Vitamin D Testing Market Size & Growth Analysis:

Get more information on Vitamin D Testing Market - Request Sample Report

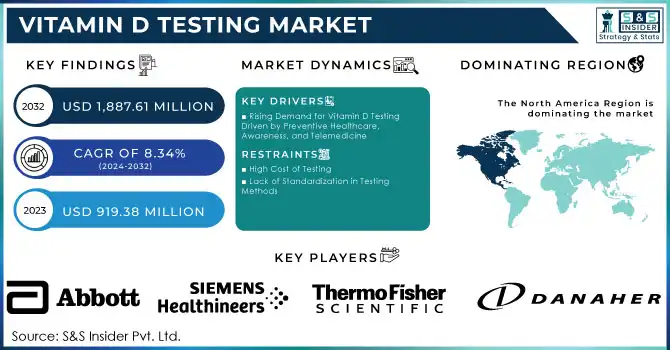

The Global Vitamin D Testing Market valued at USD 919.38 million in 2023, is projected to reach USD 1,887.61 million by 2032, growing at a CAGR of 8.34% over the forecast period 2024-2032

The Vitamin D Testing market has experienced significant growth in recent years due to the rising awareness of the health impacts of vitamin D deficiency. Research highlights that approximately 1 billion people worldwide suffer from low vitamin D levels, which are associated with a wide range of health issues, including osteoporosis, cardiovascular diseases, autoimmune disorders, and an increased risk of certain cancers. This growing awareness has led to a heightened demand for reliable and accurate testing solutions, particularly in regions where deficiency rates are high.

The aging population is another key factor driving market demand. Older adults, especially those over the age of 60, are at greater risk of vitamin D deficiency due to reduced skin synthesis, limited dietary intake, and decreased sun exposure. Studies indicate that up to 50% of older adults may have insufficient vitamin D levels, prompting an increased need for routine screening. For instance, a study published in JAMA highlighted that nearly 60% of adults in the United States have insufficient vitamin D levels, underscoring the importance of widespread testing to detect deficiencies early.

The growing recognition of the broader health benefits of vitamin D has also contributed to the surge in demand for testing. Beyond bone health, research suggests that vitamin D plays a role in immune function, mental health, and reducing the risk of chronic diseases. As a result, healthcare providers are increasingly recommending vitamin D testing as part of routine checkups, further fueling the market. In addition, initiatives by organizations such as the U.S. Preventive Services Task Force (USPSTF) and global health bodies emphasize the need for widespread screening to prevent long-term health consequences associated with vitamin D deficiency.

Technological advancements in diagnostic testing, including more accessible point-of-care devices, have also expanded market growth. Devices like portable blood testing kits allow individuals to check their vitamin D levels at home, offering a convenient and cost-effective alternative to traditional lab-based tests. Furthermore, innovations in automated laboratory testing methods have increased the accuracy, speed, and scalability of testing services, making it easier for healthcare providers to meet the growing demand.

Overall, the Vitamin D Testing market is poised for sustained growth driven by rising awareness, demographic shifts, and advancements in diagnostic technology. This trend is expected to continue as more individuals seek proactive health measures to ensure optimal vitamin D levels for overall well-being.

Market Dynamics

Drivers

-

Rising Demand for Vitamin D Testing Driven by Preventive Healthcare, Awareness, and Telemedicine

The Vitamin D Testing market is experiencing growth due to several key factors beyond just awareness of deficiency. One of the major drivers is the growing recognition among healthcare professionals of vitamin D’s important role in preventing various health conditions, including respiratory infections, cancer, and diabetes. Studies like those published in The American Journal of Clinical Nutrition have shown the vital connection between vitamin D and immune system function, leading to more frequent recommendations for testing, especially for individuals at higher risk of chronic diseases.

Another significant factor is the increasing emphasis on preventive healthcare. As more individuals take a proactive approach to managing their health, there is a heightened focus on the early detection of deficiencies. Vitamin D screening is becoming a routine part of health assessments, driving the demand for reliable and easily accessible testing methods. Additionally, government health initiatives are playing a pivotal role. Global public health organizations are intensifying efforts to address vitamin D deficiency through national screening programs, as seen in countries like the UK and the US. This shift toward a prevention-focused approach is encouraging healthcare providers to adopt routine vitamin D testing, creating a consistent demand for testing services.

Finally, the growth of telemedicine and home-based testing solutions is further fueling market expansion. The convenience of at-home testing kits for vitamin D, combined with the rise of virtual healthcare consultations, enables individuals to monitor their health without frequent clinic visits, promoting the widespread adoption of testing services.

Restraints

-

High Cost of Testing

The cost associated with vitamin D testing, especially advanced or specialized tests, can be a barrier to widespread adoption, particularly in low-income regions or for individuals without insurance coverage.

-

Lack of Standardization in Testing Methods

Variability in testing methods and lack of universally accepted guidelines for vitamin D deficiency thresholds may lead to inconsistent results, limiting the reliability and trust in testing services.

Segmentation Analysis

By Product

The 25-Hydroxy Vitamin D Test is the most widely used and dominant segment in the Vitamin D testing market in 2023, capturing the largest market share due to its high accuracy and reliability in assessing overall vitamin D levels in the body. It is considered the gold standard for vitamin D testing as it measures the total circulating vitamin D levels, including vitamin D2 and D3. The dominance of this test is attributed to its wide acceptance among healthcare professionals and its use in routine clinical practices. It accounted for approximately 75.0% of the total market share in 2023.

The 1,25-Dihydroxy Vitamin D Test is expected to be the fastest-growing segment over the forecast period, driven by its increasing application in specific conditions such as kidney disease, parathyroid disorders, and severe vitamin D deficiency. While it is not as commonly used as the 25-hydroxy test, its growth is attributed to the rising focus on these specialized conditions and advancements in testing methods that offer greater accuracy and faster results.

By Technology

In the technology segment, ELISA (Enzyme-Linked Immunosorbent Assay) was the leading method, holding the largest market share in 2023. ELISA is widely used due to its cost-effectiveness, ease of use, and ability to handle large volumes of samples with high throughput. It is particularly popular in clinical and research settings for vitamin D testing, given its accuracy, reliability, and lower cost compared to more complex technologies like LC-MS. ELISA technology dominated the market with a share of approximately 45.0% in 2023.

LC-MS (Liquid Chromatography-Mass Spectrometry) is anticipated to be the fastest growing during the forecast period 2024-2032. LC-MS is gaining traction due to its high precision and ability to measure vitamin D metabolites in a more detailed manner. It is particularly beneficial for research applications and in clinical settings where detailed analysis of vitamin D status is required. The rapid growth of LC-MS technology is attributed to increasing demand for more accurate and comprehensive testing, particularly in cases of severe deficiency or metabolic disorders.

By Indication

Vitamin D Deficiency was the dominant condition driving demand for vitamin D testing in 2023. The increasing awareness about vitamin D’s role in overall health and its link to a variety of chronic conditions, such as bone diseases, immune system disorders, and cardiovascular health, has led to a significant rise in testing for deficiencies. Vitamin D deficiency remained the primary reason for testing, contributing to around 65.0% of the market in 2023.

Osteoporosis is expected to be the fastest-growing segment from 2024-2032. As the global population ages and the incidence of osteoporosis rises, more individuals are being tested for vitamin D to assess bone health and prevent fractures. Vitamin D plays a crucial role in calcium absorption and bone density, and its deficiency is closely linked to an increased risk of osteoporosis.

