Warehouse Robotics Market Report Scope and Overview:

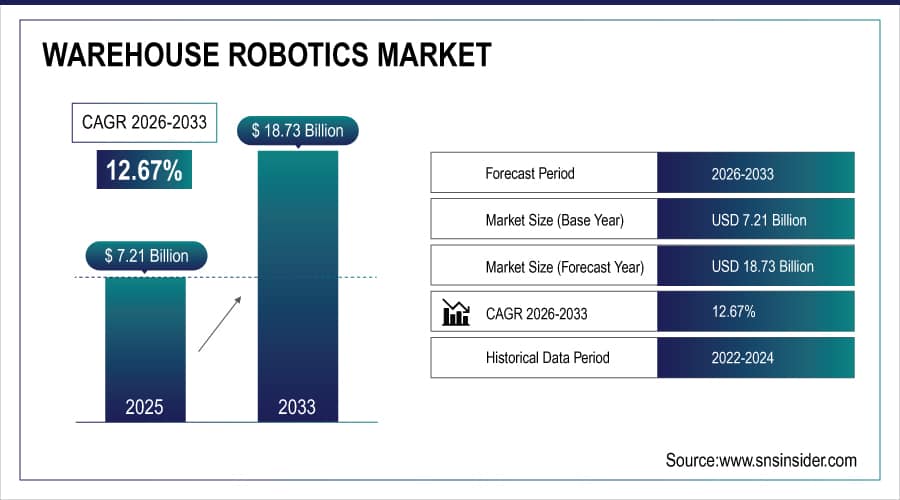

The Warehouse Robotics Market Size was valued at USD 7.21 Billion in 2025E and it is estimated to reach USD 18.73 Billion by 2033, growing at a CAGR of 12.67% during 2026-2033.

The warehouse robotics market is rapidly evolving, driven by advancements in automation technologies and the increasing need for efficiency in logistics and supply chain management. These robotic systems, designed to automate a variety of warehouse tasks, are gaining traction due to the surge in e-commerce, changes in consumer behavior, and the need to reduce operational costs. At the core of the market’s growth is the global push toward automation in response to rising labor costs, labor shortages, and the growing complexity of modern supply chains. Many companies are seeking solutions that can optimize warehouse operations and reduce dependency on manual labor. As companies increasingly turn to automation to cut costs, the worldwide warehouse automation market is expected to surpass USD 30 billion by 2026, up from USD 23 billion in 2023. Robots in warehouses are seen as the ideal solution to meet these demands, as they can operate continuously, improve throughput, and enable businesses to scale their operations more efficiently. Robotics plays a critical role in shaping the future of warehousing, with projections suggesting that robots could replace 40% of warehouse jobs.

To Get More Information On Warehouse Robotics Market - Request Free Sample Report

Warehouse Robotics Market Size and Forecast:

-

Market Size in 2025E USD 7.21 Billion

-

Market Size by 2033 USD 18.73 Billion

-

CAGR of 12.67% from 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

Warehouse Robotics Market Highlights:

-

Automation and efficiency are driving demand for warehouse robotics by reducing operational costs and improving customer satisfaction through faster order fulfillment

-

Rapid growth of e-commerce is increasing the need for streamlined order processing, precision, and quick delivery, supporting robotics adoption in warehouses

-

Integration of artificial intelligence and internet of things with robotics enables real-time inventory tracking, predictive maintenance, and data-driven operational decisions

-

Robotics support omnichannel fulfillment by ensuring inventory is readily accessible and orders are processed quickly and accurately

-

Safety and security concerns including workplace hazards, equipment accidents, and cybersecurity risks require stringent safety measures and protocols

-

Companies such as Amazon and Walmart show that robotics improve supply chain efficiency, encouraging wider adoption to remain competitive

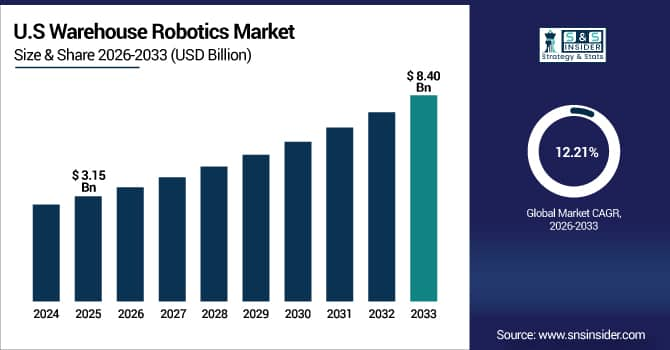

The U.S. Warehouse Robotics Market size was valued at an estimated USD 3.15 billion in 2025 and is projected to reach USD 8.40 billion by 2033, growing at a CAGR of 12.21% over the forecast period 2026–2033.

