Get More Information on U.S. Pharmacy Benefit Management Market - Request Sample Report

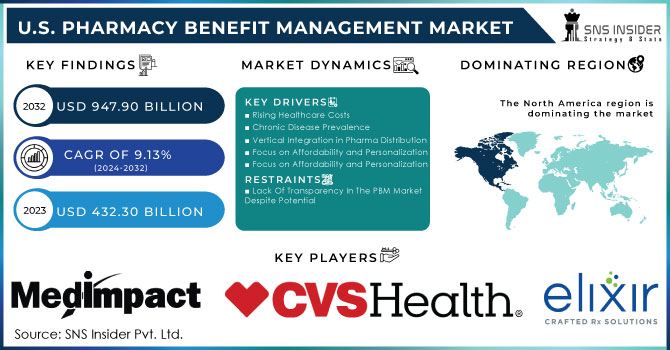

The U.S. Pharmacy Benefit Management Market was valued at USD 432.30 billion in 2023, and is expected to reach USD 947.90 billion by 2032, and grow at a CAGR of 9.13% over the forecast period 2024-2032.

Pharmacy Benefit Managers (PBMs) are a key player in the drug supply chain, acting as gatekeepers for both which drugs patients can get and how much they pay. There is a lack of transparency in how PBMs make these decisions, leaving consumers and policymakers in the dark about how PBMs might be impacting medication affordability.

PBMs negotiate rebates and discounts with drug manufacturers. While studies suggest these rebates can lower costs, others show a concerning trend – rebates may be linked to higher list prices for drugs. This creates an opaque system where PBMs might prioritize deals that benefit their bottom line over affordability for patients.

PBMs also develop formularies as well as lists of medications covered by insurance plans. This directly impacts demand for specific drugs. Patients might be directed towards formulary options, even if they're not the most effective for their condition.

A recent Federal Trade Commission report highlights a concerning trend in the pharmacy benefit management (PBM) industry. Just six companies control a whopping 96% of the PBM market, which translates to managing nearly 95% of all prescriptions filled in the US. This means these few players hold immense power over how hundreds of millions of Americans access their medications.

The market is highly concentrated, with the top three PBMs – CVS Caremark, Express Scripts, and OptumRx they are controlling a staggering 95% of prescriptions filled in the US, according to CNN Report of July 2024. This lack of competition allows PBMs to dictate terms and potentially limit patient choice.

The FTC report in July 2024 highlights how PBM practices, including vertical integration, have limited the supply of affordable prescription drugs. This is represented by nearly 30% of Americans rationing or skipping medications due to high costs.

In simpler terms, consolidation in the PBM industry has given a small number of PBMs significant control over the prescription drug market. This control allows PBMs to influence the availability and price of drugs, potentially limiting patients' access to affordable medications. The report cites the fact that nearly 30% of Americans have reported rationing or skipping medications due to high costs as evidence of this limited supply.

Government initiatives to increase transparency in healthcare costs, the US government has taken steps to address the issue of opaque healthcare pricing through two key regulations:

Hospital Price Transparency Final Rule in January 1, 2021: This rule mandates all hospitals to publicly disclose "clear, accessible pricing information online." This empowers patients to compare prices for procedures and services beforehand, allowing them to make informed decisions.

Transparency in Coverage Final Rule in July 1, 2022: This regulation targets health insurance companies. It requires insurers offering individual and group plans to publish their in-network prices and out-of-network charges. This transparency extends further with the requirement for online price estimation and comparison tools, implemented in stages throughout 2023 and 2024. These tools allow individuals to estimate their out-of-pocket costs for specific treatments based on their insurance plan.

These regulations represent a significant shift towards a more transparent healthcare system in the US. By empowering patients with price information, they can make informed choices and potentially negotiate better rates. Furthermore, these regulation and initiatives also propels the growth of the U.S. pharmacy benefit management market in coming years.

In the United States, there has been a surge of legislative activity aimed at curbing harmful practices by Pharmacy Benefit Managers (PBMs). This bipartisan effort highlights the government's growing concern about the impact of PBMs on the healthcare system. By mainly focusing on the increased transparency and reporting as well as multiple proposals target the practice of spread pricing and also with limiting PMB revenue and protecting patients to ensure that they have access to affordable medications.

MARKET DYNAMICS

Drivers

Rising Healthcare Costs

The ever-increasing cost of healthcare is a major driver for PBM adoption. PBMs help negotiate lower drug prices and manage overall pharmacy benefits, leading to cost savings for insurers and employers.

Chronic Disease Prevalence

The growing number of people with chronic conditions like diabetes and heart disease translates to a higher demand for medications. PBMs can help manage these medication needs and optimize costs associated with chronic illnesses.

Vertical Integration in Pharma Distribution

Mergers like CVS-Aetna and Cigna-Express Scripts are consolidating the industry and influencing supply chain dynamics. These partnerships between PBMs and health insurance companies are expected to further drive market growth.

Focus on Affordability and Personalization

By negotiating discounts and managing formularies, PBMs contribute to making health insurance plans more affordable. Additionally, PBM alliances with healthcare providers can lead to better-aligned treatment plans and personalized care options.

Restraints

Lack Of Transparency In The PBM Market Despite Potential

Despite the growth in the PBM market, a major concern is the lack of transparency in their practices. PBMs claim to deliver cost savings, but their opaque business models raise suspicions that they prioritize profit over customer benefit. This lack of clarity hinders stakeholders such as patients, employers, and healthcare providers.

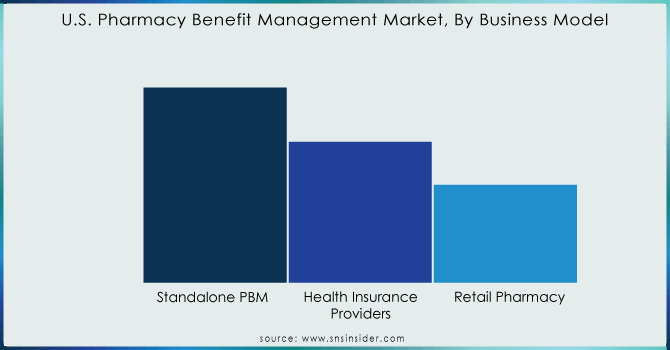

By Business Model

The pharmacy benefit management (PBM) market is dominated by the standalone PBM segment, which held a commanding 37.8% share in 2023. This segment is seeing major mergers, like those involving CVS Health and Express Scripts. These consolidations are expected to give drug manufacturers more control over pricing and better insight into competitor strategies.

However, the fastest-growing segment belongs to health insurance providers. This segment is fueled by the rising number of people with public and commercial health insurance. As the number of beneficiaries increases, insurers are increasingly opting for in-house PBMs or partnering with PBMs to build their own platforms. This trend is exemplified by Humana's acquisition of Enclara Healthcare, a hospice PBM provider, in late 2019.

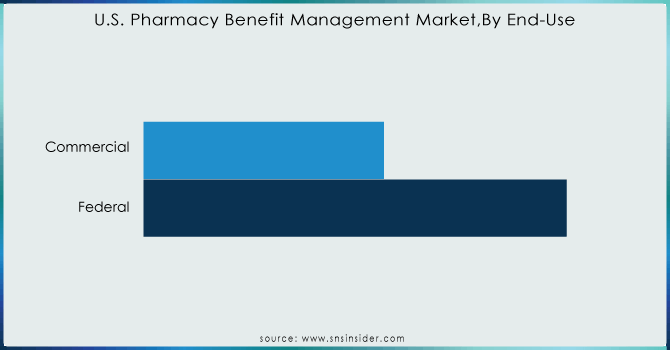

By End-use

The commercial segment is the dominated market segment for health insurance, held the maximum revenue that is 64.65% share in 2023 and projected to stay that way throughout the forecast period. This is because the majority of U.S. employees are registered under commercial private insurance plans. These plans offer a copay system that helps manage the cost of high-priced medications. In 2020, there were around 211 million people covered by private insurance, including both group and non-group plans, according to the Congressional Research Service.

Need any customization research on U.S. Pharmacy Benefit Management Market - Enquiry Now

MedImpact, Elixir Rx Solutions LLC, CVS Health, HUB International Limited, Cigna, Anthem, Prime Therapeutics LLC, Change Healthcare, CVS Caremark, Express Scripts, and OptumRx and others

Recent Developments

CVS Caremark is shaking things up with CVS CostVantage, a new pharmacy reimbursement model launching in 2025. This aims to simplify the system and bring transparency by linking payments to the quality of services offered. It's a step towards clearer pricing for everyone involved, potentially paving the way for more transparent PBM models.

Optum Rx is presenting a new pharmacy benefits solution named Optum Rx Clear Trend Guarantee. This innovative model tackles rising drug costs by offering a guaranteed single price per member, combining pharmacy costs across retail, home delivery, and specialty drugs. Unlike existing models, Clear Trend Guarantee simplifies budgeting for plan sponsors and potentially lowers costs for individuals and families. Launching in 2025, this solution joins Optum Rx's suite of transparent pricing options.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 432.30 Billion |

| Market Size by 2032 | US$ 947.90 Billion |

| CAGR | CAGR of 9.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Business Model (Standalone PBM, Health Insurance Providers, Retail Pharmacy) •By End-use (Commercial, Federal) |

| Company Profiles | MedImpact, Elixir Rx Solutions LLC, CVS Health, HUB International Limited, Cigna, Anthem, Prime Therapeutics LLC, Change Healthcare, CVS Caremark, Express Scripts, and OptumRx and others |

| Key Drivers | •Rising Healthcare Costs • Chronic Disease Prevalence • Vertical Integration in Pharma Distribution • Focus on Affordability and Personalization |

| RESTRAINTS | • Lack Of Transparency In The PBM Market Despite Potential |

Ans: The estimated compound annual growth rate is 9.13% during the forecast period for the U.S. pharmacy benefit management market.

Ans: The U.S. Pharmacy Benefit Management Market was valued at USD 432.30 Billion in 2023.

Ans: The U.S. pharmacy benefit management Market was valued at USD 947.90 Billion in 2032.

Ans: Rising healthcare costs is one of the drivers of the U.S. pharmacy benefit management market.

Ans: Lack of transparency in the PBM market despite potential is one of the restraints of the U.S. pharmacy benefit management market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Business Model Benchmarking

6.3.1 Business Model specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Business Model launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. U.S. Pharmacy Benefit Management Market Segmentation, by Business Model

7.1 Chapter Overview

7.2 Standalone PBM

7.2.1 Standalone PBM Market Trends Analysis (2020-2032)

7.2.2 Standalone PBM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Health Insurance Providers

7.3.1 Health Insurance Providers Market Trends Analysis (2020-2032)

7.3.2 Health Insurance Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Retail Pharmacy

7.4.1 Retail Pharmacy Market Trends Analysis (2020-2032)

7.4.2 Retail Pharmacy Market Size Estimates and Forecasts to 2032 (USD Billion)

8. U.S. Pharmacy Benefit Management Market Segmentation, by End-use

8.1 Chapter Overview

8.2 Commercial

8.2.1 Commercial Market Trends Analysis (2020-2032)

8.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Federal

8.3.1 Federal Market Trends Analysis (2020-2032)

8.3.2 Federal Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Company Profiles

9.1 MedImpact

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Business Models/ Services Offered

9.1.4 SWOT Analysis

9.2 Elixir Rx Solutions LLC

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Business Models/ Services Offered

9.2.4 SWOT Analysis

9.3 CVS Health

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Business Models/ Services Offered

9.3.4 SWOT Analysis

9.4 HUB International Limited

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Business Models/ Services Offered

9.4.4 SWOT Analysis

9.5 Cigna

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Business Models/ Services Offered

9.5.4 SWOT Analysis

9.6 Anthem

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Business Models/ Services Offered

9.6.4 SWOT Analysis

9.7 Prime Therapeutics LLC

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Business Models/ Services Offered

9.7.4 SWOT Analysis

9.8 Change Healthcare

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Business Models/ Services Offered

9.8.4 SWOT Analysis

9.9 CVS Caremark

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Business Models/ Services Offered

9.9.4 SWOT Analysis

9.10 Express Scripts

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Business Models/ Services Offered

9.9.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Business Model

Standalone PBM

Health Insurance Providers

Retail Pharmacy

By End-use

Commercial

Federal

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Arthroscopy Market Size was valued at USD 6.23 billion in 2023 and is expected to reach USD 8.66 billion by 2032 and grow at a CAGR of 3.76% over the forecast period 2024-2032.

The Allergic Conjunctivitis Market Size was valued at USD 2.75 Billion in 2023 and is expected to reach USD 4.02 Billion by 2032, growing at a CAGR of 4.31% over the forecast period of 2024-2032.

The Accountable Care Solutions Market Size was valued at USD 23.12 Billion in 2023 and is expected to reach USD 61.45 Billion by 2032 and grow at a CAGR of 11.50% over the forecast period 2024-2032

The Anti-Inflammatory Drugs Market size was USD 114.78 Billion in 2023 and is expected to reach USD 247.71 Billion by 2032 and grow at a CAGR of 8.92% over the forecast period of 2024-2032.

Preparative and Process Chromatography Market was valued at USD 11.74 billion in 2023 and is expected to reach USD 23.29 billion by 2032, growing at a CAGR of 8.20% from 2024-2032.

The Medical Clothing Market, valued at USD 110 Billion in 2023, The Medical Clothing Market valued USD 85.95 Billion in 2023 and anticipated to reach USD 163.84 billion by 2032 with compound annual growth rate 7.45% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone