Veterinary Imaging Market Size & Overview:

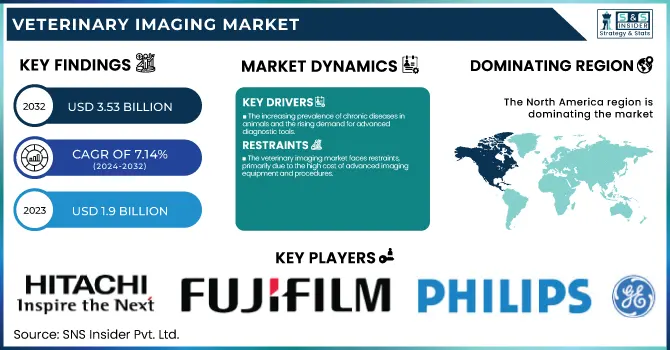

The Global Veterinary Imaging Market was valued at USD 1.9 billion in 2023 and is projected to grow at a CAGR of 7.14% from 2024 to 2032, reaching USD 3.53 billion by 2032.

Get More Information on Veterinary Imaging Market - Request Sample Report

This Report illustrates the growing occurrence and prevalence of veterinary illness, propelling the need for next-generation imaging technology, and evaluates regional veterinary health spending, comprised of government appropriation, commercial funding, private health expenditure, and out-of-pocket expenses. It discusses technical breakthroughs in veterinary imaging technology, including artificial intelligence-based diagnosis and mobile imaging solutions, while providing an evaluation of veterinary imaging fee trends and its availability across regions. Furthermore, it determines the increasing demand for point-of-care veterinary imaging as a consequence of the desire for quicker diagnosis, and calculates the replacement rate and life span of imaging technology, influencing purchase behavior and general market trends.

Veterinary Imaging Market Dynamics

Drivers

-

The increasing prevalence of chronic diseases in animals and the rising demand for advanced diagnostic tools.

With an increasing number of pets, there is an increased prevalence of diseases like arthritis, cancer, and cardiovascular disease in companion animals, making the application of imaging modalities such as X-ray, MRI, and ultrasound necessary. Furthermore, advances in technology, such as AI-based imaging analysis and handheld imaging equipment, are enhancing diagnostic precision and accessibility. The rising spending on pet health is another key factor, with owners of pets shelling out more for advanced diagnosis and treatment. For instance, the American Pet Products Association (APPA) has noted that U.S. pet owners spent more than USD 35 billion on veterinary care and diagnostics in 2023. The growing application of telemedicine and cloud-based PACS (Picture Archiving and Communication Systems) also contributes to market growth by enabling veterinarians to remotely access and analyze images. Moreover, growing awareness of livestock health, fueled by food safety issues and government regulations, is boosting the use of imaging solutions in the agricultural industry. With more veterinary clinics adopting advanced imaging technologies, the demand for advanced and affordable diagnostic tools is likely to keep growing.

Restraints

-

The veterinary imaging market faces restraints, primarily due to the high cost of advanced imaging equipment and procedures.

MRI and CT scanners, for example, demand high investment with prices between USD 150,000 and USD 500,000, hence being out of reach for smaller veterinary clinics. Moreover, high imaging service charges deter pet owners from seeking enhanced diagnostic tests, particularly in lower disposable income areas. An MRI scan for one pet can charge anywhere from USD 1,500 to USD 2,500, thereby being a very costly affair. Another limitation is the unavailability of trained veterinary radiologists, thereby restricting the full utilization of advanced imaging modalities. Most veterinarians continue to use conventional methods of diagnosis as a result of the unavailability of trained professionals to interpret the results of complicated imaging. In addition, the lengthy approval process for veterinary imaging equipment by regulatory bodies, including the FDA and the European Medicines Agency (EMA), holds back the entry of new technologies into the market. These regulatory barriers and compliance expenses pose challenges to manufacturers seeking to diversify their product offerings. Consequently, even with high demand, these economic and logistical hurdles slow down the mass adoption of advanced veterinary imaging solutions.

Opportunities

-

The veterinary imaging market presents several growth opportunities, particularly with the rise of artificial intelligence (AI) and machine learning in diagnostic imaging.

AI-based imaging technologies have the potential to improve diagnostic precision and enable image interpretation without the need for trained radiologists. Firms like SignalPET and Vetology AI already have AI-based veterinary radiology technology under development, augmenting efficiency in diagnostic processes. The use of portable and point-of-care imaging equipment is growing considerably, especially among rural and mobile veterinary clinics. Portable X-ray units and handheld ultrasound devices allow veterinarians to make on-the-spot diagnoses in rural locations, enhancing access to imaging solutions. Growing pet insurance uptake is also set to boost demand, as increasing numbers of pet owners take out policies that cover diagnostic imaging services. The North American Pet Health Insurance Association (NAPHIA) finds that more than 4 million pets were insured in 2023, with image costs covered under most policies. In addition, increasing demand for sophisticated veterinary treatments such as oncology, neurology, and cardiology is encouraging veterinary clinics to invest in sophisticated imaging equipment. With ongoing investment in R&D and an expansion of veterinary facilities, the market is anticipated to see additional innovation and increased accessibility of imaging solutions.

Challenges

-

The limited reimbursement policies for veterinary diagnostic procedures, which often results in high out-of-pocket expenses for pet owners.

Compared to human health, where diagnosis imaging is typically insured, animal imaging is generally self-funded and therefore not being widely used. Equipment maintenance, too, becomes a huge constraint for veterinary centers, as state-of-the-art machines need continuous servicing, new software, and specialized experts on a regular basis, increasing their economic burden on veterinary centers. Another limitation is the absence of standardization in veterinary imaging procedures, which impinges on diagnostic precision and consistency. Unlike human medicine, veterinary imaging lacks a set of universal imaging guidelines, resulting in inconsistencies in diagnosis and treatment planning. In addition, radiation exposure issues in veterinary X-ray and CT imaging are a challenge, given that regulatory agencies stress greater safety standards for veterinary clinicians and pet owners. The gradual uptake of advanced imaging in developing markets owing to affordability limitations and a lack of veterinary infrastructure further limits market growth. This can be overcome through cooperation between industry stakeholders, regulatory authorities, and veterinary schools to enhance affordability, accessibility, and technological harmonization in veterinary imaging.

Veterinary Imaging Market Segmentation Insights

By Product

The X-ray segment held the largest share of revenue, at 37.7%, in 2023 for the veterinary imaging market. The prevalence of using X-ray imaging to diagnose fractures, arthritis, and respiratory disorders in both small and large animals made it the leader in the market. Its cost-effectiveness, rapid results, and availability in veterinary hospitals and clinics also promoted its use.

The video endoscopy segment is anticipated to be the fastest-growing segment. The rising demand for minimally invasive diagnostic procedures, especially in gastrointestinal and respiratory tests, is driving its growth. Developments in flexible and high-resolution endoscopic systems are also driving its adoption among veterinarians.

By Solutions

The equipment segment held the highest share of revenue of 55.7% in 2023. The expensive nature of imaging equipment like X-ray machines, ultrasound machines, and MRI scanners was a major factor behind the dominance of the segment. The increasing presence of veterinary hospitals and clinics that have this advanced diagnostic equipment also strengthened its market leadership.

The PACS (Picture Archiving and Communication System) segment is expected to expand at the highest rate. The growing requirement for storing digital images, remote access to diagnostic images, and smooth integration with telemedicine solutions are fueling the demand for PACS in veterinary imaging.

By Animal Type

The small animals segment accounted for the highest share of 69.4% in 2023 due to the increasing trend of pet ownership, growing healthcare spending on companion animals, and rising awareness of preventive diagnostics. Dogs and cats account for most veterinary imaging procedures such as orthopedic, dental, and cardiology applications, hence dominating the segment.

The small animals segment is also projected to expand at the highest growth rate during the forecast period. The humanization of pets, technological improvements in imaging technology specific to small animals, and the rising incidence of long-term conditions like cancer and arthritis in pets are major drivers of its higher growth.

By Application

The orthopedics and traumatology segment led the market in 2023 with a revenue share of 37.8%. The prevalence of bone fractures, joint diseases, and ligament injuries, particularly among active and elderly pets, was responsible for the segment's dominance. The need for accurate imaging modalities, such as X-ray and MRI, for the diagnosis of musculoskeletal disorders further increased its uptake.

The oncology segment will witness the highest growth. Increasing incidence of cancer in pets and rising awareness along with technological developments in imaging technologies like MRI and CT for detecting tumors at early stages are spurring the rapid growth of the segment. Increasing use of targeted cancer therapies in veterinary medicine is also boosting demand for sophisticated imaging solutions.

