Get More Information on Veterinary Vaccines Market - Request Sample Report

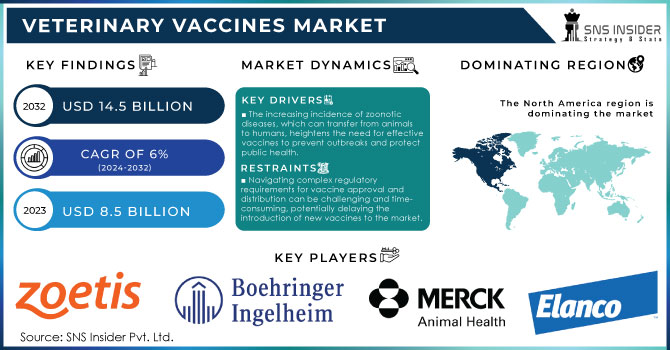

The Veterinary Vaccines Market size was valued at USD 8.5 Billion in 2023 and is expected to reach USD 14.5 Billion By 2032 and grow at a CAGR of 6% over the forecast period of 2024-2032.

The veterinary vaccine market is an important segment of the global healthcare industry and has considerable importance in animal health management. The market includes thousands of vaccines, which have been developed to provide animals with immunity against all sorts of diseases, from domestic pets to livestock and wild animals. A raised awareness of animal health and the incidence of zoonotic diseases, which are diseases that occur across species from animals to humans, forms one of the major growth drivers for veterinary vaccine demand.

Veterinary Vaccines Demand Several factors drive the demand for veterinary vaccines. With healthy growth in the pet population, especially in developed economies, there is a need for companion animals to be healthy and live long lives. In developing regions, the health status of livestock is significantly improving to ensure food security and increase agricultural productivity. The high prevalence of diseases such as foot-and-mouth, avian influenza, and rabies is another significant driver for veterinary vaccines. Rising investment in the healthcare for pets and advances in technology regarding vaccines besides an increased focus on preventive care are also witnessing a high traction for veterinary vaccines.

There is a strong pipeline of vaccine products and is currently the subject of ongoing R&D activities. Major pharmaceutical companies and specialized biotech firms are actively developing innovative vaccines in response to emerging as well as existing animal health challenges. There is a distribution network in place in the market, including veterinary clinics, animal hospitals, and agricultural cooperatives.

The veterinary vaccines market is segmented based on type. This includes inactivated vaccines, live attenuated vaccines, and recombinant vaccines. The market also varies by animal type. This includes companion animals and livestock. Regional differentiation also occurs, primarily between North America and Europe, with Europe being more developed in veterinary healthcare systems. This market is experiencing growth in the Asia-Pacific region, driven by increased livestock farming and rising disposable incomes. However, this market faces some regulatory hurdles, very high development costs, and the need to constantly innovate to respond to changing disease patterns.

Overall, the market for veterinary vaccines is rising with an increasing awareness of the fact that there is a problem to be addressed, in addition to modern technologies.

Drivers of the Veterinary Vaccines Market

Increasing Animal Health Awareness: Growing awareness about the importance of animal health and disease prevention is driving the demand for veterinary vaccines. Pet owners and livestock farmers are increasingly prioritizing vaccination to maintain the health and productivity of animals.

Rising Incidence of Zoonotic Diseases: The increasing incidence of zoonotic diseases, which can transfer from animals to humans, heightens the need for effective vaccines to prevent outbreaks and protect public health.

Advancements in Vaccine Technology: Innovations in vaccine technology, such as the development of recombinant and DNA vaccines, enhance the efficacy and safety of vaccines, driving their adoption in veterinary practices.

Growing Pet Ownership: The rising pet population, particularly in developed regions, drives demand for vaccines to ensure the health and well-being of companion animals, leading to a robust market for pet vaccines.

Regulatory Support and Government Initiatives: Supportive regulatory frameworks and government initiatives promoting vaccination programs for livestock and companion animals contribute to market growth. Subsidies and financial incentives for vaccination in agriculture also play a role.

Increasing Focus on Preventive Care: The shift towards preventive care in veterinary medicine encourages early intervention through vaccination, reducing the incidence of severe diseases and enhancing overall animal health.

Restraints of the Veterinary Vaccines Market

High Development and Production Costs: The development and production of veterinary vaccines involve significant investment in R&D and manufacturing processes. High costs can limit the availability and affordability of vaccines, particularly in low-income regions.

Regulatory Challenges: Navigating complex regulatory requirements for vaccine approval and distribution can be challenging and time-consuming, potentially delaying the introduction of new vaccines to the market.

Limited Awareness in Developing Regions: In some developing regions, there is a lack of awareness about the benefits of veterinary vaccines, which can result in lower vaccination rates and reduced market potential.

