Virtual Reality (VR) in Healthcare Market Size & Overview:

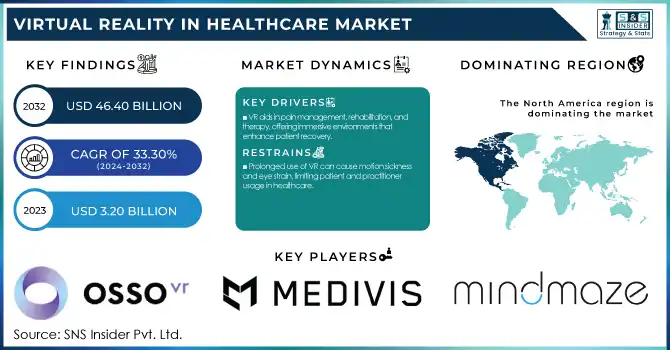

The Virtual Reality in Healthcare Market Size was valued at USD 4.27 billion in 2024 and is expected to reach USD 46.40 Billion by 2032, growing at a CAGR of 33.30% from 2025-2032.

The Virtual Reality in healthcare market is flourishing and it has a prominent role to play in different medical areas, thus the entire market space is experiencing swift growth. VR has been used in a variety of medical applications, including education and patient care, with significant improvements to outcomes. VR simulation tools provide a risk-free environment for medical professionals to practice complex surgeries, thereby honing their skills. Virtual surgical training is another example, as provided by platforms like Osso VR to improve proficiency in orthopedic procedures. The application of VR in patient care includes areas such as pain management, rehabilitation, and therapy. Patients receiving pain therapy with VR based on a 2024 study at Cedars-Sinai Medical Center experienced a 24% reduction in pain levels, as opposed to traditional treatments. Apart from that, Virtual Reality has a major applicability in physical rehabilitation program where the patient can get immersed into these environments which helps them recover faster. For example; Take Samsung Medical Center, South Korea they use VR to train stroke patients motor skills and found better recovery results.

Get more information Virtual Reality (VR) in Healthcare Market - Request Sample Report

Virtual Reality (VR) in Healthcare Market Size and Forecast:

-

Market Size in 2024: USD 4.27 Billion

-

Market Size by 2032: USD 46.40 Billion

-

CAGR: 33.30% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Trends in Virtual Reality (VR) in Healthcare Market

-

Immersive Training & Simulation – VR is widely used for medical education, surgical planning, and risk-free practice.

-

Patient Care & Mental Health – Growing use in pain management, PTSD, anxiety, and phobia therapies.

-

Rehabilitation & Therapy – Enhances physical, neurological, and cognitive rehabilitation with personalized programs.

-

Integration with Wearables – Combining VR with sensors and remote monitoring expands applications beyond clinics.

-

Advancements in Hardware – Better resolution, motion tracking, and lower costs make VR more accessible.

-

AI-Powered Personalization – Tailored therapies and simulations improve patient outcomes.

-

Institutional & Regulatory Adoption – Hospitals and governments are increasingly funding and integrating VR programs.

VR is known for helping patients feel less anxious before coming in for surgeries or invasive procedures. VR headsets have been used to calm patients at St. George's Hospital in London during surgery — significantly reducing their stress and allowing less sedative to be needed. Telemedicine is another emerging application, which uses VR for doctors to treat or examine patients virtually and potentially improves healthcare access in areas that lack medical care facilities. Rapid technical distortion, high attention for telehealth services and emphasised importance on personalised medicine, have steadily fuelled the diffusion of VR into healthcare.

Virtual Reality (VR) in Healthcare Market Drivers:

-

VR allows realistic simulations of surgeries, enabling medical professionals to practice complex procedures in a risk-free environment.

-

VR enables tailored treatments and rehabilitation programs, improving patient outcomes.

-

VR aids in pain management, rehabilitation, and therapy, offering immersive environments that enhance patient recovery.

