Virtual Sensors Market Size & Growth Insights:

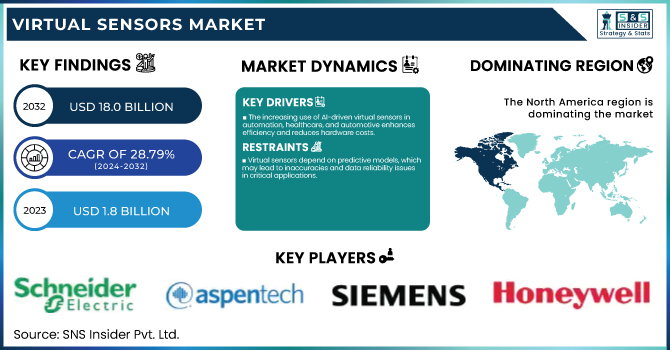

The Virtual Sensors Market Size was valued at USD 1.8 Billion in 2023 and is expected to reach USD 18.0 Billion by 2032, growing at a CAGR of 28.79% from 2024-2032. The adoption of virtual sensors is rising across industries such as automotive, manufacturing, and healthcare due to their cost-effectiveness and ability to enhance operational efficiency. These sensors are becoming more accurate and reliable with advancements in AI-driven algorithms, making them strong alternatives to traditional physical sensors.

Get E-PDF Sample Report on Virtual Sensors Market - Request Sample Report

The market is witnessing significant regional growth, with key vendors competing based on innovation and industry demand. Virtual sensors also contribute to substantial cost savings by reducing hardware dependency and minimizing maintenance expenses. The report will explore AI and machine learning advancements, the regulatory landscape, integration with IoT and edge computing, and emerging trends shaping the future of the virtual sensors market.

Virtual Sensors Market Dynamis

Drivers

-

The increasing use of AI-driven virtual sensors in automation, healthcare, and automotive enhances efficiency and reduces hardware costs.

The adoption of virtual sensors is further driven by their growing significance in IoT and AI in industrial automation, automotive systems, and healthcare. Virtual sensors are non-physical sensors that use software algorithms to estimate data; thus, they are more cost-effective than physical sensors and allow for better efficiency. From predictive analytics powered by AI that allow you to make data-based decisions accurately and in real-time. With industries rapidly shifting to digital transformation, virtual sensors are scalable, affordable, and cost-effective solutions. Another factor for their increasing adoption is their ability to perform under extreme conditions without deterioration. Next-generation smart systems are poised at the intersection of cloud computing, edge AI, and various IoT deployments, and are expected to utilize virtual sensors extensively.

Restraints

-

Virtual sensors depend on predictive models, which may lead to inaccuracies and data reliability issues in critical applications.

However, virtual sensors have to deal with accuracy and mitigative challenges of data reliability. Discrepancies arise from the fact that these sensors rely on predictive models and software algorithms and not direct physical measurements; inaccuracies in the underlying software or calibration errors can easily lead to errors in buoyancy estimates. However, fields carrying high accuracy demands, like aerospace and healthcare, are somewhat reluctant to replace those physical sensors as they do not know how consistent the measurements are going to be. It is also very important to notice that virtual sensors are also dependent on good quality raw input data coming from the physical sensors, thus errors on the source data may severely affect their performance and accuracy of the output. Continuous improvement in AI with more stringent calibration techniques for AI-generated exhibits will help overcome these challenges and allow for greater acceptance.

Opportunities

-

Virtual sensors play a crucial role in digital twins and smart infrastructure, driving demand across industries like manufacturing and energy.

Large growth opportunities for virtual sensors are anticipated shortly due to the emergence of digital twin technology and smart infrastructure. Digital twins mimic real-world environments with virtual sensors, allowing for predictive maintenance, performance optimization, and improved decision-making. Application areas and sectors such as manufacturing, energy, and smart cities are using these solutions more and more to enhance operational efficiency and reduce overall costs. In connected systems, particularly where the automation relies on real-time data analysis, virtual sensors are essential. Virtual sensors will find new market opportunities as investments grow in Industry 4.0, smart grids and intelligent transportation, creating an accelerating market demand for virtual sensors.

Challenges

-

Compatibility issues with legacy systems and complex deployments hinder the seamless adoption of virtual sensors.

The market for virtual sensors faces major challenges, such as difficulties in integrating these sensors with existing IT and operational technology infrastructures. In multiple sectors, legacy systems are found causing a hindrance in virtual sensor implementation unless considerable upgrades are performed. Adoption can be slowed due to compatibility issues, challenges with data sync, and the shortage of experts who can operate Atlas software-based sensor systems. Moreover, operating these virtual sensors, cloud platforms, and edge devices ensure that networking and cybersecurity is a mature process. Addressing these integration challenges will be critical for organizations that want to unlock the full potential of virtual sensor technology.

Virtual Sensors Market Segmentation Overview

By Component

In 2023, the solution segment dominated the market and accounted for significant revenue share, as they are a fundamental part of data collection & analyzing data. Virtual sensor solutions give organizations the ability to monitor processes successfully and to improve operational efficiency; processes can be examined in real time, and the appropriate tools can be deployed to combat loss of efficiency. This has been particularly true for the solutions segment, as the demand for integrated systems for hardware and software-oriented capabilities continues to drive businesses towards integrated offerings that serve to augment data-driven decision-making processes.

The services segment is poised to grow at the fastest CAGR during the forecast period, as organizations are realizing the importance of support and maintenance in the proper functioning of their virtual sensors implementations. Consulting, training, and ongoing technical support are also critical to ensure that the virtual sensor systems are being used efficiently and are growing and changing with the business.

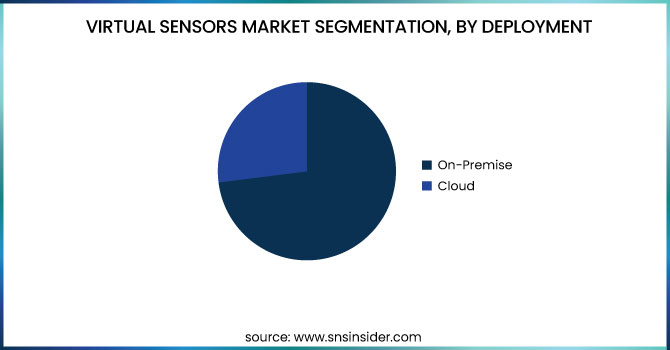

By Deployment

In 2023, the on-premise segment dominated the market and accounted for 73% of the market owing to benefits including data security and control. Due to security concerns, organizations prefer on-premise solutions as sensitive data is managed in-house, and the risk from a third-party data breach is reduced. Such a deployment mode also allows sensor virtualisation assets to be tailored for operational requirements, guaranteeing performance and reliability.

The cloud segment is expected to achieve the fastest compound annual growth rate throughout the forecast period as organizations look for more flexibility and scalability in their operations. Virtual sensors powered by the cloud allow for remote access to data, enabling real-time monitoring and analytics without requiring a massive physical infrastructure. Being able to roll out quickly and having the option to be updated quickly makes it an ideal deployment model for those enterprises looking to improve operational efficiency.

By End-Use

In 2023, the manufacturing & utilities segment dominated the market and accounted for significant revenue share, due to their vital application in production processes and resource management. Enhanced monitoring capabilities lead to improved efficiency and reduced operational cost by way of predictive maintenance and real-time performance monitoring for these sectors.

The aerospace & defense segment is expected to register the fastest CAGR during the forecast period, due to increasing technological advancements, leading to new opportunities for application of virtual sensors in predictive maintenance and safety monitoring fields. Due to the growing emphasis on operational efficiency and safety in this industry, there is increasing demand for advanced virtual sensing technology that can deliver accurate data analytics and real-time insights into the flow and temperature of the fluid.

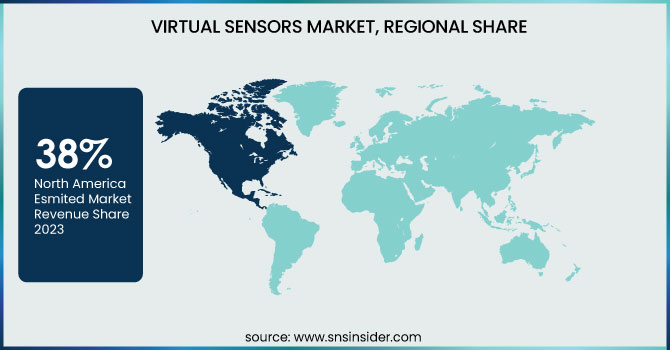

Virtual Sensors Market Regional Outlook

In 2023, North America dominated the market and accounted for 38% of revenue share, owing to its technological infrastructure and increasing implementation of virtual sensors in local industries. High focus on manufacturing, healthcare, and automotive sectors has led major investments in the virtual sensor technologies from the region. These solutions are increasingly being leveraged by organizations to improve operational efficiencies, reduce costs, and enhance decision-making processes.

Asia-Pacific is expected to register the fastest CAGR during the forecast period, Rapid industrialization and rising investments in smart technologies are the major factors driving the growth of the virtual sensors market in the Asia Pacific region. The fastest growing economies such as China, India, and Japan, along with rising adoption of advance monitoring solutions in industries is a major driving factor for the growth of the market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

The major key players along with their products are

-

Siemens AG – XHQ Operations Intelligence

-

General Electric (GE) – Predix Digital Twin

-

IBM Corporation – IBM Watson IoT

-

Microsoft Corporation – Azure Digital Twins

-

SAP SE – SAP Predictive Engineering Insights

-

Schneider Electric– EcoStruxure Asset Advisor

-

Rockwell Automation – FactoryTalk Analytics

-

Emerson Electric Co. – Plantweb Digital Ecosystem

-

Honeywell International Inc. – Honeywell Forge

-

ABB Ltd. – ABB Ability Digital Powertrain

-

PTC Inc. – ThingWorx Industrial IoT Platform

-

Bosch Sensortec – BME AI-Studio

-

ANSYS, Inc. – ANSYS Twin Builder

-

Altair Engineering Inc. – Altair SmartWorks

-

Aspen Technology, Inc. – Aspen Mtell

Recent Developments

-

In 2024, Schneider Electric launched updates to its EcoStruxure platform, incorporating virtual sensor technology to improve energy management solutions.

-

In 2024, Rockwell Automation introduced enhancements to its FactoryTalk Analytics, leveraging virtual sensors to provide deeper insights into manufacturing processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.8 Billion |

| Market Size by 2032 | USD 18.0 Billion |

| CAGR | CAGR of 28.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment (Cloud, On-premise) • By End-Use (Oil & Gas, Aerospace & Defense, Automotive & Transportation, Healthcare, Manufacturing & Utilities, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, General Electric (GE), IBM Corporation, Microsoft Corporation, SAP SE, Schneider Electric, Rockwell Automation, Emerson Electric Co., Honeywell International Inc., ABB Ltd., PTC Inc., Bosch Sensortec, ANSYS, Inc., Altair Engineering Inc., Aspen Technology, Inc. |