Voice Picking Solutions Market Report Scope and Overview:

Get More Information on Voice Picking Solutions Market - Request Sample Report

The Voice Picking Solutions Market Size was valued at USD 2.6 Billion in 2023 and is expected to reach USD 8.78 Billion by 2032, growing at a CAGR of 14.5% over the forecast period 2024-2032.

The voice-picking solutions are primarily driven by government initiatives and policies focusing on enhancing labour efficiency and work safety. In terms of statistics, the U.S. Bureau of Labor Statistics reported that the warehousing and storage industry in 2023 employed nearly 1.4 million people, reflecting a 2.7% growth from the previous year. Many industries, such as retail, manufacturing, and logistics, among others, are experiencing high labour prices and increasing needs to satisfy quick order deliveries. As a result, the implementation of operational technologies becomes vital, and the corresponding pressure on the market drives an increase in solutions such as voice picking. Particularly, the advantage of voice picking lies in its hands-free nature of order picking, which diminishes the possibilities of human-produced errors. At the same time, the government regulations focussing on workers’ safety emphasise the need for the corresponding ergonomic solutions that reduce physical pressure. For example, in the case of Germany, the government subsidised automation in logistics encouraging the voice-picking solutions implementation as part of the business’s digitalisation process.

The noteworthy drivers of the voice-picking solutions market include the growing retail sector and correspondingly increasing warehousing. The consistent pressure to enhance productivity, efficiency, and accuracy of warehouse operations is increasing the demand for voice-direct solutions. The expansion of the voice-picking market is facilitated by urbanisation, the need for enhancing supply chain efficiency, and the overall growth and the development of smart devices in emerging markets. Also, the increasing technology-driven nature of the sector and the increasing number of solution providers create favourable conditions for the market expansion. The other key contributor to the growth is the emergence of the corresponding demand from the health, e-commerce, and public transportations industries.

Voice Picking Solutions Market Dynamics

Drivers

-

The growing need for operational efficiency in warehouses and distribution centers drives the adoption of voice picking solutions. Automation helps streamline processes, reduce human errors, and improve overall productivity.

-

Recent improvements in voice recognition technologies enhance the accuracy and efficiency of voice picking solutions, making them more appealing to businesses looking to modernize their logistics and supply chain operations.

One of the key drivers of the voice picking solutions market is the growing demand for automation at warehouses and distribution centers. With the expanding role of e-commerce, businesses are increasingly focused on operational efficiency to meet customers’ demands for fast deliveries at reasonable prices. As is typical with logistics operations, these procedures have been changing into fully automated ones, and voice picking solutions enable the workers at the site to pick, pack, and process the orders hands-free. According to the company’s market insights, warehouses using voice-picking technologies are 30% more productive than traditional paper-based sites. Moreover, error rates are reduced for the companies by 15-20%, leading to fewer costly mistakes in order fulfilment.

The hands-free nature of voice picking allows workers to safe and free movement in the facilities, operating machinery, without needing to consult paper instructions or handheld devices, making the process faster and safer. For instance, Amazon and Walmart have a high demand for voice-directed picking processes at their fulfilment centers, as the volume of orders is rapidly increasing during peak shopping seasons. These solutions have also proven to improve worker concentration and accuracy, reducing picking time and the fatigue of the employee, which after finishing the task can get the next orders ready three times faster than it would be possible with manual compilation. As the supply chain strategies are being reordered across a range of sectors, such as retail, logistics, food and beverage, and others, the demand for the warehousing and transportation software technologies is increasing rapidly.

Restraints

-

The initial investment required for integrating voice picking solutions can be substantial, which may deter small and medium-sized enterprises from adopting these systems.

-

As businesses increasingly rely on digital solutions, concerns regarding the security of sensitive data and potential cybersecurity threats can hinder the adoption of voice picking technologies.

Concerns over data security is a major restraint for the voice picking solutions market. Many companies decide to implement digital solutions for their logistics and supply chain activities, which makes them prone to data breaches and hacking. According to a report by cybersecurity ventures, cybercrime will cost the world $10.5 trillion every year by 2025; therefore, as the pace of digitalization becomes quicker, the risk also elevates. For example, in 2021, a ransomware attack was imposed on a major logistics firm, and its effects clearly showed how the vulnerability of a system can led to substantial financial and operational losses.

For example, in 2021, a ransomware attack on a major logistics firm disrupted operations significantly, demonstrating how vulnerabilities can lead to substantial financial and operational losses. Moreover, a survey by PwC revealed that 60% of companies experienced a cyber incident in 2021, emphasizing the pervasive threat that impacts decision-making for adopting technologies like voice picking systems. Organizations may hesitate to invest in these solutions unless they are confident in their data protection measures and cybersecurity protocols

Voice Picking Solutions Market Segmentation Overview:

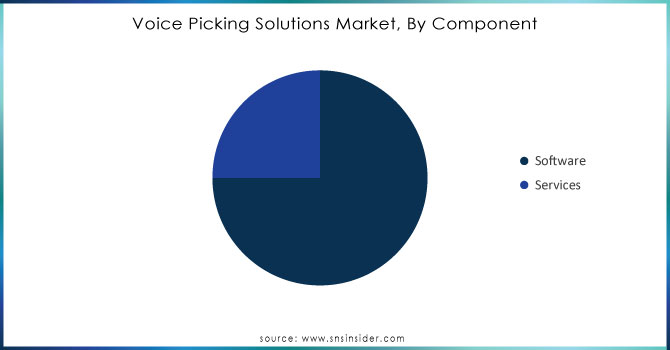

By Component

The global voice-picking solutions market was dominated by the software segment in 2023, accounted 76% of total revenue share. The reason for this is the rising demand for scalable and flexible software that could be customized and integrated into various warehouse management systems and enterprise resource planning platforms. As global enterprises expand their supply chains and increase the volume of their products, scalable software provides better opportunities to address the complexity of logistical operations. According to the report published by the U.S. Department of Commerce in 2023, approximately 85% of large warehouses use digital systems for their management, contributing to the increasing need for voice-picking software supported by integration between pick-by-voice devices and management systems.

The services segment is projected to grow with the highest compound annual growth rate from 2024 to 2032. This increase is related to the growing complexity of supply chain cycles, meaning that companies need help with installing, customizing, and operating these solutions. The support for this hypothesis comes from developments involving government-funded initiatives for training workers in digital technologies across Canada and the U.K. which will promote the expansion of the services segment. In this way, hardware installation and training in support of voice-picking operations will become increasingly important. Similarly, companies will increasingly depend on continuous support that the software providers will give in the form of updates, patches, and troubleshooting.

Need Any Customization Research On Voice Picking Solutions Market - Inquiry Now

By Vertical

The retail and e-commerce sector comprised 23% of the global voice-picking solutions in 2023. The retail and e-commerce sector dominated the international voice-picking solutions market due to the growing demand for rapid order fulfilment and inventory accuracy. According to the U.S. Census Bureau, retail e-commerce sales in the United States accounted for approximately 15.7% of total retail sales in 2023, driven by the surge in online shopping during and post-pandemic. Voice-picking solutions help warehouse staff handle high turnover speed and fulfill orders efficiently by performing tasks with both hands free. Such technologies reduce the risk of errors during order picking by 25–40%, and in the current situation, such a rate is indispensable for fulfilling consumer demand for rapid and accurate delivery. Therefore, as the retail market continues to implement omnichannel policies and advanced technologies to fulfil customer orders, the segment will dominate the global voice-picking solutions market.

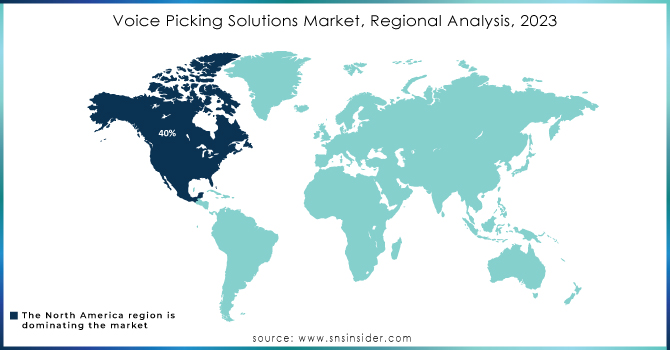

Voice Picking Solutions Market Regional Analysis

North America dominated the global voice-picking solutions market, held a market share of 40% in 2023. The growth of this regional market is driven by the presence of advanced technological infrastructure and the availability of automation technologies as well as the existence of government policies that support digital transformation. According to the U.S. National Institute of Standards and Technology, there was a 12% increase in the grants of the government for technological advancement by logistics companies in 2023. Moreover, the fact that the North American market has a high number of retail, e-commerce, and logistics companies also made it the leader of the global market since these companies are in need of efficient warehouse operations. The rapid growth of the North America market is also facilitated by the labour shortage in the region implying that companies invest in automated and voice-activated solutions to maintain the efficiency of their operations. the warehousing and storage industry in Canada reported a 15% increase in automation adoption between 2022 and 2023, further indicating the region's commitment to embracing new technologies in logistics operations. The governments of the U.S. and Canada employ training programs to equip workers with the skills needed to operate digital and automated systems, leading to the overall growth of the market.