Risk of Adverse Reactions: Although rare, adverse reactions to vaccines can occur, which may affect their acceptance among pet owners and farmers. Ensuring vaccine safety and managing any negative reactions is crucial for maintaining trust in vaccination programs.

By Type

Live Attenuated Vaccines: These vaccines employ weakened pathogens. They said that these can evoke good immunity without causing the disease. It is very effective in giving long-term immunity and is one of the most commonly used vaccines. This category is very important for diseases such as rabies, distemper, and parvovirus.

Inactivated Vaccines: Inactivated vaccines contain killed pathogens and elicit a protective immune response without a risk of causing disease. Inactivated vaccines are commercially very widely used in many vaccines for bacterial infections and some viral diseases, including foot-and-mouth disease and avian influenza.

Subunit, Recombinant, and Conjugate Vaccines: These utilize components of the pathogens to invoke immunity. This is used for conditions in which a live or attenuated vaccine cannot be administered for a specific type of cancer or complicated infection.

DNA and mRNA Vaccines: New methods in vaccine development, DNA and mRNA vaccines utilize genetic information to provoke an immune response. They provide the benefits of accelerated and custom development, thus promising much for the future of veterinary science.

By Application

Companion Animals: This category includes vaccines for companion animals such as dogs, cats, and horses. Companion animal vaccines are a major product offered and serve as a means of prevention against diseases such as parvovirus and feline leukemia in cats and kennel cough in dogs. The trend of pet ownership is growing and has been crucial for this category's growth.

Livestock - Vaccines against cattle, poultry, and pigs are administered to prevent diseases among animals and thus affect animal health and productivity. Some of the most common vaccines in this category include foot-and-mouth disease, avian influenza, and swine flu.

Wildlife: Animal vaccines in the wild can prevent diseases among animals in their natural habitat. Such measures enhance societal units' control over the outbreak of zoonotic diseases and conservation. Examples include rabies vaccines in wild animal populations.

North America:

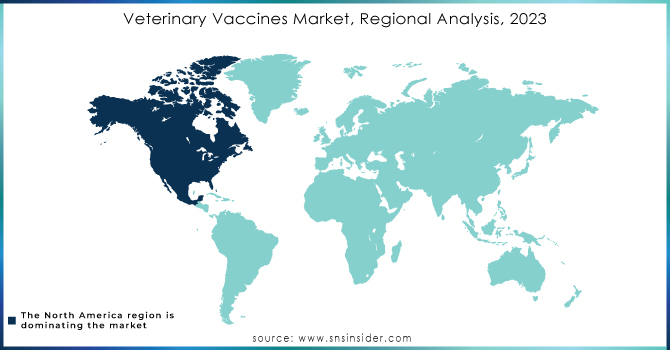

The US and Canada are the largest contributors to the veterinary vaccines market in North America, accounting for a large pet population, significant investments in veterinary research, and high penetration of advanced veterinary practices. The market will also experience rapid advancement in the North American region owing to vast investment in veterinary research.

Europe:

Europe still experiences an increased demand for veterinary vaccines, as the awareness of the welfare of animals is improving, along with strict judgments and laws related to the health issues of animals and the continued development of vaccines. In terms of growth, the leading countries are Germany, France, and the UK.

Asia-Pacific:

The Asia-Pacific region will continue to grow, more so in the context of growth in the regional livestock population, increasing pet ownership, and an improvement in healthcare infrastructure within the emerging markets of China and India, as well as Japan. Investments are also on the rise in veterinary research and development.

Latin America, Middle East & Africa:

This region is diversified concerning market maturity. Rising agricultural activities, increasing awareness about animal health, and investments in veterinary healthcare are contributing to the growth of the market.

Need any customization research on Veterinary Vaccines Market - Enquiry Now

Boehringer Ingelheim

Elanco Animal Health

Ceva Santé Animale

Virbac

Phibro Animal Health Corporation

HIPRA

Biogenesis Bago

Neogen Corporation

Idexx Laboratories

Indian Immunologicals Ltd.

Dechra Pharmaceuticals

In May 2024, MSD Animal Health, a division of Merck & Co., Inc., based in Rahway, N.J., USA, received marketing authorization from the European Commission for their INNOVAX-ND-H5 vaccine, specifically designed for chickens.

In June 2024, at the World Buiatrics Congress held in Mexico, HIPRA unveiled its new DIVENCE range of vaccines. These advanced vaccines are aimed at significantly improving the prevention of major viral diseases in cattle.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.5 Billion |

| Market Size by 2032 | US$ 14.5 USD Billion |

| CAGR | CAGR of 6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Live Attenuated Vaccines, Inactivated Vaccines, Subunit, Recombinant, and Conjugate Vaccines, DNA and mRNA Vaccines) • By Application (Companion Animals, Livestock, Wildlife) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe [Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health, Ceva Santé Animale, Virbac, Phibro Animal Health Corporation, Vetoquinol, HIPRA, and other players. |

| Key Drivers | • Rising incidence of zoonotic diseases • Surging demand for animal-derived food products |

| Market Oportunities | • Expansion of companion animal healthcare • Innovation in vaccine delivery systems |

Ans: The estimated compound annual growth rate is 6% during the forecast period for the Veterinary Vaccines market.

