Get more information on Video Surveillance Market - Request Sample Report

Video Surveillance Market Size was valued at USD 60.1 Billion in 2023 and is expected to reach USD 149.5 Billion by 2032, growing at a CAGR of 10.67% over the forecast period 2024-2032.

The most prominent driver behind the growing trend of the video surveillance market is the increasing governmental initiatives to enhance public safety, prevent crime, and protect infrastructure. Security threats on a global scale, in the form of terrorism or the form of crime, have motivated many governments to implement advanced surveillance systems to monitor public and private areas as well as critical facilities. For example, in 2023, the U.S. government provided $2 billion to be spent on security technologies and video surveillance across federal buildings, airports, and other critical infrastructure. Similarly, the Safe Streets Fund set up by the U.K. Home Office, received £50 million in 2023 to focus on installing advanced CCTV cameras in high-crime areas to reduce street-level crime. In addition, increased use of video surveillance by domestic terror groups also drives growth.

According to the European Union, public initiatives of video surveillance have increased by 18% in the past five years in all European cities. The European Union endorsement constitutes the remaining leading force, ensuring governmental programs proceed to the same extent in other regions. Smart city programs are driving demand for intelligent video solutions in conjunction with AI-based analytics and ensure heightened situational awareness along with automated responses to security threats. China’s Ministry of Public Security reported in 2023 that over 600 million surveillance cameras have been installed in the country, and the system has been further incorporated with AI technologies, for better comprehensive monitoring of urban management and public safety. Thus, governments’ increased interest in the growth of national security through effective surveillance, as well as increased use of video surveillance in law enforcement and local security, ensure the continuous and sustainable growth of the video surveillance market.

In addition, the need to monitor remotely and access the surveillance feed in real-time, as well as regulatory requirements for improved security measures, are driving demand. In all sectors, demand for video surveillance is growing as it is integrated with other systems such as access control and the Internet of Things. The market’s growth is driven by the need for security in schools, airports, businesses, or homes and the demand for both private and public. Intelligent video surveillance is required to monitor all activities in the emergence of smarter cities. Cloud-based systems appear to be gaining popularity due to their scalability and low cost.

Drivers

One of the prominent drivers of the video surveillance market is increasing security concerns resulting from growing crime rates and terrorist attacks. As public safety becomes the primary concern for people, governments and organizations are employing sophisticated surveillance systems. For example, based on a survey conducted by the National Institute of Justice, more than 60% of law enforcement agencies reported an increase in violent crime and a high demand for technology to prevent aggressive actions. Furthermore, numerous cities across the world are deploying smart surveillance solutions. For instance, in 2023, the video surveillance system was powered by AI and implemented in the city of Los Angeles. This city camera network complements existing infrastructure and ensures 24/7 real-time monitoring and quick response to events. The primary goal of this initiative is to decrease crime rates and enhance emergency services’ efficiency. Correspondingly, according to a recent report, around 54% of customers noted that they demonstrated more interest in recognizing public cameras. Overall, both public and private sectors acknowledge the value and potential of surveillance systems. As a result, such a tendency drives investments to maintain and enhance video surveillance as the most effective solution to maintaining people’s safety.

Innovations in AI, machine learning, and video analytics have improved the capabilities of video surveillance systems, allowing for features like real-time monitoring, object recognition, and behavioral analysis, which enhance both security and operational efficiency.

The push towards developing smart cities involves extensive use of video surveillance to monitor traffic, ensure public safety, and improve emergency response, significantly driving market demand.

Restraints

One significant restraint in the video surveillance market is related to concerns about privacy. With the ever-increasing presence of surveillance technologies, the public has become more and more alarmed about the possible infringement of privacy. Given that surveillance cameras can be configured to record continuously, people inherently feel that they are being watched. It raises concerns about governments using them to gain excessive control or selling the information acquired to make profits. This issue is supported by numerous cases of data breaches and footage misuse that have been publicized in recent years. As such, customers or businesses may resist the adoption of new surveillance solutions due to the fear of violating individual rights. Additionally, regulatory frameworks around data protection, such as GDPR in Europe, impose strict guidelines that companies must adhere to, adding complexity to compliance and implementation.

By System Type

In 2023 the market was dominated by the IP video surveillance systems segment which contributed to more than 53% of total revenue. This can be explained by the rising adoption of IP systems instead of traditional analog solutions due to their increased capabilities. It offers higher-resolution video, increased power of analytics such as face recognition and object detection, and the ability of remote monitoring, which makes it suitable for implementation in various areas of the public and private sectors. In addition, governments are enforcing regulations to stimulate the switch from analog to IP systems all over the world. In 2023 the Ministry of Urban Development of India declared the requirement that all new monitoring systems in the public areas should be IP, which led to the significant increase in demand for these systems. Moreover, IP solutions are easily integrated into the It infrastructure of the organization and allow for centralized monitoring from multiple locations, which further drives its implementation in the commercial, governmental, and industrial sectors.

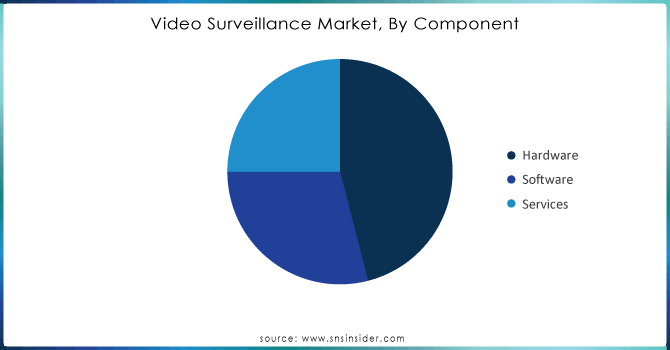

By Component

The hardware segment dominated the market and held over 69% of the market revenue in 2023, with hardware including cameras, monitors, storage devices, and others, produced. The market share of the segment is significant largely due to the high demand for surveillance cameras, which are the foundation of video surveillance systems. Governments across the globe make huge investments in the deployment of surveillance cameras to enhance the monitoring of public spaces and critical infrastructure. For example, in 2023, the Ministry of Public Security of China announced that 20 million new high-resolution surveillance cameras were deployed under the nationwide “Sharp Eyes” initiative. Moreover, the technological progress in camera hardware, including 4K resolution, night vision, and thermal imaging, is playing a part in the rising demand for modern surveillance equipment. Therefore, in 2023, as reported by the U.S. Department of Homeland Security, 78% of new surveillance projects sponsored by the federal government involved the acquisition of modern hardware components, such as high-definition cameras and sophisticated storage systems to ensure permanent, secure data retention.

Need any customization data on Video Surveillance Market - Enquiry Now

By Vertical

In 2023, the commercial sector led the video surveillance market, accounting for over 36% of global revenue. The growing need for enhanced security in commercial establishments such as retail stores, offices, hotels, and entertainment venues has driven the demand for advanced video surveillance systems. Governments have introduced various regulations requiring commercial businesses to install surveillance systems for both safety and compliance purposes. In the U.S., the Department of Justice implemented new guidelines in 2023 requiring commercial establishments in high-crime urban areas to deploy 24/7 video surveillance to prevent criminal activities.

The commercial sector takes the leading position in the video surveillance market in 2023, accounting for over 36% of global revenue. With the rising concerns over the safety and security of commercial establishments, such as retail, offices, hotels, and entertainment places, the need for advanced video surveillance systems has driven the development. In response to the ever-rising complexity and risks within commercial domains, governments have introduced multiple regulations and standards obligating commercial businesses to install surveillance systems for their safety and compliance purposes. In the U.S., the Department of Justice introduced its new guidelines in 2023, which require all commercial establishments operating in high-crime, urban areas to deploy video surveillance 24/7 to curb criminal activities.

The commercial vertical has adopted advanced video surveillance systems, powered by AI to enhance operational efficiency and provide insight into customer behavior, which has also propelled its growth. Facing multiple business-critical challenges in the form of protecting expensive assets, mitigating risks, and ensuring safety and security, the commercial vertical is expected to continue driving the video surveillance market.

Regional Insights

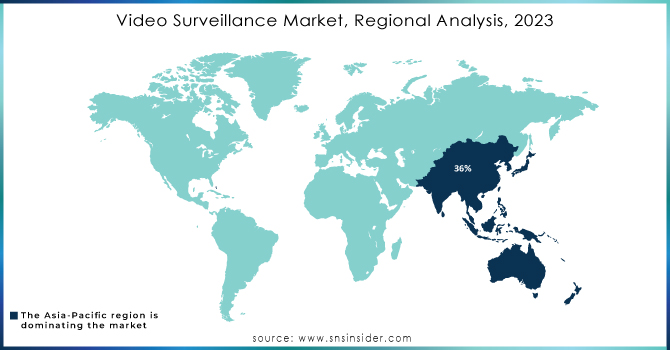

In 2023, the Asia-Pacific region maintained its leadership in the global video surveillance market, with a market share of 36%. The primary reason for such dominance is the large-scale deployment of surveillance systems in such countries as China and India. These activities have been boosted by various governmental smart city programs and public security initiatives. For instance, the “SkyNet” program initiated by the Chinese government to monitor smart cities using AI-based surveillance cameras increased the market share of the Asia-Pacific up to 60% in 2023. In this case, China specifically exceeded APAC’s market share as the Ministry of Public Security reported that it installed more than 600 million surveillance cameras by the end of 2023.

In North America, the regional level of video surveillance deployment has grown at the fastest CAGR due to the significant increases in governmental investments in the modernization of the security infrastructure. The U.S. Department of Homeland Security's focus on securing critical infrastructure and public spaces led to a market share of 28% in 2023. It is expected that the application of AI solutions to be deployed in smart city programs will contribute to the even greater growth rate of the region.

Key Players

Key Manufacturers/Service Providers

Axis Communications (AXIS P5635-E PTZ Network Camera, AXIS Q6215-LE Network Camera)

Hikvision (DS-2CD2087G2-L, DS-2DE4A425IW-DE)

Dahua Technology (N52A2P, DH-IPC-HDW5831R-ZE)

Bosch Security Systems (AUTODOME IP starlight 7000i, DINION IP 5000i)

Hanwha Techwin (QNP-6320R, PNV-A9081R)

FLIR Systems (FLIR FX, FLIR DNR-SL)

Honeywell Security (Honeywell Fusion, Performance Series Cameras)

Tyco Integrated Security (Tyco Illustra Flex, Tyco 3 Series Cameras)

Motorola Solutions (Avigilon H4 Multisensor Camera, Avigilon Control Center)

Genetec (Security Center, Genetec Clearance)

Key Users of Video Surveillance Services/Products

Walmart

Amazon

Bank of America

Target

McDonald's

University of California

FedEx

MGM Resorts International

City of Los Angeles

Houston Police Department

Recent Developments

In March 2024, the U.S. Department of Defense announced a $1.5 billion investment over the next five years in the upgrade of its video surveillance infrastructure across its bases and sensitive sites to enable real-time monitoring.

In April 2024, the South Korean Hanwha Vision Co., Ltd. and US-based Allied Telesis, Inc. partnered to boost the compatibility and security of their systems with a comprehensive physical security solution, simplifying the management of networks and IP cameras for security applications.

In April 2024, Hangzhou Hikvision Digital Technology Co., Ltd. unveiled its new Turbo HD 8.0 two-way audio cameras designed for instant human communication, with applications including Intercoms and security fencing.

In February 2024, Zhejiang Dahua Technology Co., Ltd. collaborated with Clear Digital, a New Zealand firm, to expand its market presence and deliver improved IP surveillance hardware and video management software in the area.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 60.1 Billion |

| Market Size by 2032 | USD 149.5 Billion |

| CAGR | CAGR 10.67% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Service) • By System (IP Video Surveillance Systems, Analog Video Surveillance Systems, Hybrid Video Surveillance Systems) • By Vertical (Commercial, Industrial, Residential, Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Axis Communications, Hikvision, Dahua Technology, Bosch Security Systems, Hanwha Techwin, FLIR Systems, Honeywell Security, Tyco Integrated Security, Motorola Solutions, Genetec |

| Key Drivers | •Increased incidents of crime and terrorism have heightened the need for effective surveillance systems. Video surveillance is crucial for enhancing public safety in urban areas and smart city initiatives •Innovations in AI, machine learning, and video analytics have improved the capabilities of video surveillance systems, allowing for features like real-time monitoring, object recognition, and behavioral analysis, which enhance both security and operational efficiency. •The push towards developing smart cities involves extensive use of video surveillance to monitor traffic, ensure public safety, and improve emergency response, significantly driving market demand |

| Market Restraints | •Growing apprehensions about privacy violations due to pervasive surveillance can hinder market growth. The balance between safety and individual privacy rights is a significant concern •The initial investment for advanced video surveillance systems, including installation and maintenance, can be prohibitively high for smaller businesses or residential users |

Ans: The North American region dominated the Video Surveillance Market in 2023.

Ans: The Video Surveillance Market size was valued at USD 63.97 billion in 202.

The market has been segmented with respect to component, system and application.

Top-down research, bottom-up research, qualitative research, quantitative research, and Fundamental research.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Video Surveillance Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Camera

7.2.3.1 Camera Market Trends Analysis (2020-2032)

7.2.3.2 Camera Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Monitors

7.2.4.1 Monitors Market Trends Analysis (2020-2032)

7.2.4.2 Monitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Storage Devices

7.2.5.1 Storage Devices Market Trends Analysis (2020-2032)

7.2.5.2 Storage Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Others

7.2.6.1 Others Market Trends Analysis (2020-2032)

7.2.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Video Surveillance Market Segmentation, By System Type

8.1 Chapter Overview

8.2 Analog Video Surveillance Systems

8.2.1 Analog Video Surveillance Systems Market Trends Analysis (2020-2032)

8.2.2 Analog Video Surveillance Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hybrid Video Surveillance Systems

8.3.1 Hybrid Video Surveillance Systems Market Trends Analysis (2020-2032)

8.3.2 Hybrid Video Surveillance Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 IP Video Surveillance Systems

8.4.1 IP Video Surveillance Systems Market Trends Analysis (2020-2032)

8.4.2 IP Video Surveillance Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Video Surveillance Market Segmentation, By Vertical

9.1 Chapter Overview

9.2 Commercial

9.2.1 Commercial Market Trends Analysis (2020-2032)

9.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.3 Retails Stores & Malls

9.2.3.1 Retails Stores & Malls Market Trends Analysis (2020-2032)

9.2.3.2 Retails Stores & Malls Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.4 Hospitality Centers

9.2.4.1 Hospitality Centers Market Trends Analysis (2020-2032)

9.2.4.2 Hospitality Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.5 Data Centers & Enterprises

9.2.5.1 Data Centers & Enterprises Market Trends Analysis (2020-2032)

9.2.5.2 Data Centers & Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.6 Banking & Finance Building

9.2.6.1 Banking & Finance Building Market Trends Analysis (2020-2032)

9.2.6.2 Banking & Finance Building Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.7 Warehouses

9.2.7.1 Warehouses Market Trends Analysis (2020-2032)

9.2.7.2 Warehouses Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.8 Others

9.2.8.1 Others Market Trends Analysis (2020-2032)

9.2.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Industrial

9.3.1 Industrial Market Trends Analysis (2020-2032)

9.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Residential

9.4.1 Residential Market Trends Analysis (2020-2032)

9.4.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Government

9.5.1 Government Market Trends Analysis (2020-2032)

9.5.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.3 Healthcare Buildings

9.5.3.1 Healthcare Buildings Market Trends Analysis (2020-2032)

9.5.3.2 Healthcare Buildings Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.4 Educational Buildings

9.5.4.1 Educational Buildings Market Trends Analysis (2020-2032)

9.5.4.2 Educational Buildings Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.5 Religious Buildings

9.5.5.1 Religious Buildings Market Trends Analysis (2020-2032)

9.5.5.2 Religious Buildings Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.6 Government Buildings

9.5.6.1 Government Buildings Market Trends Analysis (2020-2032)

9.5.6.2 Government Buildings Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.7 Others

9.5.7.1 Others Market Trends Analysis (2020-2032)

9.5.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.2.5 North America Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.2.6.3 USA Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.2.7.3 Canada Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.7.3 France Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.6.3 China Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.7.3 India Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.8.3 Japan Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.12.3 Australia Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.2.5 Africa Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.6.5 Latin America Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Video Surveillance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Video Surveillance Market Estimates and Forecasts, By System Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Video Surveillance Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11. Company Profiles

11.1 Axis Communications

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Hikvision

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Dahua Technology

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Bosch Security Systems

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Hanwha Techwin

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 FLIR Systems

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Honeywell Security

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Tyco Integrated Security

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Motorola Solutions

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Genetec.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Camera

Monitors

Storage Devices

Others

Software

Services

By System Type

Analog Video Surveillance Systems

Hybrid Video Surveillance Systems

IP Video Surveillance Systems

By Vertical

Commercial

Retails Stores & Malls

Hospitality Centers

Data Centers & Enterprises

Banking & Finance Building

Warehouses

Others

Industrial

Residential

Government

Healthcare Buildings

Educational Buildings

Religious Buildings

Government Buildings

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sensitive Data Discovery Market was valued at USD 8.10 billion in 2023 and will reach USD 35.58 billion by 2032, growing at a CAGR of 17.93% by 2032

The Context-Aware Computing Market size was USD 57.2 Billion in 2023 and will Reach USD 206.3 Billion by 2032 and grow at a CAGR of 15.3% by 2032.

The Digital Video Advertising Market Size was valued at USD 184.2 Billion in 2023 and is expected to reach USD 1018.1 Billion by 2032, growing at a CAGR of 20.9% over the forecast period 2024-2032.

The E-passport Market was valued at USD 32.67 Billion in 2023 and is expected to reach USD 145.45 Billion by 2032, growing at a CAGR of 18.08% over the forecast period 2024-2032.

The Federated Learning Market size was valued at USD 127.75 Million in 2023. It is expected to hit USD 341.92 Million by 2032 and grow at a CAGR of 11.60% over the forecast period of 2024-2032.

The Generative AI Market Size was valued at USD 20.21 Billion in 2023 and is expected to reach USD 440 Billion by 2032 and grow at a CAGR of 41.31% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone