Get more information on Warehouse Management System Market - Request Sample Report

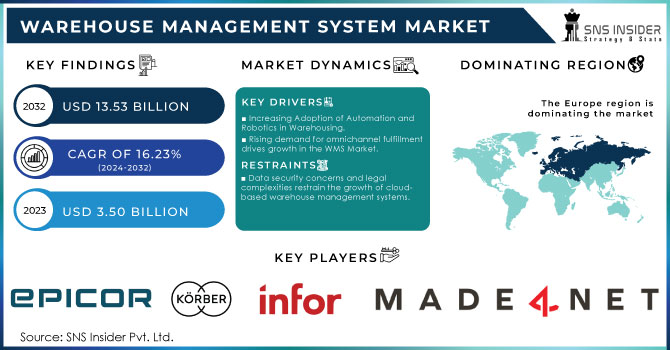

The Warehouse Management System Market Size was valued at USD 3.50 Billion in 2023 and is expected to reach USD 13.53 Billion by 2032 and grow at a CAGR of 16.23% over the forecast period 2024-2032.

The warehouse management systems (WMS) market is growing rapidly as companies strive to boost operational efficiency, cut costs, and enhance inventory accuracy. During 2023, there was a strong increase in the U.S. e-commerce market, making up around 20% of overall retail sales, which was a notable increase compared to past years. Consumer demand for convenience, competitive pricing, and faster delivery options propelled e-commerce revenue in the U.S. to approximately USD 1.06 trillion. Mobile commerce was crucial, accounting for more than 40% of all e-commerce transactions, showcasing the growing dependence on smartphones for shopping online. The growth of online shopping has greatly influenced the adoption of warehouse management systems. Due to the increase in online shopping, retailers are feeling the need to improve their processes to satisfy customers who expect quick and precise deliveries. WMS solutions offer businesses the ability to effectively manage their supply chains by providing immediate visibility into inventory levels and order status. Automating inventory management helps companies decrease human mistakes and guarantee optimal stock levels, resulting in improved resource allocation and reduced carrying costs.

The healthcare sector also takes advantage of WMS solutions to improve effectiveness and adherence to regulations. WMS is essential in a field where precise inventory control is vital for patient safety, as it aids in monitoring medical supplies and medications to prevent expiration or misplacement. Healthcare facilities are emphasizing automation for their supply chains, with approximately 75% of major healthcare institutions having either already integrated or are currently in the process of incorporating Warehouse Management Systems (WMS) to enhance operational effectiveness. Furthermore, the increasing popularity of digital healthcare programs has led to a growing need for cloud-based WMS solutions, which now represent close to 40% of WMS implementations in the healthcare sector. This skill is crucial in hospitals and clinics, as the capacity to rapidly find and disperse necessary items can directly affect patient care. Businesses are making efforts to reduce waste and enhance their environmental impact, with effective warehouse management being a key component in these efforts. WMS solutions help promote more sustainable logistics practices by optimizing inventory levels and minimizing unnecessary shipments.

Drivers

Increasing Adoption of Automation and Robotics in Warehousing.

Automation and robotics have played a vital role in the rapid integration of Warehouse Management Systems applications. During the past decade, automation has been a growing trend in the business world. This is especially true in the rising popularity of automated robots and machines. In the warehouse industry, automation has provided a solution for managing the increasing number of goods and information related to the goods. Companies are also more focused on providing faster and more efficient delivery services to achieve better customer satisfaction. Therefore, WMS application will have a higher demand in integrating and tracking the inventory and in the timely direction and administration of order execution. In addition, automated systems controlled with WMS application can manage data and facilitate order and goods tracking in real-time ensuring swift delivery. There are many examples of robots and robotic systems employed for automated systems, such as autonomous guided vehicles which are used to sort and deliver products, and drones products. One main advantage of such a system is that it will be easier to increase the number of products as the need arises, which will be also a cost-effective and time-efficient operation. WMS application will also allow automated systems to be used to deal with increasingly larger and more complex warehouse tasks as the markets become global. Another benefit of having an automated system with a WMS application is that it can identify shortages of workers and thus reduce the dependence on human labor. This will bring long-run cost savings in the operations. Due to the benefits of automation for businesses, many companies will invest in WMS systems applications that can be integrated with automated robots and machines.

Rising demand for omnichannel fulfillment drives growth in the WMS Market.

The WMS market has been greatly influenced by the rapid expansion of e-commerce and the move towards omnichannel retail. Consumers anticipate quick and smooth delivery experiences on different platforms including online, in-store, and mobile shopping. The expectation has compelled companies to reassess their supply chain tactics to stay competitive. Warehouse Management Systems help businesses effectively handle multi-channel fulfillment processes by maximizing inventory distribution, tracking in real-time, and forecasting demand. WMS makes it easier to combine various sales channels into one system, ensuring that businesses can satisfy consumer needs for fast and precise deliveries. Having visibility of inventory in real-time enables companies to promptly transfer stock among different locations, making sure all channels are well-stocked without putting too much strain on one warehouse. Moreover, WMS systems facilitate the simple handling of returns, an essential aspect of the expanding e-commerce industry. With the continuous expansion of omnichannel retailing, the WMS market is expected to experience significant growth due to the demand for efficient fulfillment strategies powered by technology.

Restraints

Data security concerns and legal complexities restrain the growth of cloud-based warehouse management systems.

Due to the increasing complexity and integration of Warehouse Management Systems with cloud-based technology, as well as the advances in AI and other data-driven technologies, the increased focus was placed on businesses on the security and privacy of their data. WMS systems contain extremely sensitive types of information, including stock levels, information about suppliers, and purchase orders, details of customers and their orders. For this reason, they attract the highest levels of attention from cyber-attackers, data breaches, and leaks, which eventually lead to high financial costs, lawsuits, and sanctions, as well as a bad reputation in case a company is unable to protect the data of its clients and workers. Moreover, the legal landscape is highly complex, with special data protection provisions, such as GDPR in the EU, which must be adjusted by the management and users of warehouse data. This means that companies that use WMS which stores data in the cloud may be risking non-compliance, whereas the dangers of cyber breaches may prevent them from using the storage. This type of market condition works as a major restraint of market growth, particularly for those businesses whose main concern is data security.

by Component

The services sector dominated the market in 2023 with an 80% market share, providing vital assistance and tailor-made solutions to customers. Services consist of various activities such as consulting, implementation, training, and ongoing support, which are essential for the effective implementation of WMS solutions. This part assists companies in customizing their WMS to meet specific operational requirements and guarantees seamless integration with current systems. Corporations such as Manhattan Associates and JDA Software provide comprehensive service bundles, which consist of system integration and user training, making it easier to shift to automated warehouse operations.

The software sector of the Warehouse Management System (WMS) market is to account for experiencing rapid growth, due to technological advancements and a growing demand for streamlined inventory control. More and more companies are embracing cloud-based solutions that provide scalability, flexibility, and real-time data analytics. Software solutions improve operational efficiency by automating tasks such as order picking, keeping track of inventory, and processing shipments, leading to decreased errors and increased productivity. SAP and Oracle are examples of companies that offer extensive WMS software that can easily connect with current ERP systems, providing functions like demand prediction, data analysis, and mobile availability.

by Deployment

The cloud segment led the market in 2023 with a 55% market share. Cloud-based WMS solutions provide various benefits, including scalability, lower IT costs, and improved accessibility from any location with internet access. Companies can take advantage of cutting-edge analytics, up-to-the-minute data, and automatic updates without requiring costly hardware purchases. Companies such as SAP with their SAP S/4HANA Cloud and Oracle with Oracle Cloud WMS demonstrate top cloud-based solutions.

The on-premises deployment is accounted to have a rapid growth rate during 2024-2032. This deployment method allows organizations to have full authority over their data and systems, offering increased levels of customization and security. Nonetheless, it necessitates a substantial initial investment in infrastructure and continued upkeep expenses. Companies like Manhattan Associates still favor them due to their strong data governance policies, offering robust on-premises WMS solutions.

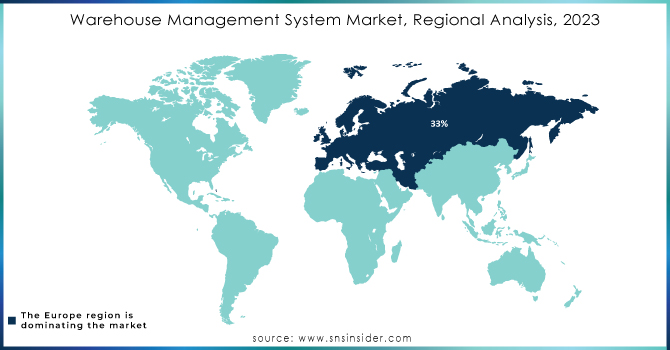

Europe dominated the market in 2023 with a market share of 33%, as the region’s logistics and manufacturing industries are relatively strong. Leading countries, including Germany, the United Kingdom, and France, are increasingly driven to implement more advanced WMS tools to become more efficient and cost-effective in their operations. Moreover, Europe’s market attractiveness is justified by the increasing demand for automation and digitalization across the region, which is also beneficial for supply chain management. Thus, some major companies, including SAP, Oracle, and Manhattan Associates, have a strong presence on the market and offer valuable solutions and services that meet the varied requirements of European organizations.