Virtual Reality (VR) is proving ideal for pain management, rehabilitation and therapy in the healthcare market with the most immersive environments that patients can recover from. VR offers distraction-based therapies for pain management where patients immerse themselves into virtual worlds that distract their mind and reduce the awareness of pain. This is a great aid for the chronic pain patients to refrain this. According to a 2023 reports, VR pain therapy promotes 24% lower levels of pain compared to standard treatment approaches.

When VR is used in a physical rehabilitation context, it allows patients to do fun and interactive exercises that require them to move. Instead of dreadful prosaic exercises that need to be repeated there dozens of times — VR makes rehab an appealing experience, able to keep patients motivated and engaged. VR reproduces real-world tasks, allowing patients to rehearse motor activities in a virtual space during stroke rehabilitation. One such way is utilizing VR for motor skill practice, as patients are likely to engage with VR and find it more enjoyable; Patients at Samsung Medical Center in South Korea have shown better recovery from a stroke using VR than standard treatment.

Even in the field of mental health and cognitive therapy, VR is commonly utilized. This creates an opportunity for exposure therapy to be conducted in a safe environment, making it useful for those suffering from anxiety, PTSD or phobias. In a convincing but safe virtual environment, patients confront their worst nightmares in order to develop increasing immunity to them. Such virtual reality-based pain management, rehabilitation, and therapy applications are expanding the healthcare VR market. As the use of VR technology increases in health care, more cardiochnologies will employ Vr from lower/socketed technologies and improved graphic-based systems. With increasing healthcare providers incorporating VR in treatment plans, the role of VR will rapidly expand to improve patient care and recovery outcomes.

Virtual Reality (VR) in Healthcare Market Restraints:

-

Prolonged use of VR can cause motion sickness and eye strain, limiting patient and practitioner usage in healthcare.

-

Handling sensitive patient data in VR applications raises privacy and security challenges that require strict compliance.

-

VR requires specialized setup and technical expertise, which can complicate integration into existing healthcare systems.

One key challenge in the Virtual Reality (VR) healthcare market is the need for specialized setup and technical expertise, which complicates its integration into existing healthcare systems. VR technology, including headsets and motion sensors, requires specific infrastructure and trained personnel for effective use. Hospitals and clinics must invest in not only the devices but also in creating suitable environments for VR therapy or training, such as dedicated spaces for patient sessions or staff training. Additionally, healthcare professionals must be trained to use VR technology effectively, which involves understanding the software, troubleshooting potential issues, and incorporating VR into clinical workflows. This adds to the complexity, as many medical staff may not be familiar with advanced VR systems, requiring extra time and resources for training and adaptation. For example, implementing VR for surgical simulation requires not only knowledge of the VR system but also expertise in syncing it with real-world medical procedures.

Moreover, integrating VR with existing medical databases, patient management systems, and ensuring compatibility with other technologies can be a technical challenge. Healthcare providers may face difficulties in aligning VR solutions with their current systems, which could disrupt workflows or create inefficiencies.

These factors contribute to the restraint on VR adoption in healthcare, especially for smaller facilities with limited resources. Overcoming these barriers requires significant investment in infrastructure, training, and technical support, which can delay widespread implementation.

Virtual Reality in Healthcare Market Segmentation Overview:

By Application, Education and Training Segment Leads, While Pain Management Set for Fastest Growth

The education and training segment dominated the market and represented significant revenue share in 2024. Driven by, extensive utilization of VR for medical education and professional training purposes. As automation becomes more widespread and customer bases grow, demand in this area is only expected to rise. Additionally, increasing demand for innovative training solutions, advancements in immersive technologies, and the need for hands-on experience in medical education. The integration of AR and VR in simulations allows healthcare professionals to practice procedures safely, improving their skills and confidence.

On the other hand, pain management segment is anticipated to grow at highest CAGR during the forecast period. VR has gained popularity as a pain management solution by immersing patients in compelling content during some of the more uncomfortable or painful procedures available skin grafts, open surgeries and burn bandaging all come to mind, as it does a great job at diverting attention and reducing discomfort.

By Component, Hardware Segment Dominates, Software Expected to Grow at Highest CAGR

In 2024, the hardware segment dominated the market, driven by the increasing affordability of VR devices and ongoing investments from companies developing headsets, devices, and associated content. Many organizations are expanding their use of virtual reality in healthcare applications. For instance, in June 2024, VA Immersive rolled out over 1,200 VR headsets across more than 160 VA medical centers and clinics in all 50 U.S. states and Puerto Rico, reinforcing the VA's commitment to delivering timely and effective care to Veterans. VA Immersive is transforming Veteran healthcare through the adoption of immersive technologies.

At the same time, the software segment is expected to experience the highest CAGR during the forecast period, driven by the increasing demand for advanced software solutions for training healthcare professionals, treatment analysis, patient management, and more, thus fueling the growth of virtual reality in the healthcare sector.

Virtual Reality (VR) in Healthcare Market Regional Analysis

North America dominates the Virtual Reality (VR) in healthcare market in 2024

In 2024, North America holds an estimated 42% share of the VR in Healthcare market, driven by advanced healthcare infrastructure, strong investments in digital health, and high adoption of immersive technologies. The region benefits from growing applications of VR in medical education, surgical simulations, rehabilitation, and pain management. Collaborations between hospitals, universities, and technology providers accelerate adoption. Federal initiatives in areas such as mental health and veteran care further support expansion, positioning North America as the leading region in the global VR in Healthcare market.

-

United States leads North America’s Virtual Reality (VR) in Healthcare market

The U.S. dominates due to its robust healthcare ecosystem, strong presence of VR solution providers, and high adoption across hospitals and medical schools. Applications range from surgical training and rehabilitation to mental health therapies and pain management programs. Federal and private investments in digital healthcare accelerate development, while innovative startups and global tech leaders introduce new VR-based platforms. The integration of VR into veterans’ care and medical education programs highlights U.S. leadership. With a strong digital infrastructure and policy support, the U.S. remains the largest contributor to North America’s VR healthcare revenues.

Asia-Pacific is the fastest-growing region in the Virtual Reality (VR) in Healthcare market in 2024

The Asia-Pacific VR in Healthcare market is projected to grow at an estimated CAGR of 34.5% from 2025 to 2032, fueled by rising healthcare digitalization, large patient populations, and increasing investments in immersive technologies. Government-backed healthcare modernization programs and growing partnerships between tech firms and hospitals accelerate VR adoption. Applications in medical training, telehealth, and rehabilitation are expanding rapidly. Strong demand for innovative treatment methods and cost-efficient training solutions further positions Asia-Pacific as the fastest-growing region in the forecast period.

-

China leads Asia-Pacific’s Virtual Reality (VR) in Healthcare market

China dominates the regional market due to its large healthcare system, strong government focus on digital health, and rapid adoption of VR technologies. Local technology companies are partnering with hospitals and universities to implement VR in surgical simulations, pain management, and psychiatric care. High investments in telehealth platforms and rehabilitation solutions further drive market expansion. With its combination of scale, policy support, and technology innovation, China is emerging as the key growth engine and the leading contributor to Asia-Pacific’s VR healthcare revenues.

Europe Virtual Reality (VR) in healthcare market insights, 2024

Europe accounts for an estimated 27% share of the VR in Healthcare market in 2024, supported by strict healthcare regulations, strong adoption of medical technologies, and growing use of VR in rehabilitation and training. Hospitals and clinics are leveraging VR for patient therapy, surgical planning, and immersive medical education. EU healthcare regulations and funding programs encouraged VR adoption in hospitals, improving patient outcomes, digital treatment solutions, and immersive training systems. Germany leads the European market due to its advanced healthcare infrastructure, robust medical device industry, and strong integration of VR in surgical training and rehabilitation. Early adoption of digital innovations and compliance with strict safety standards further strengthen Germany’s leadership in the region.

Middle East & Africa and Latin America Virtual Reality (VR) in healthcare insights, 2024

In 2024, the Middle East & Africa and Latin America regions demonstrate moderate but steady growth in VR healthcare adoption. In the Middle East, the UAE and Saudi Arabia lead with national digital health strategies, integrating VR into surgical training, rehabilitation, and mental health therapy. In Africa, South Africa emerges as a key adopter, driven by private sector healthcare investments. In Latin America, Brazil dominates due to growing telehealth adoption and demand for rehabilitation tools, while Mexico shows increasing uptake supported by healthcare digitalization and cost-efficient VR applications.

Need any customization research on Virtual Reality (VR) in Healthcare Market - Enquiry Now

Competitive Landscape for the Virtual Reality (VR) in Healthcare Market:

Osso VR

Osso VR is a U.S.-based leader in surgical training and skills assessment using high-fidelity virtual reality simulations. The company builds realistic, procedure-specific training modules that allow surgeons and medical trainees to practice techniques, rehearse complex cases, and measure competency in a risk-free environment. By partnering with medical device manufacturers and teaching hospitals, Osso VR accelerates device adoption and improves surgical outcomes through standardized, repeatable training. Its role in the VR healthcare market is pivotal, providing scalable, data-driven surgical education that shortens learning curves and enhances clinical readiness.

-

-

In 2024, Osso VR expanded its surgical curriculum with new procedure modules and enterprise partnerships to broaden hospital and device-maker adoption.

-

Medivis

Medivis is a U.S.-based developer of AR/VR visualization tools for image-guided surgery and preoperative planning. The company integrates medical imaging with immersive overlays that help surgeons visualize anatomy in 3D, improving precision during minimally invasive and complex procedures. Medivis works closely with clinical teams to embed its visualization platform into surgical workflows, enhancing operative planning, intraoperative navigation, and cross-disciplinary collaboration. Its role in the market centers on improving surgical accuracy and reducing procedure times through clearer, context-rich imaging.

-

-

In 2024, Medivis introduced enhanced AR visualization features for image-guided procedures to improve intraoperative decision-making.

-

MindMaze

MindMaze is a neurotechnology company specializing in VR-based neurorehabilitation and cognitive therapy solutions. The company combines immersive environments, neural-sensor feedback, and therapeutic protocols to support stroke recovery, motor rehabilitation, and cognitive retraining. MindMaze partners with healthcare providers and rehabilitation centers to deliver clinically validated programs that increase patient engagement and track recovery metrics over time. Its role in VR healthcare emphasizes restoring function and accelerating rehabilitation through personalized, evidence-informed virtual therapies.

-

-

In 2024, MindMaze launched an upgraded neurorehabilitation platform focused on enhanced motor recovery and clinician analytics.

-

VRHealth

VRHealth is a U.S.-based clinical VR platform offering tools for pain management, physical rehabilitation, and telehealth delivery. The company provides patient-facing therapy content and clinician dashboards that enable remote treatment, progress tracking, and outcome measurement. By integrating evidence-based VR therapies with telemedicine workflows, VRHealth supports broader access to rehabilitation and behavioral health services while lowering cost and travel barriers for patients. Its role in the market is to operationalize VR therapies in clinical settings and extend care beyond the hospital through remote, measurable programs.

-

-

In 2024, VRHealth rolled out an enterprise telehealth VR solution for remote rehabilitation and clinician-driven treatment plans.

-

Virtual Reality (VR) in Healthcare Market Key Players:

-

Osso VR

-

Medivis

-

MindMaze

-

VRHealth

-

Surgical Theater

-

Augmedics

-

ImmersiveTouch

-

Virtual Reality Medical Center (VRMC)

-

Simulated Surgical Systems

-

EchoPixel

-

HoloAnatomy

-

Strivr

-

EVA Health

-

Auris Health

-

DeepStream

-

Rendever

-

Unimmersive

-

Physitrack

-

Karuna Labs

-

Pillars of Wellness

| Report Attributes | Details |

| Market Size in 2024 | USD 4.27 billion |

| Market Size by 2032 | USD 46.40 Billion |

| CAGR | CAGR of 33.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Content) • By Application (Pain Management, Education & Training, Surgery, Patient Care Management, Rehabilitation, and Therapy Procedures, Others (Post-Traumatic Stress Disorder (PTSD)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Osso VR Medivis, MindMaze, VRHealth, Surgical Theater Augmedics, ImmersiveTouch, Virtual Reality Medical Center (VRMC), Simulated Surgical Systems, EchoPixel |