Get More Information on Vacuum Skin Packaging Market - Request Sample Report

The Vacuum Skin Packaging Market size was valued at USD 7.97 Billion in 2023 and it is expected to reach USD 11.04 Billion by 2032 with a growing CAGR of 3.69 % over the forecast period 2024-2032.

Recent innovations in VSP technologies have significantly reduced plastic usage while maintaining the integrity and freshness of packaged products. Advanced top webs used in VSP systems are offering cost savings of 15-53% when compared to traditional Modified Atmosphere Packaging (MAP). Additionally, material downgrades, reducing film thickness to as low as 80 microns, are leading to a reduction in carbon footprints by 21-37% and plastic use by up to 51%.

The increased operational efficiency, with packaging cycles improving from 6 to 8.5 cycles per minute, further drives the adoption of VSP solutions. These innovations align with growing environmental concerns, as they contribute to reduced food waste and offer significant material savings. As consumer and retailer demand for eco-friendly packaging continues to rise, particularly in the food sector, the VSP market is poised for substantial growth in the coming years. The focus on sustainability, combined with the enhanced preservation of product freshness, positions VSP as a preferred packaging solution for food processors and manufacturers globally.

In recent developments, companies like Coveris are expanding their production capabilities to meet the growing demand for vacuum skin packaging. For example, Coveris recently opened a state-of-the-art vacuum skin packaging facility in Winsford, UK, to cater to this rising consumer need. The facility, which is the largest blown-extrusion site for polyethylene (PE) films in the UK, further solidifies Coveris' position as a key player in the VSP market. The expansion underscores the market's potential for growth, driven by innovations and investments that aim to boost efficiency and production capacity.

Furthermore, technological advancements in the packaging industry are contributing significantly to the growth of the VSP market. New materials and sealing technologies have improved the performance of vacuum skin packaging, including enhanced barrier properties, which help prolong shelf life and improve the visual appeal of food products. These innovations meet the increasing consumer demand for clean-label products that emphasize natural ingredients without artificial preservatives. As more consumers prioritize transparency and health, vacuum skin packaging has become a preferred solution for maintaining product integrity.

Drivers

The Pivotal Role of Innovative Packaging Solutions in Sustainability

A key driver of the vacuum skin packaging (VSP) market is the pressing need to combat food waste and its environmental consequences. In 2021, a staggering 38% of the U.S. food supply went unsold or uneaten, resulting in a loss of USD 444 billion and significantly contributing to resource depletion and greenhouse gas emissions. In this regard, vacuum skin packaging emerges as an essential solution, as it extends the shelf life of perishable goods and provides superior protection during storage and transportation. By creating an effective barrier against oxygen and moisture, VSP not only maintains food freshness but also reduces spoilage, ultimately lessening the total amount of food waste. The adoption of innovative packaging designs, such as vacuum skin technology, could significantly divert millions of tons of food waste each year while also decreasing greenhouse gas emissions. This relationship highlights the increasing significance of VSP in fostering sustainability and resilience in the food supply chain, meeting consumer demands for fresh, high-quality products while alleviating environmental impacts. For example, optimizing packaging design could prevent 1.1 million tons of food waste annually and cut greenhouse gas emissions by 6 million metric tons, illustrating the potential of innovative packaging solutions to enhance sustainability across the food supply chain.

Restraints

Material Constraints in Vacuum Skin Packaging as Barriers to Sustainability and Market Growth

Vacuum skin packaging (VSP) relies on specialized plastic films, including nylon, polyester, and polyethylene, designed to create a secure seal around food products. However, these materials present several challenges that can hinder market growth. Availability of these specialized films may be limited, leading manufacturers to rely on niche suppliers and resulting in potential production delays. Cost is another concern, as high-quality films for VSP can be expensive due to raw material prices and advanced manufacturing processes, discouraging adoption among companies with tight margins. Additionally, recyclability poses a significant issue; many plastics used in VSP are not easily recyclable because of their multilayer structures, creating challenges in environmentally regulated markets. As consumers increasingly demand sustainable packaging options, the inability of VSP to meet these expectations may negatively affect its market acceptance. Moreover, regulatory compliance varies by region, with differing packaging regulations related to food safety and environmental impact adding complexity and increasing costs. Addressing these material limitations is essential for broader VSP adoption, with innovations in material science, such as recyclable films or alternative packaging solutions, potentially alleviating these concerns and enhancing the sustainability of vacuum skin packaging in the food industry.

By Material

In 2023, the dominance of polyethylene (PE) in the vacuum skin packaging (VSP) market, capturing approximately 38% of total revenue, was further reinforced by notable product launches and strategic developments by leading companies in the segment. For instance, Sealed Air Corporation unveiled a new range of vacuum skin packaging solutions that utilize advanced PE materials to enhance food preservation while reducing environmental impact. Their innovative packaging design not only improves the shelf life of perishable products but also incorporates recyclable PE, responding to the growing consumer demand for sustainable packaging options. Amcor launched its latest line of VSP solutions made from high-performance PE films, focusing on the meat and dairy sectors. These products are designed to provide superior barrier properties against oxygen and moisture, ensuring freshness and safety while appealing to environmentally conscious consumers. Amcor's commitment to sustainability is reflected in its goal to make all its packaging recyclable or reusable by 2025, further solidifying its market position. Berry Global has invested in developing PE-based vacuum skin packaging that enhances product visibility while maintaining an eco-friendly profile. Their recent developments emphasize reducing plastic waste through innovative recycling processes and the use of post-consumer recycled materials. These strategic initiatives not only highlight the growing trend towards sustainable packaging but also demonstrate how advancements in polyethylene materials are driving innovation within the vacuum skin packaging market . As companies continue to launch new products and improve their existing offerings, the importance of PE in the VSP market is expected to strengthen, enabling it to maintain its significant revenue share in the coming years.

By Technology

In 2023, thermoforming technology dominated the vacuum skin packaging (VSP) market, capturing approximately 44% of the total revenue. This substantial market share can be attributed to several key factors and notable company developments in the segment.

One major driver of thermoforming’s success is its ability to create customized packaging solutions tailored to various food products. For instance, companies like Sealed Air have introduced innovative thermoformed packaging that enhances product presentation and minimizes waste by ensuring precise fits for perishable goods. Their recent launch of the BUBBLE WRAP brand foam packaging, which utilizes thermoforming technology, showcases how brands are leveraging this approach to extend shelf life while appealing to environmentally conscious consumers. Cost-effectiveness and scalability also play a crucial role in the widespread adoption of thermoforming. Berry Global, a leading packaging solutions provider, announced new investments in their thermoforming production capabilities in early 2023. This expansion enables them to efficiently meet growing demand while offering high-quality packaging solutions at competitive prices. Advancements in material efficiency are another significant aspect. For example, Pactiv Evergreen has developed lightweight thermoformed trays that reduce material usage without sacrificing strength or barrier properties. This innovation aligns with sustainability goals and responds to consumer preferences for eco-friendly packaging options. Companies are increasingly integrating smart packaging features into their thermoformed products. Amcor, a global leader in packaging, unveiled a new range of thermoformed packaging solutions that incorporate active and intelligent packaging technologies, allowing for real-time monitoring of product freshness. This advancement not only enhances food safety but also boosts consumer engagement by providing vital information about shelf life.

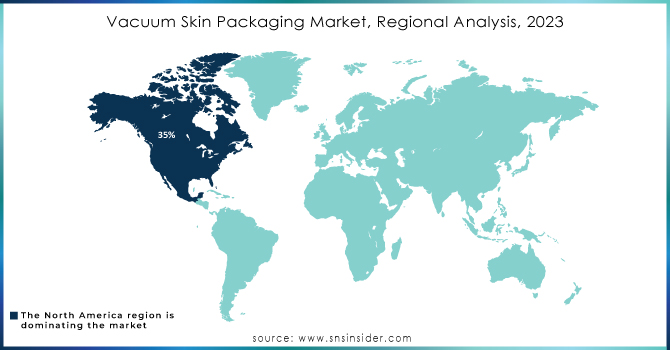

North America accounted for approximately 35% of the market, driven by a robust food industry and rising consumer demand for convenience and sustainability. Major players like Tyson Foods and Kraft Heinz have adopted VSP to enhance product freshness and reduce food waste, aligning with consumer preferences for fresh, minimally processed foods.

Meanwhile, the Asia-Pacific region emerged as the fastest-growing market, fueled by rapid industrialization and urbanization. Countries like China, India, and Japan are leading the charge, with rising disposable incomes prompting consumers to seek convenient, high-quality food options. In China, VSP adoption is surging among food companies, supported by government initiatives for modernization in packaging. Both regions emphasize sustainability, with manufacturers developing eco-friendly materials and adhering to stringent food safety regulations, ensuring product integrity and consumer satisfaction.

Need Any Customization Research On Vacuum Skin Packaging market - Inquiry Now

Some of the major players in Vacuum Skin Packaging market who provide product and solution:

Adapa (Custom vacuum skin packaging films, pre-formed trays)

Amcor (Flexible packaging, rigid containers, vacuum skin packaging solutions)

Atlantis-Pak (Vacuum skin packaging systems, materials for meat and seafood)

Coveris Holdings (Flexible and rigid packaging solutions, vacuum skin packaging for food and non-food applications)

Flexopack (Vacuum skin packaging films, trays for meat and dairy products)

G. Mondini (Vacuum skin packaging machines, systems for various food applications)

Klckner Pentaplast (Rigid and flexible films for vacuum skin packaging, food and pharmaceutical applications)

KM Packaging Services (Custom packaging solutions, vacuum skin packaging for the food industry)

MULTIVAC Group (Complete packaging solutions, vacuum skin packaging machines and materials)

Pakmar (Vacuum skin packaging films, materials for fresh produce and meat)

Plastopil (Specialty films for vacuum skin packaging, food applications)

Hazorea Prepac Packaging Solutions (Custom vacuum skin packaging solutions for fresh and processed foods)

Sealed Air Corporation (Vacuum packaging solutions, Cryovac® brand vacuum skin packaging films and equipment)

SEALPAC International (Vacuum packaging machines, trays for various food products)

Sirane (Innovative vacuum skin packaging solutions for meat, poultry, and seafood)

Stora Enso (Sustainable packaging solutions, vacuum skin packaging materials)

Toray Plastics (America) (Advanced films for vacuum skin packaging, food and other industries)

Triton International (Vacuum packaging solutions tailored for food products)

Winpak (Vacuum skin packaging films, trays primarily for food packaging)

Amcor

Sealed Air Corporation

MULTIVAC Group

Coveris Holdings

Toray Plastics (America)

Klckner Pentaplast

Flexopack

Pakmar

Atlantis-Pak

Winpak

In August 16, 2024, ExxonMobil partnered with Brazilian packaging converter Videplast to create a cost-effective vacuum skin packaging solution that eliminates the use of ionomers. This innovative packaging addresses the demand for reduced film thickness while ensuring high performance, making it suitable for a range of food packaging applications.

On September 19, 2024, Coveris inaugurated a new vacuum skin packaging manufacturing facility in Winsford, Cheshire, making it the UK's sole producer of VSP. This investment includes a dedicated conversion hall and advanced manufacturing equipment, enhancing the site’s capabilities in polyethylene film production.

On June 13, 2024, SEE launched three innovative skin packaging top webs designed to enhance efficiency and performance in the food packaging industry. Compatible with CRYOVAC Darfresh technologies, these solutions feature superior oxygen barriers and exceptional formability, all while maintaining the integrity of the packaged products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.97 Billion |

| Market Size by 2032 | USD 11.04 Billion |

| CAGR | CAGR of 3.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), and Others) • By Technology(Thermoforming Technology, Film-based Technology, Tray-based Technology) • By Application (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy, Ready-to-eat Meals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adapa, Amcor, Atlantis-Pak, Coveris Holdings, Flexopack, G. Mondini, Klckner Pentaplast, KM Packaging Services, MULTIVAC Group, Pakmar, Plastopil, Hazorea Prepac Packaging Solutions, Sealed Air Corporation, SEALPAC International, Sirane, Stora Enso, Toray Plastics (America), Triton International, and Winpak. |

| Key Drivers | • The Pivotal Role of Innovative Packaging Solutions in Sustainability |

| Restraints | • Material Constraints in Vacuum Skin Packaging as Barriers to Sustainability and Market Growth |

Ans: The Vacuum Skin Packaging Market grow at a CAGR of 3.69 % over the forecast period of 2024-2032.

Ans: The Vacuum Skin Packaging Market size was valued at USD 7.97 Billion in 2023 and it is expected to reach USD 11.04 Billion by 2032 with a growing CAGR of 3.69 % over the forecast period 2024-2032.

Ans: The major growth factor of the Vacuum Skin Packaging Market is the increasing demand for extended shelf life and enhanced product protection in the food and pharmaceutical industries.

Ans: The Polyethylene (PE) segment dominated the Vacuum Skin Packaging Market.

Ans: North America dominated the Vacuum Skin Packaging Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Material Usage Trends, by Material Type, by Region, 2023

5.2 Upcoming Projects, by Region, by Type (Residential, Commercial, Industrial)

5.3 Building Permit Issuances, by Region, 2023

5.4 Labor Market Statistics, by Region, 2023

5.5 Technology Adoption, by Technology Type

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Vacuum Skin Packaging Market Segmentation, by Material

7.1 Chapter Overview

7.2 Polyethylene (PE)

7.2.1 Polyethylene (PE) Market Trends Analysis (2020-2032)

7.2.2 Polyethylene (PE) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyvinyl Chloride (PVC)

7.3.1 Polyvinyl Chloride (PVC) Market Trends Analysis (2020-2032)

7.3.2 Polyvinyl Chloride (PVC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polypropylene (PP)

7.4.1 Polypropylene (PP) Market Trends Analysis (2020-2032)

7.4.2 Polypropylene (PP) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyamide (PA)

7.5.1 Polyamide (PA) Market Trends Analysis (2020-2032)

7.5.2 Polyamide (PA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Vacuum Skin Packaging Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Thermoforming Technology

8.2.1 Thermoforming Technology Market Trends Analysis (2020-2032)

8.2.2 Thermoforming Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Film-based Technology

8.3.1 Film-based Technology Market Trends Analysis (2020-2032)

8.3.2 Film-based Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Tray-based Technology

8.4.1 Tray-based Technology Market Trends Analysis (2020-2032)

8.4.2 Tray-based Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Vacuum Skin Packaging Market Segmentation, by Application

9.1 Chapter Overview

9.2 Meat, Poultry & Seafood

9.2.1 Meat, Poultry & Seafood Market Trends Analysis (2020-2032)

9.2.2 Meat, Poultry & Seafood Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Fruits & Vegetables

9.3.1 Fruits & Vegetables Market Trends Analysis (2020-2032)

9.3.2 Fruits & Vegetables Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Dairy

9.4.1 Dairy Market Trends Analysis (2020-2032)

9.4.2 Dairy Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Ready-to-eat Meals

9.5.1 Ready-to-eat Meals Market Trends Analysis (2020-2032)

9.5.2 Ready-to-eat Meals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.4 North America Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.6.2 USA Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.7.2 Canada Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.8.2 Mexico Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.6.2 Poland Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.7.2 Romania Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.4 Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.6.2 Germany Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.7.2 France Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.8.2 UK Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.9.2 Italy Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.10.2 Spain Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.13.2 Austria Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.6.2 China Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.7.2 India Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.8.2 Japan Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.9.2 South Korea Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.10.2 Vietnam Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.11.2 Singapore Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.12.2 Australia Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.4 Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.6.2 UAE Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.4 Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.4 Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.6.2 Brazil Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.7.2 Argentina Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.8.2 Colombia Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Vacuum Skin Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Adapa

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Amcor

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Atlantis-Pak

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Coveris Holdings

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Flexopack

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 , G. Mondini

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Klckner Pentaplast

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 KM Packaging Services

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 MULTIVAC Group

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Pakmar

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material

Polyethylene (PE)

Polyvinyl Chloride (PVC)

Polypropylene (PP)

Polyamide (PA)

Others

By Technology

Thermoforming Technology

Film-based Technology

Tray-based Technology

By Application

Meat, Poultry & Seafood

Fruits & Vegetables

Dairy

Ready-to-eat Meals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Box And Carton Overwrap Film Market size was USD 12.18 billion in 2023 and is expected to Reach USD 16.42 billion by 2031 and grow at a CAGR of 3.8% over the forecast period of 2024-2031.

The Aseptic Paper Packaging Market size was USD 9.7 billion in 2023 and is expected to Reach USD 13.86 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The Recyclable Packaging Market size was USD 28.83 billion in 2023 and is expected to Reach USD 47.24 billion by 2032 and grow at a CAGR of 5.64% over the forecast period of 2024-2032.

The Flexible Packaging Market size was valued at USD 257.14 billion in 2023 and is expected to Reach USD 411.78 billion by 2032 and grow at a CAGR of 5.37% over the forecast period of 2024-2032.

The Jerry Cans Market size was USD 2.34 billion in 2023 and is expected to Reach USD 3.51 billion by 2031 and grow at a CAGR of 4.64 % over the forecast period of 2024-2031.

The Stick Packaging Market Size was valued at USD 909.805 million in 2023 and will reach $1378.80 million by 2032 and grow at a CAGR of 4.75% by 2024-2032.

Hi! Click one of our member below to chat on Phone