Video Measuring System Market Size & Industry Trends:

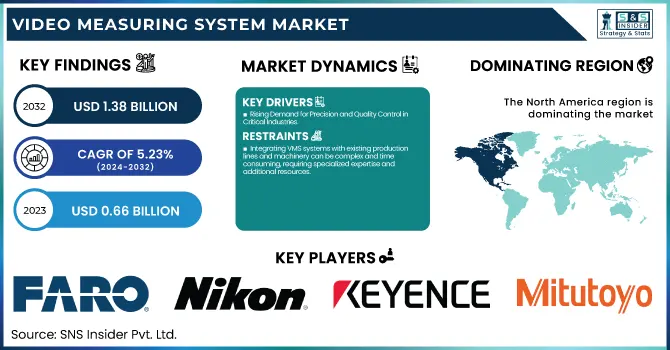

The Video Measuring System Market was valued at USD 0.66 Billion in 2023 and is projected to reach USD 1.38 Billion by 2032, growing at a CAGR of 5.23% from 2024 to 2032. The growth of the Video Measuring System (VMS) Market is primarily driven by the rising demand for high-precision measurements, automation, and improved quality control across industries such as automotive, aerospace, electronics, and healthcare. VMS systems help manufacturers enhance efficiency by reducing defects, improving accuracy, and speeding up production cycles, leading to cost savings and better operational performance.

To Get more information on Video Measuring System Market - Request Free Sample Report

In the U.S., the market contributed USD 0.18 billion in 2023 and is projected to grow at a CAGR of 4.41%, reaching USD 0.26 billion by 2032. Technological advancements in automation, AI, and machine learning are enabling faster and more accurate measurements, while the integration of Industry 4.0 technologies like IoT and cloud computing further accelerates growth by allowing real-time data analysis and predictive maintenance. Additionally, VMS systems support sustainable manufacturing practices by reducing material waste, optimizing resources, and improving energy efficiency, fostering broader adoption across industries.

Video Measuring System Market Dynamics:

Drivers:

-

Rising Demand for Precision and Quality Control in Critical Industries

Increasing demand for accuracy and quality control in various sectors including automotive, aerospace, electronics, and medical devices is a key factor driving the growth of the Video Measuring System market. There are numerous applications of precision measurement in manufacturing and healthcare. For instance, in automotive production, VMS systems are essential for inspecting parts such as engine components and body panels for defects. In the aerospace and medical device manufacturing sectors too, where it is critical to all the factors, VMS solution has proven to be highly effective in detecting even the minutest of defects, ensuring the reliability and usability of important components. This, in turn, drives the rapid implementation of VMS solutions in these industries as the need for high-precision measurements to enhance product quality and minimize defects grows.

Restraints:

-

Integrating VMS systems with existing production lines and machinery can be complex and time-consuming, requiring specialized expertise and additional resources.

Integrating Video Measuring System (VMS) solutions into existing production lines and machinery can be a complex and resource-intensive process. In automobile manufacturing, VMS systems make sure that components such as engine parts, chassis, and body panels are free from any defects in order to meet stringent quality standards. In aerospace, VMS plays a vital role in checking safety-critical components like turbine blades and fuselages for the safety of flights. Both industries focus heavily on regulatory compliance and high-precision measurements, which provides substantial opportunities for VMS adoption. Moreover, the demand for automation and efficient production processes in these sectors also necessitates VMS systems to ensure operational excellence and quality assurance.

Opportunities:

-

The growing demand for precision and quality control in the automotive and aerospace sectors presents significant expansion opportunities for VMS technologies.

VMS technologies are increasingly vital in the automotive and aerospace sectors due to the growing demand for precision, quality control, and safety. In automotive manufacturing, VMS systems ensure defect-free components like engine parts, chassis, and body panels, meeting stringent quality standards. In aerospace, VMS is essential for inspecting critical components such as turbine blades and fuselages to ensure flight safety. The emphasis on regulatory compliance and high-precision measurements in both industries presents significant opportunities for VMS adoption. Additionally, the push for automation and efficient production processes in these sectors further drives the need for VMS systems to maintain operational excellence and quality assurance.

Challenges:

-

The growing technological complexity of VMS systems, with advancements like 3D imaging and AI, challenges manufacturers in staying updated and maintaining compatibility.

As Video Measuring Systems (VMS) continue to advance with capabilities like 3D imaging, AI integration, and real-time data processing, their technological complexity also increases. VMS now offers enhanced precision, efficiency and versatility for industrial applications thanks to these innovations. The fast pace of technology development, however, also presents previously unknown challenges to manufacturers, who need to keep investing in training solutions, system upgrades, or expert advice to use their latest tools properly. With increasing sophistication in VMS systems also comes a steeper learning curve for operators, as well as the potential for system incompatibility with legacy equipment. Furthermore, the maintenance of such intricate systems entails periodic updates and troubleshooting, potentially resulting in increased operational costs and downtime. Hence manufacturers need to maintain an edge when it comes to technology and infrastructure to leverage VMS's potential.

Video Measuring System Market Segmentation Outlook:

By Offering

In 2023, the hardware segment dominated the Video Measuring System (VMS) market, contributing to around 39% of the total revenue. This dominance is owed to the critical nature of hardware in both the precision and accuracy of VMS systems. Resolution cameras, lasers, sensors and advanced optical and imaging equipment make up important components of VMS systems. With automotive, aerospace, electronics and many more industries requiring precise measurements for quality control and defect detection, the need for performance-hitting hardware has exploded. Also, advancements in sensor technology, camera resolution, and computational power are powering hardware segment growth, making it a significant factor in the market's growth.

The software segment is expected to be the fastest-growing in the Video Measuring System (VMS) market from 2024 to 2032. This growth is driven by advancements in software technologies that enhance the capabilities of VMS systems, such as AI-powered image processing, real-time data analysis, and automation for measurement tasks. Software plays a crucial role in improving the precision, speed, and efficiency of VMS systems by enabling advanced features like 3D modeling, automated defect detection, and predictive maintenance. As industries increasingly adopt Industry 4.0 technologies, the integration of VMS systems with software solutions, such as cloud computing, IoT, and machine learning, is gaining traction. This trend is expected to drive the demand for advanced software, leading to significant growth in the segment over the forecast period.

By Product

In 2023, the manual segment dominated the Video Measuring System (VMS) market, contributing to around 44% of the total revenue. This dominance stems from the widespread use of manual systems in industries where precision is crucial but automated solutions have not yet been fully adopted. Manual VMS systems offer flexibility and are often more affordable compared to their automated counterparts, making them appealing for small to medium-sized businesses or industries with less frequent measurement requirements. These systems typically require skilled operators to conduct measurements, which can be advantageous in scenarios where human judgment and expertise are needed. Despite the increasing adoption of automated and semi-automated systems, manual VMS still holds significant value in quality control processes, especially for companies that are transitioning to more advanced technologies or dealing with low-volume, high-precision tasks. As industries continue to evolve, the manual segment's importance is expected to remain substantial, although automation trends will likely shift market dynamics over time.

The Automated/CNC segment is expected to be the fastest-growing in the Video Measuring System (VMS) market from 2024 to 2032. This growth is fueled by the growing need for automation in manufacturing processes to enhance precision, speed, and efficiency. In VMS, the integration of CNC (computer numerical control) technology with automated systems can provide great accuracy and consistency than manual or semi-automated systems. These systems are able to perform high-throughput measurements with very little human intervention, which helps to minimize error rates and improves throughput in production. Now we have Industry 4.0 techs — robotics, AI, and machine learning — that are driving the adoption of automated systems even faster. As industries like automotive, aerospace, and electronics demand faster, more precise measurements, the Automated/CNC segment is expected to see significant growth during the forecast period.

By Application

In 2023, the automotive segment dominated the largest share of the Video Measuring System (VMS) market, contributing approximately 31% of the total revenue. The automotive industry requires high-precision measurement systems to ensure the quality, safety, and reliability of components such as engine parts, body panels, and chassis. VMS systems are essential for detecting defects, ensuring compliance with industry standards, and enhancing overall manufacturing efficiency. As vehicles become more complex, with the integration of advanced technologies such as electric powertrains and autonomous driving features, the demand for precise measurement solutions has grown significantly. This trend is expected to continue, as automotive manufacturers increasingly rely on VMS systems to maintain high-quality production standards while reducing waste and improving operational performance in an increasingly competitive market.

The aerospace and defense segment is expected to be the fastest-growing in the Video Measuring System (VMS) market from 2024 to 2032. This expansion is fueled by the rising needs for precision and safety in producing essential components like turbine blades, fuselages, and control surfaces. As stringent industry regulations and demand for the highest levels of safety and reliability rise, VMS systems are gaining traction for the inspection and measurement of aerospace and defense components making them a necessity in the process. As advancements in technology, such as 3D imaging and AI-driven measurements, continue to evolve, VMS systems offer enhanced accuracy, reducing defects and improving operational efficiency. This is further supported by the growing investments in defense technologies and the expansion of the aerospace sector, contributing to the segment’s rapid growth during the forecast period.

Video Measuring System Market Regional Landscape:

In 2023, North America dominated the Video Measuring System (VMS) market, accounting for approximately 40% of the total revenue. This dominance is primarily driven by the region's advanced manufacturing industries, including automotive, aerospace, electronics, and medical sectors, all of which require high-precision measurement solutions. The adoption of VMS systems in North America is fueled by the increasing demand for automation, quality control, and defect detection in manufacturing processes. Furthermore, the region’s focus on technological innovation, with advancements in AI, machine learning, and 3D imaging, has further accelerated the adoption of VMS systems. With a strong presence of key players and substantial investments in automation and manufacturing technologies, North America is expected to maintain its leading position in the VMS market over the forecast period.

The Asia Pacific region is expected to be the fastest-growing market for Video Measuring Systems (VMS) during the forecast period from 2024 to 2032. . High demand for manufacturing growth comes from manufacturing industries in countries like Japan, South Korea, China, and India, where automotive, electronics, and aerospace production is concentrated. This growth stimulates the demand for VMS technologies due to the rising focus on automation, quality control, and precision measurements in these sectors. Furthermore, the increasing utilization of Industry 4.0 technologies such as AI and IoT are further improving the capabilities and efficiency of VMS systems. The growing manufacturing capabilities in the region, as well as ongoing investments in advanced technologies, are anticipated to contribute to the growth of the VMS market in Asia Pacific during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

-

Faro Technologies (USA): FARO Laser Scanners, FARO Arm, FARO Quantum Laser Tracker, FARO Freestyle 3D Scanner

-

Nikon (Japan): Nikon Laser Displacement Sensors, Nikon Optical Profilers, Nikon Coordinate Measuring Machines (CMMs)

-

Keyence (Japan): Keyence Laser Displacement Sensors, Keyence Vision Systems, Keyence Measuring Microscopes

-

Mitutoyo (Japan): Mitutoyo CMMs, Mitutoyo Vision Measuring Systems, Mitutoyo Surface Roughness Testers, Mitutoyo Micrometers

-

Zeiss (Germany): Zeiss Coordinate Measuring Machines (CMMs), Zeiss Optical Microscopes, Zeiss Industrial Metrology Solutions

-

Brunson Instrument Company (USA): Brunson Precision Alignment Instruments, Brunson Metrology Equipment

-

Ametek (USA): Ametek Precision Instruments, Ametek Video Measuring Systems, Ametek Microscopes

-

Wenzel Group (Germany): Wenzel CMMs, Wenzel Laser Scanners, Wenzel Vision Measuring Systems

-

Vision Engineering (UK): Vision Engineering Measuring Microscopes, Vision Engineering Optical Instruments

-

GOM (Germany): GOM 3D Scanners, GOM Optical Measuring Systems, GOM Inspection Software

-

Trimble (USA): Trimble Laser Scanners, Trimble Metrology Solutions, Trimble 3D Measurement Systems

-

Creaform (Canada): Creaform 3D Scanners, Creaform Handyscan 3D, Creaform Metrology Solutions

-

OGP (USA): OGP Vision Measuring Systems, OGP Coordinate Measuring Machines, OGP Vision Systems

-

Renishaw (UK): Renishaw Probes, Renishaw CMMs, Renishaw Laser Measurement Systems

-

Hexagon (Sweden): Hexagon CMMs, Hexagon Laser Scanners, Hexagon Metrology Systems, Hexagon Vision Systems

List of key suppliers providing raw materials and components for the Video Measuring System (VMS) market:

-

3M (USA)

-

Schott AG (Germany)

-

Corning Inc. (USA)

-

Edmund Optics (USA)

-

Thorlabs (USA)

-

Mitsubishi Chemical Corporation (Japan)

-

Hamamatsu Photonics (Japan)

-

Canon Inc. (Japan)

-

Sony Corporation (Japan)

-

Omron Corporation (Japan)

-

SICK AG (Germany)

-

Laser Components GmbH (Germany)

-

Teledyne DALSA (Canada)

-

PI (Physik Instrumente) (Germany)

-

Panasonic Corporation (Japan)

Recent Development:

-

On January 27, 2025, FARO Technologies launched the FARO Leap ST handheld 3D scanner and updated its CAM2 Software for enhanced scanning and probing capabilities.

-

On January 2, 2025, Nikon launched the NEXIV VMF-K Series Video Measurement System, designed to improve semiconductor and electronic component inspection with stable micron-level measurements and enhanced throughput.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.66 Billion |

| Market Size by 2032 | USD 1.38 Billion |

| CAGR | CAGR of 8.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Product Type (Manual, Semi-automated, Automated/CNC) • By Application (Automotive, Aerospace & Defense, Heavy Machinery Industry, Energy & Power, Electronics, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Faro Technologies (USA), Nikon (Japan), Keyence (Japan), Mitutoyo (Japan), Zeiss (Germany), Brunson Instrument Company (USA), Ametek (USA), Wenzel Group (Germany), Vision Engineering (UK), GOM (Germany), Trimble (USA), Creaform (Canada), OGP (USA), Renishaw (UK), Hexagon (Sweden). |