To Get More Information on Upstream Bioprocessing Market - Request Sample Report

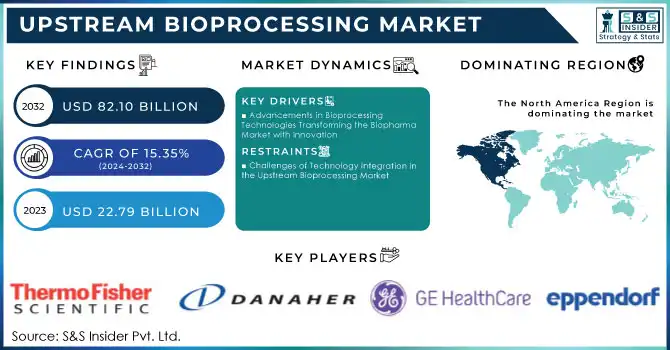

Upstream Bioprocessing Market was valued at USD 22.79 billion in 2023 and is expected to reach USD 82.10 billion by 2032, growing at a CAGR of 15.35% from 2024-2032.

The Upstream Bioprocessing market continues to grow steadily with the increasing involvement of biopharmaceuticals in healthcare and development in the field of production of biologics. Advancing investment in optimizing cell culture, media development, and fermentation processes, with U.S. and EU biotech companies collectively raised a total of USD 81.1 billion in 2023 and in the first quarter of 2024, the biopharma sector formed 115 R&D partnerships totaling USD 36 billion, highlighting a strong focus on innovation and collaboration. With innovations such as single-use bioreactors and automation continuing to make upstream bioprocessing increasingly efficient, companies can push production processes further for cost and quality. This progress reflects a wider industry trend toward making biopharmaceutical manufacturing more adaptable and scalable.

The upstream bioprocessing market will be influenced by several factors that will shape the demand for biologics, vaccines, and advanced therapies that call for complex, high-precision manufacturing. Increasing interest in personalized medicine and also in biosimilars has added complexity to this entire market as well, as companies try to strike a balance between maximum volumes and tailored solutions. With the increase in competition, firms are increasingly focusing on flexible and efficient production platforms to meet the dynamic needs of the biopharmaceutical sector, building capabilities to accommodate evolving therapeutic innovation.

Emerging technologies such as artificial intelligence and advanced sensing are expected to drive the future of upstream bioprocessing by improving process optimization and real-time monitoring. AI also enables the improvement of quality control-it is one of the factors that 60% of professionals assert can analyze large datasets quickly and ensure high standards. Finally, policy support for biotechnological innovation is likely to spur growth as regulatory agencies switch to more flexible manufacturing approaches. It's also developing sustainable bioprocessing practices that reduce environmental impact. All these advancements will promote innovation and adaptability, important aspects of sustainability, which are crucial for long-term market growth.

DRIVERS

Advancements in Bioprocessing Technologies Transforming the Biopharma Market with Innovation

Single-use technologies, automation, and high-throughput systems have more than doubled the efficiency, scalability, and flexibility of biologics production. These innovations cut the complicated cleaning and sterilization processes, simplify workflows, and reduce timelines for the manufacture, thus aligning with the demand for cost-effectiveness and high efficiency. Where the industry continues to value faster development and lower production costs, these technologies keep companies ahead of the changing market. Thereafter, expansion in this market with the adoption of these advancements would expand existing product access, open up opportunities for new entrants to the biopharma space, and attract more players.

The Impact of Emerging Biotech Companies on the Upstream Bioprocessing Market Fueling Growth through Novel Therapies and Precision Medicine

These new companies, developing innovative therapies and targeted medicines, are increasingly demanding scalable bioprocessing solutions able to match the specific demands for small-batch, high-value biologic production. As gene and cell therapies advance, these companies need cost-effective, flexible biomanufacturing platforms that assist in innovation while driving timelines down. As regulatory environments evolve to support novel therapies, such biotech firms are applying new technologies for increased acceleration in development, which means a great scope of growth within the bioprocessing sector. Expansions for these biotech companies will continue to fuel demand for advanced bioprocessing solutions, along with competition and opportunities for further market innovation.

