Veterinary Clinical Trials Market Report Scope & Overview:

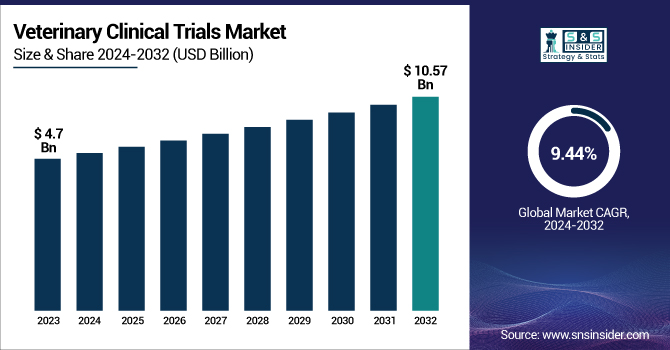

The Veterinary Clinical Trials Market Size was valued at USD 4.7 Billion in 2023 and is expected to reach USD 10.57 billion by 2032, growing at a CAGR of 9.44% over the forecast period 2024-2032.

This report provides key statistical insights and trends in the Veterinary Clinical Trials Market, focusing on the prevalence and incidence of veterinary diseases, alongside regional drug usage and prescription trends. It also analyzes clinical trial volumes globally, with a breakdown by region. Additionally, the report delves into healthcare spending for veterinary clinical trials, covering government funding, private investments, and out-of-pocket expenses by animal owners. Key insights include enrollment data by animal type, highlighting companion animals and livestock, and a review of regulatory compliance and approval timelines by region, offering a comprehensive view of the evolving veterinary clinical trial landscape.

To Get more information on Veterinary Clinical Trials Market - Request Free Sample Report

The veterinary clinical trials market is driven by advancements in veterinary medicine, increasing pet ownership, and the rising prevalence of chronic diseases in animals. According to the U.S. FDA’s Center for Veterinary Medicine (CVM), regulatory support for veterinary drug approvals has significantly expanded, bolstering clinical trial activities. The United States has demonstrated a steady growth trajectory, with market size was USD 1.21 billion in 2023, the value rises consistently each year, expected to reach USD 2.70 Billion by 2032 with a significant annual growth rate. The growing focus on animal welfare and zoonotic disease prevention further fuels the demand for innovative treatments. Additionally, initiatives like India’s All-India Institute of Veterinary Sciences (AIIVS) in October 2023 highlight global efforts to enhance veterinary research facilities. The veterinary clinical trials market is witnessing significant growth due to increased awareness about animal health and welfare, coupled with advancements in veterinary science. Governments worldwide are prioritizing animal healthcare through funding and regulatory support.

Market Dynamics

Drivers

-

The increasing prevalence of animal diseases, including chronic ailments like cancer in pets, has heightened the demand for effective treatments, thereby driving the need for veterinary clinical trials.

The global veterinary clinical trials market is growing at a rapid pace, driven primarily by the growing pet population and increasing expenditure on veterinary care. In 2024, there are approximately 1 billion pets on the planet, with the most cats being owned, followed closely by men, where about 52% of male pet owners have cats while only about 48% of female pet owners have cats. In the United States, pet ownership has reached notable levels, with 66% of households, equating to 86.9 million homes, owning a pet. This trend is mirrored in Europe, where 56% of households own a cat or dog, and in Asia-Pacific regions, where 32% of households own a dog and 26% own a cat.

Correspondingly, expenditures on veterinary care have surged. In the U.S., the veterinary healthcare market is experiencing robust growth, driven by increasing pet ownership, a rising emphasis on animal health, and advancements in diagnostic technologies. This surge in pet ownership and veterinary spending has led to a heightened demand for advanced veterinary services, including clinical trials for new treatments and medications. The U.S. Department of Agriculture's Veterinary Services Grant Program, for example, awards funding for educational, extension, and training programs to improve veterinary services, which help stimulate the generation of clinical trials in veterinary medicine. Veterinary Clinical Trials Market is predicted to get up to US$ 3.24 Victuals by 2024 owing to the increasing global pet population, rising expenditures on veterinary care, and growing alignment of pharmaceutical companies towards developing veterinary medicines.

Restraint

-

The high costs associated with conducting veterinary clinical trials pose significant financial challenges for research organizations and pharmaceutical companies.

High costs associated with veterinary clinical trials are a major challenge to the growth of the market. Like their human counterparts, veterinary clinical trials require a significant investment of resources for research and development and compliance with regulatory requirements. One of the major hurdles is the expensive nature of animal care and maintenance for trials. The mean animal per clinical trial and mean cost of animals in a clinical trial have been rising due to an increase in standards of veterinary care and specialized animal facilities. Studies show that strict ethical and legal processes are in place to govern the health and welfare of animals involved in trials, which in turn further heightens costs.

Also, it is expensive due to the need for skilled manpower, such as veterinarians, animal behaviourists, and lab technicians. In markets like the U.S. and countries in the European Union, the price of labour and compliance with stringent animal welfare standards have increased. According to the U.S. Bureau of Labor Statistics, veterinarians who work with clinical trials may earn between $90,000 and $140,000 per year, adding a significant financial burden for those funding veterinary clinical trials. This is further complicated by the need for advanced technology and the time-consuming effort to recruit, monitor, and evaluate animals in trial phases.

Opportunity

-

Advancements in precision medicine, leveraging genomics and biomarkers, present opportunities to develop personalized treatments tailored to individual animals, enhancing the effectiveness of veterinary care.

Innovations to extend the health span and lifespan of pets, especially dogs, are rapidly driving forward advances in veterinary clinical trials. Biotechnology firms are actively developing interventions to promote longevity in pets, with some products nearing market availability. For instance, Loyal, a San Francisco-based biotech startup, has a dog anti-aging pill with a “reasonable expectation of efficacy” certification from the U.S. Food and Drug Administration (FDA). All hope with this pill is to improve older dogs’ metabolic health, and it could potentially grant them an extra-long healthy lifetime by a year. Loyal said it hopes to launch this product within the next year, subject to final approvals.

Similarly, the Dog Aging Project, a collaborative research initiative, has received a $7 million grant from the National Institutes of Health (NIH) to expand its clinical trial of rapamycin, a drug that has shown promise in extending lifespan and improving health metrics in dogs. The multi-site study seeks to recruit 580 dogs throughout the United States to assess the effectiveness of rapamycin in extending dog lifespan and offering clues about human aging. This is a major step showing that the veterinary field is getting serious about doing more than just improving the quality of life of pets but also increasing their life span with alternative treatment methods. Supplemented with farm animal models with large genetic variation and the inclusion of biometrical methods for optimal basic design these innovations provide excellent windows for veterinary clinical trials to validate the safety and efficacy of new treatments and devices and contribute to the advancement of veterinary medicine with, due to the similarities of the farm animal with the human species, a chance to translate findings for human health.

Challenge

-

Navigating complex regulatory requirements and ensuring compliance with ethical standards in veterinary clinical trials remain ongoing challenges that can impede the progress of research and development.

Navigating the complex regulatory frameworks across different regions poses significant challenges for veterinary clinical trials, potentially hindering timely and efficient market access for new veterinary medicinal products (VMPs). Regulatory standards for veterinary clinical trials differ markedly across regions, leading to complexities for multinational studies. In the United States, the FDA's Center for Veterinary Medicine oversees VMPs, while the European Medicines Agency (EMA) sets guidelines under Regulation (EU) 2019/6. These differences can result in prolonged approval timelines due to varying documentation requirements and regulatory inefficiencies, as companies must tailor submissions for each market. Despite efforts by organizations like the International Cooperation on Harmonisation of Technical Requirements for Registration of Veterinary Medicinal Products (VICH) to align standards, inconsistencies in data expectations and dossier formats persist, creating barriers to global product registrations.

The approval process for VMPs is often lengthy and resource-intensive, involving extensive data collection on safety, efficacy, and quality. Complex preclinical and clinical studies, along with stringent Good Manufacturing Practice (GMP) requirements, contribute to these delays. This complexity can be particularly challenging for smaller firms that may lack sufficient resources, potentially slowing the introduction of innovative products to the market.

Segment Analysis

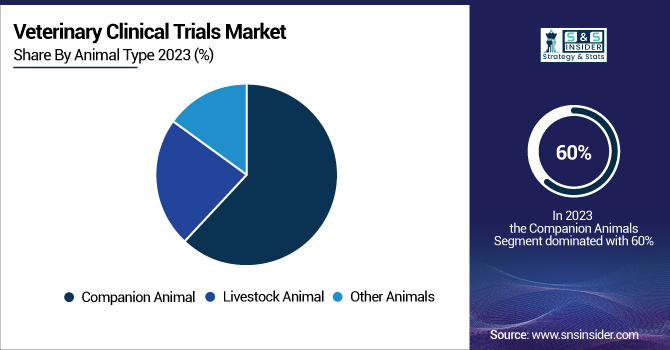

By Animal Type

The Companion Animal segment dominated the veterinary clinical trials market in 2023 with a 60% share. This dominance is driven by the growing number of pet owners worldwide and increased spending on pet healthcare. The U.S., for instance, has approximately 65 million dogs and 32 million cats, with over 6 million new cancer diagnoses annually among these pets. This substantial population creates a need for advanced treatments tailored to companion animals, particularly canines, which hold the highest market share within this segment. Government initiatives further reinforce this trend. Regulatory bodies like the FDA emphasize rigorous testing for companion animal treatments to ensure their safety and efficacy. Additionally, research organizations such as the Veterinary Cancer Society promote advancements in oncology, addressing rising cancer prevalence among pets. The focus on personalized medicine and targeted therapies for companion animals enhances their health outcomes while driving market growth.

By Indication

Oncology accounted for the largest share 26% in 2023 due to the increasing prevalence of cancer among pets. According to the National Cancer Institute, approximately 6 million new cancer cases are diagnosed annually in dogs and cats in the U.S., making oncology a critical area for research. Veterinary oncology studies leverage spontaneous cancers in pets that closely resemble human cancers, enabling translational research that benefits both animals and humans. Organizations like Vivesto AB are actively conducting oncology-focused clinical trials, such as their December 2023 pilot study on Paccal Vet for canine hemangiosarcoma post-splenectomy. These efforts underscore the importance of addressing complex cancer types through innovative therapies. Government-backed initiatives further support oncology research by providing funding and regulatory frameworks that ensure effective treatment development.

By Intervention

Medicines held the highest share 54% in 2023 due to their pivotal role in treating various animal diseases. Pharmaceutical companies invest heavily in developing innovative drugs tailored to specific needs, such as targeted therapies for rare diseases or chronic conditions. For example, Vivesto AB’s Paccal Vet trial explores novel formulations designed to improve treatment outcomes for canine cancers. Regulatory agencies worldwide mandate rigorous clinical trials for medicines before approval, ensuring their safety and efficacy. This focus on drug development aligns with growing demand for advanced veterinary care among pet owners. The integration of technologies like precision medicine further enhances treatment effectiveness while driving growth within this segment.

By Sponsors

Pharmaceutical and biopharmaceutical companies dominated the market with a 53% share in 2023 due to their advanced R&D facilities and strategic collaborations with veterinary clinics and research institutions. These partnerships enable comprehensive studies that address complex diseases while expanding access to innovative treatments. In April 2024, Boehringer Ingelheim invested $593 million in animal health R&D to accelerate clinical trials for new medicines. Such investments highlight industry commitment to advancing veterinary science through robust research frameworks. Additionally, collaboration between academic institutions and pharmaceutical firms fosters innovation while ensuring regulatory compliance.

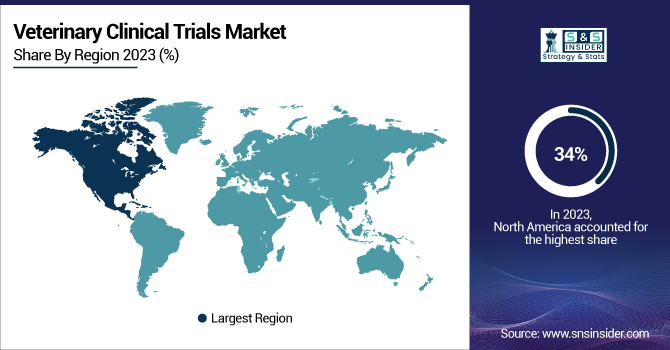

Regional Insights

North America dominated the veterinary clinical trials market in 2023 and held the largest revenue share at 34%. This leadership can be attributed to the region's advanced healthcare infrastructure, significant R&D investments, and robust regulatory frameworks. The U.S. Food and Drug Administration (FDA) plays a pivotal role in facilitating veterinary clinical trials by setting stringent safety and efficacy standards for new drugs and biologics. Additionally, increasing pet ownership and the humanization of pets have significantly boosted veterinary healthcare spending. According to recent statistics, 70% of U.S. households own pets, contributing to a surge in demand for innovative treatments and therapies. Technological advancements such as digital health tools and diagnostic imaging have further enhanced the efficiency of clinical trials in North America. Public-private partnerships between pharmaceutical companies, research institutions, and veterinary clinics have accelerated R&D activities. For instance, Boehringer Ingelheim invested $593 million in animal health R&D in 2024 to support clinical trials for new medicines. Furthermore, educational initiatives for veterinarians improve trial implementation and management, ensuring high-quality research outcomes.

Asia-Pacific is projected to grow at the fastest compound annual growth rate (CAGR) from 2024 to 2032. The region's growth is driven by its large livestock population, increasing pet ownership, and evolving regulatory frameworks that support clinical trials. Countries like China, India, and Indonesia are key contributors due to their robust agricultural sectors and rising demand for animal-derived food products. Government initiatives play a critical role in fostering this growth. For example, India launched super-specialty veterinary branches at the All-India Institute of Veterinary Sciences (AIIVS) in October 2023 to enhance research capabilities. Additionally, collaborations between pharmaceutical companies and academic institutions are expanding research opportunities. Fujifilm India partnered with A’alda Vet India Pvt Ltd in December 2023 to supply advanced diagnostic devices for veterinary care.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Charles River Laboratories (Preclinical Services, Clinical Trial Management)

-

IDEXX Laboratories, Inc. (SNAP Tests, VetLab Station)

-

Boehringer Ingelheim International GmbH (Atopica, Metacam)

-

Argenta (Canine Osteoarthritis Study, Veterinary Clinical Research Services)

-

Bioagile Therapeutics Pvt. Ltd. (Preclinical Toxicology Studies, Clinical Research Services)

-

Veterinary Research Management (Clinical Trial Management, Regulatory Affairs Consulting)

-

Merck & Co., Inc. (Bravecto, Nobivac Vaccines)

-

Labcorp Drug Development (Preclinical and Clinical Services, Bioanalytical Testing)

-

OCR - Oncovet Clinical Research (Canine Cancer Trials, Clinical Research Services)

-

Vivesto AB (Paccal Vet, Cantrixil)

-

Vetbiolix (VBX-1000 for Periodontal Disease, Clinical Trials in Veterinary Dentistry)

-

Zoetis (Simparica, Apoquel)

-

Ceva Santé Animale (Feliway, Porcilis Vaccines)

-

Merck & Co. (Keytruda, Januvia)

-

Parexel (Clinical Research Services, Regulatory Consulting)

-

Clinvet (Veterinary Clinical Trials, Research Services)

-

Ondax Scientific (Analytical Testing Services, Research Support)

-

Ceva Santé Animale (C.H.I.C.K Program, Reproduction Management Products)

-

Charles River Laboratories (Humane Care Imperative, Preconditioning Services)

-

Jackson Laboratory (Research Animal Models, Genetic Testing Services)

Recent Developments

-

Vivesto AB Oncology Trials: In December 2023, Vivesto AB announced FDA approval for its Paccal Vet pilot study targeting canine hemangiosarcoma post-splenectomy.

-

Boehringer Ingelheim Investment: In April 2024, Boehringer Ingelheim allocated $593 million toward animal health R&D to enhance clinical trial capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.7 Billion |

| Market Size by 2032 | USD 10.57 Billion |

| CAGR | CAGR of 9.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal (Companion Animal, Livestock Animal, Other Animals) • By Intervention (Medicines, Medical Device, Others) • By Indication (Oncology, Internal Medicine, Orthopedics, Ophthalmology, Cardiology, Neurology, Dermatology, Other Indication) • By Sponsor (Academics And Research Centers, Pharmaceutical And Biopharmaceutical Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Charles River Laboratories, IDEXX Laboratories, Inc., Boehringer Ingelheim International GmbH, Argenta, Bioagile Therapeutics Pvt. Ltd., Veterinary Research Management, Merck & Co., Inc., Labcorp Drug Development, OCR - Oncovet Clinical Research, Vivesto AB, Vetbiolix, Zoetis, Ceva Santé Animale, Merck & Co., Parexel, Clinvet, Ondax Scientific, Ceva Santé Animale, Charles River Laboratories, Jackson Laboratory. |