Get More Information on US Packaged Food Market - Request Sample Report

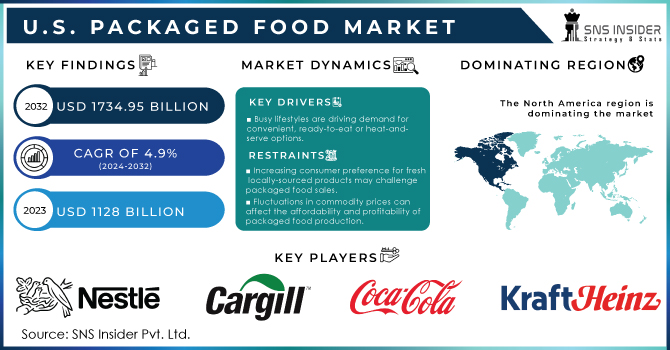

U.S. Packaged Food Market size was valued at USD 1128 billion in 2023 and is expected to reach USD 1734.95 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032.

Busy lifestyles continue to fuel the demand for convenient food options. Consumers are seeking out for packaged foods which are easy to prepare and store. This rise of e-commerce platforms has further boosted the sales by making packaged foods readily available for online purchases and deliveries. The food manufacturers are constantly developing the new and exciting products to cater the changing consumer preferences. This includes the focus on healthier ingredients, with a rise in demand for organic, natural, and minimally processed options. The plant-based alternatives to meat and dairy products are gaining the significant traction. Thus, there is a growing interest in bold flavours and ethnic cuisines, prompting the manufacturers to introduce the new varieties that cater to these trends.

The sustainable packaging solutions are another area of advancement. As consumers become more environmentally conscious, the packaged food industry is responding with eco-friendly packaging materials and recyclable options. This focus on sustainability is driven by the consumer preferences and also by government initiatives which promotes the responsible waste management and resource utilization. These factors combined are shaping the future of the U.S. Packaged Food Market, ensuring a dynamic and ever-evolving landscape in future.

Key Drivers:

The explosive growth of e-commerce is significantly impacting how Americans obtain their packaged food. In the past, grocery shopping often involved a physical trip to the store to browse shelves and select items. Today, however, consumers can conveniently shop for a vast array of packaged foods from the comfort of their own homes. User-friendly e-commerce platforms allow customers to browse virtual aisles stocked with everything from pantry staples to specialty snacks. Once a selection is made, the chosen packaged foods are delivered directly to the customer's doorstep, eliminating the need for a physical shopping trip. This convenience factor is a major driver for the U.S. packaged food market. Busy individuals and families with limited time appreciate the ability to have their groceries delivered, saving them valuable time and effort. The e-commerce platforms often offer features like subscription services and targeted promotions, further enhancing the appeal of online packaged food shopping. As e-commerce continues to grow and evolve, it's likely to play an even greater role in shaping how Americans obtain and consume packaged food products.

Restraints:

The cost of raw ingredients like grains, sugar, and oils can fluctuate significantly, impacting both affordability for consumers and profitability for manufacturers. When commodity prices rise, packaged food companies may face pressure to raise their own prices, potentially leading to sticker shock for consumers and reduced sales. If commodity prices fall, companies may struggle to maintain profit margins, impacting their ability to invest in innovation and marketing. This price volatility creates uncertainty for both businesses and consumers, making it difficult to plan and budget effectively. Thus, these fluctuations can disrupt supply chains, as companies struggle with securing raw materials at stable prices.

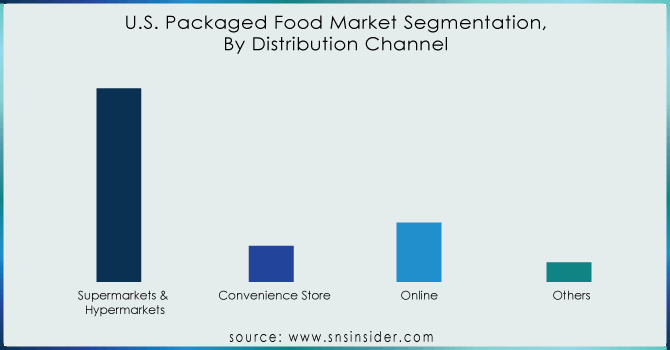

By Distribution Channel

Supermarkets & Hypermarkets

Convenience Store

Online

Others

Supermarkets and hypermarkets is the dominating sub-segment in the U.S. Packaged Food Market by distribution channel holding above 67% of market share. They offer a one-stop-shop experience, allowing consumers to purchase a wide variety of packaged goods alongside fresh produce and other household essentials. This convenience factor is crucial for busy consumers who value time-saving solutions. These stores have the physical space to accommodate a large selection of national and regional brands, catering to diverse consumer preferences. The supermarkets and hypermarkets often leverage bulk buying power to negotiate competitive prices for packaged foods, making them a cost-effective option for many consumers.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Product

Bakery & Confectionary Products

Dairy Products

Snacks & Nutritional Bars

Beverages

Sauces, Dressings, & Condiments

Ready-to-Eat Meals

Breakfast Cereals

Processed Meats

Rice, Pasta, & Noodles

Ice Creams & Frozen Novelties

Others

Beverages is the dominating sub-segment in the U.S. Packaged Food Market by product holding above 16% of market share. The beverages are a necessity, consumed throughout the day to quench thirst and stay hydrated. This regular consumption drives consistent demand. The beverage category offers a vast array of options, from bottled water and juices to soft drinks, coffee, and tea. This variety caters to diverse taste preferences and caters to different consumption occasions. The advancements in packaging technology have led to a proliferation of single-serve and portable beverage options, perfectly aligned with the on-the-go lifestyles of many consumers.

