Vitamin C Market Report Scope & Overview:

Get More Information on Vitamin C Market - Request Sample Report

The Vitamin C Market Size was valued at USD 1.89 billion in 2023 and is expected to reach USD 2.99 billion by 2032 and grow at a CAGR of 5.23% over the forecast period 2024-2032.

One major factor is the increasing awareness of the importance of vitamin C for immune function and overall health. Consumers are actively seeking ways to improve their well-being, and vitamin C supplements are seen as a convenient and effective option. Research suggests that vitamin C may help reduce inflammation and oxidative stress, both of which are linked to the development of chronic conditions that drive the vitamin C demand in the market.

Furthermore, the booming cosmetics industry, particularly in North America, is utilizing vitamin c's antioxidant properties in skincare products. Vitamin C can help protect the skin from sun damage and promote collagen production, which leads to a more youthful appearance. This trend is expected to continue as consumers become increasingly interested in natural and effective anti-aging solutions.

As per the National Institutes of Health in 2023, the recommended dietary allowance for vitamin C is 90 mg/day for adult men and 75 mg/day for adult women. According to the USDA's 2022 dietary guidelines, major sources of vitamin C in the American diet include citrus fruits, strawberries, kiwi, bell peppers, broccoli, Brussels sprouts, and tomatoes.

The National Health and Nutrition Examination Survey data from 2021 indicates that less than 7% of the U.S. population has serum vitamin C concentrations indicative of deficiency. The NHANES 2021 report shows that approximately 29% of adults in the U.S. take a vitamin C supplement. Therefore, these all factors show the growing demand for the vitamin C market.

The vitamin C market has growth of e-commerce platforms and online retail. Nowadays, consumers can easily find a large selection of vitamin goods, many of which come with thorough product descriptions, user ratings, and tailored suggestions. Since people can now choose and buy products that suit their unique requirements and preferences from the comfort of their homes, the convenience and variety provided by online merchants have led to a rise in demand for vitamins.

Market Dynamics

Drivers

Rising prevalence of cardiovascular diseases to boost the vitamin C market growth.

The escalating prevalence of cardiovascular diseases is a powerful driver behind the surging vitamin C market. This connection is fueled by the potential benefits vitamin C offers for heart health. Vitamin C's antioxidant properties act as a shield, neutralizing free radicals that damage cells and contribute to the development of CVDs. Furthermore, it may play a role in regulating blood pressure and boosting nitric oxide production, both of which are essential for maintaining healthy circulation and reducing the risk of heart attack and stroke.

The rising focus on cardiovascular disease prevention translates into a multi-faceted market growth. Consumers are more likely to purchase vitamin C supplements and food products fortified with vitamin C for heart health. This will lead to a significant expansion in the market for heart-health-focused vitamin C supplements and fortified food products. Pharmaceutical and food companies have a golden opportunity to develop innovative vitamin C products catering to this growing demand for heart health.

Rising demand for vitamin C for food fortification drives market growth.

The vitamin C market is experiencing a surge, fueled in large part by the growing trend of vitamin C fortification in food products. This rise in fortification is driven by several key factors. Firstly, vitamin C deficiencies remain a global concern, and fortification offers a reliable way to ensure people receive their daily recommended intake of this essential nutrient. Secondly, consumers are becoming increasingly health-conscious, actively seeking out food products enriched with vitamins and minerals. Vitamin C, well-known for its immune-supporting properties and overall health benefits, is a popular choice for fortification. Convenience also plays a role, as fortified foods provide an easy way to maintain adequate vitamin C levels, especially for those with busy lifestyles. Finally, food manufacturers are constantly innovating with new fortification techniques that minimize nutrient degradation and ensure a longer shelf life for fortified products.

This rising demand for vitamin C fortification has a ripple effect on the market. It translates to increased sales of vitamin C premixes used by food manufacturers, growth in the market for fortified food products like cereals, dairy beverages, juices, and bakery items, and potentially even the development of new fortification technologies specifically designed for optimal vitamin C stability and effectiveness.

Restrain

Limited shelf life of Vitamin C may hinder the market growth.

This limited shelf-life may hinder market growth. First, exposure to heat, light, and air acts as a time bomb for vitamin C, breaking it down and reducing its potency within fortified foods. This can potentially render them less effective in delivering the intended health benefits. Second, consumers might perceive products with significant vitamin C loss as spoiled, leading to waste and tarnishing the brand reputation. Food manufacturers also face the hurdle of developing effective fortification techniques that minimize this degradation and ensure fortified products retain their potency throughout their shelf life. This can necessitate additional research and development investment.

Market segmentation

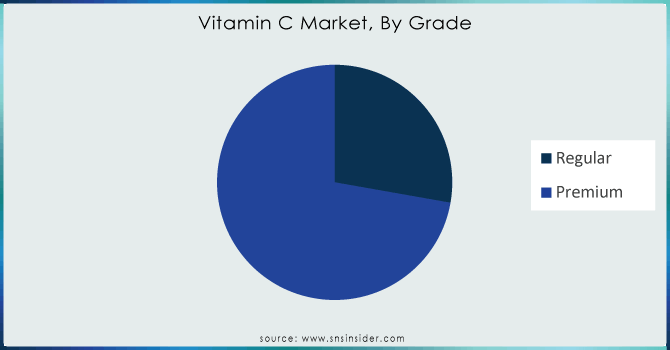

By Grade

The premium segment held the largest market share approx. 72.22% in grade segment in 2023. Premium-grade vitamin C is used for applications where firm quality and consistency are non-negotiable. This includes pharmaceuticals, personal care products, and cosmetics, industries where ensuring product efficacy and safety is of the utmost importance. Premium-grade vitamin C also carves out a niche in specialized applications like food fortification for at-risk populations such as infants and the elderly, as well as in research activities. In these contexts, a high-quality vitamin C Grade is indispensable to achieve the desired outcomes. Pharmaceuticals and other industries that leverage premium-grade vitamin C are subject to rigorous regulations governing product quality and safety. Fortunately, premium-grade vitamin C rises to the challenge, meeting these exacting standards and ensuring compliance. While specific market share percentages may vary slightly depending on the research Grade, it's evident that the premium grade segment holds a commanding lead over other grades within the overall vitamin C market.

Need any customization research on Vitamin C Market - Enquiry Now

By Distribution Channel

The offline segment held the largest market share for Vitamin C market and accounted for the largest market share is around 81.56% in 2023. The reason for this is because ascorbic acid is distributed offline through a network of producers that create the acid in liquid or powder form, and suppliers who serve as middlemen between producers and end-user industries. Manufacturers often supply ascorbic acid as a white, crystalline powder that is soluble in water.

The increasing digitalization of organizations and the surge in international trade operations have supported the tremendous rise that the online distribution channel segment has experienced in recent years. As global e-commerce sites like Amazon and Alibaba have grown, an international market for ascorbic acid has emerged. Customers are beginning to favor online distribution channels more and more due to their convenience and diversity in terms of ascorbic acid suppliers, producers, and quantities.

By End-use

The pharmaceutical held the largest market of approx. 60.38% in application segment. This is explained by its increasing use as a component of vitamin c tablets, pills or capsules intended to prevent or cure low vitamin C levels, which can lead to scurvy and its symptoms, which include weakness, joint pain, fatigue, rashes, and tooth loss. Additionally, it functions as an antioxidant, promoting the body's ability to mend wounds, improve the body's absorption of iron from plant-based diets, and strengthen the immune system.

Another significant end-user market for vitamin C (ascorbic acid) is the personal care and cosmetics sector, where it is a component of many manufacturing processes and made for vitamin c for skin. Because it is a strong antioxidant, and vitamin c benefits is utilized in dermatology to cure and prevent changes brought on by the photoaging phenomena. In addition, it's utilized to treat other skin issues like hyperpigmentation. It is naturally able to combat poisons or free radicals that come into touch with human skin as a result of air pollution.