The Asia Pacific voice-picking solutions market is expected to grow at the most rapid CAGR during the forecast period. The growth is attributed to the rapid economic growth of countries in the region such as India and China. The growth of these countries’ retail and logistics sectors is driving the adoption of advanced warehousing technologies. In 2023, India was the most significant country in the region’s market, driven by the growing retail demand and the increasing status of the retail sector, which has made companies in the sector consider warehousing as a strategy to provide satisfactory services to their customers.

Latest News in Voice Picking Solutions Industry

-

In March 2024, ProGlove, a key player in the warehousing solutions market, partnered with Ehrhardt Partner Group (EPG) to provide an integrated mobile logistics solution that combines EPG's LYDIA Voice Pick-by-Voice system with ProGlove's wearable barcode scanners.

-

February 2024, the U.S. Department of Labor unveiled an initiative to set up a $50 million grant fund. The investment targets companies that are investing in digital technology and automation, including voice picking systems, to improve labour productivity and lessen work-related injuries. The funding is part of the broader modernization of the warehousing and logistics sector in the country.

-

In March 2024, UK Department for Business and Trade unveiled a £20 million research program. The investment is focused on research in automatic technologies, including voice picking. It is aimed at modernizing and enhancing worker and operational safety in warehouses. In particular, the program is set to benefit the small and medium-sized business enterprises.

Key Players in Voice Picking Solutions Market

-

Honeywell International Inc. (Voice Guided Solutions, Vocollect Voice)

-

Zebra Technologies Corporation (FulfillmentEdge, TC52x Series Mobile Computer)

-

Voxware, Inc. (VoxPilot, VoxPick)

-

Dematic (VoiceDirected Picking, iQ Optimize Software)

-

Lucas Systems, Inc. (Jennifer Voice, Engage Voice Picking)

-

TopVox Corporation (LYDIA Voice, Pick by Voice)

-

Ivanti (formerly Wavelink) (Velocity Voice Picking, Avalanche Voice)

-

Speech Interface Design (Voice picking hardware, Vocollect Voice)

-

Zetes Industries (ZetesMedea Voice, ZetesChronos)

-

Ehrhardt + Partner Group (EPG) (LFS.V8 Voice Solution, Lydia Voice Suite)

-

Apex Supply Chain Technologies (Actylus, Apex Trajectory Cloud)

-

Symphony RetailAI (Voice Task Manager, Warehouse Operations Suite)

-

ProCat Distribution Technologies (VoicePick, Labeling System)

-

Bastian Solutions (Exacta Supply Chain Software, Pick to Voice)

-

Snapfulfil (SnapVoice, SnapLogic)

-

HighJump (Körber Supply Chain) (HighJump Voice, VoCollect Integration)

-

Blue Yonder Group, Inc. (Luminate Logistics, Dispatcher WMS)

-

Panasonic Corporation (Voice Picking System, TOUGHPAD FZ-N1)

-

SAP SE (SAP Extended Warehouse Management, SAP Task Management)

-

Infor (Infor WMS, Infor Nexus) and others in final Report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.6 Billion |

| Market Size by 2032 | USD 8.78 Billion |

| CAGR | CAGR of 14.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-Premises) • By Vertical (Food & Beverage, Retail & E-commerce, Healthcare & Pharmaceutical, Logistics & Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Zebra Technologies Corporation, Voxware, Inc., Dematic, Lucas Systems, Inc., TopVox Corporation, Ivanti (formerly Wavelink), Speech Interface Design, Zetes Industries, Ehrhardt + Partner Group (EPG), Apex Supply Chain Technologies, Symphony RetailAI, ProCat Distribution Technologies, Bastian Solutions |

| Key Drivers | • The growing need for operational efficiency in warehouses and distribution centers drives the adoption of voice picking solutions. Automation helps streamline processes, reduce human errors, and improve overall productivity. |

| RESTRAINTS | • The initial investment required for integrating voice picking solutions can be substantial, which may deter small and medium-sized enterprises from adopting these systems. |