The Asia-Pacific region is accounted to have the fastest CAGR during the forecast period 2024-2032. Chemicalsization, growing e-commerce, and new distribution companies working in expanding markets such as China, India, and Japan should expect significant advancements in warehouse automation and logistics sectors. Moreover, the new and young tech companies will have a chance to alter and bring more innovations with the help of advanced analytics and AI-driven solutions. For example, Alibaba and Panasonic are two representative examples of the current regional WMS co-customers that attempt to achieve better operational and customer service outcomes.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the market are:

Epicor (Epicor ERP, Epicor Prophet 21)

Korber AG (HighJump) (HighJump Warehouse Advantage, HighJump Transportation Management System)

Infor (Infor CloudSuite Industrial (SyteLine), Infor WMS)

Made4net (WarehouseExpert, TransportationExpert)

Manhattan Associates (Manhattan Active® Warehouse Management, Manhattan Active® Transportation Management)

Oracle (Oracle Fusion Cloud SCM, Oracle Warehouse Management Cloud)

PSI Logistics (PSIwms, PSIglobal)

Reply (LEA Reply™ WMS, Click Reply™)

SAP (SAP Extended Warehouse Management (EWM), SAP Integrated Business Planning (IBP))

Softeon (Softeon Warehouse Management System, Softeon Distributed Order Management (DOM))

Synergy Ltd (SnapFulfil, Synergy Voice)

Tecsys (Tecsys Elite™ WMS, Tecsys Streamline™)

Blue Yonder Group (Luminate Platform, Demand Planning)

Recent Development

February 2024: Despatch Cloud launched a new WMS solution that offers real-time synchronization with over 80 e-commerce platforms and 160 couriers. This system is designed to support businesses in managing multi-channel sales effectively.

January 2024: Blue Yonder released significant updates to its WMS, focusing on integrating artificial intelligence to improve supply chain visibility and operational efficiency. This enhancement aims to support companies in managing inventory more effectively while optimizing order fulfillment processes.

March 2023: SAP announced an upgrade to its WMS, incorporating machine learning algorithms to enhance demand forecasting and inventory management. This integration is designed to help businesses respond more quickly to market changes.

July 2023: Peoplevox introduced a new version of its WMS tailored specifically for e-commerce operations. This version includes advanced analytics and reporting features, providing retailers with insights into their warehouse performance.

November 2023: GreyOrange launched a new WMS that integrates with their robotics solutions. This system aims to automate picking and packing processes, significantly improving efficiency in warehouse operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.50 Billion |

| Market Size by 2032 | USD 13.53 Billion |

| CAGR | CAGR of 16.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployments (Software and Services) • By Deployment (Cloud, On-Premises) • By Application (Third-Party Logistics, Food & Beverages, Retail, Chemicals, Metals & Machinery, Automotive, Healthcare, E-commerce, Electricals & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Epicor, Körber AG (HighJump), Infor, Made4net, Manhattan Associates, Oracle, PSI Logistics, Reply, SAP, Softeon, Synergy Ltd, Tecsys, Blue Yonder Group |

| Key Drivers | • Increasing Adoption of Automation and Robotics in Warehousing. • Rising demand for omnichannel fulfillment drives growth in the WMS Market. |

| Restraints | • Data security concerns and legal complexities restrain the growth of cloud-based warehouse management systems. |

Ans: The Warehouse Management System Market is expected to grow at a CAGR of 16.23% during 2024-2032.

Ans: Warehouse Management System Market size was USD 222.65 Billion in 2023 and is expected to Reach USD 726.08 Billion by 2032.

Ans: Rising demand for omnichannel fulfillment drives growth in the WMS Market.

Ans: The Food & Beverages segment dominated the Warehouse Management System Market.

Ans: North America dominated the Warehouse Management System Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Warehouse Management System Adoption Rate by Industry, 2023

5.2 Warehouse Management System Performance Benchmarks, 2023

5.3 Warehouse Management System Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Warehouse Management System Market Segmentation, by Deployments Component

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Warehouse Management System Market Segmentation, by Deployment

8.1 Chapter Overview

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 On-Premises

8.4.1 On-Premises Market Trends Analysis (2020-2032)

8.4.2 On-Premises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Warehouse Management System Market Segmentation, by Application

9.1 Chapter Overview

9.2 Third-Party Logistics

9.2.1 Third-Party Logistics Market Trends Analysis (2020-2032)

9.2.2 Third-Party Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Food & Beverages

9.3.1 Food & Beverages Market Trends Analysis (2020-2032)

9.3.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Retail

9.4.1 Retail Market Trends Analysis (2020-2032)

9.4.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Chemicals

9.5.1 Chemicals Market Trends Analysis (2020-2032)

9.5.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Metals & Machinery

9.6.1 Metals & Machinery Market Trends Analysis (2020-2032)

9.6.2 Metals & Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Automotive

9.7.1 Automotive Market Trends Analysis (2020-2032)

9.7.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Healthcare

9.8.1 Healthcare Market Trends Analysis (2020-2032)

9.8.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 E-commerce

9.9.1 E-commerce Market Trends Analysis (2020-2032)

9.9.2 E-commerce Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Electricals & Electronics

9.10.1 Electricals & Electronics Market Trends Analysis (2020-2032)

9.10.2 Electricals & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.11 Others

9.11.1 Others Market Trends Analysis (2020-2032)

9.11.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.2.4 North America Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.5 North America Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.2.6.2 USA Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.6.3 USA Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.2.7.2 Canada Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.7.3 Canada Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.2.8.2 Mexico Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.8.3 Mexico Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.6.2 Poland Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.6.3 Poland Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.7.2 Romania Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.7.3 Romania Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.4 Western Europe Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.5 Western Europe Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.6.2 Germany Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.6.3 Germany Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.7.2 France Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.7.3 France Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.8.2 UK Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.8.3 UK Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.9.2 Italy Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.9.3 Italy Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.10.2 Spain Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.10.3 Spain Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.13.2 Austria Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.13.3 Austria Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.6.2 China Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.6.3 China Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.7.2 India Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.7.3 India Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.8.2 Japan Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.8.3 Japan Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.9.2 South Korea Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.9.3 South Korea Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.10.2 Vietnam Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.10.3 Vietnam Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.11.2 Singapore Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.11.3 Singapore Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.12.2 Australia Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.12.3 Australia Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.4 Middle East Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.5 Middle East Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.6.2 UAE Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.6.3 UAE Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.2.4 Africa Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.5 Africa Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Warehouse Management System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.6.4 Latin America Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.5 Latin America Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.6.6.2 Brazil Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.6.3 Brazil Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.6.7.2 Argentina Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.7.3 Argentina Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.6.8.2 Colombia Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.8.3 Colombia Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Warehouse Management System Market Estimates and Forecasts, by Deployments (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Warehouse Management System Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Warehouse Management System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Epicor

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Korber AG (HighJump)

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Infor

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Made4net

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Manhattan Associates

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Oracle

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 PSI Logistics

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Reply

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 SAP

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Softeon

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

BY COMPONENT

Software

Services

BY DEPLOYMENT

Cloud

On-Premises

BY APPLICATION

Third-Party Logistics

Food & Beverages

Retail

Chemicals

Metals & Machinery

Automotive

Healthcare

E-commerce

Electricals & Electronics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Industrial Agitators Market was valued at USD 2.81 billion in 2023 and is expected to reach USD 4.32 billion by 2032, growing at a CAGR of 4.93% over the forecast period 2024-2032.

The Satellite Modem Market Size was valued at USD 507.2 million in 2023, and is expected to reach USD 1391.88 million by 2032, and grow at a CAGR of 11.87% over the forecast period 2024-2032.

The global Defect Detection Market Size was valued at USD 3.73 Billion in 2023 and is expected to grow at a CAGR of 7.45% to reach USD 7.12 Billion by 2032.

The Battery Sensor Market size was valued at USD 6.30 billion in 2023 and is expected to reach USD 15.92 billion by 2032 and grow at a CAGR of 10.85% over the forecast period 2024-2032.

The IoT Node and Gateway Market Size was valued at USD 478.12 billion in 2023 and is expected to reach USD 1459.33 billion by 2032 and grow at a CAGR of 13.2% over the forecast period 2024-2032.

The Nanorobotics Market size was valued at USD 7.87 billion in 2023 and expected to reach to USD 21.53 billion by 2032 and grow at a CAGR of 11.27 % over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone