Vitrification Market Size & Trends:

Get More Information on Vitrification Market - Request Sample Report

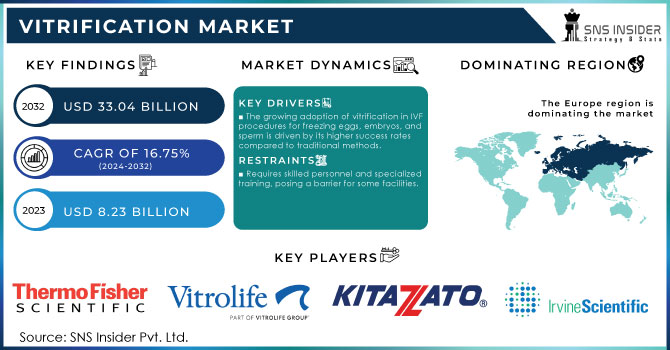

The Vitrification Market Size was valued at USD 8.23 billion in 2023 and is expected to reach USD 33.04 billion by 2032 and grow at a CAGR of 16.75% from 2024-2032.

In recent years, the most relevant growing trend is in the vitrification market, specifically in cryopreservation and reproductive medicine. Vitrification is a rapid freezing technique that prevents ice crystal formation in cells, tissues, and biological samples, making it more effective at preserving these materials compared to traditional slow-freezing methods. Major market drivers include the increasing demand in the market for assisted reproductive technologies, where eggs, embryos, and sperm are vitrified to be frozen. The trends in cryopreservation technologies facilitated better effectiveness and safety of vitrification, thus making vitrification a well-established procedure in a high number of laboratories.

One more growth driver is the broader adoption of vitrification in biobanking. Biobanks store biological samples for future or ongoing research, drug development and testing, and personalized medicine. For Instance, the adoption of vitrification techniques is expected to see an increase, particularly with more than 60% of biobanks utilizing these methods to preserve biological samples effectively. Growing investments into research and development boosted the biobanking industry and, subsequently, the demand for vitrification. In addition, a larger number of cancer patients undergoing chemotherapy and radiotherapy are likely to need preservation of their fertility and biobanks can provide required services. The need for costly equipment and devices along with high costs may pose certain obstacles to market growth, however, it is expected to remain the demand driver alongside technological advancements.

Vitrification Market Dynamics

Drivers

-

The growing adoption of vitrification in IVF procedures for freezing eggs, embryos, and sperm is driven by its higher success rates compared to traditional methods.

-

Rising infertility rates globally are boosting the demand for ART services, thereby driving the vitrification market.

-

Vitrification's role in preserving stem cells for regenerative medicine and research is contributing to its market expansion.

Vitrification is essential for effectively preserving stem cells, which are vital for advancements in regenerative medicine and research. Unlike traditional freezing methods that risk damaging cells through ice crystal formation, vitrification employs rapid freezing techniques that maintain the structural integrity and functionality of stem cells. This preservation is critical for various applications, including tissue engineering, organ regeneration, and cell therapy, all of which depend on high-quality stem cells. The growing emphasis on stem cell research, driven by the need for innovative therapies for chronic diseases such as diabetes, Parkinson's, and heart conditions, is increasing the demand for vitrification. Additionally, a rise in clinical trials and heightened investment from both governmental and private sectors in regenerative medicine further boosts the need for effective vitrification methods. This synergy highlights the important role of advanced cryopreservation techniques in driving market growth.

Simultaneously, rising infertility rates worldwide are intensifying the demand for Assisted Reproductive Technologies (ART), particularly in vitro fertilization (IVF), where vitrification is commonly employed. Approximately 15% of couples globally experience infertility, translating to around 48.5 million couples affected. Factors like lifestyle changes, delayed parenthood, and various medical conditions contribute to this rise. Vitrification enhances ART by enabling the freezing of eggs, embryos, and sperm with improved survival rates, thereby increasing IVF success rates. As the need for fertility treatments escalates, so does the demand for vitrification, fostering market expansion. The growing number of ART procedures is closely associated with the increased adoption of vitrification techniques worldwide.

Restraints

-

Requires skilled personnel and specialized training, posing a barrier for some facilities.

-

Competing cryopreservation methods, like slow freezing, may be preferred due to familiarity.

-

Potential for sample contamination during the vitrification process.

In the vitrification market, the risk of sample contamination is a critical issue that can significantly affect the safety and viability of preserved biological materials, including eggs, embryos, and tissues. During the vitrification process, samples may be exposed to open environments or handled manually, raising the chances of contamination from airborne particles, microorganisms, or cross-contamination between samples. Such contaminants can jeopardize the integrity of the samples, lower success rates in procedures like IVF, and pose health risks when contaminated materials are used in clinical applications.

Moreover, cryoprotectants essential chemicals that prevent ice formation can add to contamination risks if not handled correctly. This highlights the necessity for stringent quality control, sterile conditions, and trained personnel, which can increase operational costs and complexity for facilities. As a result, these contamination concerns may discourage some clinics from adopting vitrification or limit its broader application, especially in less-equipped or resource-limited settings, thus hindering market growth.

Additionally, the vitrification market encounters competition from traditional cryopreservation methods such as slow freezing, which remains widely accepted among clinicians and laboratories. In the early 2000s, slow freezing was the dominant technique for embryo cryopreservation, capturing about 80% of the market share. Despite vitrification being utilized in around 70-80% of IVF clinics worldwide today, slow freezing continues to be preferred in areas where technological adoption is gradual. Its established protocols, lower initial costs, and perceived ease of use make it appealing for smaller clinics and in developing regions, where moving to vitrification might appear costly or complicated. This reliance on slow freezing practices acts as a barrier to the widespread adoption of vitrification, despite its proven advantages in improving survival rates and outcomes for cryopreserved samples.

Vitrification Market Segmentation Analysis

By Specimen

In 2023, The oocyte segment dominated the market and represented more than 42.50% market share. The notable revenue share in this segment stems from increased awareness of oocyte preservation, alongside supportive legislation from various governments. Recently, several governments have legalized oocyte preservation, positioning vitrification as a highly effective method in egg banks and assisted reproductive technology (ART).

The sperm segment is expected to witness the highest CAGR of over 18.06% during the forecast period. Advancements in 3D printing are anticipated to introduce innovative methods for developing freezing devices. A study published by MDPI in August 2021 presented a 3D-printed vitrification device tailored for small sperm volumes, known as Cryo-Vials (VDCV). Furthermore, ongoing research is exploring minimal-volume vitrification techniques aimed at enhancing IVF treatment efficacy.

By End-Use

In 2023, the IVF clinics segment held the largest share of 60.15%, primarily due to the growing number of clinics providing vitrification and other assisted reproductive technology (ART) services. These clinics are broadening their range of services to encompass the storage of sperm, eggs, and oocytes, which is anticipated to further enhance their revenue share.

The biobanks segment is expected to exhibit the highest compound annual growth rate (CAGR) of 17.88% throughout the forecast period. The shift from traditional slow-freezing techniques to vitrification has significantly improved the cryobanking processes for eggs, embryos, and sperm. Moreover, the growth of biobanks has streamlined the egg donation process by offering extensive databases of donors and empowering individuals pursuing IVF with donor eggs to make informed decisions. This trend is projected to greatly increase the revenue share of biobanks within the market.

Vitrification Market Regional Insights

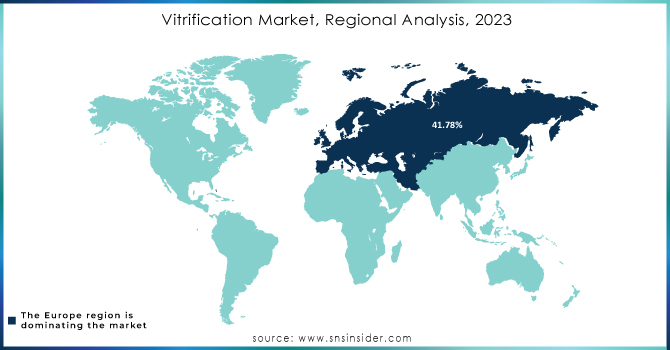

In 2023, Europe captured the largest share of the global vitrification market, holding 41.78%. The strength of the market is mainly generated by developed economies such as Germany, Spain, the UK, France, and Italy, which all have high-quality infrastructure and other favorable conditions enhancing the effectiveness of cryopreservation. The growth drivers are strong biotechnology sectors and rising investments in assisted reproductive technologies in the UK and Germany. The ranking of Germany in the market is determined by several factors: having advanced healthcare infrastructure in place facilitates the more widespread use of state-of-the-art cryopreservation techniques, such as vitrification, in fertility treatments and studies. In addition, Germany has a well-developed system of regulations in place ensuring the high safety, efficacy, and ethical standards appropriately followed both in commercial and research applications of ART. Under these circumstances, patients and healthcare professionals have confidence in the acceptable levels of quality, which is a strong competitive advantage.

The Asia Pacific is expected to demonstrate the highest CAGR of 19.27% which will also be promoted by the wider awareness and possible upcoming legalization of the right for single women to freeze their eggs following the high-profile legal cases changed many existing laws in China.

Need any customization research on Vitrification Market - Enquiry Now

Top Vitrification Companies

Some major key players are

-

Vitrolife (Vitrification devices, cryopreservation media)

-

Kitazato Corporation (Vitrification kits, sperm freezing devices)

-

Thermo Fisher Scientific (Cryopreservation equipment, media for IVF)

-

Irvine Scientific (Vitrification solutions, embryo culture media)

-

Fertility Associates (IVF services, cryopreservation services)

-

CooperSurgical (Vitrification devices, cryopreservation kits)

-

Cryoport (Biologics transportation solutions, specimen storage)

-

ES Diagnostics (Cryopreservation equipment, embryo storage)

-

Reproductive Health Technologies (IVF equipment, fertility preservation solutions)

-

ReproTech (Oocyte and embryo cryopreservation, storage services)

-

Sage Scientific (Vitrification products, media for IVF)

-

Birmingham Women's Hospital (Fertility treatments, egg freezing services)

-

OvaScience (Oocyte preservation, fertility treatment services)

-

Fertility Solutions (IVF and embryo freezing services, vitrification technologies)

-

CReATe Fertility Centre (IVF services, cryopreservation techniques)

-

The Center for Reproductive Health (Egg freezing, embryo storage services)

-

Advanced Fertility Center of Chicago (Fertility preservation, cryopreservation services)

-

Genea (IVF technology, vitrification kits)

-

Reproductive Medicine Associates of New Jersey (Fertility services, cryopreservation)

-

New Hope Fertility Center (IVF treatments, egg freezing)

Recent Developments

In July 2023, Ivy Fertility broadened its partnership with TMRW Life Sciences to implement automation in its IVF lab, leveraging TMRW's cutting-edge platform for the secure storage of frozen eggs and embryos.

In December 2021, VitaVitro received marketing approval in China for its Vitrification and Warming Kit, an essential tool for the cooling and warming of oocytes, embryos, and blastocysts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.23 billion |

| Market Size by 2032 | US$ 33.04 billion |

| CAGR | CAGR of 16.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Specimen (Oocytes, Embryo, Sperm) • By End-Use (IVF Clinics, Biobanks) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Vitrolife, Kitazato Corporation, Thermo Fisher Scientific, Irvine Scientific, Fertility Associates, CooperSurgical, Cryoport, ES Diagnostics, Reproductive Health Technologies, ReproTech, Sage Scientific, Birmingham Women's Hospital, OvaScience and other players |

| Key Drivers | • The growing adoption of vitrification in IVF procedures for freezing eggs, embryos, and sperm is driven by its higher success rates compared to traditional methods. • Rising infertility rates globally are boosting the demand for ART services, thereby driving the vitrification market. • Vitrification's role in preserving stem cells for regenerative medicine and research is contributing to its market expansion. |

| Market Restraints | • Requires skilled personnel and specialized training, posing a barrier for some facilities. • Competing cryopreservation methods, like slow freezing, may be preferred due to familiarity. • Potential for sample contamination during the vitrification process. |