Market growth is driven by the rapid expansion of e-commerce, increasing demand for faster order fulfillment, and rising labor shortages in warehousing and logistics operations. Growing adoption of autonomous mobile robots (AMRs), automated guided vehicles (AGVs), robotic picking systems, and AI-powered warehouse automation solutions is significantly enhancing operational efficiency and accuracy. Additionally, advancements in robotics technologies, integration with warehouse management systems (WMS), and strong investments in smart logistics infrastructure further strengthen the growth outlook of the U.S. warehouse robotics market during the forecast period.

Warehouse Robotics Market Drivers:

-

Driving efficiency and customer satisfaction in the warehouse robotics market through automation and advanced technologies.

The warehouse robotics market is primarily driven by the increasing need for automation in supply chain management. Businesses are relying more on robotic solutions to enhance efficiency, cut operational expenses, and satisfy customer needs while striving for improvement. Automation simplifies tasks such as managing inventory, picking and packing items, and handling shipping. Utilizing robotics in warehouses decreases mistakes made by humans, speeds up order completion, and reduces operational setbacks. The demand for effective warehousing systems has become crucial as consumers now require quicker delivery times.

Furthermore, incorporating technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) with robotics improves operational productivity. These advancements allow for tracking inventory levels in real-time, maintaining robotic systems predictively, and making decisions based on data, which in turn promotes the use of warehouse robotics. Amazon and Walmart have utilized sophisticated robotic systems to improve their supply chains, showing how automation can boost efficiency and customer happiness. More companies are realizing the benefits of automation for staying competitive in the market, leading to a predicted continuation of this trend.

-

Rapid growth of warehouse robotics market driven by e-commerce expansion and automation needs.

The warehouse robotics market has experienced significant growth due to the rapid expansion of e-commerce. With the rise in online shopping, retailers are struggling to handle higher order quantities and the demand for streamlined order processing. E-commerce companies need warehouses that can efficiently manage large volumes of orders while ensuring precision and quickness in processing. Warehouse robotics offer an efficient answer through automation of processes like order selection, packaging, and organizing. Automated systems can greatly decrease the time needed to process orders, enabling businesses to satisfy customers' need for fast delivery.

Moreover, warehouses must adjust to diverse order fulfillment methods due to the shift towards omnichannel retailing, where customers anticipate a smooth shopping experience on multiple platforms. Robotics can enhance inventory control for various channels, ensuring products are easily accessible for rapid shipment. The increase in e-commerce has also resulted in the emergence of fulfillment centers, specifically built to manage large quantities of orders with effectiveness. With the implementation of robotic solutions in these facilities, it is expected that there will be a notable expansion in the Warehouse Robotics Market due to companies embracing automation to remain competitive.

Warehouse Robotics Market Restraints:

-

The challenges and implications of implementing robotics in warehouses due to safety and security concerns.

The use of robotics in warehouses is a crucial emerging technology that can enhance productivity, reduce costs, and provide other significant benefits. However, its implementation also manifests certain drawbacks and safety concerns. First, there can be hazards and further potential accidents holding robots. Even though such automated systems can avoid any workplace incidents that could occur with the manual labor of employees, this new mode also opens up additional dangers to people and equipment.

Therefore, it is essential to create stringent safety regulations, regular maintaining spaces, and training employees to learn how to behave with robotic systems safely. In addition to safety issues, the use of robotics also correlates with possible security problems, including data protection. It seems likely that, as more and more warehouses become automated and connected, such risks considerably grow. Therefore, cybersecurity will become a highly important issue as businesses develop security measures that will prevent any possible attacks leading to disrupted operations and controlled warehouses. Both dangers of accidents and security threats can prevent some businesses from using this emerging technology, as they will not be able to proceed due to safety and security reasons and make employees and other stakeholders support the idea.