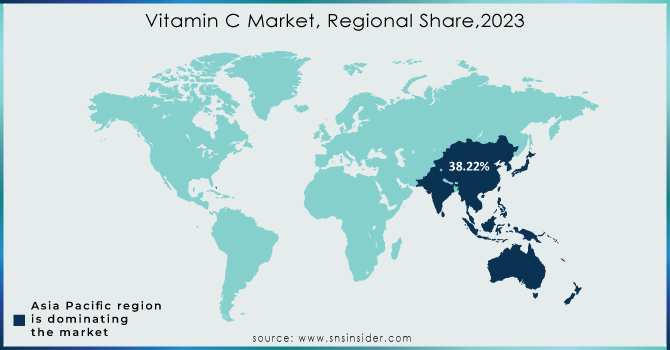

Regional Analysis

Asia Pacific dominated the market and held the largest market share approx. 38.22% in 2023. This is explained by shifting dietary habits, an increase in the consumption of convenience foods, and an increase in the proportion of working women in the area. This is explained by the existence of sizable pharmaceutical corporations as well as significant usage in other industries including cosmetics and animal feed. Asia-Pacific is home to one of the biggest pharmaceutical markets globally, with nations like China, India, and Japan setting the standard in a variety of areas like vaccine development, generic medication manufacturing, and other services.

Europe held the second largest market share in the vitamin C market. Europe is a major player in the market, with nations like France, Germany, and the United Kingdom propelling its expansion. The expansion is explained by the expansion of the European pharmaceutical market. Furthermore, Europe boasts a strong base for pharmaceutical research and development, with several universities, research institutes, and biotech firms fostering innovation and the creation of novel medications. All of these elements work together to propel the pharmaceutical industry's growth and the ascorbic acid market's demand.

Key Players

Sinofi Ingredients, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd Spectrum Chemical, Fooding, Fengchen Group Co., Ltd, Foodchem International Corporation, Global Calcium PVT LTD, Anhui BBCA Group, Honson Pharmatech Group., VCos Cosmetics Pvt Ltd., Shandong Luwei Pharmaceutical Co., Ltd., Reckon Organics Private Ltd., NAGASE & CO., LTD., and Others.

Recent Development:

June 2023, DSM-Firmenich, initiated a comprehensive review and restructuring of its vitamin business unit. This strategic move is a direct response to a confluence of current market trends and conditions.

In April 2023, Prinova Europe, expertise in sports nutrition and a glimpse into innovative lifestyle concepts. Visitors to Stand #G40 explored the company's range of branded sports nutrition ingredients, including the high-performance Enduracarb, the mineral-rich Aquamin, and the muscle-building EAAlpha.

In October 2021, First Base Skincare introduced a revolutionary anti-aging solution: the Double Dose Superpower Organic Vitamin C serum. The natural antioxidant properties of vitamin C help boost hydration, while also stimulating collagen production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.89 billion |

| Market Size by 2032 | US$ 2.99 Billion |

| CAGR | CAGR of 5.23 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Regular, Premium) •By Distribution Channel (Offline and Online) •By End-use (Food & Beverage, Pharmaceutical, Nutraceutical, Personal Care & Cosmetics, Animal Feed, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sinofi Ingredients, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd Spectrum Chemical, Fooding, Fengchen Group Co., Ltd, Foodchem International Corporation, Global Calcium PVT LTD, Anhui BBCA Group, Honson Pharmatech Group., VCos Cosmetics Pvt Ltd., Shandong Luwei Pharmaceutical Co., Ltd., Reckon Organics Private Ltd., NAGASE & CO., LTD., and Others. |

| Key Drivers | • Rising demand for Vitamin C for food Fortification drives the market growth |

| RESTRAINTS | • Limited shelf life of Vitamin C may hinder the market growth |

Ans: The Vitamin C Market was valued at USD 1.89 billion in 2023.

Ans: The expected CAGR of the global Vitamin C Market during the forecast period is 5.23%.

Ans: The Pharmaceutical will grow rapidly in the Vitamin C Market from 2024-2032.

Ans: Factors such as increasing products in food & beverage industry create the opportunity in the market.

Ans: The U.S. led the Vitamin C Market in the North America region with highest revenue share in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Vitamin C Market Segmentation, By Grade

7.1 Introduction

7.2 Regular

7.3 Premium

8. Vitamin C Market Segmentation, By Distribution Channel

8.1 Introduction

8.2 Crude

8.3 Industrial

9. Vitamin C Market Segmentation, By End-use

9.1 Introduction

9.2 Food & Beverage

9.3 Pharmaceutical

9.4 Nutraceutical

9.5 Personal Care & Cosmetics

9.6 Industrial

9.7 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Vitamin C Market by Country

10.2.3 North America Vitamin C Market By Grade

10.2.4 North America Vitamin C Market By Distribution Channel

10.2.5 North America Vitamin C Market By End-use

10.2.6 USA

10.2.6.1 USA Vitamin C Market By Grade

10.2.6.2 USA Vitamin C Market By Distribution Channel

10.2.6.3 USA Vitamin C Market By End-use

10.2.7 Canada

10.2.7.1 Canada Vitamin C Market By Grade

10.2.7.2 Canada Vitamin C Market By Distribution Channel

10.2.7.3 Canada Vitamin C Market By End-use

10.2.8 Mexico

10.2.8.1 Mexico Vitamin C Market By Grade

10.2.8.2 Mexico Vitamin C Market By Distribution Channel

10.2.8.3 Mexico Vitamin C Market By End-use

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Vitamin C Market by Country

10.3.2.2 Eastern Europe Vitamin C Market By Grade

10.3.2.3 Eastern Europe Vitamin C Market By Distribution Channel

10.3.2.4 Eastern Europe Vitamin C Market By End-use

10.3.2.5 Poland

10.3.2.5.1 Poland Vitamin C Market By Grade

10.3.2.5.2 Poland Vitamin C Market By Distribution Channel

10.3.2.5.3 Poland Vitamin C Market By End-use

10.3.2.6 Romania

10.3.2.6.1 Romania Vitamin C Market By Grade

10.3.2.6.2 Romania Vitamin C Market By Distribution Channel

10.3.2.6.4 Romania Vitamin C Market By End-use

10.3.2.7 Hungary

10.3.2.7.1 Hungary Vitamin C Market By Grade

10.3.2.7.2 Hungary Vitamin C Market By Distribution Channel

10.3.2.7.3 Hungary Vitamin C Market By End-use

10.3.2.8 Turkey

10.3.2.8.1 Turkey Vitamin C Market By Grade

10.3.2.8.2 Turkey Vitamin C Market By Distribution Channel

10.3.2.8.3 Turkey Vitamin C Market By End-use

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Vitamin C Market By Grade

10.3.2.9.2 Rest of Eastern Europe Vitamin C Market By Distribution Channel

10.3.2.9.3 Rest of Eastern Europe Vitamin C Market By End-use

10.3.3 Western Europe

10.3.3.1 Western Europe Vitamin C Market by Country

10.3.3.2 Western Europe Vitamin C Market By Grade

10.3.3.3 Western Europe Vitamin C Market By Distribution Channel

10.3.3.4 Western Europe Vitamin C Market By End-use

10.3.3.5 Germany

10.3.3.5.1 Germany Vitamin C Market By Grade

10.3.3.5.2 Germany Vitamin C Market By Distribution Channel

10.3.3.5.3 Germany Vitamin C Market By End-use

10.3.3.6 France

10.3.3.6.1 France Vitamin C Market By Grade

10.3.3.6.2 France Vitamin C Market By Distribution Channel

10.3.3.6.3 France Vitamin C Market By End-use

10.3.3.7 UK

10.3.3.7.1 UK Vitamin C Market By Grade

10.3.3.7.2 UK Vitamin C Market By Distribution Channel

10.3.3.7.3 UK Vitamin C Market By End-use

10.3.3.8 Italy

10.3.3.8.1 Italy Vitamin C Market By Grade

10.3.3.8.2 Italy Vitamin C Market By Distribution Channel

10.3.3.8.3 Italy Vitamin C Market By End-use

10.3.3.9 Spain

10.3.3.9.1 Spain Vitamin C Market By Grade

10.3.3.9.2 Spain Vitamin C Market By Distribution Channel

10.3.3.9.3 Spain Vitamin C Market By End-use

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Vitamin C Market By Grade

10.3.3.10.2 Netherlands Vitamin C Market By Distribution Channel

10.3.3.10.3 Netherlands Vitamin C Market By End-use

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Vitamin C Market By Grade

