they are dumped in the incineration and landfill sectors. This increases the demand for waste recycling and waste equipment. Moreover, there is an increased number of industries around the globe and technological advancements in recycling facilities.

The developments in waste management equipment, such as development of the automated recycling and processing equipment, also benefit the market because they make the process more efficient.

Waste management equipment have been facilitated by advanced technologies include automated sorting systems that use technologies to separate different types of waste through a feature of artificial intelligence and machine learning by which the equipment identifies and separates different types of waste accurately. This different waste separation is free of contamination reducing the disorientation of recyclable materials and improving the recycling process. Another innovation that has risen from the use of advanced technologies in waste management equipment is efficient machinery for processing. This machinery includes the effective use of shredders, compactors and incinerators to reduce the waste volume, hence allowable waste handling.

All these factors may be considered to be the obligation of improving waste management and treatment, as well as making these processes more efficient and less costly. Nevertheless, the solutions are technologically advanced, meaning that the costs of employing staff to operate waste management facilities will be decreased, not increased. Furthermore, this approach will become significantly cost-saving and profitable for waste management companies, as by improving the quality and types of sorting and regular processes with the help of new means of technology, they will be able to decrease the costs of its operations, as mentioned.

RESTRAIN

Developing countries often lack proper waste collection and processing infrastructure, hindering the adoption of advanced equipment.

A waste-inefficient infrastructure is one of the main obstacles to the successful implementation of advanced waste management equipment in many developing countries. On the one hand, these countries lack appropriate waste collection and processing facilities. On the other hand, such countries are characterized by the poor availability of financial, human, and legislative resources. As a result, solid waste collection and disposal are usually very ineffective. In many undeveloped areas waste is not collected altogether and it is not an unusual occurrence to find open-air dumps which contaminate drinking water sources and the grounds near them. In the majority of the cases, the required infrastructure, such as a landfill or an appropriate waste processing plant, has to be put in place before the advanced equipment can be imported. However, these countries are more focused on solving the existing issues with waste which pose threat to the public health rather on the arrangement of advanced long-term engineering methods. This, however, leads to the development of a vicious circle the absence of infrastructure doesn’t allow for the implementation of advanced equipment, while the unsophisticated equipment does not contribute to the efficiency of waste management.

By Product Type

Waste Disposal Equipment

Dumpsters

Compactors

Trucks

Others (Drum Crushers and Others)

Waste Recycling & Sorting Equipment

Conveyors

Screeners

Shredder

Others

By Waste Type

Hazardous

Non-hazardous

The hazardous waste segment primarily generated by the pharmaceuticals, chemicals, and medical industries is expected to hold the highest market share approx. 56% in 2023. This category of waste with high capacities of risks, which can have a negative impact to public health as well as the environment. Some types of such waste include toxic, reactive or sometimes infectious waste.

By Application

Industrial Waste

Municipal Waste

Others

The industrial waste segment dominates the market and is expected to exhibit a significant growth of approx. 45% in 2023, during the forecast period. This is due to the increasing waste generation from the construction, oil & gas waste, and manufacturing sectors.

The municipal waste segment is expected to register moderate growth. This is due to rising public awareness regarding sustainable waste management techniques, which creates the demand for more waste equipment for handling and disposing of waste generated from municipal sectors.

REGIONAL ANALYSES

North America currently dominating with 34.48% share in 2023, during the forecast period owing to the presence of several key players in the region along with good product offerings. Additionally, huge amount of waste generated in the U.S., Canada and Mexico create demand for waste equipment to manage waste properly.

In 2023, the fastest growing is going to be the Asia Pacific, because countries like Japan, India and China, have more production of garbage. In every year India produces more than 60 million tonnes of garbage.

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key Players

Some of the major players in the waste management equipment Dover Corporation, Morita Holdings Corporation, Wast equip LLC, Oshkosh Corporation, Sierra International Machinery LLC,, JCB, Kirch off Group, Waste Connections, Enerpat Group UK Ltd. Caterpillar Inc. and other players.

RECENT DEVELOPMENT

In May 2023: Wastequip announced the all-new Compactor Service Solutions from its Wastequip WRX service division. These solutions are the industry’s first end-to-end service offering, providing waste management compactor customers a hub for quickly scheduling preventative maintenance, installation, repair, or service from Wastequip WRX’s robust network of technicians.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.98 Bn |

| Market Size by 2032 | US$ 26.49 Bn |

| CAGR | CAGR of 4.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type(Waste Disposal Equipment, Dumpsters, Compactors, Trucks, Others (Drum Crushers and Others), Waste Recycling & Sorting Equipment, Conveyors, Screeners, Shredder, Others) •By Waste Type(Hazardous, Non-hazardous) •By Application (Industrial Waste, Municipal Waste, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dover Corporation, Morita Holdings Corporation, Wast equip LLC, Oshkosh Corporation, Sierra International Machinery LLC, JCB, Kirch off Group, Waste Connections, Enerpat Group UK Ltd.Caterpillar Inc |

| Key Drivers |

• Rising Levels of Municipal Waste and Growing Demand for Effective Disposal Methods to Propel Market Growth. • The developments in waste management equipment, such as development of the automated recycling and processing equipment, also benefit the market because they make the process more efficient. |

| Market Restraints | • Developing countries often lack proper waste collection and processing infrastructure, hindering the adoption of advanced equipment. |

Ans: North America is the dominating region in the Waste Management Equipment Market.

Ans: Rising Levels of Municipal Waste and Growing Demand for Effective Disposal Methods to Propel Market Growth.

Ans: Industrial Waste is the dominating segment by application in the Waste Management Equipment Market.

Ans: Waste Management Equipment Market size was USD 17.98 billion in 2023 and is expected to Reach USD 26.49 billion by 2032.

Ans: The Waste Management Equipment Market is expected to grow at a CAGR of 4.4%

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Waste Management Equipment Market Segmentation, By Product Type

7.1 Introduction

7.2 Waste Disposal Equipment

7.2.1 Dumpsters

7.2.2 Compactors

7.2.3 Trucks

7.2.4 Others (Drum Crushers and Others)

7.3 Waste Recycling & Sorting Equipment

7.3.1 Conveyors

7.3.2 Screeners

7.3.3 Shredder

7.3.4 Others

8. Waste Management Equipment Market Segmentation, By Waste Type

8.1 Introduction

8.2 Hazardous

8.3 Non-hazardous

9. Waste Management Equipment Market Segmentation, By Application

9.1 Introduction

9.2 Industrial Waste

9.3 Municipal Waste

9.4 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Waste Management Equipment Market, By Country

10.2.3 North America Waste Management Equipment Market, By Product Type

10.2.4 North America Waste Management Equipment Market, By Waste Type

10.2.5 North America Waste Management Equipment Market, By Application

10.2.6 USA

10.2.6.1 USA Waste Management Equipment Market, By Product Type

10.2.6.2 USA Waste Management Equipment Market, By Waste Type

10.2.6.3 USA Waste Management Equipment Market, By Application

10.2.7 Canada

10.2.7.1 Canada Waste Management Equipment Market, By Product Type

10.2.7.2 Canada Waste Management Equipment Market, By Waste Type

10.2.7.3 Canada Waste Management Equipment Market, By Application

10.2.8 Mexico

10.2.8.1 Mexico Waste Management Equipment Market, By Product Type

10.2.8.2 Mexico Waste Management Equipment Market, By Waste Type

10.2.8.3 Mexico Waste Management Equipment Market, By Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Waste Management Equipment Market, By Country

10.3.2.2 Eastern Europe Waste Management Equipment Market, By Product Type

10.3.2.3 Eastern Europe Waste Management Equipment Market, By Waste Type

10.3.2.4 Eastern Europe Waste Management Equipment Market, By Application

10.3.2.5 Poland

10.3.2.5.1 Poland Waste Management Equipment Market, By Product Type

10.3.2.5.2 Poland Waste Management Equipment Market, By Waste Type

10.3.2.5.3 Poland Waste Management Equipment Market, By Application

10.3.2.6 Romania

10.3.2.6.1 Romania Waste Management Equipment Market, By Product Type

10.3.2.6.2 Romania Waste Management Equipment Market, By Waste Type

10.3.2.6.4 Romania Waste Management Equipment Market, By Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Waste Management Equipment Market, By Product Type

10.3.2.7.2 Hungary Waste Management Equipment Market, By Waste Type

10.3.2.7.3 Hungary Waste Management Equipment Market, By Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Waste Management Equipment Market, By Product Type

10.3.2.8.2 Turkey Waste Management Equipment Market, By Waste Type

10.3.2.8.3 Turkey Waste Management Equipment Market, By Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Waste Management Equipment Market, By Product Type

