Get More Information on Trash Bags Market - Request Sample Report

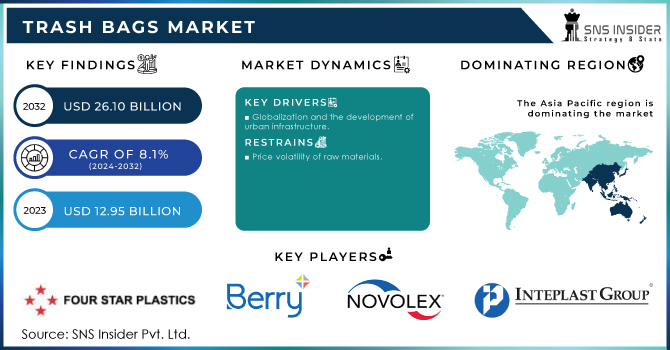

The Trash Bags Market size was USD 12.95 billion in 2023 and is expected to Reach USD 26.10 billion by 2032 and grow at a CAGR of 8.1% over the forecast period of 2024-2032.

As the urban population continues to grow, the demand for garbage bags also increases due to a higher rate of waste generation. Urbanization often leads to changes in lifestyles and consumption patterns, contributing to an increase in waste. In turn, this reinforces the need for durable and reliable trash bags capable of holding different amounts of waste.

Environmental concerns also have a significant impact on the trash bag market. Consumers and regulators increasingly emphasize the importance of responsible waste management to minimize environmental impact. Therefore, there is a growing demand for eco-friendly and biodegradable garbage bags in line with the goal of sustainable development.\

Additionally, advances in technology have led to the development of innovative trash bag designs. Odor control features, antibacterial properties and advanced sealing mechanisms are some examples of innovations that have enhanced the market's attractiveness. Such features address common problems such as unpleasant odors and potential leaks, improving the overall user experience.

The retail sector plays an important role in the distribution of garbage bags. They are available in different sizes, strengths and types to meet different customer needs. From small kitchen trash bags to large industrial waste bags, the market offers a wide variety to choose from.

Global economic trends are also affecting the trash bag market. The level of disposable income affects consumers' preferences for convenience and quality, which in turn affects their choice of garbage bags. In addition, industries that require a waste management solution are contributing to the increased demand for larger and sturdier garbage bags.

In recent times, the COVID-19 pandemic has highlighted the importance of hygiene and sanitation, increasing the demand for garbage bags, especially in healthcare facilities and residential areas. The lifestyle changes caused by the pandemic, with more people working from home, have led to changes in waste generation patterns and subsequently affected demand for garbage bags.

KEY DRIVERS:

Health and Safety Regulations

The stringent health and safety legislation requires the proper collection and disposal of waste within industry, e.g., healthcare or food services. This results in a corresponding demand for special garbage bags that comply with these requirements.

Globalization and the development of urban infrastructure.

RESTRAIN:

Price volatility of raw materials

Due to factors such as supply chain interruptions, geopolitical issues and market fluctuations, raw material prices used for the production of garbage bags like plastics or resins may be volatile. This will have a bearing on the costs of production and subsequent pricing strategies.

Mismanagement and improper disposal.

OPPORTUNITY:

Education and awareness campaigns to promote the proper disposable of waste

Demands for good quality trash bags and encouraging the proper use of these may be stimulated by education campaigns to inform consumers, businesses and municipalities on sound waste management practices.

The rising emphasis on sustainability has opened doors for the development of advanced ecofriendly garbage bags made from biodegradable materials.

CHALLENGES:

Mismanagement of Waste

Insufficient waste disposal practices can lead to litter, environmental pollution and problems with waste management systems, even with the right trash bags.

The war caused the price of raw materials used to make garbage bags, such as polyethylene, soar. This is due to supply chain disruptions and growing demand for these materials from other industries. In the United States, the price of polyethylene has increased by 15% since the beginning of the war. The Asia-Pacific region is the largest consumer of garbage bags, accounting for more than 45% of global demand. The war also disrupted demand in the region. According to research by SNS Insider, it was found that the demand for garbage bags in the European Union fell 2% in the first quarter of 2023.

Recessions often lead to a decrease in consumer spending. This is because people have less disposable income to spend on non-essential items, like garbage bags. A study by the National Retail Federation found that consumer spending fell 0.8 percent in the first quarter of 2023. The unemployment rate in the U.S. hit 5.5% in June 2023. The price of polyethylene, a material commonly used to make garbage bags, increasing by 10% in the first half of 2023. The demand for garbage bags is also influenced by factors such as population growth and urbanization. These factors will continue to increase in the coming years, which could offset some of the negative effects of the recession. The trash bag market is relatively price-sensitive, so even a slight increase in prices could cause demand to drop.

By Type

Star Sealed Trash Bags

Flat Trash Bags

Drawstring Trash Bags

Flat Star Sealed Trash Bags

Zipper Bags

T-Shirt Trash Bags

Others

By Capacity

10-50 Kg

50-100 Kg

100-150 Kg

More Than 150 Kg

By Distribution Channel

Supermarkets

Specialty Stores

E-commerce

Convenience Stores

Others

By End User

Institutions

Hospitals

Laboratories

Residential

Corporate Office

Industries

Others

Asia Pacific dominated the trash bags market with the largest market share of 45.80%. The rising disposable incomes along with the growth of the economies of countries such as India and China are driving the market growth. The increased us of garbage bags, and strict rules and regulations regarding waste management have additionally given market growth.

European region is the second largest market for the trash bags. Increasing sustainability and stringent government rules have significantly increased the market growth. Germany holds the largest market share in this region, and Canada trash bags market is the fastest growing market over the forecast period.

North American region is the fastest growing market for the trash bags. Laws against disposable of waste, have given growth to the market. The laws have given growth to the sustainable and biodegradable bags.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Trash Bags market are Four Star Plastics, Berry Global Inc, Novolex, International Plastics Inc, Inteplast Group Ltd, The Clorox Company, Poly America LP, Reynolds Consumer Products, Cosmoplast Industrial Company, Alpha Omega Plastic Manufacturing LLC and other players.

As from July 1, 2022, businesses in India will have to comply with new rules on plastic waste management that ban single use plastics.

In a deal to increase six production plants and continue its expansion, Novolex acquires Heritage Bag.

| Report Attributes | Details |

| Market Size in 2023 | US$ 12.95 Bn |

| Market Size by 2032 | US$ 26.10 Bn |

| CAGR | CAGR of 8.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Star Sealed Trash Bags, Flat Trash Bags, Drawstring Trash Bags, Flat Star Sealed Trash Bags, Zipper Bags, T-Shirt Trash Bags, Others) • by Capacity (10-50 Kg, 50-100 Kg, 100-150 Kg, More Than 150 Kg) • by Distribution Channel (Supermarkets, Specialty Stores, E-commerce, Convenience Stores, Others) • by End User (Institutions, Hospitals, Laboratories, Residential, Corporate Offices, Industries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Four Star Plastics, Berry Global Inc, Novolex, International Plastics Inc, Inteplast Group Ltd, The Clorox Company, Poly America LP, Reynolds Consumer Products, Cosmoplast Industrial Company, Alpha Omega Plastic Manufacturing LLC |

| Key Drivers | • Health and Safety Regulations • Globalization and the development of urban infrastructure. |

| Key Restraints | • Price volatility of raw materials |

Ans. The Compound Annual Growth rate for Trash Bags Market over the forecast period is 8.1 %.

Ans. USD 24.14 Billion is the projected Trash Bags market size of market by 2031.

Ans. North America is the fastest growing region for the Trash Bags Market.

Ans. The major key players are Berry Global Inc, Novolex, International Plastics Inc.

Ans. Health and Safety Regulations for the proper disposable of waste.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Trash Bags Market Segmentation, by Type

8.1 Star Sealed Trash Bags

8.2 Flat Trash Bags

8.3 Drawstring Trash Bags

8.4 Flat Star Sealed Trash Bags

8.5 Zipper Bags

8.6 T-Shirt Trash Bags

8.7 Others

9. Trash Bags Market Segmentation, by Capacity

9.1 10-50 Kg

9.2 50-100 Kg

9.3 100-150 Kg

9.4 More Than 150 Kg

10. Trash Bags Market Segmentation, by Distribution Channel

10.1 Supermarkets

10.2 Specialty Stores

10.3 E-commerce

10.4 Convenience Stores

10.5 Others

11. Trash Bags Market Segmentation, by End User

11.1 Institutions

11.2 Hospitals

11.3 Laboratories

11.4 Residential

11.5 Corporate Office

11.6 Industries

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Trash Bags Market by Country

12.2.2North America Trash Bags Market by Type

12.2.3 North America Trash Bags Market by Capacity

12.2.4 North America Trash Bags Market by Distribution Channel

12.2.5 North America Trash Bags Market by End User

12.2.6 USA

12.2.6.1 USA Trash Bags Market by Type

12.2.6.2 USA Trash Bags Market by Capacity

12.2.6.3 USA Trash Bags Market by Distribution Channel

12.2.6.4 USA Trash Bags Market by End User

12.2.7 Canada

12.2.7.1 Canada Trash Bags Market by Type

12.2.7.2 Canada Trash Bags Market by Capacity

12.2.7.3 Canada Trash Bags Market by Distribution Channel

12.2.7.4 Canada Trash Bags Market by End User

12.2.8 Mexico

12.2.8.1 Mexico Trash Bags Market by Raw Distribution Channel

12.2.8.2 Mexico Trash Bags Market by Capacity

12.2.8.3 Mexico Trash Bags Market by Distribution Channel

12.2.8.4 Mexico Trash Bags Market by End User

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Trash Bags Market by Country

12.3.1.2 Eastern Europe Trash Bags Market by Type

12.3.1.3 Eastern Europe Trash Bags Market by Capacity

12.3.1.4 Eastern Europe Trash Bags Market by Distribution Channel

12.3.1.5 Eastern Europe Trash Bags Market by End User

12.3.1.6 Poland

12.3.1.6.1 Poland Trash Bags Market by Type

12.3.1.6.2 Poland Trash Bags Market by Capacity

12.3.1.6.3 Poland Trash Bags Market by Distribution Channel

12.3.1.6.4 Poland Trash Bags Market by End User

12.3.1.7 Romania

12.3.1.7.1 Romania Trash Bags Market by Type

12.3.1.7.2 Romania Trash Bags Market by Capacity

12.3.1.7.3 Romania Trash Bags Market by Distribution Channel

12.3.1.7.4 Romania Trash Bags Market by End User

12.3.1.8 Hungary

12.3.1.8.1 Hungary Trash Bags Market by Type

12.3.1.8.2 Hungary Trash Bags Market by Capacity

12.3.1.8.3 Hungary Trash Bags Market by Distribution Channel

12.3.1.8.4 Hungary Trash Bags Market by End User

12.3.1.9 Turkey

12.3.1.9.1 Turkey Trash Bags Market by Type

12.3.1.9.2 Turkey Trash Bags Market by Capacity

12.3.1.9.3 Turkey Trash Bags Market by Distribution Channel

12.3.1.9.4 Turkey Trash Bags Market by End User

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Trash Bags Market by Type

12.3.1.10.2 Rest of Eastern Europe Trash Bags Market by Capacity

12.3.1.10.3 Rest of Eastern Europe Trash Bags Market by Distribution Channel

12.3.1.10.4 Rest of Eastern Europe Trash Bags Market by End User

12.3.2 Western Europe

12.3.2.1 Western Europe Trash Bags Market by Country

12.3.2.2 Western Europe Trash Bags Market by Type

12.3.2.3 Western Europe Trash Bags Market by Capacity

12.3.2.4 Western Europe Trash Bags Market by Distribution Channel

12.3.2.5 Western Europe Trash Bags Market by End User

12.3.2.6 Germany

12.3.2.6.1 Germany Trash Bags Market by Type

12.3.2.6.2 Germany Trash Bags Market by Capacity

12.3.2.6.3 Germany Trash Bags Market by Distribution Channel

12.3.2.6.4 Germany Trash Bags Market by End User

12.3.2.7 France

12.3.2.7.1 France Trash Bags Market by Type

12.3.2.7.2 France Trash Bags Market by Capacity

12.3.2.7.3 France Trash Bags Market by Distribution Channel

12.3.2.7.4 France Trash Bags Market by End User

12.3.2.8 UK

12.3.2.8.1 UK Trash Bags Market by Type

12.3.2.8.2 UK Trash Bags Market by Capacity

12.3.2.8.3 UK Trash Bags Market by Distribution Channel

12.3.2.8.4 UK Trash Bags Market by End User

12.3.2.9 Italy

12.3.2.9.1 Italy Trash Bags Market by Type

12.3.2.9.2 Italy Trash Bags Market by Capacity

12.3.2.9.3 Italy Trash Bags Market by Distribution Channel

12.3.2.9.4 Italy Trash Bags Market by End User

12.3.2.10 Spain

12.3.2.10.1 Spain Trash Bags Market by Type

12.3.2.10.2 Spain Trash Bags Market by Capacity

12.3.2.10.3 Spain Trash Bags Market by Distribution Channel

12.3.2.10.4 Spain Trash Bags Market by End User

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Trash Bags Market by Type

12.3.2.11.2 Netherlands Trash Bags Market by Capacity

12.3.2.11.3 Netherlands Trash Bags Market by Distribution Channel

12.3.2.11.4 Netherlands Trash Bags Market by End User

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Trash Bags Market by Type

12.3.2.12.2 Switzerland Trash Bags Market by Capacity

12.3.2.12.3 Switzerland Trash Bags Market by Distribution Channel

12.3.2.12.4 Switzerland Trash Bags Market by End User

12.3.2.13 Austria

12.3.2.13.1 Austria Trash Bags Market by Type

12.3.2.13.2 Austria Trash Bags Market by Capacity

12.3.2.13.3 Austria Trash Bags Market by Distribution Channel

12.3.2.13.4 Austria Trash Bags Market by End User

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Trash Bags Market by Type

12.3.2.14.2 Rest of Western Europe Trash Bags Market by Capacity

12.3.2.14.3 Rest of Western Europe Trash Bags Market by Distribution Channel

12.3.2.14.4 Rest of Western Europe Trash Bags Market by End User

12.4 Asia-Pacific

12.4.1 Asia Pacific Trash Bags Market by Country

12.4.2 Asia Pacific Trash Bags Market by Type

12.4.3 Asia Pacific Trash Bags Market by Capacity

12.4.4 Asia Pacific Trash Bags Market by Distribution Channel

12.4.5 Asia Pacific Trash Bags Market by End User

12.4.6 China

12.4.6.1 China Trash Bags Market by Type

12.4.6.2 China Trash Bags Market by Capacity

12.4.6.3 China Trash Bags Market by Distribution Channel

12.4.6.4 China Trash Bags Market by End User

12.4.7 India

12.4.7.1 India Trash Bags Market by Type

12.4.7.2 India Trash Bags Market by Capacity

12.4.7.3 India Trash Bags Market by Distribution Channel

12.4.7.4 India Trash Bags Market by End User

12.4.8 Japan

12.4.8.1 Japan Trash Bags Market by Type

12.4.8.2 Japan Trash Bags Market by Capacity

12.4.8.3 Japan Trash Bags Market by Distribution Channel

12.4.8.4 Japan Trash Bags Market by End User

12.4.9 South Korea

12.4.9.1 South Korea Trash Bags Market by Type

12.4.9.2 South Korea Trash Bags Market by Capacity

12.4.9.3 South Korea Trash Bags Market by Distribution Channel

12.4.9.4 South Korea Trash Bags Market by End User

12.4.10 Vietnam

12.4.10.1 Vietnam Trash Bags Market by Type

12.4.10.2 Vietnam Trash Bags Market by Capacity

12.4.10.3 Vietnam Trash Bags Market by Distribution Channel

12.4.10.4 Vietnam Trash Bags Market by End User

12.4.11 Singapore

12.4.11.1 Singapore Trash Bags Market by Type

12.4.11.2 Singapore Trash Bags Market by Capacity

12.4.11.3 Singapore Trash Bags Market by Distribution Channel

12.4.11.4 Singapore Trash Bags Market by End User

12.4.12 Australia

12.4.12.1 Australia Trash Bags Market by Type

12.4.12.2 Australia Trash Bags Market by Capacity

12.4.12.3 Australia Trash Bags Market by Distribution Channel

12.4.12.4 Australia Trash Bags Market by End User

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Trash Bags Market by Type

12.4.13.2 Rest of Asia-Pacific APAC Trash Bags Market by Capacity

12.4.13.3 Rest of Asia-Pacific Trash Bags Market by Distribution Channel

12.4.13.4 Rest of Asia-Pacific Trash Bags Market by End User

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Trash Bags Market by country

12.5.1.2 Middle East Trash Bags Market by Type

12.5.1.3 Middle East Trash Bags Market by Capacity

12.5.1.4 Middle East Trash Bags Market by Distribution Channel

12.5.1.5 Middle East Trash Bags Market by End User

12.5.1.6 UAE

12.5.1.6.1 UAE Trash Bags Market by Type

12.5.1.6.2 UAE Trash Bags Market by Capacity

12.5.1.6.3 UAE Trash Bags Market by Distribution Channel

12.5.1.6.4 UAE Trash Bags Market by End User

12.5.1.7 Egypt

12.5.1.7.1 Egypt Trash Bags Market by Type

12.5.1.7.2 Egypt Trash Bags Market by Capacity

12.5.1.7.3 Egypt Trash Bags Market by Distribution Channel

12.5.1.7.4 Egypt Trash Bags Market by End User

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Trash Bags Market by Type

12.5.1.8.2 Saudi Arabia Trash Bags Market by Capacity

12.5.1.8.3 Saudi Arabia Trash Bags Market by Distribution Channel

12.5.1.8.4 Saudi Arabia Trash Bags Market by End User

12.5.1.9 Qatar

12.5.1.9.1 Qatar Trash Bags Market by Type

12.5.1.9.2 Qatar Trash Bags Market by Capacity

12.5.1.9.3 Qatar Trash Bags Market by Distribution Channel

12.5.1.9.4 Qatar Trash Bags Market by End User

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Trash Bags Market by Type

12.5.1.10.2 Rest of Middle East Trash Bags Market by Capacity

12.5.1.10.3 Rest of Middle East Trash Bags Market by Distribution Channel

12.5.1.10.4 Rest of Middle East Trash Bags Market by End User

12.5.2. Africa

12.5.2.1 Africa Trash Bags Market by country

12.5.2.2 Africa Trash Bags Market by Type

12.5.2.3 Africa Trash Bags Market by Capacity

12.5.2.4 Africa Trash Bags Market by Distribution Channel

12.5.2.5 Africa Trash Bags Market by End User

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Trash Bags Market by Type

12.5.2.6.2 Nigeria Trash Bags Market by Capacity

12.5.2.6.3 Nigeria Trash Bags Market by Distribution Channel

12.5.2.6.4 Nigeria Trash Bags Market by End User

12.5.2.7 South Africa

12.5.2.7.1 South Africa Trash Bags Market by Type

12.5.2.7.2 South Africa Trash Bags Market by Capacity

12.5.2.7.3 South Africa Trash Bags Market by Distribution Channel

12.5.2.7.4 South Africa Trash Bags Market by End User

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Trash Bags Market by Type

12.5.2.8.2 Rest of Africa Trash Bags Market by Capacity

12.5.2.8.3 Rest of Africa Trash Bags Market by Distribution Channel

12.5.2.8.4 Rest of Africa Trash Bags Market by End User

12.6. Latin America

12.6.1 Latin America Trash Bags Market by country

12.6.2 Latin America Trash Bags Market by Type

12.6.3 Latin America Trash Bags Market by Capacity

12.6.4 Latin America Trash Bags Market by Distribution Channel

12.6.5 Latin America Trash Bags Market by End User

12.6.6 Brazil

12.6.6.1 Brazil Trash Bags Market by Type

12.6.6.2 Brazil Africa Trash Bags Market by Capacity

12.6.6.3 Brazil Trash Bags Market by Distribution Channel

12.6.6.4 Brazil Trash Bags Market by End User

12.6.7 Argentina

12.6.7.1 Argentina Trash Bags Market by Type

12.6.7.2 Argentina Trash Bags Market by Capacity

12.6.7.3 Argentina Trash Bags Market by Distribution Channel

12.6.7.4 Argentina Trash Bags Market by End User

12.6.8 Colombia

12.6.8.1 Colombia Trash Bags Market by Type

12.6.8.2 Colombia Trash Bags Market by Capacity

12.6.8.3 Colombia Trash Bags Market by Distribution Channel

12.6.8.4 Colombia Trash Bags Market by End User

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Trash Bags Market by Type

12.6.9.2 Rest of Latin America Trash Bags Market by Capacity

12.6.9.3 Rest of Latin America Trash Bags Market by Distribution Channel

12.6.9.4 Rest of Latin America Trash Bags Market by End User

13 Company Profile

13.1 Four Star Plastics

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Berry Global Inc

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Novolex

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 International Plastics Inc

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Inteplast Group Ltd

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 The Clorox Company

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Poly America LP

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Reynolds Consumer Products

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Cosmoplast Industrial Company

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Alpha Omega Plastic Manufacturing LLC

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Building and Construction Tapes Market size was valued at USD 4.8 billion in 2023 and is expected to Reach USD 7.36 billion by 2031 and grow at a CAGR of 5.5 % over the forecast period of 2024-2031.

The Industrial Drum Market size was USD 12.96 billion in 2023 and is expected to Reach USD 23.98 billion by 2031 and grow at a CAGR of 8% over the forecast period of 2024-2031.

Advanced Packaging Market Size was valued at USD 31.1 billion in 2023 and is expected to reach USD 54.44 billion by 2031 and grow at a CAGR of 7.25% over the forecast period 2024-2031.

The Water Soluble Packaging Market size was USD 3.29 billion in 2023 and is expected to Reach USD 5.09 billion by 2031 and grow at a CAGR of 5.6 % over the forecast period of 2024-2031.

The Online On-Demand Laundry Market size was USD 27 billion in 2023 and expected to reach 129.59 billion by 2032, Growing at a CAGR of 19.56% by 2024 to 2032

Packaging Laminates Market Size was valued at USD 6.4 billion in 2023 and is expected to reach USD 9.03 billion by 2031 and grow at a CAGR of 4.4% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone