Video Surveillance-as-a-Service Market Report Scope & Overview:

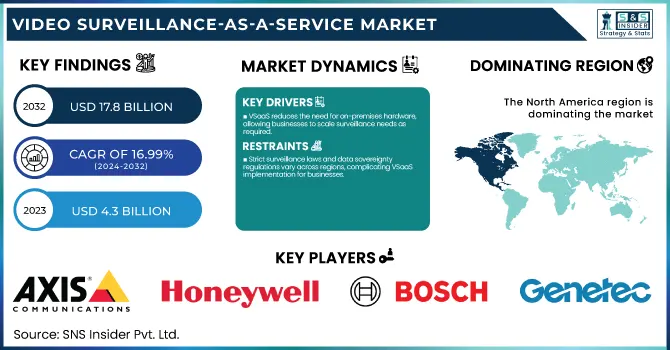

The Video Surveillance-as-a-Service Market was valued at USD 4.3 Billion in 2023 and is expected to reach USD 17.8 Billion by 2032, growing at a CAGR of 16.99% from 2024-2032. The VSaaS market is evolving with AI-based analytics, the Internet of Things, and edge computing, allowing us to detect threats in real-time. Video streaming benefits from various 5G developments, while encryption and compliance become paramount because of ever-climbing cybersecurity threats. Rising cloud adoption assists in scalable storage and remote monitoring, contributing to the noteworthy expansion of the market by having robust, cost-effective, and scalable surveillance solutions.

To Get more information on Video Surveillance-as-a-Service Market - Request Free Sample Report

Video Surveillance-as-a-Service Market Dynamics

Drivers

-

VSaaS reduces the need for on-premises hardware, allowing businesses to scale surveillance needs as required.

Video Surveillance-as-a-Service utilizes cloud-based infrastructure for video storage and monitoring, which minimizes traditional on-premises hardware dependence. VSaaS is far distinct from traditional surveillance setups that involve highly expensive servers, DVRs, and NVRs, as this is a subscription-based service that eliminates high capital investment on physical equipment. Not only does this switch to solutions minimize capital expenditures it also creates lower upkeep expenses as service providers manage and update systems, run cybersecurity processes, and store data remotely.

Scalability is one of the major benefits of using VSaaS, it gives businesses the flexibility to scale up or down their video surveillance capabilities as needed when security requirements change. Most traditional systems force you into a permanent hardware installation making adaptability an issue. By comparison, VSaaS allows organizations to deploy cameras on demand, scale their storage as needed, and even eliminate camera feeds without additional costs in data center space. But if they have multiple locations, the benefits of managing and monitoring security through a cloud-based platform are convenient.

Restraints

-

Strict surveillance laws and data sovereignty regulations vary across regions, complicating VSaaS implementation for businesses.

The Video Surveillance-as-a-Service market is struggling with the threat of privacy laws varying from region to region, along with data sovereignty and other regulations. To prevent infringements on privacy and security, governments enforce strict policies on data storage, transmission, and access which adds complexity to implementing cloud-based surveillance systems for businesses. The national security and citizen privacy policies in many countries mandate that surveillance data be stored locally, reason forcing VSaaS providers to deploy data centers in the region. Apart from inflating the costs, it also adds challenges while scaling services across geographies. There are additional challenges they can face with complying with certain regulations such as the General Data Protection Regulation in Europe, the California Consumer Privacy Act in the U.S., and China’s Cybersecurity Law. VSaaS providers have to implement appropriate measures for data protection, including encryption, access control, and audit trails, to comply with relevant laws. This has resulted in a fear of non-compliance leading to heavy penalties and reputation risk such that some businesses are holding back on adopting VSaaS solutions. The use of AI-based surveillance technologies like facial recognition is restricted in some other countries, which inhibits VSaaS providers from using these features.

Opportunities:

-

Growth in AI-powered analytics, 5G expansion, and increasing smart city investments.

Increasing adoption of technologies, including artificial intelligence-based analytics, facial recognition, and edge computing to enable cloud-based workflow will prove key growth opportunities for VSaaS markets. Cloud solutions are highly leveraged due to smart infrastructure, urban surveillance, and public safety program investments, driving market growth. Instead, VSaaS technology is being used by SMEs to enhance security at a one-off cost. The advent of 5G networks is enhancing connectivity efficiency and minimizing latency which can promote the most efficient real-time video monitoring. With advancements in data encryption and cybersecurity, privacy concerns are also being mitigated, and even more organizations are making the move to VSaaS to better ensure the security of their operations.

Challenges

-

Ensuring data security, regulatory compliance, and seamless integration with legacy systems.

Data protection remains one of the largest hurdles in the VSaaS market with regional laws including GDPR and CCPA requiring compliance. Cyberattacks, breaches, unauthorized access, and security risks will continue to take center stage, but cloud security protocols will need to evolve to strengthen themselves. Legacy systems can be difficult to integrate into VSaaS. Moreover, from the prospect of service reliability, downtime, and price and charge variability; the cloud provider is a third-party supplier and there is no direct control over it from the company. These challenges can only be overcome by constant innovation in enabling secure cloud storage, AI-driven threat detection, and better regulatory compliance measures to bring trust back in end-users.

Video Surveillance-as-a-Service Market Segment Analysis

By Type

The hosted VSaaS segment dominated the market and accounted for a revenue share of more than 46% in 2023, owing to cost-effectiveness, easy deployment, and less infrastructure required. Hosted solutions are more appealing to businesses as they do not require on site storage management, thus reducing initial capital expenses. Rising usages of cloud-based security among SMEs and enterprises and growing trends of AI-powered video analytics further boost the market.

the hybrid VSaaS segment will witness the fastest CAGR during 2024 – 2032, Due to the growing necessity for an equilibrium between cloud and on-premises surveillance. Some businesses still require high-security environments, for instance in government institutions, healthcare, and large enterprises, and those are increasingly turning toward hybrid models that allow them to maintain controlled local datasets, while also benefitting from cloud-based analytics and remote access. Increased apprehensions about data privacy, compliance with regulatory requirements, and cybersecurity threats also drive organizations towards hybrids. Hybrid surveillance capabilities will be further augmented by technological advancements such as edge computing and AI-driven analytics.

By Vertical

The commercial segment dominated the market and held the largest share of more than 39% in the VSaaS market in 2023, owing to the increasing adoption of the advanced security solution, especially in the retail and banking sector, hospitality, and office. Cloud-based surveillance has been creatively adopted by businesses of all sizes seeking to protect their property, eliminate pilferage, and bolster operational efficiency. This further encourages its use with AI-powered analytics, face identification, and remote observing joining it too. Forensic analysis follows and continues to fuel growth within the market owing to increased compliance with data protection regulations as well as the need for real-time surveillance in high-traffic regions.

The industrial segment will record a rapid CAGR between 2024 and 2032, Due to raising awareness among organizations towards workplace safety, asset protection, and safeguarding against hazardous environments to comply with industry rules and regulations. VSaaS is being implemented in manufacturing plants, warehouses, and energy facilities to monitor operations, recognize exceptions, and protect critical facilities from unauthorized access. IoT sensors combined with AI-assisted video analytics improve the analysis of risks and predictive, preventative maintenance.

Regional Landscape

North America held the largest market share of more than 36% of revenue share in 2023, As Commercial, government, and residential end-users in North America are among the highest adopters of VSaaS solutions across the region. The demand is further driven by the strong cybersecurity ecosystem of the region, extensive cloud adoption, and some regulatory compliance like GDPR-like laws & CCPA. Several key players are operating in the artificial intelligence surveillance market, which is attributable to the increasing demand for AI systems for surveillance applications in recent years.

Asia-Pacific is anticipated to experience the fastest CAGR from 2024-2032, due to urbanization, smart city projects, and the growing investment security infrastructure. This in turn is the reason why governments of countries such as China, India, Japan, etc., are utilizing AI-driven surveillance for public protection as well as traffic regulation. Due to expanding 5G networks, and cloud services, as well as IoT-driven security solutions, more opportunities in the market are greatly contributing to the growth of the market. As cyber and industrial security concerns are rising, the region will witness sustained momentum in the VSaaS uptake.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Axis Communications – AXIS Camera Station Cloud

-

Honeywell International Inc. – Honeywell MAXPRO Cloud

-

Bosch Security Systems – Bosch Remote Portal

-

ADT Inc. – ADT Cloud Video Surveillance

-

Eagle Eye Networks – Eagle Eye Cloud VMS

-

Cisco Systems, Inc. – Cisco Meraki MV Cameras

-

Avigilon (Motorola Solutions) – Avigilon Alta Cloud

-

Genetec Inc. – Genetec Stratocast

-

Panasonic i-PRO Sensing Solutions – i-PRO Video Surveillance Cloud

-

Hikvision Digital Technology – HikCentral Cloud

-

Dahua Technology – Dahua WizSense Cloud

-

Verint Systems Inc. – Verint EdgeVMS

-

VIVOTEK Inc. – VIVOTEK VAST Security Cloud

-

Brivo Inc. – Brivo Onair Video

-

Evolv Technology – Evolv Express Cloud

Recent Developments

-

In January 2024, SimpliSafe Launched Active Guard Outdoor Protection, an AI-powered outdoor camera with live monitoring by call center agents for real-time threat response.

-

In January 2024, Ring Introduced Smart Video Search, an AI-driven feature allowing users to quickly locate specific events in their recorded footage.

-

In September 2024, Reolink Unveiled the Atlas PT Ultra camera at IFA 2024, designed with advanced security features for improved surveillance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.3 Billion |

| Market Size by 2032 | USD 17.8 Billion |

| CAGR | CAGR of 16.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hosted, Managed, Hybrid) • By Vertical (Commercial, Industrial, Residential, Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Axis Communications, Honeywell International Inc., Bosch Security Systems, ADT Inc., Eagle Eye Networks, Cisco Systems Inc., Avigilon (Motorola Solutions), Genetec Inc., Panasonic i-PRO Sensing Solutions, Hikvision Digital Technology, Dahua Technology, Verint Systems Inc., VIVOTEK Inc., Brivo Inc., Evolv Technology |