Video Encoder Market Report Scope & Overview:

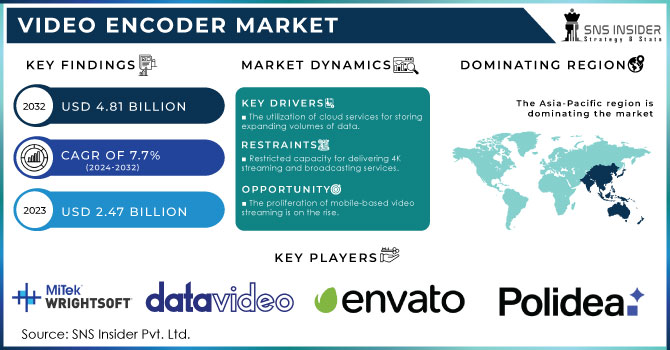

Video Encoder Market was valued at USD 2.40 billion in 2023 and is expected to reach USD 4.11 billion by 2032, growing at a CAGR of 6.19% from 2024-2032. This report includes insights into demand and adoption trends, while demonstrating a growing need for quality video streaming across industries. With a sub-focus on the impact of technology, it discusses supply chain & distribution related metrics. Pricing and cost analysis spanning factors of affordability, Consumer behaviour and usage analysis showing adoption trend in the security, entertainment and broadcasting. The second investment insight shows that funding is increasing for AI-driven and cloud-based encoding solutions.

Get more information on Video Encoder Market - Request Sample Report

Market Dynamics

Drivers

-

Growing Demand for High-Quality Video Streaming Drives Adoption of Advanced Encoding Technologies in OTT, Live Streaming, and Remote Broadcasting.

The rapid rise in OTT platforms, live streaming, and remote broadcasts creates the need for advanced video encoding solutions. While consumers reach into their pockets for high-quality, low-latency content access on multiple devices, service providers are acknowledging the very effective use of HEVC video compression and AWV to better utilize bandwidth while still overwhelming consumers with superior visual quality. This fuels further rapid SKI growth in OTT distribution as devices demand on-demand and real-time content streaming on smartphones, smart TVs, and connected devices. Additionally, the use of video encoders is being integrated in the business and education and entertainment sectors to amplify the virtual experience. Also, the shift towards cloud-based and AI-based encoding solutions provide seamless video deliveries thus highlighting the importance of these technologies by providers to maintain competitiveness in a growing digital market.

Restraints

-

High Initial Investment and Upgrade Costs Limit Adoption of Advanced Video Encoding Technologies in Streaming, Broadcasting, and Surveillance Applications.

One significant restraint to the video encoder market is high initial investment and upgrade costs. Hardware, software, and infrastructure upgrades that allow for the shift to high-efficiency encoding technologies like HEVC and AV1 demand huge upfront capital. To satisfy the increasing demand for high-quality video streaming, businesses, broadcasters, and service providers are compelled to perpetually invest in new encoding equipment, cloud deployments, or high-performance servers. In addition, there are ongoing operation costs in maintaining and upgrading such systems, using it with small and medium-sized enterprises difficult. Such cost constraints could curb market growth, particularly in price-sensitive regions or industries operating on tight budgets.

Opportunities

-

AI-Driven Video Encoding Optimizes Compression, Enhances Security, and Enables Personalized Content Delivery for Streaming, Surveillance, and Enterprise Applications.

The integration of artificial intelligence in video encoding is transforming the way video content is processed, transmitted, and consumed. AI actuated program optimizes compression efficiency by lowering bandwidth demands while still maintaining exceptional video quality. In security applications, AI forges accuracy with regard to susceptibility detection in real-time surveillance footage analyses. AI-based encoders could provide the personalization that adds to viewer engagement across all streaming platforms. Drive industries-driving into adoption: automation for commercial video enhancement, upscaling, and in-situ analytics. Evolving AI with improvements in encoding speed, quality, and responsiveness is changing the way streaming and broadcasting for intelligent content delivery will be done.