By End-use

The veterinary hospitals and clinics segment commanded the largest market share of 64.9% in 2023. The dominance of this segment can be contributed to the ubiquitous availability of sophisticated imaging technologies, the rising number of patient visits for diagnostic imaging procedures, and the rising number of specialized veterinary healthcare centers. Veterinary hospitals and clinics provide a complete array of imaging services, thereby being the prime end-users of diagnostic imaging devices.

The segment of veterinary clinics and hospitals is also anticipated to expand at the highest rate. The trend towards pet insurance coverage, increased investments in veterinary facilities, and escalating demand for advanced imaging services are major drivers contributing to the growth of the segment at a very high rate. The growth of multi-specialty veterinary centers is also supporting its high growth path.

Veterinary Imaging Market Regional Analysis

North America led the in the veterinary imaging market in 2023, with a revenue share of 41.2%. Its leadership is especially influenced by the high uptake of advanced imaging technologies, a developed veterinary healthcare infrastructure, and the rising incidence of chronic diseases among companion animals. The growing pet population, coupled with increased expenditure on pet healthcare, has driven demand for diagnostic imaging products. Moreover, the market presence of influential players, on-going technology progress, and telemedicine's expanding use have contributed to the prevalence of the veterinary imaging market in North America further. Pet insurance availability and policy support by government for veterinary health also influence the region's stable market position considerably.

The veterinary imaging market of the Asia-Pacific region is forecasted to emerge as the region with the fastest growth. The growth of veterinary healthcare facilities at a rapid pace, rising pet health awareness, and the growing number of pets being adopted in nations like China, India, and Japan are central drivers propelling the growth of the market. Moreover, economic growth and growing disposable income are driving expenditure on pets' diagnostics and treatments. The growing need for sophisticated imaging modalities, combined with an expanding number of veterinary hospitals and clinics, is driving the adoption of veterinary imaging solutions in the Asia-Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

List of Key Players and Their Veterinary Imaging Products

-

IDEXX Laboratories, Inc. – Digital Radiography, Ultrasound Systems, PACS

-

ESAOTE S.p.A. – Veterinary Ultrasound Systems, MRI Scanners

-

Mars, Inc. – Veterinary Diagnostic Imaging Solutions

-

GE HealthCare – X-ray Systems, Ultrasound, CT, MRI for Veterinary Use

-

Midmark Corporation – Veterinary Digital X-ray Systems, Dental Imaging

-

FUJIFILM Holdings America Corporation – Digital Radiography, PACS, Veterinary Ultrasound

-

Hallmarq Veterinary Imaging – MRI and CT Imaging for Companion and Equine Animals

-

Canon Medical Systems Corporation – Veterinary Ultrasound, X-ray, CT Imaging

-

Shenzhen Mindray Animal Medical Technology Co., Ltd. – Veterinary Ultrasound, X-ray, CT Systems

-

IMV Imaging – Veterinary Ultrasound, X-ray Systems, PACS

Recent Developments in Veterinary Imaging Market

In Oct 2024, WOORIEN Co., Ltd. introduced 'MyVet CT Plus', an advanced veterinary imaging solution and successor to the 'MyVet CT i3D', the world’s first animal spiral CT launched in 2018. This latest innovation enhances imaging capabilities for veterinary diagnostics.

In April 2024, Antech launched two breakthrough veterinary diagnostic tools: AIS RapidRead, an AI-powered radiology solution for faster radiograph interpretation, and the Nu.Q Canine Cancer Test, an in-house screening tool for early cancer detection. These innovations enhance clinical decision-making and improve patient outcomes.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.9 billion |

| Market Size by 2032 | USD 3.53 billion |

| CAGR | CAGR of 7.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [X-ray, Ultrasound, MRI, CT Imaging, Video Endoscopy] • By Solutions [Equipment, Accessories/ Consumables, PACS] By Animal Type [Small Animals, Large Animals] • By Application [Orthopedics and Traumatology, Oncology, Cardiology, Neurology, Respiratory, Dental Application, Other] • By End-use [Veterinary Hospitals & Clinics, Other End-use] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IDEXX Laboratories, Inc., ESAOTE S.p.A., Mars, Inc., GE HealthCare, Midmark Corporation, FUJIFILM Holdings America Corporation, Hallmarq Veterinary Imaging, Canon Medical Systems Corporation, Shenzhen Mindray Animal Medical Technology Co., Ltd., IMV Imaging |