RESTRAINTS

Challenges of Technology Integration in the Upstream Bioprocessing Market

A major constraint in the upstream bioprocessing market is the difficulty of adopting and integrating advanced technologies like AI, automation, and single-use systems in the existing production environment. As these technologies are the future to improve efficiency and scale up, for many biopharma companies, integrating them poses severe obstacles. The key challenge in all this is the cost factor required in upgrading existing systems for new technologies. Also, the incorporation of such technologies by itself calls for specialty skills and a long period of training, hence with higher cost. Other regulatory hurdles add to this complexity as new technologies must come up with strict compliance and safety requirements, which eventually hampers real progress. Such financial and operational barriers may make growth hard and, for instance, confine small companies from embracing new technologies.

BY USE TYPE

The multi-use segment dominated the upstream bioprocessing market in 2023, with the largest share of about 56%. This can be attributed to established demand in the market, proven technology delivery, and scalability in high-volume production. Multi-use systems have long been preferred due to their capital and lifecycle cost competitiveness and long-term operational stability, confirming their dominant position in the market.

The single-use segment is expected to grow at the fastest CAGR of 16.53% from 2024 to 2032 due to flexibility, reduced setup times, and lesser chances of contamination. Innovations in materials and designs are making single-use technologies more attractive, particularly for smaller-scale and personal biomanufacturing. As this segment expands, it may reshape the market competition, creating new opportunities for investments, and change the production strategies throughout the industry.

BY MODE

The in-house segment dominated the upstream bioprocessing market in 2023, with the highest revenue share of 59%, since it is the segment that facilitates control over product quality, intellectual property, and process integration. Technological advancements in automation further enhance operations' security in-house, making them more efficient and scalable. Consequently, in-house biomanufacturing remains a key investment area, thereby adding to the stronghold of the market leaders in the industry.

The outsourced segment is expected to grow at the fastest CAGR of 16.39% from 2024 to 2032, because of the increasing demand for cost efficiency, flexibility, and specialized expertise. Innovation in contract manufacturing and the rise in small to mid-sized biopharma companies are growth factors for the market. As outsourcing expands, it would shift market dynamics toward new partnerships and investment opportunities within specialized service providers.

BY WORKFLOW

The cell culture segment dominated the upstream bioprocessing market in 2023, with the highest revenue share of about 58%. Its growth is buoyed by the well-established demands for biologics, especially in vaccine and monoclonal antibody production, where cell culture plays a crucial role. Improvement in process efficiency has come from enhancements in cell line optimization and the design of bioreactors and has cemented the cell culture segment's position in the market.

The media preparation segment is expected to grow at the fastest CAGR of 16.64% from 2024 to 2032, because of innovation in cell culture media and the surging demand for personalized therapies. As companies focus on optimizing cell growth conditions, the need for advanced, tailored media solutions is expanding. Therefore, this growth is likely to drive increased investment in media development shifting market dynamics and encouraging new players to enter the market with specialized offerings.

BY PRODUCT

In 2023, the bioreactors/fermenters segment dominated the upstream bioprocessing market with the highest revenue share of 32%. This is attributed to the strong demand for large-scale biologics production, wherein bioreactors play a key role in optimizing the growth of cells and improving yields. Automation and real-time monitoring in bioreactor systems have contributed to further better efficiency. This, in turn, captures greater investment and cements market leadership for the segment in the manufacturing of biopharmaceuticals.

Cell culture products are also expected to grow at the fastest CAGR of 17.04% from 2024 to 2032, driven by innovations in cell culture media and equipment. Increasing demand for personalized therapies and complex biologics increases the demand for advanced, customized cell culture products. This growth is expected to fuel more competition and investment in developing customized solutions, shaping biopharmaceutical production's future.

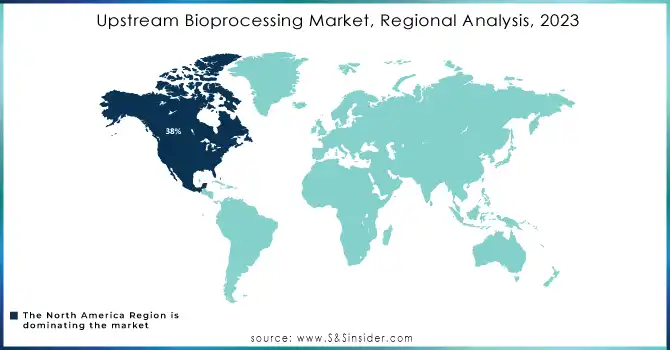

North America region dominated the upstream bioprocessing market with the highest revenue share of about 38% in 2023. Its dominance is due to the demand for biopharmaceuticals, which is underpinned by good infrastructure as well as leading market players. Advanced manufacturing capabilities, access to cutting-edge technologies, and a favorable regulatory environment continue to fuel the region's share. As a result, North America would be the stronghold with continued investments improving its competitive edge in global biomanufacturing.

The Asia Pacific region is expected to grow at the fastest CAGR of 17.74% during the forecast period from 2024 to 2032, led by major investment inflows and untapped opportunities in biopharmaceutical manufacturing. Emerging trends such as increasing healthcare demands, government support for biotechnology, and growing contract manufacturing capabilities are fueling this growth. The bioprocessing footprint of Asia Pacific is expected to change as it reshapes the competitive landscape while attracting more investment and increasing its share in the global biopharma market, thereby altering production strategies and consumer dynamics.

Do You Need any Customization Research on Upstream Bioprocessing Market - Enquire Now

LATEST NEWS -

In 2024, Thermo Fisher Scientific launched biobased solutions to reduce the climate impact of biologics manufacturing. These innovations include sustainable single-use bioprocessing containers, aiming to lower emissions while ensuring high product performance and consistency

In August 2024, Merck KGaA acquired Mirus Bio, a leader in advanced transfection technologies for cell and gene therapies, strengthening its position in upstream bioprocessing solutions. This acquisition enhances Merck’s ability to support innovations in biological production.

KEY PLAYERS

Thermo Fisher Scientific, Inc. (Nalgene Labware, HyClone Cell Culture Media)

Merck KGaA (Millipore Sigma Cell Culture Media, Merck Millipore Bioreactors)

Corning Incorporated (Cell Culture Dishes, Bioprocess Containers)

Sartorius AG (BIOSTAT Bioreactors, Sartorius Stedim Biotech Single-Use Systems)

Eppendorf AG (Bioreactor Systems, Cell Culture Equipment)

Danaher (Ultipor Membranes, XRS Bioreactor)

Boehringer Ingelheim GmbH (Cell Culture Media, Bioprocess Systems)

Applikon Biotechnology (Bioreactor Systems, Control Systems)

PBS Biotech, Inc (Wave Bioreactor, Bioreactor Systems)

Lonza (CHO Media, Disposable Bioreactors)

VWR International, LLC (Bioprocessing Buffers, Single-Use Bioreactors)

Meissner Filtration Products, Inc. (Bioprocess Filtration, Single-Use Systems)

Repligen Corporation (Protein A Chromatography Resins, Filtration Solutions)

Entegris (Bioprocessing Filtration, Single-Use Systems)

Kuhner AG (ShakeFlask, Bioreactor Systems)

GE Healthcare Life Sciences (Xcellerex Single-Use Bioreactors, HyClone Cell Culture Media)

AbbVie (CHO Media, Cell Line Development Services)

Fisher Scientific (Nalgene Labware, HyClone Cell Culture Media)

Bio-Rad Laboratories, Inc. (Bio-Plex Pro Assays, Protein Purification Systems)

Cytiva (Bioprocess Single-Use Systems, Flow Cytometry Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.79 Billion |

| Market Size by 2032 | USD 82.10 Billion |

| CAGR | CAGR of 15.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bioreactors/Fermenters, Cell Culture Products, Filters, Bioreactors Accessories, Bags & Containers, Others) • By Workflow (Media Preparation, Cell Culture, Cell Separation) • By Use Type (Multi-use, Single-use) • By Mode (In-house, Outsourced) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Corning Incorporated, Sartorius AG, Eppendorf AG, Danaher, Boehringer Ingelheim GmbH, Applikon Biotechnology, PBS Biotech, Inc., Lonza, VWR International, LLC, Meissner Filtration Products, Inc., Repligen Corporation, Entegris, Kuhner AG, GE Healthcare Life Sciences, AbbVie, Fisher Scientific, Bio-Rad Laboratories, Inc., Cytiva |

| Key Drivers | • Advancements in Bioprocessing Technologies Transforming the Biopharma Market with Innovation • The Impact of Emerging Biotech Companies on the Upstream Bioprocessing Market Fueling Growth through Novel Therapies and Precision Medicine |

| RESTRAINTS | • Challenges of Technology Integration in the Upstream Bioprocessing Market |

Upstream Bioprocessing Market was valued at USD 22.79 billion in 2023 and is expected to reach USD 82.10 billion by 2032, growing at a CAGR of 15.35% from 2024-2032.

The multi-use segment dominated with a market share of about 56%, due to its proven technology, scalability, and cost competitiveness.

The media preparation segment is expected to grow at a CAGR of 16.64%, driven by demand for advanced, customized media solutions.

North America dominated the market in 2023 with a 38% share, driven by strong demand, advanced infrastructure, and leading market players.

Asia Pacific is expected to grow at a CAGR of 17.74% due to increasing healthcare demand, government support for biotech, and growing contract manufacturing capabilities.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Increased R&D Investment

5.2 Technological Distribution

5.3 Outsourcing of Biopharmaceutical Manufacturing

5.4 Technological Innovations

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Upstream Bioprocessing Market Segmentation, by Product

7.1 Chapter Overview

7.2 Bioreactors/Fermenters

7.2.1 Bioreactors/Fermenters Market Trends Analysis (2020-2032)

7.2.2 Bioreactors/Fermenters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Cell Culture Products

7.3.1 Cell Culture Products Market Trends Analysis (2020-2032)

7.3.2 Cell Culture Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Filters

7.4.1 Filters Market Trends Analysis (2020-2032)

7.4.2 Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Bioreactors Accessories

7.5.1 Bioreactors Accessories Market Trends Analysis (2020-2032)

7.5.2 Bioreactors Accessories Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Bags & Containers

7.6.1 Bags & Containers Market Trends Analysis (2020-2032)

7.6.2 Bags & Containers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Upstream Bioprocessing Market Segmentation, by Workflow

8.1 Chapter Overview

8.2 Media Preparation

8.2.1 Media Preparation Market Trends Analysis (2020-2032)

8.2.2 Media Preparation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cell Culture

8.3.1 Cell Culture Market Trends Analysis (2020-2032)

8.3.2 Cell Culture Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Cell Separation

8.4.1 Cell Separation Market Trends Analysis (2020-2032)

8.4.2 Cell Separation Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Upstream Bioprocessing Market Segmentation, by Mode

9.1 Chapter Overview

9.2 In-house

9.2.1 In-house Market Trends Analysis (2020-2032)

9.2.2 In-house Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Outsourced

9.3.1 Outsourced Market Trends Analysis (2020-2032)

9.3.2 Outsourced Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Upstream Bioprocessing Market Segmentation, By Use Type

10.1 Chapter Overview

10.2 Multi-use

10.2.1 Multi-use Market Trends Analysis (2020-2032)

10.2.2 Multi-use Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Single-use

10.3.1 Single-use Market Trends Analysis (2020-2032)

10.3.2 Single-use Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.4 North America Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.2.5 North America Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.2.6 North America Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.7.2 USA Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.2.7.3 USA Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.2.7.4 USA Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.8.2 Canada Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.2.8.3 Canada Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.2.8.4 Canada Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.9.2 Mexico Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.2.9.3 Mexico Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.2.9.4 Mexico Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.7.3 Poland Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.7.4 Poland Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.8.3 Romania Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.8.4 Romania Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.5 Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.6 Western Europe Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.7.3 Germany Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.7.4 Germany Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.8.2 France Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.8.3 France Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.8.4 France Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.9.2 UK Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.9.3 UK Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.9.4 UK Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.10.3 Italy Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.10.4 Italy Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.11.3 Spain Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.11.4 Spain Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.14.3 Austria Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.14.4 Austria Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.5 Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.6 Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.7.2 China Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.7.3 China Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.7.4 China Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.8.2 India Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.8.3 India Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.8.4 India Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.9.2 Japan Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.9.3 Japan Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.9.4 Japan Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.10.2 South Korea Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.10.3 South Korea Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.10.4 South Korea Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.11.3 Vietnam Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.11.4 Vietnam Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.12.2 Singapore Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.12.3 Singapore Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.12.4 Singapore Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.13.2 Australia Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.13.3 Australia Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.13.4 Australia Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.4 Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.5 Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.6 Middle East Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.7.3 UAE Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.7.4 UAE Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.4 Africa Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.2.5 Africa Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.2.6 Africa Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.4 Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.6.5 Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.6.6 Latin America Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.7.2 Brazil Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.6.7.3 Brazil Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.6.7.4 Brazil Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.8.2 Argentina Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.6.8.3 Argentina Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.6.8.4 Argentina Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.9.2 Colombia Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.6.9.3 Colombia Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.6.9.4 Colombia Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Upstream Bioprocessing Market Estimates and Forecasts, by Mode (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Upstream Bioprocessing Market Estimates and Forecasts, By Use Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Thermo Fisher Scientific, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Merck KGaA

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Corning Incorporated

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Sartorius AG

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Eppendorf AG

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Danaher

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Boehringer Ingelheim GmbH

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Applikon Biotechnology

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 PBS Biotech, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Lonza

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Bioreactors/Fermenters

Cell Culture Products

Filters

Bioreactors Accessories

Bags & Containers

Others

By Workflow

Media Preparation

Cell Culture

Cell Separation

By Use Type

Multi-use

Single-use

By Mode

In-house

Outsourced

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Metagenomics Market Size was valued at USD 2.11 Billion in 2023 and is expected to reach USD 6.70 Billion by 2032, growing at a CAGR of 13.69% over the forecast period of 2024-2032.

The Latex Agglutination Test Kits Market was valued at USD 639.13 million in 2023 and is expected to reach USD 1049.64 million by 2032, growing at a CAGR of 5.69% over the forecast period of 2024-2032.

The Generative AI in Healthcare Market size was valued at US$ 1.7 Bn in 2023 and is estimated to US$ 19.99 Bn by 2032 with a growing CAGR of 31.5% Over the Forecast Period of 2024-2032.

The Soft Contact Lenses Market size was valued at USD 9.05 billion in 2023, projected to reach USD 17.39 billion by 2032, with a 7.55% CAGR from 2024 to 2032.

The Deep Brain Stimulation (DBS) Devices Market Size was valued at USD 1.25 billion in 2023 and is witnessed to reach USD 3.10 billion by 2032 and grow at a CAGR of 11.12% over the forecast period 2024-2032.

The Thyroid Cancer Diagnostics Market size was estimated at USD 2.94 billion in 2023, expected to reach USD 4.81 billion by 2032 with a 5.65% CAGR.

Hi! Click one of our member below to chat on Phone