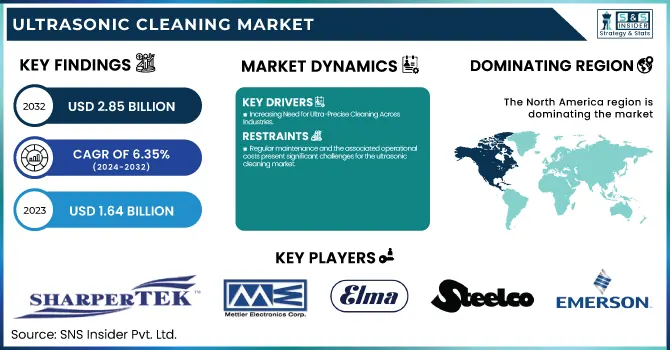

The Ultrasonic Cleaning Market Size was valued at USD 1.64 billion in 2023 and is projected to reach USD 2.85 billion by 2032, growing at a CAGR of 6.35 % from 2024 to 2032. Expanding significantly owing to the rising need for precise cleaning in sectors such as healthcare, electronics, and automotive, where controlling contamination is essential. Ultrasonic technology has been improved over many years by researchers, in order for it to be effective for different parts which, in addition to being delicate, also have complex shapes. Tightening environmental regulations are increasingly pushing the industry toward green alternatives, resulting in a decreased dependency on chemical-based cleaning agents.

To Get more information on Ultrasonic Cleaning Market - Request Free Sample Report

Modern manufacturing: Several companies phased out production lines and combined automation and Industry 4.0 at a faster pace. Emission standards compliance and performance metrics improvement are also driving market growth. In the U.S., the market was valued at USD 0.96 billion in 2023 and is projected to reach USD 1.45 billion by 2032, growing at a 4.68% CAGR. Increased adoption in hospitals, laboratories, semiconductors, and automotive sectors is driving growth. Regulatory policies promoting sustainable cleaning solutions and rising investments in automated, high-frequency ultrasonic systems are further boosting demand, positioning the U.S. as a key market player.

Drivers:

Increasing Need for Ultra-Precise Cleaning Across Industries

Industries such as healthcare, electronics, aerospace, and automotive require highly precise cleaning solutions to ensure contamination control and maintain product quality. Ultrasonic cleaning is commonly employed in healthcare settings for sterilization of surgical instruments and medical devices to prevent infections. The electronics industry uses these systems to clean fragile circuit boards and micro components without damaging them. Ultrasound cleaning is utilized in the aerospace and automotive industries for essential engine components to guarantee optimal functionality and longer life. With industries moving toward stricter standards of cleanliness and more environmental-friendly solutions, ultrasonic cleaning is of increasing demand. The trend corresponds with the market's stable growth, spurred by technological advancements, automation, and compliant with stricter regulation requirement across industries.

Restraints:

Regular maintenance and the associated operational costs present significant challenges for the ultrasonic cleaning market.

These systems require consistent upkeep to maintain their efficiency and effectiveness, including tasks such as inspecting and cleaning transducers, checking ultrasonic generators, and ensuring all components are functioning optimally. Failure to adhere to a proper maintenance schedule can result in system malfunctions, reduced cleaning performance, and increased downtime, which ultimately leads to costly repairs. Additionally, ultrasonic cleaning equipment can be complex to operate, requiring trained personnel to ensure optimal performance and avoid damage to delicate components. These factors contribute to higher operating expenses, making it a barrier for smaller companies with limited budgets. Moreover, as industries demand higher precision and faster cleaning times, the need for ongoing maintenance increases, further driving up costs and affecting profitability. Consequently, the high maintenance burden can deter companies from investing in ultrasonic cleaning solutions.