The West Coast is experiencing the strongest growth in this market. The region boasts a large health-conscious population, driving demand for organic, plant-based, and functional packaged foods. The presence of a thriving tech industry with a young, busy workforce fuels the market for convenient, ready-to-eat options. The government initiatives in these states often focus on promoting healthy eating habits, which can indirectly benefit the sales of packaged foods catering to these preferences. For example, California has implemented various programs to encourage access to fresh fruits and vegetables in underserved communities, potentially influencing the demand for healthy packaged alternatives in these areas.

The major key players are Nestlé, The Coca-Cola Company, yson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, The Kraft Heinz Company, PepsiCo, General Mills Inc., Conagra Brands, Inc., Kellogg Co. and other key players.

In June 2024: Kraft Heinz grew its partnership with Chile-based NotCo to launch plant-based Oscar Mayer hot dogs and sausages, now available in approximately 4,000 stores across the United States, including retailers such as Albertson's, Safeway, and Mayer.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1128 Billion |

| Market Size by 2032 | US$ 1734.95 Billion |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Store, Online, Others) • By Product ( Bakery & Confectionary Products, Dairy Products, Snacks & Nutritional Bars, Beverages, Sauces, Dressings, & Condiments, Ready-to-Eat Meals, Breakfast Cereals, Processed Meats, Rice, Pasta, & Noodles, Ice Creams & Frozen Novelties, Others ) |

| Regional Analysis/Coverage | USA |

| Company Profiles | Nestlé, The Coca-Cola Company, yson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, The Kraft Heinz Company, PepsiCo, General Mills Inc., Conagra Brands, Inc., Kellogg Co. |

| Key Drivers | • Busy lifestyles are driving demand for convenient, ready-to-eat or heat-and-serve options. • Food science advancements are leading to innovative products like plant-based alternatives. • E-commerce growth is making packaged foods readily available for home delivery. |

| Restraints | • Increasing consumer preference for fresh, locally-sourced products may challenge packaged food sales. • Fluctuations in commodity prices can affect the affordability and profitability of packaged food production. |

Ans: The expected CAGR of the U.S. Packaged Food Market during the forecast period is 4.9%.

Ans: The U.S. Packaged Food Market was valued at USD 1128 billion in 2023.

Ans: Busy lifestyles, new food options like plant-based products, and the convenience of online grocery shopping are key drivers.

Ans: Consumer preference for fresh produce and fluctuating ingredient prices can be obstacles for packaged food sales.

Ans: Beverages hold the largest market share due to their necessity and wide variety of options.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. U.S. Packaged Food Market Segmentation, By Distribution Channel

7.1 Introduction

7.2 Supermarkets & Hypermarkets

7.3 Convenience Store

7.4 Online

7.5 Others

8. U.S. Packaged Food Market Segmentation, By Product

8.1 Introduction

8.2 Bakery & Confectionary Products

8.3 Dairy Products

8.4 Snacks & Nutritional Bars

8.5 Beverages

8.6 Sauces, Dressings, & Condiments

8.7 Ready-to-Eat Meals

8.8 Breakfast Cereals

8.9 Processed Meats

8.10Rice, Pasta, & Noodles

8.11 Ice Creams & Frozen Novelties

8.12 Others

9. Country Analysis

9.1 Introduction

9.2 U.S

9.2.1 Trend Analysis

9.2.2 U.S. Packaged Food Market Segmentation, By Distribution Channel

9.2.3 U.S. Packaged Food Market Segmentation, By Product

10. Company Profiles

10.1 Nestlé

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 The Coca-Cola Company

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 PepsiCo

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Tyson Foods, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Mars, Incorporated

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Cargill, Incorporated

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 The Kraft Heinz Company

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 General Mills Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Conagra Brands, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Kellogg Co.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Beverage Carton Packaging Machinery Market size was USD 1176.35 million in 2022 and is expected to Reach USD 1685.74 million by 2031 and grow at a CAGR of 4.6 % over the forecast period of 2024-2031.

Dairy Packaging Market was valued at USD 26.92 billion in 2023 and is expected to reach USD 39.84 billion by 2032, growing at a CAGR of 4.49% from 2024 to 2032.

The Perfume Packaging Market Size was valued at USD 3.32 billion in 2023 and is expected to reach USD 5.96 billion by 2032 and grow at a CAGR of 6.73% over the forecast period 2024-2032.

The Inclusive Packaging Market is rapidly growing, spurred by a focus on accessibility and convenience for diverse consumer groups, including those with disabilities and the elderly.

The Modular Container Market size projected to reach at USD 52.05 billion by 2032 & was valued at USD 28.05 billion in 2023 with CAGR of 7.8% by 2024-2032.

The Dunnage Packaging Market size was USD 4.08 billion in 2023 and is expected to Reach USD 6.55 billion by 2031 and grow at a CAGR of 6.1% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone