The Ultrasonic Cleaning Equipment Market size was valued at USD 5.50 Billion in 2023 and is now anticipated to grow to USD 9.71 Billion by 2032, displaying a compound annual growth rate of 6.52% during the forecast Period (2024-2032). The ultrasonic cleaning equipment market report covers the coverage on technology innovations (like advanced ultrasonic technologies), industrial applications, etc. It examines trends in regional utilization to gain insight into the global adoption of ultrasonic cleaning equipment. This report also provides insights into relevant export/import dynamics and key global trade patterns. It explores environmental and sustainability trends such as the growing preference for environmentally-accommodating cleaning products and energy-saving systems.

Get More Information on Ultrasonic Cleaning Equipment Market - Request Sample Report

Drivers

Ultrasonic cleaning is gaining momentum across industries like automotive, electronics, medical, aerospace, and manufacturing due to its efficiency in cleaning intricate parts and sensitive equipment.

The ultrasonic cleaning equipment market is experiencing significant growth due to its expanding applications across various industries such as automotive, electronics, medical, aerospace, and manufacturing. Ultrasonic cleaning is also used in the automotive sector for components like engine parts, fuel injectors, and complex geometry parts to enhance performance and service life. In electronics, it is critical to laundering delicate circuit boards and semiconductors, essential to the reliability of the products that host them. Ultrasonic cleaners placed in the medical industry for cleaning surgical tools and such as they offer contamination-free solution as well as efficient in terms of cleaning. In aerospace applications, ultrasonic cleaning is used for the cleaning of sensitive components like visuals and critical parts including turbine blades and sensors. The manufacturing sector, one of the places where small parts are professional cleaned with complex designs, is a key contributor to the market demand. As industries seek efficient, eco-friendly, and precise cleaning solutions, ultrasonic cleaning technology continues to gain traction, driven by advancements in technology, automation, and the growing focus on quality and hygiene.

Restraint

The high initial cost and maintenance of ultrasonic cleaning equipment limit its adoption, especially for smaller businesses, despite growing demand in precision-driven industries.

The high initial cost of ultrasonic cleaning equipment, along with ongoing maintenance expenses, remains a significant barrier to market growth, particularly for smaller businesses. Ultrasonic cleaning systems have a higher initial investment than traditional cleaning methods, which makes it a difficult technology for budget-tight companies to adopt. Such costs cover not just the procurement of the equipment but also the installation, calibration, and training of personnel. In addition, regular maintenance activities such as frequent repairs and replacements of components like transducers or tanks contribute to the operational cost as well. However, the market is growing owing to greater demand for high-precision and effective cleaning solutions in the healthcare, electronics and automotive sectors. Technological advancements, including cost savings associated with an energy-efficient model and reduced maintenance needs, are demonstrated as some of the reasons supporting the ultrasonic cleaners market growth as they alleviated cost concerns and made the ultrasonic cleaners for affordable adoption across different sectors, including the emerging markets.

Opportunities

The healthcare industry's growth, driven by rising demand for sterile instruments and stricter hygiene standards, fuels the adoption of ultrasonic cleaning equipment for efficient, precise cleaning.

The healthcare industry is experiencing significant growth, driven by the rising demand for clean and sterile surgical instruments, dental tools, and medical devices. Ultrasonic cleaning systems are now a critical part of the process for all the cleaning of these sophisticated and often complicated instruments, as much greater emphasis is placed on patient safety and hygiene standards. The increasing number of surgeries and medical procedures performed worldwide, as well as stricter control on sterilization are driving the demand for advanced cleaning solutions. Furthermore, the growing trend of minimally invasive surgery and increasing employment of smaller, complex devices also enhances the demand for thorough and precise cleaning which is provided by ultrasonic technology. With healthcare facilities prioritizing high-quality and contamination-free tools, ultrasonic cleaning equipment is expected to become increasingly popular over time. Furthermore, innovations in ultrasonic cleaning systems, such as automation and improved energy efficiency, are likely to drive further adoption within the healthcare sector, creating long-term growth opportunities.

Challenges

Energy consumption in ultrasonic cleaning systems is a concern for high-volume industries, driving the demand for energy-efficient solutions that reduce costs and environmental impact.

Energy consumption remains a key concern for the Ultrasonic Cleaning Equipment Market, particularly in industries with high-volume cleaning needs. Such systems are power-hungry, consuming the energy needed to produce the ultrasonic waves and applying requisite temperatures, both of which can become costly in the longer run. In these years where sectors such as automotive, aerospace, and electronics industry are progressively adopting ultrasonic cleaning techniques for complex components, the need for energy-efficient systems is on the rise. As a result, manufacturers have started doing R&D to establish more energy-efficient ultrasonic cleaners that consume less power and still deliver high performance. This is coupled with the growing implementation of green technologies as well as sustainability initiatives across various sectors, driving the market towards developments that reduce environmental footprint. It is becoming increasingly popular to integrate energy-saving features like adjustable power settings and smart sensors. These advancements not only help lower energy costs but also align with the growing demand for eco-friendly solutions in industrial operations, ensuring both performance and sustainability.

By Type

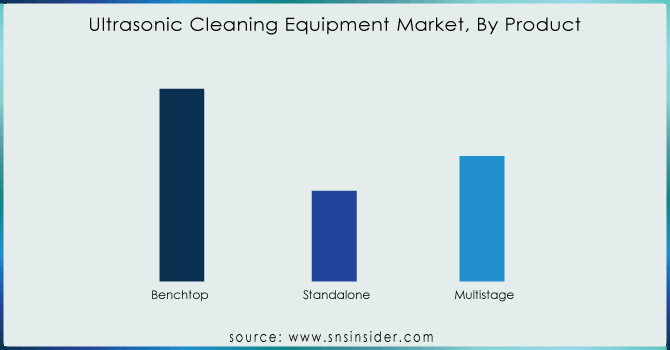

The Benchtop segment dominated with a market share of over 48% in 2023, due to its extensive use across various industries, particularly in laboratories, medical settings, and industrial applications. As a result, ultrasonic cleaners for benchtops are small, low-cost, effective devices that can be used in sensitive environments, such as labs, clinics, and hospitals, to clean tools as well as metal pieces. They have become the preference in these industries because of their capability of supplying high-frequency sound waves that eradicate impurities without harming fragile surfaces. Moreover, their increasing adoption in benchtop models that allow for simple integration into workstations has increased their usage even further.

By Power Output

The 1000–2000 W segment dominated with a market share of over 28% in 2023, due to its versatility and effectiveness across numerous industries. Chamber ultrasonic cleaners above a certain power and frequency are no longer necessary, as they become overkill, and fall outside the low-frequency range useful for gentle and complex items, such as jewelry, dental instruments, surgical devices, industrial components, and scientific samples and in this frequency range, ultrasonic cleaners can clean grease, oil, rust, dust, flux agents, and other contaminants without causing damage. The great success of this segment is also due to its evolution it fits in small applications and big, more intense cleaning jobs alike. Consequently, the 1000–2000 W segment leads the market, providing reliable performance at a competitive cost, and supporting diverse industrial needs.

By Industry

The Healthcare segment dominated with a market share of over 32% in 2023. The healthcare sector demands rigorous sanitation standards for cleaning medical instruments and devices to prevent cross-contamination and ensure patient safety. One factor that makes ultrasonic cleaning systems preferred in healthcare is their ability to clean intricate and delicate equipment with precision, removing dirt, debris, and contaminants efficiently without causing damage. High-frequency sound waves are used by these systems to produce microscopic bubbles that gently scrub the surfaces of instruments, resulting in a higher level of cleanliness than can be achieved through traditional methods. Due to the steadily rising demand for infection control, sterilization, and quality of maintenance of medical tools, ultrasonic cleaning equipment have become essential in the medical field, keeping up to standards of hygiene and standards of safety in hospitals healthcare organizations.

By Frequency Range

The 20-50 kHz segment dominated with a market share of over 34% in 2023. This frequency range is particularly effective for general cleaning tasks across various industries, including automotive, electronics, and jewelry. It achieves a sweet spot between cleaning power and the capacity to accommodate plumage minimal high and low attachment pieces. As for the 20-50 kHz range, it is extremely versatile, capable of cleaning oils, dust and other contaminants from electronic circuit boards and components, as well as larger, tougher objects such as auto parts. This is due to its efficacy and dependability, which is why it is the preferred option for manufacturers and service providers that must maintain excellent cleanliness and precision in many different industrial applications.

North America region dominated with a market share of over 38% in 2023, primarily due to its advanced industrial infrastructure and widespread adoption of precision cleaning technologies. It's balancing a presence of the leading manufacturers for innovation/technological advancement. Ultrasonic cleaning equipment is widely used in industries including healthcare, aerospace, automotive, and electronics because of its ability to clear contaminants from fragile components. Moreover, strict regulatory norms regarding cleanliness in medical and manufacturing sectors boost the market growth. Its existing, highly developed research and development ecosystem facilitates the growth of advanced ultrasonic cleaning systems with improved efficiency and energy efficiency. North America is also likely to continue its leadership in this market with high investments across automation and industrial cleaning solutions.

The Asia-Pacific region is experiencing significant growth in the ultrasonic cleaning equipment market, primarily fueled by rapid industrialization and expanding manufacturing activities. The countries which drive the most implementation of ultrasonic cleaning solutions are China, India, and Japan, and the key industries being automotive, healthcare, and electronics. Growing demand for precision cleaning of automotive parts and components along with strict cleanliness requirements from the healthcare sector is further stimulating market growth. Furthermore, growth of advanced cleaning technologies for microelectronics across the electronics industry is another factor fostering the growth of the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

SharperTek (U.S.) – (Ultrasonic Cleaning Systems, Cavitation Ultrasonic Cleaners)

Mettler Electronics Corp. (U.S.) – (Ultrasonic Cleaners, Medical Ultrasonic Equipment)

L&R Manufacturing (U.S.) – (Quantrex Ultrasonic Cleaners, SweepZone Technology)

Elma Schmidbauer GmbH (Germany) – (Elmasonic Ultrasonic Cleaners, Industrial Cleaning Systems)

Steelco S.p.A. (Italy) – (Industrial and Medical Ultrasonic Cleaning Equipment)

Emerson Electric Co. (U.S.) – (Branson Ultrasonic Cleaners, Industrial Cleaning Solutions)

GT Sonic (China) – (Benchtop Ultrasonic Cleaners, Multi-tank Systems)

Kemet International Limited (U.K.) – (Ultrasonic Cleaning Systems, Precision Cleaning Solutions)

Crest Ultrasonics Corporation (U.S.) – (CPX Series Ultrasonic Cleaners, Industrial Ultrasonic Systems)

Ultrasonic LLC (U.S.) – (Ultrasonic Cleaning Machines, Custom Ultrasonic Systems)

Blue Wave Ultrasonics (U.S.) – (Aqueous Ultrasonic Cleaners, Precision Cleaning Equipment)

Branson Ultrasonics (U.S.) [Subsidiary of Emerson] – (Branson Digital Ultrasonic Cleaners, Industrial Tanks)

Kaijo Corporation (Japan) – (Ultrasonic Cleaning Transducers, Semiconductor Cleaning Systems)

Skymen Cleaning Equipment Shenzhen Co., Ltd. (China) – (Tabletop Ultrasonic Cleaners, Large Industrial Systems)

FinnSonic Oy (Finland) – (Sonic Industrial Ultrasonic Cleaners, Medical & Aerospace Cleaning Equipment)

Mecasonic (France) – (Ultrasonic Cleaning Systems, Welding & Bonding Solutions)

Sonixtek (Canada) – (Portable Ultrasonic Cleaners, High-Precision Cleaning Equipment)

Ultrawave Ltd. (U.K.) – (Industrial & Laboratory Ultrasonic Cleaning Machines)

Anmasi A/S (Denmark) – (Automated Ultrasonic Cleaning Systems, Customized Solutions)

Telsonic AG (Switzerland) – (Ultrasonic Cleaning Transducers, Metal Cleaning Systems)

Suppliers for (ultrasonic cleaning machines and vapor degreasing systems) in Ultrasonic Cleaning Equipment Market

Supersonics India

Mak Technosys

IMECO Ultrasonic Cleaning Machine Manufacturer

Sonicor

Leela Electronics

Crest Ultrasonics India Pvt. Ltd.

Nuristaa Pvt. Ltd.

ActOn Finishing India

Samarth Electronics

Ecoclean India

In August 2023: Emerson Electric Co. acquired Sonics & Materials to enhance its market position and expand its offerings in industrial cleaning applications.

In May 2024: Sodexo Group began incorporating ultrasonic cleaning equipment into its healthcare and hospitality service contracts. Emphasizing sustainability, the company is collaborating with cleaning solution providers to develop eco-friendly cleaning agents tailored for ultrasonic cleaning.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 5.50 Billion |

|

Market Size by 2032 |

USD 9.71 Billion |

|

CAGR |

CAGR of 6.52% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Benchtop, Standalone, Multistage) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

SharperTek, Mettler Electronics Corp., L&R Manufacturing, Elma Schmidbauer GmbH, Steelco S.p.A., Emerson Electric Co., GT Sonic, Kemet International Limited, Crest Ultrasonics Corporation, Ultrasonic LLC, Blue Wave Ultrasonics, Branson Ultrasonics, Kaijo Corporation, Skymen Cleaning Equipment Shenzhen Co., Ltd., FinnSonic Oy, Mecasonic, Sonixtek, Ultrawave Ltd., Anmasi A/S, Telsonic AG. |

Ans: The Ultrasonic Cleaning Equipment Market is expected to grow at a CAGR of 6.52% during 2024-2032.

Ans: The Ultrasonic Cleaning Equipment Market was USD 5.50 billion in 2023 and is expected to Reach USD 9.71 billion by 2032.

Ans: Ultrasonic cleaning is gaining momentum across industries like automotive, electronics, medical, aerospace, and manufacturing due to its efficiency in cleaning intricate parts and sensitive equipment.

Ans: The “Benchtop” segment dominated the Ultrasonic Cleaning Equipment Market.

Ans: North America dominated the Ultrasonic Cleaning Equipment Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technological Trends and Innovations

5.2 Utilization Rates, by Region (2020-2023)

5.3 Export/Import Data, by Region (2023)

5.4 Environmental and Sustainability Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Ultrasonic Cleaning Equipment Market Segmentation, By Product

7.1 Chapter Overview

7.2 Benchtop

7.2.1 Benchtop Market Trends Analysis (2020-2032)

7.2.2 Benchtop Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Standalone

7.3.1 Standalone Market Trends Analysis (2020-2032)

7.3.2 Standalone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Multistage

7.4.1 Multistage Market Trends Analysis (2020-2032)

7.4.2 Multistage Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Ultrasonic Cleaning Equipment Market Segmentation, By Power Output

8.1 Chapter Overview

8.2 Up to 250 W

8.2.1 Up to 250 W Market Trends Analysis (2020-2032)

8.2.2 Up to 250 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 250–500 W

8.3.1 250–500 W Market Trends Analysis (2020-2032)

8.3.2 250–500 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 500–1000 W

8.4.1 500–1000 W Market Trends Analysis (2020-2032)

8.4.2 500–1000 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 1000–2000 W

8.5.1 1000–2000 W Market Trends Analysis (2020-2032)

8.5.2 1000–2000 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 2000–5000 W

8.6.1 2000–5000 W Market Trends Analysis (2020-2032)

8.6.2 2000–5000 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 5000–10000 W

8.7.1 5000–10000 W Market Trends Analysis (2020-2032)

8.7.2 5000–10000 W Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 More than 10000 W

8.8.1 More than 10000 W Market Trends Analysis (2020-2032)

8.8.2 More than 10000 W Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Ultrasonic Cleaning Equipment Market Segmentation, By Industry

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Healthcare

9.3.1 Healthcare Market Trends Analysis (2020-2032)

9.3.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Food & Beverage

9.4.1 Food & Beverage Market Trends Analysis (2020-2032)

9.4.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Metal

9.5.1 Metal Market Trends Analysis (2020-2032)

9.5.2 Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Electrical & Electronics

9.6.1 Electrical & Electronics Market Trends Analysis (2020-2032)

9.6.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Aerospace & Defense

9.7.1 Aerospace & Defense Market Trends Analysis (2020-2032)

9.7.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Ultrasonic Cleaning Equipment Market Segmentation, By Frequency Range

10.1 Chapter Overview

10.2 Below 20 kHz

10.2.1 Below 20 kHz Market Trends Analysis (2020-2032)

10.2.2 Below 20 kHz Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 20-50 kHz

10.3.1 20-50 kHz Market Trends Analysis (2020-2032)

10.3.2 20-50 kHz Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 50-100 kHz

10.4.1 50-100 kHz Market Trends Analysis (2020-2032)

10.4.2 50-100 kHz Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Above 100 kHz

10.5.1 Above 100 kHz Market Trends Analysis (2020-2032)

10.5.2 Above 100 kHz Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.4 North America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.2.5 North America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.2.6 North America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.7.2 USA Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.2.7.3 USA Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.2.7.4 USA Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.8.2 Canada Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.2.8.3 Canada Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.2.8.4 Canada Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.9.2 Mexico Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.2.9.3 Mexico Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.2.9.4 Mexico Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.7.3 Poland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.7.4 Poland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.8.3 Romania Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.8.4 Romania Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.5 Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.6 Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.7.3 Germany Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.7.4 Germany Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.8.2 France Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.8.3 France Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.8.4 France Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.9.2 UK Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.9.3 UK Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.9.4 UK Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.10.3 Italy Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.10.4 Italy Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.11.3 Spain Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.11.4 Spain Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.14.3 Austria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.14.4 Austria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.5 Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.6 Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.7.2 China Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.7.3 China Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.7.4 China Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.8.2 India Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.8.3 India Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.8.4 India Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.9.2 Japan Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.9.3 Japan Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.9.4 Japan Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.10.2 South Korea Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.10.3 South Korea Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.10.4 South Korea Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.11.3 Vietnam Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.11.4 Vietnam Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.12.2 Singapore Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.12.3 Singapore Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.12.4 Singapore Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.13.2 Australia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.13.3 Australia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.13.4 Australia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.4 Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.5 Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.6 Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.7.3 UAE Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.7.4 UAE Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.4 Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.2.5 Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.2.6 Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.4 Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.6.5 Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.6.6 Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.7.2 Brazil Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.6.7.3 Brazil Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.6.7.4 Brazil Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.8.2 Argentina Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.6.8.3 Argentina Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.6.8.4 Argentina Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.9.2 Colombia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.6.9.3 Colombia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.6.9.4 Colombia Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Power Output (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Industry (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Ultrasonic Cleaning Equipment Market Estimates and Forecasts, By Frequency Range (2020-2032) (USD Billion)

12. Company Profiles

12.1 SharperTek

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Mettler Electronics Corp.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 L&R Manufacturing

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Elma Schmidbauer GmbH

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Steelco S.p.A.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Emerson Electric Co.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 GT Sonic

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Kemet International Limited

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Crest Ultrasonics Corporation

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Ultrasonic LLC

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Benchtop

Standalone

Multistage

By Power Output

Up to 250 W

250–500 W

500–1000 W

1000–2000 W

2000–5000 W

5000–10000 W

More than 10000 W

By Industry

Automotive

Healthcare

Food & Beverage

Metal

Electrical & Electronics

Aerospace & Defense

Others

By Frequency Range

Below 20 kHz

20-50 kHz

50-100 kHz

Above 100 kHz

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players