Challenges

- Cybersecurity Threats in Video Transmission Increase Risks of Hacking, Data Breaches, and Unauthorized Access in Streaming and Surveillance Applications.

With the increasing reliance on video streaming and surveillance systems, the risk of hacking, data breaches, and unauthorized access has become a major concern. Cyberattacks upon video streams carried over the networks, both public and private, may yield data leaks, content piracy, or even privacy violations. For surveillance, compromised video feeds may even bring about the danger of actual breach of security for the sensitive footage. It is pertinent to ensure end-to-end encryption, secure access control, and compliance with data protection regulations as the industry moves toward cloud-based and AI-encoded solutions. There's increasing investment ON IT-Security, blockchain technology, and AI-based detection mechanisms to protect video content from the moment they connect into embracing the digital video ecosystem.

Segment Analysis

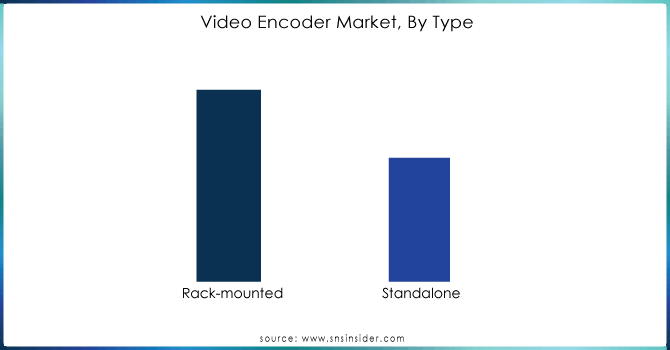

By Type

Rack-Mounted Encoders Led the Video Encoder Market with 75% Revenue Share in 2023, due to their high processing power, scalability, and integration capabilities in broadcasting, enterprise, and surveillance applications. These encoders support multi-channel video encoding, making them the preferred choice for large-scale content delivery networks, live streaming services, and IP-based surveillance systems. Their ability to handle high-resolution video formats with minimal latency ensures superior performance in professional setups.

Standalone Encoders to Grow at the Fastest CAGR of 7.63% from 2024 to 2032, due to the rising demand for portable, cost-effective, and flexible video streaming solutions. Their compact design and ease of deployment make them ideal for remote broadcasting, live events, and field surveillance. Increasing adoption in small-scale enterprises, educational institutions, and sports streaming is further driving demand. Additionally, the shift toward cloud-based video processing and AI-driven encoding enhances their appeal.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Surveillance Segment Dominated the Video Encoder Market with 61% Revenue Share in 2023, due to the increasing demand for advanced video security systems across industries like government, retail, banking, and transportation. The shift to IP-based cameras and real-time video monitoring has driven the need for high-quality video encoding to enhance security, traffic management, and public safety. Additionally, the rise of smart cities and heightened security concerns worldwide continue to fuel significant investments in video surveillance technology, contributing to the segment’s dominance.

The broadcasting segment is expected to grow at the fastest CAGR of 7.70% from 2024 to 2032, driven by the surging demand for high-definition, live streaming content. The increasing popularity of OTT platforms, sports events, and live news broadcasting has spurred investments in advanced video encoding technologies that support multiple resolutions and low-latency streaming. The transition to IP-based broadcasting and the need for scalable, cloud-based solutions further accelerate growth, positioning broadcasting as a high-growth segment.

By Number of channels

Multi-Channel Segment Led the Video Encoder Market with 68% Revenue Share in 2023 and is Expected to Grow at the Fastest CAGR of 6.97% from 2024 to 2032. The dominance of the multi-channel segment is driven by the growing demand for high-performance encoding solutions in broadcasting, surveillance, and live streaming. Multi-channel encoders enable simultaneous processing of multiple video feeds, making them ideal for applications such as news production, sports coverage, large-scale security monitoring, and enterprise communications. Their ability to optimize bandwidth, support high-definition formats, and reduce latency enhances their adoption. This segment is expected to grow at the fastest rate due to the increasing shift toward AI-driven video analytics, cloud-based encoding solutions, and rising demand for real-time multi-stream content.

Regional Analysis

North America dominated the Video Encoder market in 2023 with a 38% share, Due to its robust technological infrastructure and strong demand for advanced video streaming, North America leads the market, broadcasting, and surveillance solutions. The other drivers of this growth include growing adoption of IP-based security systems throughout the region, the escalation of OTT platforms, and the broad shift towards live streaming services. In addition, with key players of the video encoder being present and increasingly investing in cloud-based video processing and AI-based encoding technologies, North America has cemented itself as a leader in its domain.

The Asia-Pacific is expected to emerge as the fastest-growing market, which will grow at a CAGR of 7.87% from 2024 to 2032, driven by increasing digital content consumption, increased infrastructure spending, and the development of smart cities. Demand for economical and scalable video encoding solutions is growing as governments in the region adopt advanced surveillance systems and real-time video streaming. Focus on development in AI, integration of IoT, and cloud-based video platforms has positioned Asia Pacific as a high-growth region for the further years regarding video encoding technology.

Key Players

-

Hikvision (DS-6700 Series, M-Series)

-

VITEC (EZ TV, MGW Ace)

-

Harmonic (VOS360, Electra)

-

Motorola Solutions (VB400, WAVE PTX)

-

CISCO (Media Suite, UCS Server)

-

CommScope Holding Company Inc. (MPEG-4 Encoder, ME-7000)

-

Mediakind (Aquila Streaming, AVP 4000)

-

Cisco Systems Inc. (Encoder MediaPack, NCS Encoder)

-

Imagine Communications Corp. (Selenio, Versio)

-

Hangzhou Hikvision Digital Technology Co., Ltd. (DS-9600 Series, DS-6700 Series)

-

Telairity (VITEC) (BE8500, BC8100)

-

E Right Soft (Super Encoder, Riva FLV Encoder)

-

Panasonic (AW-UE150, AV-HLC100)

-

Axis Communications AB (M7011, P7304)

-

Niagara Video Corporation (Niagara 9300, GoStream)

-

Datavideo (NVS-33, NVD-30)

-

March Networks (Command Video Encoder, ME4 Series)

-

Elecard (CodecWorks, StreamEye)

-

Cathexis Technologies (CathexisVision, CatEncoder)

-

Haivision (Makito X4, Kraken)

Recent Developments:

-

In 2024, Hikvision launched the DS-7716NI-I4 (B) Network Video Recorder, a 16-channel 4K NVR capable of decoding up to 32 MP for a single channel and supporting up to 16 IP cameras.

-

In 2024, Axis Communications introduced the ARTPEC-9 system-on-chip (SoC), featuring AV1 video encoding for improved streaming with low bitrates and high image quality, to be integrated into select products starting in 2025

-

In 2024, Harmonic unveiled AI-powered innovations for live sports streaming, targeted advertising, and production workflows at IBC2024. These advancements are set to transform video streaming and broadcast delivery

| Report Attributes | Details |

| Market Size in 2023 | USD 2.40 Billion |

| Market Size by 2032 | USD 4.11 Billion |

| CAGR | CAGR of 6.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Number of Channels (Single Channel, Multi-Channel) • By Type (Standalone Encoders, Rack-Mounted Encoders) • By Application (Broadcasting, Surveillance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hikvision, VITEC, Harmonic, Motorola Solutions, CISCO, CommScope Holding Company Inc., Mediakind, Cisco Systems Inc., Imagine Communications Corp., Hangzhou Hikvision Digital Technology Co., Ltd., Telairity (VITEC), E Right Soft, Panasonic, Axis Communications AB, Niagara Video Corporation, Datavideo, March Networks, Elecard, Cathexis Technologies, Haivision |