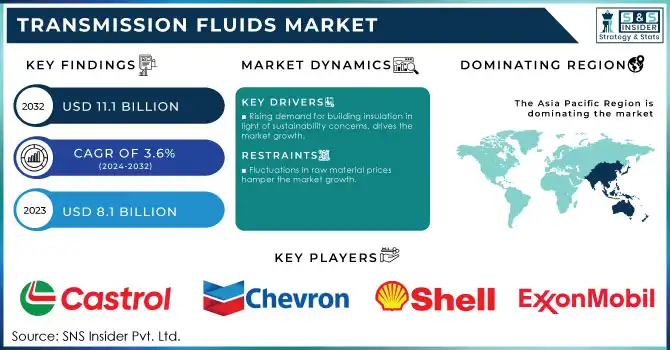

Transmission Fluids Market Key Insights:

The Transmission Fluids Market size was valued at USD 8.1 Billion in 2023. It is expected to grow to USD 11.1 Billion by 2032 and grow at a CAGR of 3.6% over the forecast period of 2024-2032.

Get More Information on Transmission Fluids Market - Request Sample Report

The growth in heavy commercial vehicles (HCVs) is significantly boosting the demand for heavy-duty transmission fluids, driven by the expansion of the logistics and construction sectors. The introduction of advanced HCV technologies like automated manual transmissions (AMTs) and hybrid systems has increased the demand for specialized fluids with enhanced thermal stability, wear resistance, and fuel efficiency. The expanding e-commerce industry also adds to logistics demand and the high need for long-haul HCVs further accelerating the market growth of transmission fluids.

For instance, the U.S. Bureau of Transportation Statistics (BTS) reported that in 2022, the number of heavy trucks registered in the U.S. exceeded 11 million, signaling continued expansion in HCV adoption.

The rise of fleet management systems and predictive maintenance technologies is significantly driving the demand for high-performance transmission fluids in the commercial vehicle sector. Fleet management systems allow companies to monitor and manage large fleets of vehicles in real-time, collecting data on vehicle performance, fuel efficiency, and operational health. By integrating predictive maintenance, these systems can forecast when a vehicle is likely to experience mechanical issues or require service, allowing operators to address potential problems before they result in costly breakdowns or downtime.

The addition of new fluids provides added thermal stability, which means consistent operation at higher temperatures, and better viscosity control, which leads to smoother shifts and less wear on transmission parts. Also, friction properties are optimized to improve energy efficiency, leading to better fuel economy and lower emissions. Such Innovations are in line with stringent environmental regulations and push the automotive industry to an environmentally sustainable future, fuelling up the use of next-generation transmission fluids.

According to the China Association of Automobile Manufacturers, vehicle sales in China saw a 26.8% year-on-year growth in early 2021, driven by infrastructure projects and consumer demand.

Transmission Fluids Market Dynamics:

Drivers

-

Rising demand for building insulation in light of sustainability concerns, drives the market growth.

With the global trend of carbon emissions reduction, energy efficiency has become a goal at which governments and organizations across the world are aiming, leading to an increased demand for effective insulation solutions for residential, commercial & industrial buildings all around the world. By stopping energy from escaping, insulation helps homeowners cut their heating and cooling bills and participate in the global effort to reduce greenhouse gas emissions to limit further climate change. As an example, the International Energy Agency (IEA) stated that by 2050 insulation for buildings could cut energy demand for heating by as much as 20%.

Moreover, stringent building codes and energy efficiency regulations in North America, Europe, and Asia-Pacific are enhancing the demand for advanced insulation materials like spray foam and fiberglass. They support sustainable construction practices by providing high thermal resistance and durability. The European Union has, for example, set the bigger target of retrofitting millions of buildings till 2030 to adapt to climate neutrality goals through its “Renovation Wave”, thus providing additional incentives for the insulation market.

Restraint

-

Fluctuations in raw material prices hamper the market growth.

Transmission fluids are primarily crude oil-based derivatives (base oils and additives) to which market fluctuations in raw material prices represent a key restraint. The cost of crude oil, a key component in the production of conventional and synthetic transmission fluids, is known to be highly volatile due to geopolitical factors, disasters, and shifts in global supply and demand. Such fluctuations make it difficult for manufacturers to keep uniform costs of production, which can lead to increased prices being passed on to the end-user and limited demand in the market, especially in cost-sensitive continents including Asia-Pacific and Latin America. Elsewhere, raw used in additives have also been volatile, driven by supply chain issues and higher worldwide metal demand, too. Such instability leads manufacturers to alter their pricing strategies forcing the high-end transmission fluids adoption to stagnate amongst the price-sensitive end-users. These fluctuations in the prices of raw materials can create pressure on profitability and therefore the overall growth of the transmission fluids market.

Transmission Fluids Market Segmentation Analysis

By Product

The manual transmission fluid products held the highest share of 56% in 2023. Manual transmission, vehicle-centric MTF, for example, is used. This segment is highly dynamic in terms of product innovation as the main focus is on improving fuel economy and reducing manual transmission vehicle noise. Advancements in technology and innovations in motor upgrades are predicted to drive demand for the product in the coming years. MTF has experienced robust growth in regions like Europe due to the growing demand for manual transmission vehicles. For MTF, innovations wherein it deals with dirt and sand off-road vehicles which have ride types specifically for construction and agriculture applications are predicted to stimulate segment growth. There have been numerous actions undertaken by the governments of emerging economies of Asia Pacific, Central America, and Middle East to refurbish and commercialize ecological housing projects. Furthermore, the expansion of these initiatives has increased the production of off-road vehicles with manual transmission, which, in turn, is expected to fuel the sales of MTFs in these regions.