Warehouse Robotics Market Segment Analysis:

By Function

The picking and placing segment had a major market share of 45% in 2025, fueled by the growing demand for improved efficiency and accuracy in managing inventory. This section showcases robots capable of accurately recognizing, selecting, and positioning objects, reducing mistakes made by humans and boosting productivity. Due to the increase in online shopping and customers expecting quick delivery, businesses are putting a lot of money into automation technology to improve their order completion procedures. For example, Fetch Robotics offers mobile robots designed for collaborative picking tasks, optimizing operations in various sectors such as retail and pharmaceuticals.

The sorting and packaging segment is accounted to register the most rapid growth rate during 2026-2033, which is fueled by the increase in e-commerce and the demand for effective handling of various product types. Robots in this category use complex technologies such as machine learning and computer vision to efficiently organize items according to their size, weight, and other specifications. This process automation helps to decrease congestion in warehouses, allowing for quicker handling and better precision in orders. For example, GreyOrange and other companies have created robotic systems that improve sorting abilities, allowing swift handling of goods in logistics tasks.

By Type

Automated Guided Vehicles (AGVs) held the largest share in the Warehouse Robotics Market in 2025 with a 40% market share. They are created to move materials within a site automatically, following set paths guided by magnetic strips, lasers, or vision systems. AGVs are crucial in modern warehouses and distribution centers because they greatly improve efficiency, lower labor expenses, and decrease human mistakes. For example, Amazon utilizes AGVs heavily in its fulfillment centers to streamline operations, guaranteeing punctual deliveries and maximizing space usage.

Autonomous Mobile Robots (AMRs) are expected to have the fastest CAGR during 2026-2033. AMRs, in contrast to AGVs, use sophisticated technologies like artificial intelligence and computer vision for dynamic navigation, enabling them to make instant decisions. The flexibility of AMRs is a key factor in their success in intricate warehouse designs, allowing them to navigate around barriers and efficiently plan their routes. For instance, businesses such as Ocado use AMRs in their automated warehouses to improve the speed and accuracy of order fulfillment.

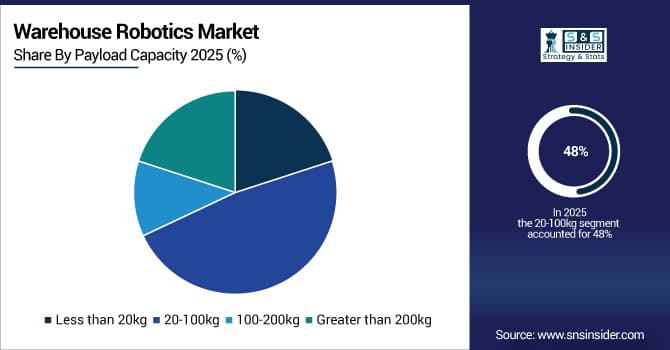

By Payload Capacity

The 20-100 kg dominated the market in 2025 with a 48% market share. This group consists of adaptable robots that are capable of effectively performing various tasks, like selecting, organizing, and moving items. These robots are well-balanced in terms of size, capability, and cost-effectiveness, making them appropriate for a range of warehouse tasks. Corporations such as Amazon employ robots such as the Kiva system, known for its effectiveness, to improve their fulfillment centers. The versatility of these robots in handling various types of products, such as boxes and pallets, further cements their supremacy.

The 100-200 kg is to experience the fastest CAGR in the warehouse robotics market in 2026-2033. The rise can be credited to the growing need for automation in managing heavier materials, especially in sectors like manufacturing and logistics. Robots in this category are made to lift and move heavy objects like pallets and large packages, crucial for effective warehouse functions. Companies such as GreyOrange utilize robots that can transport loads of 100-200 kg, improving the supply chain and reducing expenses on manual labor.

