Transplantation Market Size & Overview:

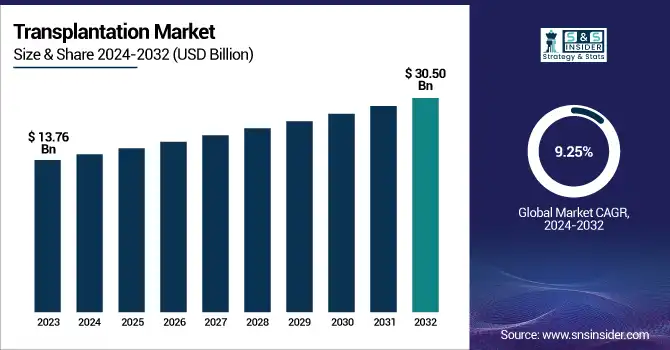

The Transplantation Market size was valued at USD 13.76 billion in 2023 and is expected to reach USD 30.50 billion by 2032 and grow at a CAGR of 9.25% during 2024-2032.

To Get more information on Transplantation Market - Request Free Sample Report

This report provide data on annual transplant procedure volumes by organ type, donor availability trends, and organ rejection rates. The report evaluates donor registration rates and average wait times and presents survival statistics post-transplant across the major regions in the market. Additionally, the report also analyses the usage patterns of immunosuppressive drugs and statistics for patient adherence. Infrastructure metrics including the number of transplant centers, insurance coverage rates, and procedure costs, are also analyzed in the report. Furthermore, the report also explores innovation via R&D investments, clinical trial counts, and patent filings. The regulatory compliance data, such as inspection outcomes and approval timelines, offers a complete picture of the market landscape.

The U.S. held the largest share in the transplantation market in 2023, with a market size of USD 4.18 Billion, and is expected to reach a valuation of USD 9.58 Billion by 2032, further growing at a CAGR of 9.64% during the forecast period. This dominance is mainly driven by the well-established healthcare infrastructure, favorable reimbursement policies, and presence of a several transplant centers across the country.

Moreover, the U.S. is also leading in organ donation registrations and maintains robust national registries including the UNOS (United Network for Organ Sharing), further allowing for efficient organ tracking and allocation. The U.S. is also experiencing a high volume of transplant surgeries annually, which are backed by the advanced immunosuppressive drug availability and surging funding for R&D related to transplants. These factors, when integrated with widespread awareness and supportive initiatives by government, positions the U.S. as the leading nation in the global transplantation market.

Transplantation Market Dynamics

Drivers

-

Rising Patient Pool and Surge in Organ Failure Incidences Drives Market Growth

The global surge in chronic diseases including hypertension, diabetes, kidney failure, and cardiovascular disorders has significantly raised the demand for organ transplants globally. There is a rapid increase in the number of patients that require life-saving organ transplants due to the aging populations and growing prevalence of unhealthy lifestyles. For instance, as per the Global Observatory on Donation and Transplantation (GODT) data, more than 150,000 organ transplants had been performed globally in 2022, of which most were kidney transplants. This trend is pushing the healthcare systems to raise their capabilities and transplant programs. In addition, several government and non-profit initiatives for promoting donation awareness have increased the donor pools in many countries globally. Due to the continuous gap between organ demand and availability, this growing patient base remains an important factor for the transplantation market growth globally.

Restraints

-

High Transplant Procedures and Post-Operative Care Costs Can Impede Market Expansion

Despite the growing advancements in the transplantation medicine, the high transplant surgeries costs, such as pre-operative testing, life-long post operative care, surgical procedures, and immunosuppressive therapy, continues to hamper the market expansion, particularly in the low- and middle-income nations globally. A single organ transplant procedure can cost up to USD 100,000 in countries, such as U.S., while post-transplant medications can add thousands annually. In several regions, limited insurance reimbursement and lack of universal health coverage, further broadens the affordability gap. This economic restraint not only limits the number of patients undergoing transplants but also affects the ability to raise transplant programs of healthcare providers globally. Thus, cost continues to be a significant restraint, which impedes the equitable access, along with limiting the overall growth potential of the global transplantation market in price-sensitive regions.

Opportunities

-

Rising Advancements in Organ Preservation Presents Promising Market Growth Opportunities

Burgeoning technological innovations in organ preservation methods including normothermic and hypothermic machine perfusion is largely enhancing the transplant outcomes by outspreading the viability of organs during transportation. Moreover, the surge in the interest and development in regenerative medicine, such as bioengineered organs and stem cell therapies, are offering new opportunities for the market expansion. Research into 3D bioprinting of tissues and xenotransplantation using genetically modified animal organs is progressing rapidly, offering potential long-term solutions to organ shortages. These developments are drawing substantial investments from both public and private sectors. For instance, under the NIH, the U.S. government continues to fund innovative programs for boosting the organ engineering research. As these technologies grow and move toward commercialization, they represent a transformative opportunity for augmenting the efficiency, reach, and success rate of the global organ transplantation.

Challenges

-

Long Waiting Lists and Severe Organ Donor Shortage can be a Challenge for Market Growth

One of the most pressing challenges in the transplantation market is the chronic shortage of available organs relative to the growing number of patients in need. According to the WHO, tens of thousands of patients die annually being on waiting lists owing to the lack of compatible organs. The countries, which have opt-in donor systems, limited awareness, administrative delays, and cultural reluctance, further deteriorate the donor supply crisis. The imbalance between demand and supply still remains unambiguous, even with surged awareness campaigns and living donor initiatives globally. This shortage delays the life-saving treatments and also raise financial and emotional burden on the healthcare systems and patients. Without major policy reforms and innovations in donor registration and allocation, this organ scarcity will continue to challenge the transplantation market’s ability to meet global demand.

Transplantation Market Segmentation Analysis

By Product

Based on product, the market is categorized into tissue products, immunosuppressive drugs, and preservation Solution. The tissue products held the largest market share of around 60% in 2023. The dominance of the segment is driven by their broad application, ease of storage and transplantation procedures, and higher success rates as compared to solid organ transplants. These products include skin grafts, bone grafts, tendons, ligaments, and corneal tissues, among others, and have significant applications in orthopedic, dental, cardiovascular, and cosmetic surgeries. While organ transplants entail sophisticated matching and necessitate lifelong immunosuppression, tissue transplants are more accessible and with less invasiveness. With the innovations of tissue banking, sterilization methods, and cryopreservation, the safety and storage life of these products have increased and this has further brought up the usage of tissue products among hospitals and surgical centers. In addition, the increasing prevalence of trauma cases, burn injuries, and musculoskeletal disorders has also drove the need for transplantation. The wide range of application and ease of operation has made the tissue products prominent segment in the market merchandise of transplant.

By Application

On the basis of application, the market is bifurcated into organ transplantation and tissue transplantation. The tissue transplantation segment is expected to hold the largest market share around 68%, in 2023. The growth is attributed to more widespread applications, lesser procedural complexity, and growing incidence of diseases causing need for tissue repair or replacement. In contrast to solid organ transplantation, however, tissue transplants (skin grafts, bone, tendons, corneas, and heart valves) are commonly utilized in orthopedic, dental, ocular, and reconstructive surgery. When compared to other methods, these procedures usually do not require complicated donor-recipient matchings, nor lifelong immunosuppressive treatment, which increases accessibility and safety around such operations. The increasing overall prevalence of trauma injuries, age-related degenerative diseases, and in particular, sports-related muscle-skeletal disorders has caused many tissue transplants. Secondly, tissue engineering and preservation technologies have progressed tremendously due to the availability of tissue banks. The necessity of the clinical procedure, coupled with technology assistance, and simplicity of the process has made tissue transplantation the dominant segment by market share.

By End-Use

Under end-use, the market is trifurcated into hospitals, transplant centers, and others. Hospitals held the largest share of the market at around 49.35% in 2023 owing to the extensive infrastructure facilities, skilled manpower, and sophisticated surgical technologies essential to conduct complex transplant procedures in these healthcare facilities. The majority of organ and tissue transplantations everything from kidneys and livers and hearts to corneal and skin grafts are conducted in a hospital environment that enable uninterrupted pre-operative, operative, and post-operative monitoring of the patients. It has been suggested that hospitals often have more specialized transplant units and are associated with public and private transplant programs, thereby increasing patient access and procedural volume. In addition, they have good relationships with OPOs and tissue banks to be able to deliver donor material quickly. Furthermore, a higher number of transplant centers based in hospitals, coupled with higher healthcare investments in hospitals and higher insurance coverage has ensured that transplant procedures in hospital are growing continuously boosting the dominance of this application segment over the forecast period.

Transplantation Market Regional Outlook

North America held the largest market share around 40% in 2023. The expansion is driven by the high standards of healthcare infrastructure as well as high adoption of innovative technologies for transplant, coupled with the presence of leading market players. Countries in the region have developed robust organ donation and procurement systems, thanks to organizations that play important roles in organ procurement, such as the U.S.-based United Network for Organ Sharing (UNOS) and Canadian Blood Services. Another factor that has significantly driven the demand for transplants is the increase in chronic diseases, such as kidney failure, heart issues and liver disorders. Other growth supporting factors are strong government initiatives, increased healthcare expenditure, a conducive round of reimbursement policies, and awareness development programs on organ donation. Additionally, the area pioneered research and development of new transplantation technologies including tissue engineering and bioartificial organs. Moreover, the availability of a vast number of surgeons-accredited transplant specialists has made North America the pulsating heart of the global transplantation market.

In 2023, Asia Pacific held a significant market share. The region’s growth is attributed to the increase in healthcare investments, awareness growth regarding organ donations, and chronic diseases causing organ failure. The worldwide increase in customized and tissue transplants is due to the changing the global population in which both the citizens of India, China, Japan, and South Korea grow old, and the increasing global population, which is recently diagnosed with kidney, liver, and coronary heart disorders. Further, several government initiatives toward enhancing healthcare infrastructure, coupled with a rise in cadaveric and living organ donation programs, are also aiding the market growth. The region is also continuing to improve its potential with better transplanting techniques, greater accessibility to transplant centers, and overseas partnerships with other more advanced healthcare industries. The rising market share of the region is attributed to the increasing medical tourism, especially among countries, such as Thailand and India offering inexpensive transplant procedures. All of these factors combined highlight the growing importance of Asia Pacific in the global transplantation market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in the Transplantation Market

-

AbbVie, Inc. (Zinbryta, Imbruvica)

-

Arthrex, Inc. (AlloSync Pure, Angel System)

-

Zimmer Biomet (Comprehensive Shoulder, Trabecular Metal Technology)

-

Medtronic (Harmony Transcatheter Valve, TYRX Envelope)

-

Novartis AG (Zortress, Simulect)

-

Stryker (Mako Robotic-Arm, Tritanium Implants)

-

21st Century Medicine (CryoStor, HypoThermosol)

-

BioLifeSolutions, Inc. (CryoStor CS10, HypoThermosol FRS)

-

Teva Pharmaceuticals (Prograf, Copaxone)

-

Veloxis Pharmaceuticals (Envarsus XR, Tacrolimus Extended Release)

-

Sanofi (Thymoglobulin, Lemtrada)

-

Astellas Pharma Inc. (Prograf, Advagraf)

-

Roche (CellCept, Valcyte)

-

Bristol-Myers Squibb (Nulojix, Orencia)

-

Pfizer Inc. (Rapamune, Zithromax)

-

Thermo Fisher Scientific (Gibco CTS, Dynabeads)

-

Xenotherapeutics (Xeno-Kidney, Xeno-Skin)

-

CryoLife, Inc. (BioGlue, On-X Heart Valve)

-

Hansa Biopharma (Idefirix, HNSA-5487)

-

OrganOx Ltd. (OrganOx metra, Liver Perfusion System)

Recent Development:

-

In May 2024, Novartis AG completed the acquisition of MorphoSys AG to expand its footprint in the global transplantation market and reinforce its competitive position within the industry.

-

In May 2024, Veloxis published a new research on its immunosuppressive candidate VEL-101 at the American Transplant Congress, emphasizing its potential to enhance transplant quality and improve patient outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD13.76 Billion |

| Market Size by 2032 | USD30.50Billion |

| CAGR | CAGR of9.25 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Tissue Products, Immunosuppressive Drugs, Preservation Solution) • By Application (Organ Transplantation, Tissue Transplantation) • By End-Use (Hospitals, Transplant Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Inc., Arthrex, Inc., Zimmer Biomet, Medtronic, Novartis AG, Stryker, 21st Century Medicine, BioLifeSolutions, Inc., Teva Pharmaceuticals, Veloxis Pharmaceuticals, Sanofi, Astellas Pharma Inc., Roche, Bristol-Myers Squibb, Pfizer Inc., Thermo Fisher Scientific, Xenotherapeutics, CryoLife, Inc., Hansa Biopharma, OrganOx Ltd. |