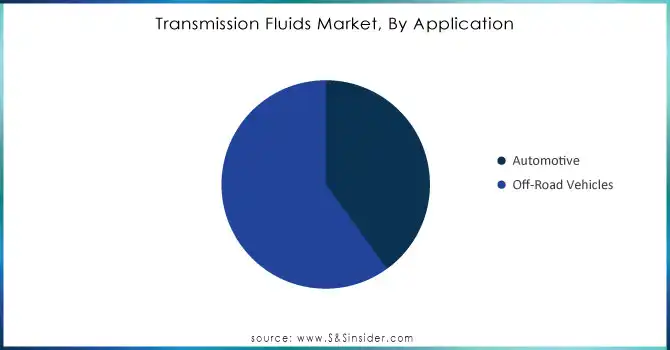

By Application

Off-road vehicles held the largest market share around 60% in 2023. This leads to the high demand for high-quality transmission fluids that provide superior thermal stability and superior viscosity control and protect against wear. The global construction and agricultural sectors have been expanding, particularly in emerging economies, where the use of off-road vehicles for infrastructure and agricultural applications is extensive.

In addition, the growing trend of automation in industries such as mining and agriculture is attributed to the increasing development of off-road vehicles with complex transmission systems, which in turn is expected to propel demand for high-performance transmission fluids.

Need Any Customization Research On Transmission Fluids Market - Inquiry Now

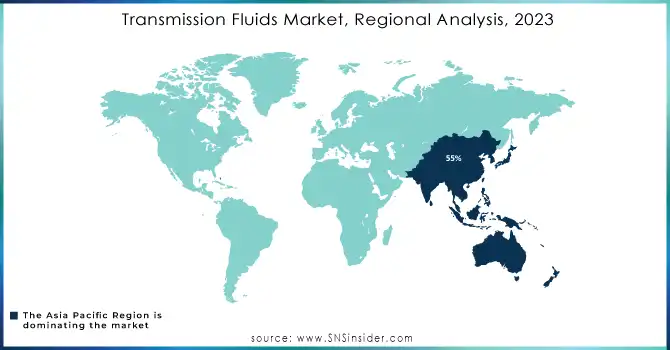

Transmission Fluids Market Regional Outlook

Asia Pacific held the largest market share around 55% in 2023. The region has experienced remarkable development in automotive manufacturing such as passenger cars and off-road vehicles can be associated with nations like China, India, Japan, and South Korea with developed automotive technology and unique technologies of transmission fluids. Rising use of off-road vehicles for agriculture, construction, and mining in countries like China and India as the automotive sector, along with high-performance transmission fluids, is also pushing demand. As per the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest vehicle producer and continues to adopt advanced transmission systems that require high-quality lubricants.

Also, the increasing use of electric vehicles (EVs) and hybrid vehicles in the region affects the demand for niche transmission fluids, as they need fluids that can work smoothly in different weather conditions. Considering the region's rising demand for fuel efficiency, durability of vehicles, and environmental protection, it also drives the demand for energy-efficient and environmentally friendly synthetic and semi-synthetic transmission fluids.

Key Players

-

ExxonMobil (Mobil 1, Mobil Super)

-

Royal Dutch Shell (Shell Helix, Shell Spirax)

-

Chevron (Chevron Havoline, Chevron Delo)

-

TotalEnergies (Total Quartz, Total Transmission Fluid)

-

Castrol (Castrol EDGE, Castrol Transmax)

-

BP (Castrol GTX, BP Visco 7000)

-

Fuchs Petrolub (Fuchs Titan, Fuchs ATF)

-

Valvoline (Valvoline MaxLife, Valvoline DEX/MERC)

-

Liqui Moly (Liqui Moly Top Tec, Liqui Moly ATF)

-

Sinopec (Sinopec 5W-30, Sinopec ATF D)

-

Lukoil (Lukoil Genesis, Lukoil ATF DEXRON)

-

Petro-Canada (Petro-Canada Supreme, Petro-Canada ATF)

-

Afton Chemical (Afton ATF, Afton 3000)

-

Addinol (Addinol ATF, Addinol Premium)

-

Motul (Motul 300V, Motul ATF)

-

Havoline (Chevron) (Havoline ProDS, Havoline ATF)

-

Idemitsu Kosan (Idemitsu ATF, Idemitsu Multi-Vehicle)

-

Kendall Motor Oil (Kendall GT-1, Kendall Transmission Fluid)

-

Phillips 66 (Phillips 66 Xtreme, Phillips 66 ATF)

-

BASF (BASF Fluid, BASF Additives)

Recent Developments:

-

In 2023, ExxonMobil launched its Mobil 1 Annual Protection Full Synthetic Motor Oil that offers superior performance and protection for both on-road and off-road vehicles, aligning with market trends for longer-lasting, more efficient transmission fluids.

-

In 2022, Chevron introduced a new line of Delo® 400 ZF 10W-30 Transmission Fluids specifically formulated for heavy-duty commercial vehicles, including off-road vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.1 Billion |

| Market Size by 2032 | US$ 11.1 Billion |

| CAGR | CAGR of 3.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Automatic Transmission Fluids, Manual Transmission Fluids, Dual Clutch Transmission Fluids, Continuously Variable Transmission Fluids) • By Application (Automotive, Off-Road Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil, Royal Dutch Shell, Chevron, TotalEnergies, Castrol, BP, Fuchs Petrolub, Valvoline, Liqui Moly, Sinopec, Lukoil, Petro-Canada, Afton Chemical, Addinol, Motul, Havoline, Idemitsu Kosan, Kendall Motor Oil, Phillips 66, BASF. |

| Key Drivers | • Rising demand for building insulation in light of sustainability concerns, drives the market growth. |

| Restraints | • Fluctuations in raw material prices hamper the market growth. |