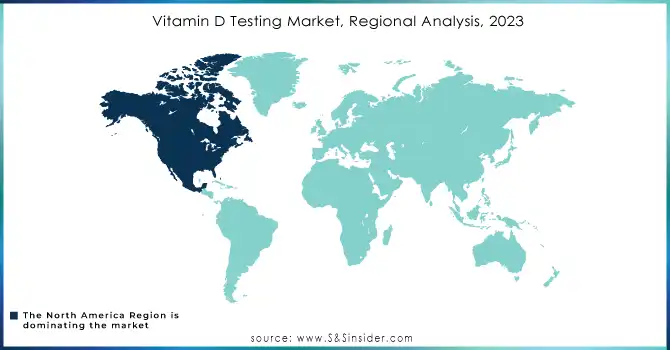

Regional Analysis

The Vitamin D Testing market showcased varied growth trends across regions, with North America leading in 2023. This dominance is attributed to well-established healthcare systems, widespread adoption of preventive health practices, and heightened awareness of vitamin D’s critical role in managing chronic conditions such as osteoporosis, diabetes, and cardiovascular diseases. The United States is at the forefront, driven by government-supported initiatives and the integration of vitamin D screening into routine health assessments.

Europe held the position as the second-largest market, bolstered by extensive public health campaigns and a significant prevalence of vitamin D deficiency in northern regions like the UK, Germany, and the Nordic countries, where sunlight exposure is limited. The region’s healthcare systems frequently subsidize vitamin D testing, ensuring greater accessibility and adoption.

The Asia-Pacific region is anticipated to be the fastest-growing market, propelled by rising health consciousness, increasing disposable incomes, and a growing focus on lifestyle-related health issues. Countries such as India and China are major contributors, with urban populations facing high rates of vitamin D deficiency due to dietary habits and reduced sunlight exposure. Additionally, government-led health initiatives are gradually integrating vitamin D testing into preventive care frameworks, further driving demand.

Need Any Customization Research On Vitamin D Testing Market - Inquiry Now

Key Players

-

-

Architect 25-OH Vitamin D Assay

-

Alinity i 25-OH Vitamin D Assay

-

-

-

Elecsys Vitamin D Total Assay

-

-

bioMérieux SA

-

VIDAS 25 OH

-

-

-

Vitamin D Assay (utilizing LC-MS/MS technology)

-

-

Siemens Healthineers AG

-

ADVIA Centaur Vitamin D Total Assay

-

Atellica IM Vitamin D Total Assay

-

-

DiaSorin S.p.A.

-

LIAISON 25 OH

-

LIAISON XL Vitamin D Total Assay

-

-

Beckman Coulter, Inc. (BD)

-

Access 25(OH) Vitamin D Total Assay

-

-

Quest Diagnostics Incorporated

-

25-Hydroxyvitamin D Test (offered through laboratory services)

-

-

Tosoh Bioscience, Inc.

-

AIA-Pack 25-OH Vitamin D Assay

-

-

Quidel Corporation

-

Triage Vitamin D Test

-

-

Danaher Corporation

-

Various immunoassay products under the Beckman Coulter and Cepheid brands

-

-

RECIPE Chemicals + Instruments GmbH

-

Vitamin D3/D2 LC-MS/MS Assay Kit

-

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 919.38 million |

| Market Size by 2032 | US$ 1887.61 million |

| CAGR | CAGR of 8.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (25-Hydroxy Vitamin D Test, 1,25-Dihydroxy Vitamin D Test, 24,25-Dihydroxy Vitamin D Test) • By Technology (Radioimmunoassay, ELISA, HPLC, LC-MS, Others) • By Indication (Osteoporosis, Rickets, Thyroid Disorders, Vitamin D Deficiency, Others) • By End-User (Hospitals, Diagnostic Laboratories, Homecare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, F. Hoffmann-La Roche Ltd, bioMérieux SA, Thermo Fisher Scientific Inc., Siemens Healthineers AG, DiaSorin S.p.A., Beckman Coulter, Inc. (BD), Quest Diagnostics Incorporated, Tosoh Bioscience, Inc., Quidel Corporation, Danaher Corporation, and RECIPE Chemicals + Instruments GmbH |

| Key Drivers | • Rising Demand for Vitamin D Testing Driven by Preventive Healthcare, Awareness, and Telemedicine |

| Restraints | • High Cost of Testing • Lack of Standardization in Testing Methods |