10.3.3.11.2 Switzerland Vitamin C Market By Distribution Channel

10.3.3.11.3 Switzerland Vitamin C Market By End-use

10.3.3.12 Austria

10.3.3.12.1 Austria Vitamin C Market By Grade

10.3.3.12.2 Austria Vitamin C Market By Distribution Channel

10.3.3.12.3 Austria Vitamin C Market By End-use

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Vitamin C Market By Grade

10.3.3.13.2 Rest of Western Europe Vitamin C Market By Distribution Channel

10.3.3.13.3 Rest of Western Europe Vitamin C Market By End-use

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Vitamin C Market by Country

10.4.3 Asia-Pacific Vitamin C Market By Grade

10.4.4 Asia-Pacific Vitamin C Market By Distribution Channel

10.4.5 Asia-Pacific Vitamin C Market By End-use

10.4.6 China

10.4.6.1 China Vitamin C Market By Grade

10.4.6.2 China Vitamin C Market By Distribution Channel

10.4.6.3 China Vitamin C Market By End-use

10.4.7 India

10.4.7.1 India Vitamin C Market By Grade

10.4.7.2 India Vitamin C Market By Distribution Channel

10.4.7.3 India Vitamin C Market By End-use

10.4.8 Japan

10.4.8.1 Japan Vitamin C Market By Grade

10.4.8.2 Japan Vitamin C Market By Distribution Channel

10.4.8.3 Japan Vitamin C Market By End-use

10.4.9 South Korea

10.4.9.1 South Korea Vitamin C Market By Grade

10.4.9.2 South Korea Vitamin C Market By Distribution Channel

10.4.9.3 South Korea Vitamin C Market By End-use

10.4.10 Vietnam

10.4.10.1 Vietnam Vitamin C Market By Grade

10.4.10.2 Vietnam Vitamin C Market By Distribution Channel

10.4.10.3 Vietnam Vitamin C Market By End-use

10.4.11 Singapore

10.4.11.1 Singapore Vitamin C Market By Grade

10.4.11.2 Singapore Vitamin C Market By Distribution Channel

10.4.11.3 Singapore Vitamin C Market By End-use

10.4.12 Australia

10.4.12.1 Australia Vitamin C Market By Grade

10.4.12.2 Australia Vitamin C Market By Distribution Channel

10.4.12.3 Australia Vitamin C Market By End-use

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Vitamin C Market By Grade

10.4.13.2 Rest of Asia-Pacific Vitamin C Market By Distribution Channel

10.4.13.3 Rest of Asia-Pacific Vitamin C Market By End-use

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Vitamin C Market by Country

10.5.2.2 Middle East Vitamin C Market By Grade

10.5.2.3 Middle East Vitamin C Market By Distribution Channel

10.5.2.4 Middle East Vitamin C Market By End-use

10.5.2.5 UAE

10.5.2.5.1 UAE Vitamin C Market By Grade

10.5.2.5.2 UAE Vitamin C Market By Distribution Channel

10.5.2.5.3 UAE Vitamin C Market By End-use

10.5.2.6 Egypt

10.5.2.6.1 Egypt Vitamin C Market By Grade

10.5.2.6.2 Egypt Vitamin C Market By Distribution Channel

10.5.2.6.3 Egypt Vitamin C Market By End-use

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Vitamin C Market By Grade

10.5.2.7.2 Saudi Arabia Vitamin C Market By Distribution Channel

10.5.2.7.3 Saudi Arabia Vitamin C Market By End-use

10.5.2.8 Qatar

10.5.2.8.1 Qatar Vitamin C Market By Grade

10.5.2.8.2 Qatar Vitamin C Market By Distribution Channel

10.5.2.8.3 Qatar Vitamin C Market By End-use

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Vitamin C Market By Grade

10.5.2.9.2 Rest of Middle East Vitamin C Market By Distribution Channel

10.5.2.9.3 Rest of Middle East Vitamin C Market By End-use

10.5.3 Africa

10.5.3.1 Africa Vitamin C Market by Country

10.5.3.2 Africa Vitamin C Market By Grade

10.5.3.3 Africa Vitamin C Market By Distribution Channel

10.5.3.4 Africa Vitamin C Market By End-use

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Vitamin C Market By Grade

10.5.3.5.2 Nigeria Vitamin C Market By Distribution Channel

10.5.3.5.3 Nigeria Vitamin C Market By End-use