Opportunities:

Unlocking the Potential of Industry 4.0 in Ultrasonic Cleaning Systems

Industry 4.0 is bringing important prospects for ultrasonic cleaning systems through their integration with various digital technologies including Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing. These integrations facilitate real-time monitoring, predictive maintenance, and data-driven insights that improve operational efficiency and minimize downtime. Integrating sensors and connectivity into ultrasonic cleaning machines allows manufacturers to streamline cleaning cycles, flag issues before failures, and confirm consistent performance. Also, Industry 4.0 integration enables transfer and analysis of data at all levels, leading to continuous system improvement and resultant productivity gains. Ultrasonic cleaning systems provide crucial benefits for industries transitioning towards smart factories by enhancing automation and process optimization, thus boosting overall productivity in sectors like healthcare, automotive, and electronics.

Challenges:

Energy consumption in ultrasonic cleaning systems raises operational costs, presenting a challenge for industries to maintain efficiency and cost-effectiveness.

Energy consumption is a significant concern in the ultrasonic cleaning market. While these systems are efficient in terms of cleaning power, the amount of energy required to operate them, particularly for larger or high-frequency models, can lead to substantial operational costs. Ultrasonic cleaning involves high-frequency sound waves that generate microscopic bubbles in a cleaning solution, and this process requires substantial energy to maintain the desired cleaning action. For industries using large-scale ultrasonic cleaning systems or operating continuously, this energy demand can add up, impacting overall cost-effectiveness. As a result, businesses are seeking energy-efficient models and considering energy-saving techniques such as optimized cleaning cycles and the use of advanced technology that reduces power consumption without compromising performance.

By Product

In 2023, the benchtop segment emerged as the dominant player in the ultrasonic cleaning market, capturing approximately 54% of the total revenue. Benchtop ultrasonic cleaners are small, easy to use, and practical, making them ideal for many applications, especially inside laboratories, medical offices, or small industrial operations. This has also contributed to their pervasive adoption by many industries, as they can clean fine and complex parts without bulky, expensive machinery. Precision cleaning is especially important in fields like healthcare, electronics and automotive where contamination can be disastrous, driving further demand for benchtop ultrasonic cleaners. They are affordable and efficient, which helps contribute to their prevalence in the market.

The multistage segment is expected to be the fastest-growing segment in the ultrasonic cleaning market during the forecast period from 2024 to 2032. The growth is driven by a growing demand for high-capacity, multi-step cleaning processes in industries, including aerospace, automotive, and electronics, where complex parts require multi-step cleaning processes to achieve optimal results. These systems include several cleaning stages, such as pre-cleaning, rinsing, post-treatment, etc., for efficient cleaning of complex parts. Multistage systems are ideal for high precision industries because they can clean delicate components in multiple stages without quality loss. With industries increasingly investing in advanced cleaning technologies for enhanced operational efficiency and minimized downtime, the adoption of multistage ultrasonic cleaning systems are likely to witness rapid growth, thereby driving the segment's growth.

By Industry

The food and beverage segment dominated the ultrasonic cleaning market, accounting for around 30% of the revenue in 2023 with the overall ultrasonic cleaning market in this segment of least 30% revenue. This type of control is resulted in the need for efficient and sanitary cleaning in the food and beverage market as contamination control together with sanitation are important during inter-corporate processes. The use of ultrasonic cleaning systems provides pinpoint cleaning without harming delicate food processing equipment, given high hygiene standards and compliance with food safety regulations. The ability of this technology to clean dirt, oils, and residues from hard-to-reach crevices in processing machinery makes it perfect for the industry. Moreover, ultrasonic cleaning minimises water and chemical use, making it a more eco-friendly cleaning option, and this ancillary advantage supports users' increasing demand for eco-friendly alternatives. The increasing focus on cleanliness and efficiency in food and beverage companies are expected to provide stronger foothold to the ultrasonic cleaning systems in the operation, in turn enabling growth in this segment's market share.

The automotive segment is the fastest-growing in the ultrasonic cleaning market from 2024 to 2032, driven by the increasing need for precise cleaning of intricate automotive components like fuel injectors, engines, and transmission parts. Ultrasonic cleaning ensures thorough removal of dirt, oil, and grease, enhancing the performance and longevity of automotive parts. With rising demand for more efficient and sustainable cleaning methods in automotive manufacturing, ultrasonic systems are becoming essential for meeting high standards of cleanliness and environmental regulations. Additionally, as the automotive industry moves toward more complex designs and advanced technologies, ultrasonic cleaning offers a versatile solution that meets the industry's precision and speed requirements. This growth reflects the increasing reliance on ultrasonic cleaning for automotive maintenance and manufacturing processes.

North America dominated the ultrasonic cleaning market with around 40% of the revenue share in 2023, driven by the region’s strong industrial base and high demand for precision cleaning in sectors such as healthcare, automotive, and aerospace. The U.S. and Canada are key contributors, with the U.S. leading in adopting advanced ultrasonic cleaning systems for both industrial and medical applications. The automotive and semiconductor industries in North America are rapidly expanding, further fueling demand for efficient cleaning solutions. Additionally, increasing investments in technology and automation, coupled with stringent environmental regulations, are driving market growth. As the region continues to focus on sustainability and operational efficiency, ultrasonic cleaning solutions are becoming integral to maintaining high standards of cleanliness and meeting regulatory requirements across industries.

The Asia Pacific region is the fastest-growing market for ultrasonic cleaning, projected to expand significantly from 2024 to 2032. The high growth in this regions comes as a result of countries like China, Japan, South Korea and India where there has been an industrialization boom especially in the manufacturing sectors such as automotive, electronics and semiconductors industries. Stringent quality standards in these industries, along with rising adoption of precision cleaning technologies, is expected to be a significant growth driver in this market. Moreover, the increasing demand for advanced cleaning system for healthcare & pharmaceutical applications supplements the growth. Ultrasonic cleaning solutions market is driven by the increasing awareness of environmental sustainability in this region along with the need for cleaner, efficient technologies promoted by government initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of Major key Players in Ultrasonic Cleaning Market along with their Product:

SharperTek (USA) – Ultrasonic cleaning systems, industrial and medical ultrasonic cleaners

Mettler Electronics Corp. (USA) – Ultrasonic therapy devices, medical-grade ultrasonic cleaners

L&R Manufacturing (USA) – Ultrasonic cleaning solutions for jewelry, medical, and dental industries

Elma Schmidbauer GmbH (Germany) – Industrial ultrasonic cleaning machines, laboratory ultrasonic cleaners

Steelco S.p.A. (Italy) – Medical and pharmaceutical ultrasonic cleaning systems

Emerson Electric Co. (USA) – Branson ultrasonic cleaners, precision cleaning solutions

GT Sonic (China) – Benchtop ultrasonic cleaners, multi-stage industrial cleaning systems

Kemet International Limited (UK) – Ultrasonic cleaning fluids, industrial cleaning equipment

Crest Ultrasonics Corporation (USA) – High-performance ultrasonic cleaning systems, cavitation technology

Ultrasonic LLC (USA) – Large-capacity industrial ultrasonic cleaners, custom ultrasonic solutions

RST Instruments Ltd. (Canada) – Ultrasonic testing and inspection equipment

Fugro (Netherlands) – Ultrasonic testing solutions for geotechnical and environmental applications

Geocomp (USA) – Ultrasonic non-destructive testing (NDT) systems

Keller Group (UK) – Ultrasonic sensors, industrial measurement solutions

Some key suppliers providing raw materials and components for the Ultrasonic Cleaning Market:

Piezo Technologies

Meggitt PLC

TDK Corporation

CTS Corporation

Murata Manufacturing

APC International Ltd.

CeramTec GmbH

Kyocera Corporation

Kemet Corporation

Bosch Rexroth AG

Analog Devices Inc.

Texas Instruments

On October 29, 2024, Elma Schmidbauer GmbH launched the Elmasonic Xtra, a high-performance ultrasonic cleaner with advanced 37 kHz technology and dual-mode operation for precision and industrial cleaning.

On March 18, 2025, Emerson announced its participation in Hannover Messe 2025, where it will showcase its Floor to Cloud solutions for factory automation. The event will also feature the launch of next-generation AVENTICS Series XV pneumatic valves, designed for enhanced flexibility and higher flow rates in automation applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.64 Billion |

| Market Size by 2032 | USD 2.85 Billion |

| CAGR | CAGR of 6.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Benchtop, Standalone, Multistage) • By Industry (Automotive, Healthcare, Food & Beverage, Metal, Electrical & Electronics, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SharperTek (USA), Mettler Electronics Corp. (USA), L&R Manufacturing (USA), Elma Schmidbauer GmbH (Germany), Steelco S.p.A. (Italy), Emerson Electric Co. (USA), GT Sonic (China), Kemet International Limited (UK), Crest Ultrasonics Corporation (USA), Ultrasonic LLC (USA), RST Instruments Ltd. (Canada), Fugro (Netherlands), Geocomp (USA), Keller Group (UK). |

Ans: The Ultrasonic Cleaning Market is expected to grow at a CAGR of 6.35% during 2024-2032.

Ans: The Ultrasonic Cleaning Market was USD1.64 Billion in 2023 and is expected to Reach USD 2.85 Billion by 2032.

Ans: Rising demand for precision cleaning, technological advancements, healthcare and electronics adoption, and eco-friendly regulations drive the Ultrasonic Cleaning Market.

Ans: The “Benchtop” segment dominated the Ultrasonic Cleaning Market.

Ans: North America dominated the Ultrasonic Cleaning Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technological Evolution

5.2 Emission Standards Compliance, by Region

5.3 Efficiency & Performance Metrics

5.4 Environmental & Regulatory Impact

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Ultrasonic Cleaning Market Segmentation, by Product

7.1 Chapter Overview

7.2 Benchtop

7.2.1 Benchtop Market Trends Analysis (2020-2032)

7.2.2 Benchtop Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Standalone

7.3.1 Standalone Market Trends Analysis (2020-2032)

7.3.2 Standalone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Multistage

7.4.1 Multistage Market Trends Analysis (2020-2032)

7.4.2 Multistage Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Ultrasonic Cleaning Market Segmentation, by Industry

8.1 Chapter Overview

8.2 Automotive

8.2.1 Automotive Market Trends Analysis (2020-2032)

8.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Healthcare

8.3.1 Healthcare Market Trends Analysis (2020-2032)

8.3.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Food & Beverage

8.4.1 Food & Beverage Market Trends Analysis (2020-2032)

8.4.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Metal

8.5.1 Metal Market Trends Analysis (2020-2032)

8.5.2 Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Electrical & Electronics

8.6.1 Electrical & Electronics Market Trends Analysis (2020-2032)

8.6.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Aerospace & Defense

8.7.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.7.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Ultrasonic Cleaning Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Ultrasonic Cleaning Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Ultrasonic Cleaning Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 SharperTek

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Mettler Electronics Corp.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 L&R Manufacturing

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Elma Schmidbauer GmbH

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Steelco S.p.A.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Emerson Electric Co.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 GT Sonic

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Kemet International Limited (UK)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Crest Ultrasonics Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Ultrasonic LLC

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Benchtop

Standalone

Multistage

By Industry

Automotive

Healthcare

Food & Beverage

Metal

Electrical & Electronics

Aerospace & Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Artificial Intelligence (AI) in Semiconductor Market Size was valued at USD 48.96 Billion in 2023 and is expected to grow at a CAGR of 15.2% From 2024-2032.

The People Counting System Market Size was valued at USD 1.0 billion in 2023 and is expected to reach USD 3.101 billion by 2032 and grow at a CAGR of 13.4 % over the forecast period 2024-2032.

The Drone Communication Market was valued at USD 2.11 billion in 2023 and is expected to reach USD 5.52 billion by 2032, growing at a CAGR of 11.33% over the forecast period 2024-2032.

The Network Engineering Services Market was valued at USD 52.7 Billion in 2023 and is expected to reach USD 118.3 Billion by 2032, growing at a CAGR of 9.41% from 2024-2032.

The Desiccant Dehumidifier Market was valued at USD 595.21 Million in 2023 and is projected to reach USD 1012.25 Million by 2032, growing at a CAGR of 6.08% from 2024 to 2032.

The Static VAR Compensator Market size was USD 872.08 Million in 2023 and will reach to USD 1256.84 Mn by 2032 and grow at a CAGR of 4.16% by 2024-2032.

Hi! Click one of our member below to chat on Phone