Get more information on Ultrasound Equipment Market - Request Free Sample Report

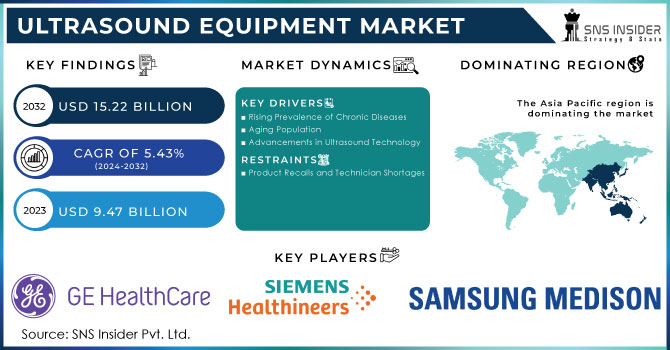

The ultrasound equipment market size was valued at USD 9.47 billion in 2023, and is expected to reach USD 15.22 billion by 2032, and grow at a CAGR of 5.43% over the forecast period 2024-2032.

Ultrasound equipment has become an indispensable tool in modern healthcare. Its non-invasive nature, real-time imaging capabilities, and versatility have driven significant demand across various medical specialties.

The ultrasound equipment market is experiencing robust growth driven by the increasing prevalence of chronic diseases, aging populations, and technological advancements. The demand for accurate and efficient diagnostic tools is propelling the adoption of ultrasound systems across healthcare settings.

The rising incidence of cardiovascular diseases, cancer, and other conditions requiring regular monitoring is a key driver of ultrasound equipment demand. Additionally, the growing preference for non-invasive procedures and the expanding application of ultrasound in point-of-care settings are contributing to market growth. According to the World Heart Federation, over half a billion people worldwide are affected by this condition. In 2021 alone, CVDs claimed a staggering 20.5 million lives, representing nearly one-third of global deaths. This marks a dramatic 60% increase compared to 1990, underscoring the urgent need for effective prevention and treatment strategies. With an estimated 20 million new cases and 9.7 million deaths in 2022 alone, cancer remains a leading cause of mortality worldwide. These staggering statistics highlight the critical need for early detection and effective treatment strategies, underscoring the vital role of diagnostic tools like ultrasound equipment in combating this disease.

The ultrasound equipment market is characterized by a competitive landscape with several major players offering a wide range of products. Technological innovation and product differentiation are crucial for gaining a competitive edge.

Governments worldwide are investing in healthcare infrastructure and promoting preventive care, which is driving the demand for medical imaging equipment, including ultrasound systems. Initiatives to improve healthcare access in rural and underserved areas are also creating opportunities for ultrasound equipment providers.

Advancements in ultrasound technology, such as AI integration, 3D/4D imaging, and portable devices, are reshaping the market. The integration of ultrasound with other imaging modalities and the development of specialized ultrasound systems for specific applications are emerging trends. The integration of artificial intelligence (AI) is revolutionizing image analysis, enabling faster and more accurate diagnosis. AI-powered systems can automatically recognize and analyze musculoskeletal abnormalities, improving diagnostic precision and efficiency.

A significant leap in ultrasound technology was achieved in February 2023 with the FDA approval of Clarius Mobile Health's HD3 device. This third-generation ultrasound system incorporates artificial intelligence to rapidly identify and measure tendon structures in the foot, ankle, and knee. By automating these tasks, the technology accelerates injury diagnosis and treatment, demonstrating the potential of AI to revolutionize musculoskeletal imaging.

Moreover, advancements such as high-frequency ultrasound and elastography are enhancing image quality, providing more detailed anatomical information, and enabling quantitative analysis. These technological breakthroughs are expanding the diagnostic capabilities of ultrasound and increasing its clinical utility.

Overall, the ultrasound equipment market is expected to continue its growth trajectory, driven by favorable demographic trends, technological advancements, and increasing healthcare spending.

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of conditions like heart disease, diabetes, and cancer necessitates regular monitoring and diagnosis, which heavily relies on ultrasound imaging.

The prevalence of chronic diseases in the United States is at epidemic levels. Over 129 million Americans grapple with at least one chronic condition, with many managing multiple diseases simultaneously. These conditions, including heart disease, cancer, diabetes and obesity, account for a significant portion of the nation's leading causes of death and disability.

The escalating burden of chronic illness has placed immense pressure on the healthcare system. Approximately 90% of total healthcare expenditures are dedicated to managing chronic diseases, underscoring the urgent need for effective diagnostic tools and monitoring solutions.

Aging Population

As the global population ages, the demand for diagnostic imaging, including ultrasound, increases due to the higher prevalence of age-related health issues.

Advancements in Ultrasound Technology

Continuous technological innovations are enhancing the capabilities of ultrasound machines, making them more accurate, efficient, and versatile, thereby expanding their applications.

Increasing Preference for Non-Invasive Procedures

Ultrasound is a non-invasive imaging technique, making it a preferred choice for patients and healthcare providers.

Growth of Point-of-Care Ultrasound

Portable ultrasound devices are gaining popularity for use in various settings, such as emergency departments, critical care units, and outpatient clinics.

Restraints

Product Recalls and Technician Shortages

Product recalls initiated by regulatory bodies due to safety concerns or performance issues can damage brand reputation and erode consumer confidence. For instance, Koninklijke Philips N.V.'s recall of the Sparq ultrasound device in 2021 due to battery issues exemplifies this risk.

Furthermore, a shortage of trained technicians, particularly prevalent in regions like Australia, the U.K., and Canada, poses a significant obstacle to market expansion. The inability to find qualified personnel to operate and maintain ultrasound equipment limits the adoption of these systems, impacting overall market growth.

Key Segmentation

By Product

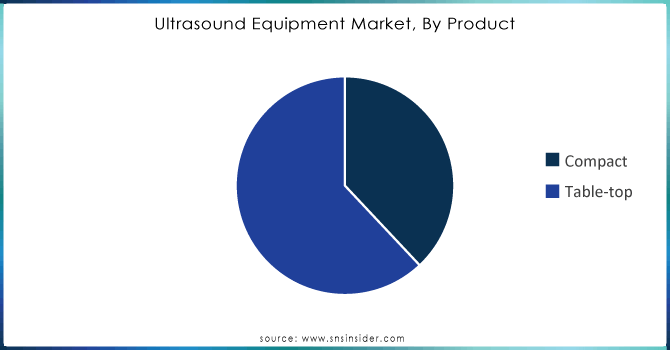

Table-top dominated the market with 62% share in 2023 due to their widespread adoption in hospitals and clinics for a variety of diagnostic imaging procedures. The extensive installation base, as evidenced by over 130,000 table-top units installed globally by ESAOTE SPA alone, underscores this segment's dominance.

However, the compact segment is emerging as the fastest-growing category. Advancements in technology, coupled with the introduction of innovative handheld devices like Mindray Bio-Medical's TE Air and GE Healthcare's Vscan Air, are driving this rapid expansion. The portability, ease of use, and ability to perform point-of-care ultrasounds are key factors propelling the adoption of compact systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Radiology emerged as the dominated segment in 2023 with 43% market share. The increasing number of radiology centers and the widespread use of ultrasound for general imaging and diagnosing medical complications have contributed to this segment's leadership. As highlighted by a study from Poland, the high volume of ultrasound examinations in radiology departments underscores the segment's importance.

The gynecology segment is anticipated to experience the fastest growth. The rising prevalence of gynecological disorders, coupled with technological advancements in ultrasound equipment, is driving demand for advanced diagnostic systems in this area.

By End User

Hospitals dominated the market with 72% share in 2023 due to higher patient admissions, well-established infrastructure, and a large volume of ultrasound procedures performed annually. For instance, the U.S. alone reported millions of patient admissions and hundreds of millions of ultrasound scans in a single year.

However, the clinics segment is poised for rapid growth. The increasing adoption of portable and point-of-care ultrasound systems, coupled with rising patient numbers seeking imaging services, is driving this expansion. The convenience and cost-effectiveness of these systems are making them increasingly popular in clinic settings.

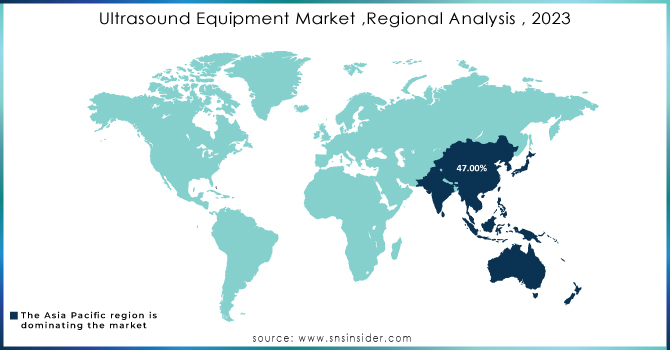

Regional Analysis

The Asia Pacific region dominated the ultrasound equipment market with 47% share in 2023, bolstered by high sales volumes and cost-effective manufacturing hubs like China. Companies such as CHISON Medical Technologies have significantly contributed to this growth, with a substantial portion of their revenue derived from overseas markets.

North America, while holding the second-largest market share, is a hub for technological advancements and new product launches. The COVID-19 pandemic accelerated innovation in the region, as evidenced by the introduction of advanced point-of-care ultrasound systems like Mindray Medical's TE7 Max.

Europe is another key market, driven by an aging population grappling with chronic diseases and a well-established healthcare infrastructure. The region's high prevalence of diabetes further fuels the demand for diagnostic imaging tools like ultrasound.

The major players are GE Healthcare, Hitachi, Siemens Healthcare, Samsung Medison, Esaote, Canon Medical Systems Corporation, and other players

January 2024: GE Healthcare launched its new LOGIQ E10 Series, an advanced ultrasound system featuring artificial intelligence (AI)-driven image analysis to improve diagnostic accuracy and efficiency.

March 2024: Siemens Healthineers introduced the ACUSON Sequoia Crown Edition, which offers enhanced imaging capabilities and integrated cloud services for better data management and collaboration.

June 2024: Canon Medical Systems unveiled its Aplio i-series Prism Edition, designed with cutting-edge elastography and Doppler imaging technologies to provide superior performance in vascular and liver diagnostics.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.47 Bn |

| Market Size by 2032 | US$ 15.22 Bn |

| CAGR | CAGR of 5.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Compact, Table-Top) • By Application (Radiology, Cardiology, Surgery, Point of Care) • By End User (Hospitals, Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GE Healthcare, Hitachi, Siemens healthcare, Samsung Medison, Esaote, Canon Medical Systems Corporation |

| Key Drivers |

• Rising Prevalence of Chronic Diseases • Aging Population • Advancements in Ultrasound Technology • Increasing Preference for Non-Invasive Procedures • Growth of Point-of-Care Ultrasound |

| Market Restraints | • Product Recalls and Technician Shortages |

Ans: The Ultrasound Equipment Market is expected to grow at a CAGR of 5.43%.

Ans: The Ultrasound Equipment Market size was valued at USD 9.47 Bn in 2023 and is expected to reach USD 15.22 Bn by 2032 and grow at a CAGR of 5.43% over the forecast period of 2024-2032.

Ans: The benefits associated with the ultrasound equipment.

Ans: The limited access in certain cases.

Ans: North America overtook other regional markets as the largest market for Ultrasound Equipment, with the highest revenue share.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Ultrasound Equipment Market Segmentation, by Product

7.1 Introduction

7.2 Compact

7.3 Table-top

8. Ultrasound Equipment Market Segmentation, by Application

8.1 Introduction

8.2 Radiology

8.3 Gynecology

8.4 Cardiology

8.5 Point of Care

8.6 Urology

8.7 Surgery

8.8 Others

9. Ultrasound Equipment Market Segmentation, by End User

9.1 Introduction

9.2 Hospitals

9.3 Clinics

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Ultrasound Equipment Market by Country

10.2.3 North America Ultrasound Equipment Market by Product

10.2.4 North America Ultrasound Equipment Market by Application

10.2.5 North America Ultrasound Equipment Market by End User

10.2.6 USA

10.2.6.1 USA Ultrasound Equipment Market by Product

10.2.6.2 USA Ultrasound Equipment Market by Application

10.2.6.3 USA Ultrasound Equipment Market by End User

10.2.7 Canada

10.2.7.1 Canada Ultrasound Equipment Market by Product

10.2.7.2 Canada Ultrasound Equipment Market by Application

10.2.7.3 Canada Ultrasound Equipment Market by End User

10.2.8 Mexico

10.2.8.1 Mexico Ultrasound Equipment Market by Product

10.2.8.2 Mexico Ultrasound Equipment Market by Application

10.2.8.3 Mexico Ultrasound Equipment Market by End User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Ultrasound Equipment Market by Country

10.3.2.2 Eastern Europe Ultrasound Equipment Market by Product

10.3.2.3 Eastern Europe Ultrasound Equipment Market by Application

10.3.2.4 Eastern Europe Ultrasound Equipment Market by End User

10.3.2.5 Poland

10.3.2.5.1 Poland Ultrasound Equipment Market by Product

10.3.2.5.2 Poland Ultrasound Equipment Market by Application

10.3.2.5.3 Poland Ultrasound Equipment Market by End User

10.3.2.6 Romania

10.3.2.6.1 Romania Ultrasound Equipment Market by Product

10.3.2.6.2 Romania Ultrasound Equipment Market by Application

10.3.2.6.4 Romania Ultrasound Equipment Market by End User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Ultrasound Equipment Market by Product

10.3.2.7.2 Hungary Ultrasound Equipment Market by Application

10.3.2.7.3 Hungary Ultrasound Equipment Market by End User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Ultrasound Equipment Market by Product

10.3.2.8.2 Turkey Ultrasound Equipment Market by Application

10.3.2.8.3 Turkey Ultrasound Equipment Market by End User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Ultrasound Equipment Market by Product

10.3.2.9.2 Rest of Eastern Europe Ultrasound Equipment Market by Application

10.3.2.9.3 Rest of Eastern Europe Ultrasound Equipment Market by End User

10.3.3 Western Europe

10.3.3.1 Western Europe Ultrasound Equipment Market by Country

10.3.3.2 Western Europe Ultrasound Equipment Market by Product

10.3.3.3 Western Europe Ultrasound Equipment Market by Application

10.3.3.4 Western Europe Ultrasound Equipment Market by End User

10.3.3.5 Germany

10.3.3.5.1 Germany Ultrasound Equipment Market by Product

10.3.3.5.2 Germany Ultrasound Equipment Market by Application

10.3.3.5.3 Germany Ultrasound Equipment Market by End User

10.3.3.6 France

10.3.3.6.1 France Ultrasound Equipment Market by Product

10.3.3.6.2 France Ultrasound Equipment Market by Application

10.3.3.6.3 France Ultrasound Equipment Market by End User

10.3.3.7 UK

10.3.3.7.1 UK Ultrasound Equipment Market by Product

10.3.3.7.2 UK Ultrasound Equipment Market by Application

10.3.3.7.3 UK Ultrasound Equipment Market by End User

10.3.3.8 Italy

10.3.3.8.1 Italy Ultrasound Equipment Market by Product

10.3.3.8.2 Italy Ultrasound Equipment Market by Application

10.3.3.8.3 Italy Ultrasound Equipment Market by End User

10.3.3.9 Spain

10.3.3.9.1 Spain Ultrasound Equipment Market by Product

10.3.3.9.2 Spain Ultrasound Equipment Market by Application

10.3.3.9.3 Spain Ultrasound Equipment Market by End User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Ultrasound Equipment Market by Product

10.3.3.10.2 Netherlands Ultrasound Equipment Market by Application

10.3.3.10.3 Netherlands Ultrasound Equipment Market by End User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Ultrasound Equipment Market by Product

10.3.3.11.2 Switzerland Ultrasound Equipment Market by Application

10.3.3.11.3 Switzerland Ultrasound Equipment Market by End User

10.3.3.12 Austria

10.3.3.12.1 Austria Ultrasound Equipment Market by Product

10.3.3.12.2 Austria Ultrasound Equipment Market by Application

10.3.3.12.3 Austria Ultrasound Equipment Market by End User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Ultrasound Equipment Market by Product

10.3.3.13.2 Rest of Western Europe Ultrasound Equipment Market by Application

10.3.3.13.3 Rest of Western Europe Ultrasound Equipment Market by End User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Ultrasound Equipment Market by Country

10.4.3 Asia-Pacific Ultrasound Equipment Market by Product

10.4.4 Asia-Pacific Ultrasound Equipment Market by Application

10.4.5 Asia-Pacific Ultrasound Equipment Market by End User

10.4.6 China

10.4.6.1 China Ultrasound Equipment Market by Product

10.4.6.2 China Ultrasound Equipment Market by Application

10.4.6.3 China Ultrasound Equipment Market by End User

10.4.7 India

10.4.7.1 India Ultrasound Equipment Market by Product

10.4.7.2 India Ultrasound Equipment Market by Application

10.4.7.3 India Ultrasound Equipment Market by End User

10.4.8 Japan

10.4.8.1 Japan Ultrasound Equipment Market by Product

10.4.8.2 Japan Ultrasound Equipment Market by Application

10.4.8.3 Japan Ultrasound Equipment Market by End User

10.4.9 South Korea

10.4.9.1 South Korea Ultrasound Equipment Market by Product

10.4.9.2 South Korea Ultrasound Equipment Market by Application

10.4.9.3 South Korea Ultrasound Equipment Market by End User

10.4.10 Vietnam

10.4.10.1 Vietnam Ultrasound Equipment Market by Product

10.4.10.2 Vietnam Ultrasound Equipment Market by Application

10.4.10.3 Vietnam Ultrasound Equipment Market by End User

10.4.11 Singapore

10.4.11.1 Singapore Ultrasound Equipment Market by Product

10.4.11.2 Singapore Ultrasound Equipment Market by Application

10.4.11.3 Singapore Ultrasound Equipment Market by End User

10.4.12 Australia

10.4.12.1 Australia Ultrasound Equipment Market by Product

10.4.12.2 Australia Ultrasound Equipment Market by Application

10.4.12.3 Australia Ultrasound Equipment Market by End User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Ultrasound Equipment Market by Product

10.4.13.2 Rest of Asia-Pacific Ultrasound Equipment Market by Application

10.4.13.3 Rest of Asia-Pacific Ultrasound Equipment Market by End User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Ultrasound Equipment Market by Country

10.5.2.2 Middle East Ultrasound Equipment Market by Product

10.5.2.3 Middle East Ultrasound Equipment Market by Application

10.5.2.4 Middle East Ultrasound Equipment Market by End User

10.5.2.5 UAE

10.5.2.5.1 UAE Ultrasound Equipment Market by Product

10.5.2.5.2 UAE Ultrasound Equipment Market by Application

10.5.2.5.3 UAE Ultrasound Equipment Market by End User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Ultrasound Equipment Market by Product

10.5.2.6.2 Egypt Ultrasound Equipment Market by Application

10.5.2.6.3 Egypt Ultrasound Equipment Market by End User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Ultrasound Equipment Market by Product

10.5.2.7.2 Saudi Arabia Ultrasound Equipment Market by Application

10.5.2.7.3 Saudi Arabia Ultrasound Equipment Market by End User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Ultrasound Equipment Market by Product

10.5.2.8.2 Qatar Ultrasound Equipment Market by Application

10.5.2.8.3 Qatar Ultrasound Equipment Market by End User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Ultrasound Equipment Market by Product

10.5.2.9.2 Rest of Middle East Ultrasound Equipment Market by Application

10.5.2.9.3 Rest of Middle East Ultrasound Equipment Market by End User

10.5.3 Africa

10.5.3.1 Africa Ultrasound Equipment Market by Country

10.5.3.2 Africa Ultrasound Equipment Market by Product

10.5.3.3 Africa Ultrasound Equipment Market by Application

10.5.3.4 Africa Ultrasound Equipment Market by End User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Ultrasound Equipment Market by Product

10.5.3.5.2 Nigeria Ultrasound Equipment Market by Application

10.5.3.5.3 Nigeria Ultrasound Equipment Market by End User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Ultrasound Equipment Market by Product

10.5.3.6.2 South Africa Ultrasound Equipment Market by Application

10.5.3.6.3 South Africa Ultrasound Equipment Market by End User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Ultrasound Equipment Market by Product

10.5.3.7.2 Rest of Africa Ultrasound Equipment Market by Application

10.5.3.7.3 Rest of Africa Ultrasound Equipment Market by End User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Ultrasound Equipment Market by country

10.6.3 Latin America Ultrasound Equipment Market by Product

10.6.4 Latin America Ultrasound Equipment Market by Application

10.6.5 Latin America Ultrasound Equipment Market by End User

10.6.6 Brazil

10.6.6.1 Brazil Ultrasound Equipment Market by Product

10.6.6.2 Brazil Ultrasound Equipment Market by Application

10.6.6.3 Brazil Ultrasound Equipment Market by End User

10.6.7 Argentina

10.6.7.1 Argentina Ultrasound Equipment Market by Product

10.6.7.2 Argentina Ultrasound Equipment Market by Application

10.6.7.3 Argentina Ultrasound Equipment Market by End User

10.6.8 Colombia

10.6.8.1 Colombia Ultrasound Equipment Market by Product

10.6.8.2 Colombia Ultrasound Equipment Market by Application

10.6.8.3 Colombia Ultrasound Equipment Market by End User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Ultrasound Equipment Market by Product

10.6.9.2 Rest of Latin America Ultrasound Equipment Market by Application

10.6.9.3 Rest of Latin America Ultrasound Equipment Market by End User

11. Company Profiles

11.1 GE Healthcare

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Hitachi

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Siemens Healthcare

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Samsung Medison

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Esaote

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Canon Medical Systems Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Hitachi

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Samsung Medison Co., Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Koninklijke Philips N.V.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Compact

Table-top

By Application

Radiology

Gynecology

Cardiology

Point of Care

Urology

Surgery

Others

By End User

Hospitals

Clinics

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Bio Decontamination Market was valued at USD 236.09 million in 2023 and is expected to reach USD 501.37 million by 2032, growing at a CAGR of 8.76% from 2024-2032.

The Radiology Information Systems Market Size was valued at USD 1.18 billion in 2023 and is expected to reach USD 2.61 billion by 2032, and grow at a CAGR of 9.2% over the forecast period 2024-2032.

The Serum-Free Media Market Size was valued at USD 1.7 billion in 2023 and is expected to grow at a CAGR of 13.0% to reach USD 5.1 billion by 2032.

The Molecular Diagnostics Market Size was USD 15.35 Billion in 2023, and expected to reach USD 32.37 Billion by 2032, and grow at a CAGR of 9.07%.

The Bionic Ear Market was valued at USD 2.34 billion in 2023 and is expected to reach USD 4.93 billion by 2032 and grow at a CAGR of 8.6% from 2024 to 2032.

The Digital Clinical Trials Market was valued at USD 8.70 Bn in 2023 and is expected to reach at $13.86 Bn in 2031 and grow at a CAGR of 6 % by 2024-2031.

Hi! Click one of our member below to chat on Phone