10.3.2.9.2 Rest of Eastern Europe Waste Management Equipment Market, By Waste Type

10.3.2.9.3 Rest of Eastern Europe Waste Management Equipment Market, By Application

10.3.3 Western Europe

10.3.3.1 Western Europe Waste Management Equipment Market, By Country

10.3.3.2 Western Europe Waste Management Equipment Market, By Product Type

10.3.3.3 Western Europe Waste Management Equipment Market, By Waste Type

10.3.3.4 Western Europe Waste Management Equipment Market, By Application

10.3.3.5 Germany

10.3.3.5.1 Germany Waste Management Equipment Market, By Product Type

10.3.3.5.2 Germany Waste Management Equipment Market, By Waste Type

10.3.3.5.3 Germany Waste Management Equipment Market, By Application

10.3.3.6 France

10.3.3.6.1 France Waste Management Equipment Market, By Product Type

10.3.3.6.2 France Waste Management Equipment Market, By Waste Type

10.3.3.6.3 France Waste Management Equipment Market, By Application

10.3.3.7 UK

10.3.3.7.1 UK Waste Management Equipment Market, By Product Type

10.3.3.7.2 UK Waste Management Equipment Market, By Waste Type

10.3.3.7.3 UK Waste Management Equipment Market, By Application

10.3.3.8 Italy

10.3.3.8.1 Italy Waste Management Equipment Market, By Product Type

10.3.3.8.2 Italy Waste Management Equipment Market, By Waste Type

10.3.3.8.3 Italy Waste Management Equipment Market, By Application

10.3.3.9 Spain

10.3.3.9.1 Spain Waste Management Equipment Market, By Product Type

10.3.3.9.2 Spain Waste Management Equipment Market, By Waste Type

10.3.3.9.3 Spain Waste Management Equipment Market, By Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Waste Management Equipment Market, By Product Type

10.3.3.10.2 Netherlands Waste Management Equipment Market, By Waste Type

10.3.3.10.3 Netherlands Waste Management Equipment Market, By Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Waste Management Equipment Market, By Product Type

10.3.3.11.2 Switzerland Waste Management Equipment Market, By Waste Type

10.3.3.11.3 Switzerland Waste Management Equipment Market, By Application

10.3.3.12 Austria

10.3.3.12.1 Austria Waste Management Equipment Market, By Product Type

10.3.3.12.2 Austria Waste Management Equipment Market, By Waste Type

10.3.3.12.3 Austria Waste Management Equipment Market, By Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Waste Management Equipment Market, By Product Type

10.3.3.13.2 Rest of Western Europe Waste Management Equipment Market, By Waste Type

10.3.3.13.3 Rest of Western Europe Waste Management Equipment Market, By Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Waste Management Equipment Market, By Country

10.4.3 Asia-Pacific Waste Management Equipment Market, By Product Type

10.4.4 Asia-Pacific Waste Management Equipment Market, By Waste Type

10.4.5 Asia-Pacific Waste Management Equipment Market, By Application

10.4.6 China

10.4.6.1 China Waste Management Equipment Market, By Product Type

10.4.6.2 China Waste Management Equipment Market, By Waste Type

10.4.6.3 China Waste Management Equipment Market, By Application

10.4.7 India

10.4.7.1 India Waste Management Equipment Market, By Product Type

10.4.7.2 India Waste Management Equipment Market, By Waste Type

10.4.7.3 India Waste Management Equipment Market, By Application

10.4.8 Japan

10.4.8.1 Japan Waste Management Equipment Market, By Product Type

10.4.8.2 Japan Waste Management Equipment Market, By Waste Type

10.4.8.3 Japan Waste Management Equipment Market, By Application

10.4.9 South Korea

10.4.9.1 South Korea Waste Management Equipment Market, By Product Type

10.4.9.2 South Korea Waste Management Equipment Market, By Waste Type

10.4.9.3 South Korea Waste Management Equipment Market, By Application

10.4.10 Vietnam

10.4.10.1 Vietnam Waste Management Equipment Market, By Product Type

10.4.10.2 Vietnam Waste Management Equipment Market, By Waste Type

10.4.10.3 Vietnam Waste Management Equipment Market, By Application

10.4.11 Singapore

10.4.11.1 Singapore Waste Management Equipment Market, By Product Type

10.4.11.2 Singapore Waste Management Equipment Market, By Waste Type

10.4.11.3 Singapore Waste Management Equipment Market, By Application

10.4.12 Australia

10.4.12.1 Australia Waste Management Equipment Market, By Product Type

10.4.12.2 Australia Waste Management Equipment Market, By Waste Type

10.4.12.3 Australia Waste Management Equipment Market, By Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Waste Management Equipment Market, By Product Type

10.4.13.2 Rest of Asia-Pacific Waste Management Equipment Market, By Waste Type

10.4.13.3 Rest of Asia-Pacific Waste Management Equipment Market, By Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Waste Management Equipment Market, By Country

10.5.2.2 Middle East Waste Management Equipment Market, By Product Type

10.5.2.3 Middle East Waste Management Equipment Market, By Waste Type

10.5.2.4 Middle East Waste Management Equipment Market, By Application

10.5.2.5 UAE

10.5.2.5.1 UAE Waste Management Equipment Market, By Product Type

10.5.2.5.2 UAE Waste Management Equipment Market, By Waste Type

10.5.2.5.3 UAE Waste Management Equipment Market, By Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Waste Management Equipment Market, By Product Type

10.5.2.6.2 Egypt Waste Management Equipment Market, By Waste Type

10.5.2.6.3 Egypt Waste Management Equipment Market, By Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Waste Management Equipment Market, By Product Type

10.5.2.7.2 Saudi Arabia Waste Management Equipment Market, By Waste Type

10.5.2.7.3 Saudi Arabia Waste Management Equipment Market, By Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Waste Management Equipment Market, By Product Type

10.5.2.8.2 Qatar Waste Management Equipment Market, By Waste Type

10.5.2.8.3 Qatar Waste Management Equipment Market, By Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Waste Management Equipment Market, By Product Type

10.5.2.9.2 Rest of Middle East Waste Management Equipment Market, By Waste Type

10.5.2.9.3 Rest of Middle East Waste Management Equipment Market, By Application

10.5.3 Africa

10.5.3.1 Africa Waste Management Equipment Market, By Country

10.5.3.2 Africa Waste Management Equipment Market, By Product Type

10.5.3.3 Africa Waste Management Equipment Market, By Waste Type

10.5.3.4 Africa Waste Management Equipment Market, By Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Waste Management Equipment Market, By Product Type

10.5.3.5.2 Nigeria Waste Management Equipment Market, By Waste Type

10.5.3.5.3 Nigeria Waste Management Equipment Market, By Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Waste Management Equipment Market, By Product Type

10.5.3.6.2 South Africa Waste Management Equipment Market, By Waste Type

10.5.3.6.3 South Africa Waste Management Equipment Market, By Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Waste Management Equipment Market, By Product Type

10.5.3.7.2 Rest of Africa Waste Management Equipment Market, By Waste Type

10.5.3.7.3 Rest of Africa Waste Management Equipment Market, By Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Waste Management Equipment Market, By Country

10.6.3 Latin America Waste Management Equipment Market, By Product Type

10.6.4 Latin America Waste Management Equipment Market, By Waste Type

10.6.5 Latin America Waste Management Equipment Market, By Application

10.6.6 Brazil

10.6.6.1 Brazil Waste Management Equipment Market, By Product Type

10.6.6.2 Brazil Waste Management Equipment Market, By Waste Type

10.6.6.3 Brazil Waste Management Equipment Market, By Application

10.6.7 Argentina

10.6.7.1 Argentina Waste Management Equipment Market, By Product Type

10.6.7.2 Argentina Waste Management Equipment Market, By Waste Type

10.6.7.3 Argentina Waste Management Equipment Market, By Application

10.6.8 Colombia

10.6.8.1 Colombia Waste Management Equipment Market, By Product Type

10.6.8.2 Colombia Waste Management Equipment Market, By Waste Type

10.6.8.3 Colombia Waste Management Equipment Market, By Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Waste Management Equipment Market, By Product Type

10.6.9.2 Rest of Latin America Waste Management Equipment Market, By Waste Type

10.6.9.3 Rest of Latin America Waste Management Equipment Market, By Application

11. Company Profiles

11.1 Dover Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Morita Holdings Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Wast equip LLC

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Oshkosh Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Sierra International Machinery LLC,

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 JCB

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Kirch off Group

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Waste Connections

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Enerpat Group UK Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Caterpillar Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Fire-Resistant Cable Market Size was estimated at USD 2.02 billion in 2023 and is expected to arrive at USD 2.89 billion by 2032 with a growing CAGR of 4.04% over the forecast period 2024-2032.

The Deep Hole Drilling Machines Market was estimated at USD 784.70 Million in 2023 and is expected to reach USD 1435.51 million by 2032, with a growing CAGR of 6.94% over the forecast period 2024-2032.

The Spray Pyrolysis Market Size accounted for USD 150.73 Million in 2023 and is projected to reach USD 273.33 Million by 2032, growing at a CAGR of 6.91% during the forecast period 2024-2032.

Shape Memory Alloys Market was estimated at USD 13.90 billion in 2023 and is supposed to reach USD 40.61 billion by 2032, at a CAGR of 12.65% from 2024-2032.

The Hot & Cold Systems Market Size was valued at USD 19.53 Billion in 2023 and is expected to reach USD 33.48 Billion by 2032 and grow at a CAGR of 6.27% over the forecast period 2024-2032.

The Strapping Machine Market was estimated at USD 5.23 billion in 2023 and is expected to reach USD 7.67 billion by 2032, with a growing CAGR of 4.34% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone