Get More Information on Vacuum Truck Market - Request Sample Report

The Vacuum Truck Market Size was valued at USD 2.0 Billion in 2023 and is expected to reach USD 3.7 Billion by 2032, growing at a CAGR of 7.1% over the forecast period 2024-2032.

The vacuum truck market is driven by a confluence of regulatory initiatives and increased industrial demand. Government bodies globally are strengthening waste management regulations, particularly for hazardous waste handling, which has elevated the demand for advanced vacuum trucks. For instance, recent data from the U.S. Environmental Protection Agency (EPA) highlights a 15% increase in spending on waste disposal and remediation services, underscoring a higher budget allocation toward environmental clean-up efforts. Additionally, EU regulatory frameworks under the Waste Framework Directive are mandating tighter controls on waste treatment and transportation, directly fueling demand for liquid and solid waste suction vehicles. In the Asia-Pacific region, emerging economies are intensifying their investments in urban infrastructure and sanitation, with China allocating $20 billion in 2023 towards urban environmental services. This push aligns with the government's "Blue Sky Action Plan," which includes provisions for efficient waste removal technologies. These government-driven initiatives not only incentivize the adoption of vacuum trucks but also catalyze innovations in multi-functional suctioning capabilities, making vacuum trucks integral to sustainable waste management.

The global vacuum truck market is growing rapidly, driven by new partnerships among construction equipment vendors to enhance vacuum truck efficiency and capabilities across industries such as construction, municipal services, oil and gas, and environmental cleanup. These alliances focus on providing integrated waste management and environmental solutions, which align with the rising demand for versatile and efficient equipment. For instance, in December 2022, Heritage Transport, part of Heritage Environmental Services, acquired Frank’s Vacuum Truck Service, expanding its capabilities. Such partnerships facilitate innovation by integrating advanced technologies like telematics, automation, and remote monitoring into vacuum trucks, optimizing performance. By pooling resources, partners can access new markets, reach broader customer bases, and strengthen their competitive edge, especially in high-growth sectors like construction, mining, and oil and gas. Through these collaborations, vacuum trucks are increasingly recognized as essential for modern waste management and environmental sustainability.

Drivers

Rapid urbanization and infrastructural expansion worldwide are driving demand for vacuum trucks for efficient waste management. Increasing investments in construction and municipal projects require reliable vacuum trucks for debris and hazardous waste removal.

Governmental regulations promoting sustainable waste management are pushing industries to adopt vacuum trucks for safe hazardous waste handling. The increased focus on environmental compliance has led to a rise in vacuum truck usage across sectors such as oil & gas, mining, and construction.

Innovations like automation and enhanced suction technology are improving efficiency and safety, making vacuum trucks more appealing

The mounting requirement for effective waste management combined with the rapid expansion of automation worldwide will augment the growth of vacuum trucks drastically over the projected period. With an increasing population, the demand for specific equipment to manage waste, sewerage, and rubble is growing along with the expansion of cities and the construction of infrastructure, especially in developing areas. The United Nations has predicted that 55 percent of the world population will live in urban areas in 2018 and that this figure will rise to 68 percent in 2050. Urbanization is mainly associated with both hazardous and non-hazardous waste due to the increased generation of waste, hence this increase poses landscaping challenges for the municipality to address.

Furthermore, vacuum trucks also play an important role in keeping hygienic operations running at construction sites, infrastructure projects as well as within urban centers. The pace of urbanization is diverse across geographies, for instance, in India, the Smart Cities Mission, which has projects worth more than USD 20 billion in the pipeline has increased demand for reliable waste and sludge management solutions. In these cities, vacuum trucks are used to keep silted sewers clean and to remove industrial effluent, helping to maintain public health and safety and preserving the environment. At the same time, advanced economies are renewing their aging infrastructure, special upgrading sewer systems which requires removing debris and sludge with vacuum trucks. Many cities in the U.S., for example, are implementing extensive infrastructure renewal programs, spurring a greater need for vacuum trucks to remove debris in a safe, effective way. This increase in urban and infrastructural projects is one of the most prominent reasons that will drive the growth of the vacuum truck market over the forecast period.

Restraints

The significant initial investment required for purchasing advanced vacuum trucks limits adoption, especially for small to mid-sized businesses.

Operating vacuum trucks requires skilled personnel, but a shortage of trained operators is challenging market growth. The high skill demand increases training expenses for companies, adding an extra layer of operational costs.

High initial and recurring costs are one of the major obstacles for the vacuum truck market. These awesome machines are equipped with high-powered suction, a tank, and special features that allow them to handle both hazardous and non-hazardous materials like a true professional. Vacuum truck capital cost is the major restriction, especially in the case of small and medium-sized enterprises that have a low capital base. Furthermore, these trucks have to be maintained regularly to keep them operationally sound and safe, which increases ownership costs. Parts such as pumps, hoses, and filtration systems all experience the wear and tear of the daily grind and many times in tough environments like construction and waste management need to be repaired and replaced often. The negative impact of such high ownership costs is that some companies find it difficult to purchase new or additional vacuum trucks which can ultimately slow the overall market adoption rate and growth.

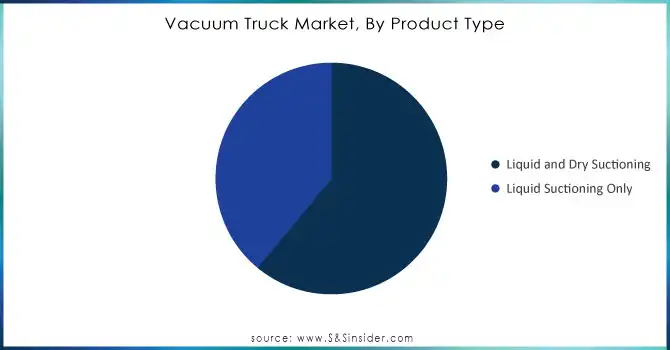

By Product Type

In 2023, the liquid & dry suctioning segment dominated the vacuum truck market with a 62% market share. This dominance is primarily credited to the ability of those trucks to manage various forms of waste, which is a stipulation from most governments. As per the latest statistics from the U.S. Department of Transportation (DOT), almost 70% of industrial waste removal projects require one that can process both liquid and dry waste streams, which in turn is boosting the demand for liquid & dry suction trucks. Moreover, since many industrial processes are being subjected to environmental audits at both national and international levels, and growing need for the equipment necessary for integrated management of mixed waste has surged. Liquid & dry suctioning vacuum trucks operate operational flexibility with the ability to service sectors varying from petrochemical facilities to municipal waste plants, securing their status as one of the leading choices in the industry.

Need Any Customization Research On Vacuum Truck Market - Inquiry Now

By Application

In 2023, the highest share (59%) of the vacuum truck market was held by the industrial application segment. This is due to the constant cleaning and waste removal required from the oil and gas, petrochemicals, and construction industry as stringent cleaning protocols are vital for safety in that sector. According to government data provided by the Bureau of Labor Statistics (BLS), industrial clean-ups performed in the oil and gas industry by year have increased 12% in the past two years due to the use of vacuum trucks to empty and process hazardous materials. The increasing number of industrial facilities complying with rigorously defined Environmental, Health, and Safety (EHS) standards also drives the need for industrial-grade vacuum trucks. These trucks provide the significant power and capacity needed to process heavy-duty waste efficiently, which has reinforced their market presence among various key industrial sectors.

By Fuel Type

Internal combustion engine (ICE) vacuum trucks held the largest share of 71% of the vacuum truck market in 2023. While electric vehicles (EVs) are garnering a greater focus on the larger global automotive stage, ICE models are still the mainstay in terms of range and reliability, particularly in heavy-duty and remote applications where the EV charging infrastructure is often lacking. ICE vehicles made up more than 80% of heavy-duty applications, as compelling in construction as industrial waste hauling, reported the U.S. Department of Energy in a 2023 report. The strong power performance of ICE trucks renders them an ideal match for high-demand operations in high-utilization industries, as these trucks require continuous operational time across several hours of each working day to maintain their top-ranking position in the vacuum truck market.

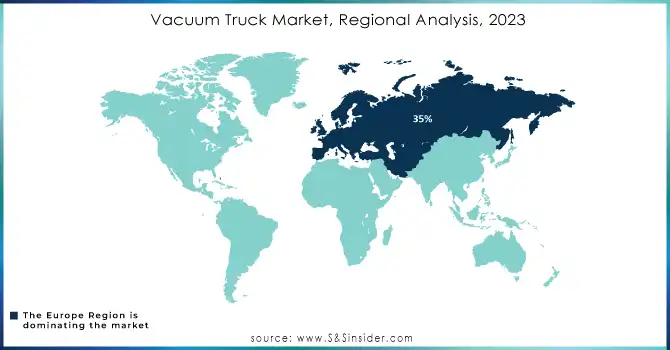

Europe held the leading position with a 35% share. This growth is due to the strict environmental regulations and advanced waste disposal infrastructure in the region. The European countries have a very strong foundation regarding waste disposal and waste disposal safety, however, the framework for environmental preservation is well operational in the foremost countries in Europe such as Germany, France, and, the UK, which creates a sizeable demand for vacuum truck suppliers in the region. Better waste management and pollution control regulations imposed by the European Union force many industries to implement effective waste collection and treatment solutions, which will support vacuum truck market growth. Additionally, Europe’s focus on technological advancements in waste management equipment and increasing investments in urban sanitation systems have further solidified its market dominance.

On the contrary, the vacuum truck market is expected to grow fastest in Asia-Pacific over the forecast period. This growth is driven by rapid urbanization, expanding industrial sectors, and enhanced awareness around environmental protection. Moreover, robust regulations and government investments in infrastructure development in emerging nations such as China and India are expected to drive the demand for vacuum trucks in waste management. The expanding oil and gas and construction sectors in Asia-Pacific are focusing on modern waste-handling solutions owing to stringent environmental regulations contributing to the potential growth of the market. The high CAGR of the Asia-Pacific can be attributed to the increasing emphasis on sustainability in the region, coupled with the need for enhanced municipal and industrial waste management.

Key Service Providers/Manufacturers:

Federal Signal Corporation (Elgin Crosswind, Guzzler CL)

Vac-Con, Inc. (X-Cavator, Titan Hydro Excavator)

KOKS Group B.V. (MegaVac, EcoVac)

Sewer Equipment Co. of America (RamJet, Model 747)

GapVax, Inc. (HV Series, MC Series)

Super Products LLC (Mud Dog, Camel Maxx)

Keith Huber Corporation (Titan, Huber Hammerhead)

Vactor Manufacturing, Inc. (Vactor 2100i, Paradigm)

Hi-Vac Corporation (Aquatech B-10, X-Vac XR)

Ledwell & Son Enterprises, Inc. (Ledwell Hydrovac, Ledwell Vacuum Trucks)

Veolia North America

Waste Management, Inc.

Clean Harbors, Inc.

Fluor Corporation

Bechtel Corporation

Skanska USA

Republic Services, Inc.

BASF Corporation

ExxonMobil Corporation

Shell Oil Company

Vac-Con showcased its non-CDL Titan 3-yard combination sewer cleaning truck, which offers a manageable and user-friendly cleaning solution for the needs of small municipalities and contractors, at the WWETT Show in Indianapolis, in February 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.0 Billion |

| Market Size by 2032 | USD 3.7 Billion |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Liquid and Dry Suctioning, Liquid Suctioning Only) • By Fuel Type (Electric, ICE) • By Application (Industrial, Excavation, Municipal, General cleaning, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Federal Signal Corporation, Vac-Con, Inc., KOKS Group B.V., Sewer Equipment Co. of America, GapVax, Inc., Super Products LLC, Keith Huber Corporation, Vactor Manufacturing, Inc., Hi-Vac Corporation, Ledwell & Son Enterprises, Inc. |

| Key Drivers | • Rapid urbanization and infrastructural expansion worldwide are driving demand for vacuum trucks for efficient waste management. Increasing investments in construction and municipal projects require reliable vacuum trucks for debris and hazardous waste removal. • Governmental regulations promoting sustainable waste management are pushing industries to adopt vacuum trucks for safe hazardous waste handling. The increased focus on environmental compliance has led to a rise in vacuum truck usage across sectors such as oil & gas, mining, and construction. |

| Restraints | • The significant initial investment required for purchasing advanced vacuum trucks limits adoption, especially for small to mid-sized businesses. |

Ans. The projected market size for the Vacuum Truck Market is USD 3.7 Billion by 2032.

Ans: The North American region dominated the Vacuum Truck Market in 2023.

Ans. The CAGR of the Vacuum Truck Market is 7.1% During the forecast period of 2024-2032.

And: The ICE Fuel Type segment dominated the Vacuum Truck Market in 2023.

Ans:

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Vacuum Truck Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Liquid and Dry Suctioning

7.2.1 Liquid and Dry Suctioning Market Trends Analysis (2020-2032)

7.2.2 Liquid and Dry Suctioning Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Liquid Suctioning Only

7.3.1 Liquid Suctioning Only Market Trends Analysis (2020-2032)

7.3.2 Liquid Suctioning Only Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Vacuum Truck Market Segmentation, By Fuel Type

8.1 Chapter Overview

8.2 Electric

8.2.1 Electric Market Trends Analysis (2020-2032)

8.2.2 Electric Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 ICE

8.3.1 ICE Market Trends Analysis (2020-2032)

8.3.2 ICE Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Vacuum Truck Market Segmentation, By Application

9.1 Chapter Overview

9.2 Industrial

9.2.1 Industrial Market Trends Analysis (2020-2032)

9.2.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Excavation

9.3.1 Excavation Market Trends Analysis (2020-2032)

9.3.2 Excavation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Municipal

9.4.1 Municipal Market Trends Analysis (2020-2032)

9.4.2 Municipal Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 General cleaning

9.5.1 General cleaning Market Trends Analysis (2020-2032)

9.5.2 General cleaning Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.4 North America Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.2.5 North America Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.2.6.3 USA Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.2.7.3 Canada Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.7.3 France Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.6.2 China Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.6.3 China Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.7.2 India Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.7.3 India Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.8.3 Japan Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.12.3 Australia Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.2.5 Africa Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Vacuum Truck Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.6.5 Latin America Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Vacuum Truck Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Vacuum Truck Market Estimates and Forecasts, By Fuel Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Vacuum Truck Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Federal Signal Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Vac-Con, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 KOKS Group B.V.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Sewer Equipment Co. of America

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 GapVax, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Super Products LLC

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Keith Huber Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Vactor Manufacturing, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Hi-Vac Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Ledwell & Son Enterprises, Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Liquid and Dry Suctioning

Liquid Suctioning Only

By Fuel Type

Electric

ICE

By Application

Industrial

Excavation

Municipal

General cleaning

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Interior Materials Market was valued at USD 60.9 Billion in 2023 and is expected to reach USD 86.2 Billion by 2032, growing at a CAGR of 3.96% from 2024-2032.

The Cell to Pack Battery Market size was estimated at USD 18.53 billion in 2023 & is expected to reach USD 66.94 Bn by 2032 at a CAGR of 15.35% by 2024-2032.

Automotive Active Purge Pump Market Size was valued at USD 94.90 million in 2023 and is expected to reach USD 1910 million by 2031 and grow at a CAGR of 45.73% over the forecast period 2024-2031.

The Electric Vehicle Market size was estimated USD 491.7 billion in 2023 and is expected to reach USD 1570.12 billion by 2032 at a CAGR of 12.34% during the forecast period of 2024-2032.

The Car Manufacturing Market Size was valued at USD 2.08 Billion in 2023, and is expected to reach USD 10.96 Billion by 2032, and grow at a CAGR of 20.30 % over the forecast period 2024-2032.

The Automotive Stainless Steel Tube Market Size was USD 4.2 Billion in 2023 & is expected to reach $5.9 Bn by 2032, growing at a CAGR of 3.9% by 2024-2032.

Hi! Click one of our member below to chat on Phone