Warehouse Robotics Market Regional Analysis:

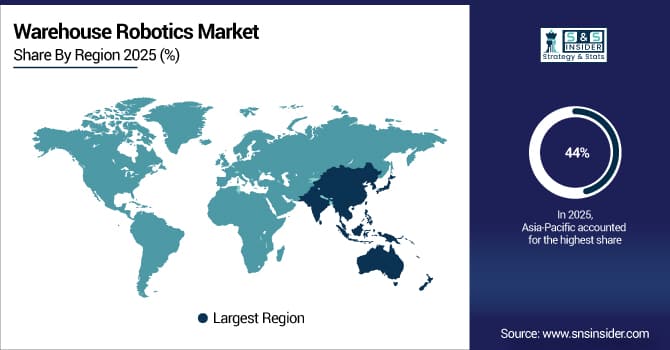

Asia-Pacific Warehouse Robotics Market Trends

The Asia-Pacific region led the market regionally in 2025 with a 44% market share due to rapid industrialization, expanding economies, and a growing need for advanced technologies. Nations such as China, Japan, and India are leading the way in pushing innovation and implementation in multiple sectors like electronics, manufacturing, and information technology. The strong industrial base of the region is demonstrated by major corporations like Samsung in South Korea and Tata Group in India. Furthermore, government efforts to enhance technology and infrastructure development, such as China's Made in China 2025, are greatly improving the competitive environment.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Warehouse Robotics Market Trends

Europe is attributed to becoming the fastest-growing region during the forecast period 2026-2033, mainly driven by a strong focus on sustainability and digital transformation. The strict environmental standards and carbon emissions regulations of the European Union are encouraging investments in green technologies and innovations. Furthermore, Europe's investment in research and development, supported by significant funding from both public and private sources, drives growth in diverse sectors such as automotive, healthcare, and renewable energy. Germany and France stand out for their progress in automation and artificial intelligence, establishing Europe as a center for innovative technological developments.

North America Warehouse Robotics Market Trends:

North America holds a significant position in the warehouse robotics market, driven by rapid e-commerce growth, advanced logistics infrastructure, and early adoption of automation technologies. The U.S. and Canada lead the region with investments in AI-enabled robotics, smart warehouses, and autonomous mobile robots. Key players like Amazon, Walmart, and FedEx are accelerating adoption, while government incentives for technology innovation support the market expansion.

Latin America Warehouse Robotics Market Trends:

Latin America is gradually emerging as a growing market for warehouse robotics, driven by the increasing demand for efficient supply chains and modernization of logistics operations. Brazil and Mexico are leading the adoption due to rising e-commerce activity and industrial automation initiatives. Investments in robotics for material handling and inventory management are increasing, although high initial costs and limited technological infrastructure remain challenges.

Middle East & Africa Warehouse Robotics Market Trends:

The Middle East & Africa region is witnessing steady growth, supported by modernization initiatives in logistics, warehousing, and industrial sectors. Countries such as the UAE, Saudi Arabia, and South Africa are investing in smart logistics and automated storage systems to enhance operational efficiency. Infrastructure development, free trade zones, and growing e-commerce demand further contribute to the adoption of warehouse robotics.

Key Warehouse Robotics Companies are:

-

Amazon Robotics (Kiva Systems, Amazon Prime Air)

-

KUKA Robotics (KMP 1500, KUKA omniMove)

-

Fetch Robotics (Freight 500, Freight 1500)

-

ABB Robotics (YuMi, IRB 6700)

-

Ocado Technology (Oconveyor, Smart Platform)

-

Clearpath Robotics (OTTO 100, OTTO 750)

-

Geek+ (P800, P2000)

-

Locus Robotics (LocusBot, LocusFleet)

-

Siemens (Siemens SIMATIC, Siemens Logistics)

-

Mujin (Mujin Controller, Mujin Manipulator)

-

Mobile Industrial Robots (MiR) (MiR100, MiR200)

-

Robotiq (Robotiq 2F-85, Robotiq Wrist Camera)

-

Seegrid (G2 Autonomous Mobile Robot, Palion AMRs)

-

Yaskawa (MOTOMAN-HP, Yaskawa Smart Pendant)

-

Vecna Robotics (Vecna Robotics AMRs, Vecna Warehouse Management)

-

Cobalt Robotics (Cobalt Security Robot, Cobalt Inventory Management)

-

Balyo (Balyo AGV, Balyo Forklift)

-

Pinc Solutions (Pinc's Real-Time Location System, Pinc Inventory Management)

-

FANUC (M-20iA, M-710iC)

-

6 River Systems (Chuck, 6 River Systems Cloud)

Warehouse Robotics Market Competitive Landscape:

Amazon Robotics was established in 2003 as Kiva Systems and later acquired by Amazon in 2012. The company specializes in warehouse automation, developing autonomous mobile robots and fulfillment solutions such as Amazon Prime Air. Its technologies enhance efficiency, reduce operational costs, and improve order fulfillment speed in global e-commerce and logistics operations.

-

March 2024: Amazon introduced a Titan robot that can move heavy items up to 2500 pounds in a fulfillment center. New robots will be used to transport large goods such as appliances and pallets. The first such system will work in the SAT1 in San Antonio Texas.

Kiva Systems was founded in 2003 and is a pioneering robotics company focused on warehouse automation. It developed autonomous mobile robots that streamline order fulfillment by transporting inventory shelves directly to workers. Acquired by Amazon in 2012, Kiva’s technology laid the foundation for modern automated warehouses, enhancing efficiency and reducing operational costs.

-

February 2024: Kiva Systems announced a new version of navigation software for the existing fleet of vehicles designed to automate operations in warehouses. According to developers, the update will increase the efficiency of robots because they are able to find a better route in the absence of an optimized one.

GreyOrange was founded in 2011 and is a global robotics and supply chain automation company. It specializes in intelligent warehouse solutions, including autonomous mobile robots and AI-powered software for inventory management, order fulfillment, and logistics optimization. GreyOrange’s innovations enhance efficiency, accuracy, and scalability for e-commerce, retail, and industrial operations worldwide.

-

January 2024: GreyOrange unveiled a new version of its order-driven delivery robot. The Butler 2.0 will be smarter: using artificial intelligence and machine learning, it can streamline the optimal picking and packing process, thereby increasing the speed and accuracy of moving goods.

Fetch Robotics was founded in 2014 and is a leading provider of autonomous mobile robots for warehouse and industrial automation. Its products, including Freight 500 and Freight 1500, streamline material handling, inventory management, and order fulfillment. Fetch Robotics enhances operational efficiency, reduces labor costs, and supports scalable automation in logistics and manufacturing environments.

-

November 2023: Fetch Robotics unveiled an updated version of the Freight line of warehouse robots. AMR is a robot system that automates product delivery in business centers. Each machine works with a certain item, so operators do not need to spend time manually moving goods around the warehouse.

Locus Robotics was founded in 2015 and specializes in autonomous mobile robots for warehouse automation. Its LocusBot and LocusFleet solutions work collaboratively with human operators to optimize order picking, inventory management, and fulfillment processes. Locus Robotics enhances efficiency, accuracy, and scalability, helping businesses meet growing e-commerce and logistics demands.

-

July 2023: Locus Robotics launched a Locus Origin robot capable of navigating the constantly changing environment of a warehouse. It was an autonomous mobile machine that specialized in picking, and carrying small items in cardboard boxes.

Omron was founded in 1933 and is a global leader in automation and robotics solutions. It provides industrial robots, autonomous mobile robots, and intelligent automation systems for manufacturing, logistics, and healthcare. Omron’s technologies enhance operational efficiency, improve safety, and enable precise, flexible, and scalable automation across diverse industries.

-

August 2023: Omron unveiled a line of low payload warehouse-type robots. The new robot, an autonomous mobile machine, is able to carry loads of up to 250 kg.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.21 Billion |

| Market Size by 2033 | USD 18.73 Billion |

| CAGR | CAGR of 12.67% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Articulated Robots, Cylindrical & SCARA Robots, COBOTS, Others) • By Function (Picking & Placing, Palletizing & De-palletizing, Transportation, Sorting & Packaging) • By Payload Capacity (Less than 20kg, 20-100 kg, 100-200 kg, Greater than 200kg) • By End User (Automotive, Semiconductor & Electronics, Chemical, E-Commerce & 3PL, Food & Beverage, Healthcare, Metals & Heavy Machinery, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Robotics, KUKA Robotics, Fetch Robotics, ABB Robotics, Ocado Technology, Clearpath Robotics, Geek+, Locus Robotics, Siemens, Mujin, Mobile Industrial Robots (MiR), Robotiq, Seegrid, Yaskawa, Vecna Robotics, Cobalt Robotics, Balyo, Pinc Solutions, FANUC, 6 River Systems |