10.5.3.6 South Africa

10.5.3.6.1 South Africa Vitamin C Market By Grade

10.5.3.6.2 South Africa Vitamin C Market By Distribution Channel

10.5.3.6.3 South Africa Vitamin C Market By End-use

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Vitamin C Market By Grade

10.5.3.7.2 Rest of Africa Vitamin C Market By Distribution Channel

10.5.3.7.3 Rest of Africa Vitamin C Market By End-use

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Vitamin C Market by country

10.6.3 Latin America Vitamin C Market By Grade

10.6.4 Latin America Vitamin C Market By Distribution Channel

10.6.5 Latin America Vitamin C Market By End-use

10.6.6 Brazil

10.6.6.1 Brazil Vitamin C Market By Grade

10.6.6.2 Brazil Vitamin C Market By Distribution Channel

10.6.6.3 Brazil Vitamin C Market By End-use

10.6.7 Argentina

10.6.7.1 Argentina Vitamin C Market By Grade

10.6.7.2 Argentina Vitamin C Market By Distribution Channel

10.6.7.3 Argentina Vitamin C Market By End-use

10.6.8 Colombia

10.6.8.1 Colombia Vitamin C Market By Grade

10.6.8.2 Colombia Vitamin C Market By Distribution Channel

10.6.8.3 Colombia Vitamin C Market By End-use

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Vitamin C Market By Grade

10.6.9.2 Rest of Latin America Vitamin C Market By Distribution Channel

10.6.9.3 Rest of Latin America Vitamin C Market By End-use

11. Company Profiles

11.1 Sinofi Ingredients

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Distribution Channels/ Services Offered

11.1.4 The SNS View

11.2 Spectrum Chemical

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Distribution Channels/ Services Offered

11.2.4 The SNS View

11.3 Fooding

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Fengchen Group Co., Ltd

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Foodchem International Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Global Calcium PVT LTD

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Anhui BBCA Group

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Honson Pharmatech Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Reckon Organics Private Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 VCos Cosmetics Pvt Ltd

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Grade

• Regular

• Premium

By Distribution Channel

• Online

• Offline

By End-use

•Animal feed

•Food & Beverage

•Personal Care & Cosmetics

•Pharmaceuticals

•Other End-Uses

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

Europe

Asia Pacific

Middle East & Africa

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Windows & Doors Market Size was valued at USD 199.8 billion in 2023 and is expected to reach USD 331.5 billion by 2032 and grow at a CAGR of 5.8% over the forecast period 2024-2032.

The Recycled Plastics Market Size was valued at USD 35.28 Billion in 2023 and is expected to reach USD 77.90 billion by 2032 and grow at a CAGR of 9.60% over the forecast period 2024-2032.

The Polymethyl Methacrylate (PMMA) market size was valued at USD 5.68 billion in 2023 and is expected to reach USD 8.46 billion by 2032 and grow at a CAGR of 4.53% over the forecast period 2024-2032.

The Ammonium Sulfate Market Size was valued at USD 4.06 Billion in 2023 and is expected to reach USD 6.15 Billion by 2032, at a CAGR of 4.73% from 2024-2032.

The Recycled Textiles Market size was valued at USD 5.76 billion in 2023 and is expected to reach USD 8.69 billion by 2032, at a CAGR of 4.70% from 2024-2032.

The Chemical as a Service Market Size was valued at USD 9.07 billion in 2023 and will reach $13.50 billion by 2032 and grow at a CAGR of 7.96% by 2024-2032

Hi! Click one of our member below to chat on Phone