Ans: The projected market value of the Veterinary Vaccines market is estimated at USD 8.5 Billion in 2023 and is expected to reach USD 14.5 billion by 2032.

Ans: Growing awareness about the importance of animal health and disease prevention is driving the demand for veterinary vaccines.

Ans: High costs can limit the availability and affordability of vaccines, particularly in low-income regions.

Ans: North America is the dominant region in the Veterinary Vaccines market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Veterinary Vaccines Market Segmentation, by Type

7.1 Chapter Overview

7.2 Live Attenuated Vaccines

7.2.1 Live Attenuated Vaccines Market Trends Analysis (2020-2032)

7.2.2 Live Attenuated Vaccines Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Inactivated Vaccines

7.3.1 Inactivated Vaccines Market Trends Analysis (2020-2032)

7.3.2 Inactivated Vaccines Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Subunit, Recombinant, and Conjugate Vaccines

7.4.1 Subunit, Recombinant, and Conjugate Vaccines Market Trends Analysis (2020-2032)

7.4.2 Subunit, Recombinant, and Conjugate Vaccines Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 DNA and mRNA Vaccines

7.5.1 DNA and mRNA Vaccines Market Trends Analysis (2020-2032)

7.5.2 DNA and mRNA Vaccines Market Size Estimates and Forecasts to 2032 (USD Million)

8. Veterinary Vaccines Market Segmentation, by Application

8.1 Chapter Overview

8.2 Companion Animals

8.2.1 Companion Animals Market Trends Analysis (2020-2032)

8.2.2 Companion Animals Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Livestock

8.3.1 Livestock Market Trends Analysis (2020-2032)

8.3.2 Livestock Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Wildlife

8.4.1 Wildlife Market Trends Analysis (2020-2032)

8.4.2 Wildlife Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.4 North America Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.5.2 USA Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.6.2 Canada Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Mexico Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.6.2 France Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.7.2 UK Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 China Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 India Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 Japan Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.6.2 South Korea Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.8.2 Singapore Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.9.2 Australia Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.4 Middle East Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.4 Africa Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Veterinary Vaccines Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.4 Latin America Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.5.2 Brazil Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.6.2 Argentina Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.7.2 Colombia Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Veterinary Vaccines Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Veterinary Vaccines Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 Vetoquinol S.A.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Services/ Services Offered

110.1.4 SWOT Analysis

10.2 HIPRA

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Services/ Services Offered

10.2.4 SWOT Analysis

10.3 IDEXX Laboratories, Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Services/ Services Offered

10.3.4 SWOT Analysis

10.4 Virbac

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Services/ Services Offered

10.4.4 SWOT Analysis

10.5 Ceva Animal Health

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Services/ Services Offered

10.5.4 SWOT Analysis

10.6 Bayer Animal Health

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Services/ Services Offered

10.6.4 SWOT Analysis

10.7 Boehringer Ingelheim Animal Health

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Services/ Services Offered

10.7.4 SWOT Analysis

10.8 Elanco Animal Health

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Services/ Services Offered

10.8.4 SWOT Analysis

10.9 Merck Animal Health

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Services/ Services Offered

10.9.4 SWOT Analysis

10.10 Zoetis Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Services/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Type:

Live Attenuated Vaccines

Inactivated Vaccines

Subunit, Recombinant, and Conjugate Vaccines

DNA and mRNA Vaccines

By Application:

Companion Animals

Livestock

Wildlife

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Mass Spectrometry in Precision Medicine Market is growing significantly and is expected to expand at a CAGR of around 8.01% from 2024-2032.

The Pet Sitting Market was valued at USD 2.62 billion in 2023 and is expected to reach USD 6.5 billion by 2032, growing at a CAGR of 10.64% over the forecast period 2024-2032.

The Cell Separation Market Size was valued at USD 9.55 Billion in 2023 and is expected to reach USD 30.15 Billion by 2032, growing at a CAGR of 13.63% over the forecast period of 2024-2032.

The Scanning Electron Microscopes Market Size was valued at USD 4.75 Billion in 2023, and is expected to reach USD 9.36 Billion by 2032, and grow at a CAGR of 9.77%.

The global Biologics Market size valued at USD 433.77 billion in 2023, is projected to reach USD 977.36 billion by 2032, growing at 9.46% CAGR from 2024-2032.

The Veterinary Vaccines Market size was valued at USD 8.5 Billion in 2023 and is expected to reach USD 14.5 Billion By 2032 and grow at a CAGR of 6% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone