To get more information on Train Battery Market - Request Free Sample Report

The Train Battery Market Size was valued at USD 383.7 billion in 2023 and is expected to reach USD 603.16 billion by 2032, growing at a CAGR of 5.18% over the forecast period 2024-2032.

The expansion of the train battery market can be attributed to the introduction of rail electrification, rising awareness about environmental sustainability, and government efforts to promote decarbonization in the transport sector. However, lithium-ion and lead-acid batteries are emerging as the way to go forward as you can power up trains with zero emissions driving into sync with countries around the world slowly but surely tightening their policies on carbon reductions. With dense, population-heavy areas benefitting from expanding railways, particularly across the Asia-Pacific region and Europe, energy storage demand has never been higher. High-speed rail development further fuels this trend as it needs resilient energy storage for onboard auxiliary power and emergency backup, catering to uninterrupted operations in both urban and intercity networks.

China has electrified more than 150k km of rail and India has 90% of its broad-gauge routes electrified. Compared with Lead-acid batteries, Lithium-ion batteries have been favored in high-speed as well as metro trains on account of their higher energy density. A fully battery-powered train with a 120 km range was introduced in 2023 by Alstom.

The Wabtec FLXdrive locomotive, which was first used in 2023, achieved 11% lower fuel consumption, demonstrating increased rail energy efficiency.

Moreover, autonomous and hybrid train technologies are amid rapid growth which is propelling the demand for high-capacity batteries to facilitate advanced features such as automated navigation and real-time diagnostics. Also, the Internet of Things (IoT) and Artificial Intelligence (AI) technology in train systems need stable and long-duration power sources as well. All these requirements support the use of lithium-ion batteries, and newer types of lead-acid (notably, Valve-Regulated Lead Acid (VRLA) batteries) used in modern trains. This, in turn, is leading operators of trains to invest in battery systems, which should lead to more technological development and market growth. Systems such as Parallel Systems, which has commenced pilot testing its autonomous, battery-electric freight rail vehicles, are capable of reducing as much as 175 tons of CO2 annually.

Hitachi Rail also has battery-powered commuter trains capable of 70 km of travel over non-electrified sections, providing up to 20%-plus emissions reduction and up to 50% fuel-consumption reduction.

KEY DRIVERS:

Advancements in Lithium and Silicon Batteries Boosting Performance and Longevity for High-Speed Rail Systems

Newer lithium-based batteries such as Lithium Iron Phosphate (LFP) and Lithium Titanate Oxide (LTO) chemistries provide long life, high charge rates, and increased safety, which can help satisfy the demanding requirements of rail applications. The next-gen battery types offer higher auxiliary function support as well as battery performance which earns additional energy regeneration, especially competitive for intensive regenerative braking applications such as electric and hybrid trains. The rise of high-speed and autonomous trains has meant that our batteries must now be capable of producing high power outputs, fast charge cycles, and the highest level of capacity at different operating conditions. Increased demand has compelled manufacturers to focus on improving the performance of batteries and their acceptance across various rail networks in the world.

LTO batteries last over 30,000 rounds of charge-discharge cycles, while the lithium-ion variants, Lithium Iron Phosphate (LFP) batteries offer approximately 2000 cycles with 90–160 Wh/kg energy densities making them reliable and safer for rail applications. Silicon batteries, on the other hand, can reach up to 10,000 cycles and ultra-fast charging supports 70–90 Wh/kg Li-ion energy densities suited to high-speed trains and demanding battery conditions.

Enhancing Rail Efficiency with Low Maintenance Batteries and Cost Savings in Modern Train Operations

Traditional power and diesel systems are expensive and need regular maintenance, while new battery systems help limit fuelling and mechanics. For instance, Valve Regulated Lead Acid (VRLA) batteries provide issues of minimal maintenance and long cycle life, resulting over time in reduced costs. These long-lasting, reliable battery systems allow train operators to lower operational expenditures, and put resources to better use, hence, bolstering the overall efficiency of rail operations. For government-funded rail projects and regional rail networks where operating budgets are limited, these savings are significant yet the need to enhance efficiency is paramount.

While VRLA batteries might give only about 200 cycles, Lithium Iron Oxide (LTO) batteries provide up to 15,000 cycles. LTO batteries are about 2.5 times pricier than VRLA but offer higher energy density, shorter discharge times, and lower operating costs per mile in rail applications. LTO’s excellent performance is well suited to high-speed and hybrid trains where rapid charging and high levels of regenerative braking.

RESTRAIN:

Overcoming Challenges of Battery Power Efficiency Safety and Environmental Impact in the Train Battery Market

Frequent wear in railway applications, however, reduces battery life and demands replacement which is an undesirable characteristic in such heavy use cases. And, in the cases of lithium and nickel-based batteries, the size and weight of the high-capacity batteries present a challenge in terms of integration on a train that needs to maximize space and weight for operational purposes. Another issue relates to the environmental consequences since batteries hold toxic materials such as lead and cadmium. These parts are difficult to dispose of and recycle and would need stringent environmental regulations.

BY BATTERY TYPE

lithium-ion (Li-ion) batteries segment led the train battery market in 2023, accounting for 52% of global revenue, and are expected to exhibit the fastest compound annual growth rate (CAGR) from 2024 and 2032. The reason for this accelerated growth is the high energy density and long-life cycle of lithium-ion technology with low maintenance, making it one of the best-suited technologies for all types of trains be it high-speed or hybrid & autonomous trains. This is significant for many modern rail applications, as these batteries enable fast charging and energy regeneration, which brings high value-added benefits to rail operations. Finally, as international rail networks continue to grow and demand sustainable, high-performance systems, many industries are switching to lithium-ion batteries because of their suitability in meeting operational requirements and minimizing emissions when compared to traditional diesel-based power systems.

BY TECHNOLOGY

In 2023, VRLA (Valve Regulated Lead Acid) batteries held the largest market share, accounting for 34% of the global market share. VRLA batteries have gained popularity in train batteries as they offer several advantages including low-maintenance needs, performance reliability under different load and ambient temperature conditions, and long service life compared to conventional lead-acid batteries making them perfect materials for train use, especially for auxiliary applications and starter batteries for diesel locomotives, where reliable, robust, and stable performance is vital.

Lithium Titanate Oxide (LTO) batteries are expected to be the fastest-growing segment with the highest CAGR from 2024 to 2032. Compared to traditional lithium-ion chemistries, LTO batteries typically boast high safety, impressive charge time, and stellar cycle life offering multiple major advantages. Due to its unique structure, LTO offers rapid movement of its electrons and ions, meaning the battery can be charged and discharged at quick rates without degrading. This unique feature of LTO batteries makes them especially attractive to high-speed and autonomous trains that require quick energy top-ups over short periods while stationary.

BY APPLICATION

Metros held the largest share of the train battery market at 37% in 2023. This is because electric trains are the backbone of metro transportation systems, which are bulwarks of public transport throughout the globe. The rapid growth of urban populations, together with the increasingly pressing need for sustainable and efficient mass transit solutions has given impetus to the expansion of metro systems. Battery technologies, mainly Li-Ion and VRLA are also being used to power metro trains because of their frequent stops and regenerative braking. The short routes this type of train covers, combined with a strong volume of passengers, further increase the demand for reliable, low-maintenance battery systems.

The high-speed trains segment registered the fastest CAGR from 2024 to 2032. Rapidly growing demand for high-speed energy-efficient rail travel worldwide, particularly in Europe and Asia, is pushing the demand for more advanced energy storage solutions. Batteries like these are important for high-speed trains because they must feature high energy density, charge quickly, and last a long time. This segment is projected to be led by technologies like Lithium Iron Phosphate (LFP) and Lithium Titanate Oxide (LTO), which have better performance properties. The global market for efficient and robust train battery solutions is projected to grow considerably as countries develop high-speed rail infrastructure at scale to shorten travel latency and promote sustainable transport.

BY TYPE

In 2023, the Auxiliary Function Batteries accounted for the largest share of 62% and is expected to grow at the CAGR from 2024 to 2032. These batteries are essential as they support the non-propulsion systems in trains, such as lighting, air conditioning, signaling, and communication. Rail operators are constantly looking to improve passenger comfort and the overall efficiency of rail networks, leading to increasing customer needs for reliable, long-life auxiliary batteries. High-capacity, long-life, and low-maintenance batteries such as lithium-ion and VRLA are most appropriate for these applications. With many rail systems already beginning to adopt next-generation technologies, such as real-time data monitoring and even autonomous operations, strong, rapid-charging batteries able to supply power to auxiliary functions are increasingly important. This is instantly going to be the fastest-growing segment in train battery market in the coming years due to increasing efforts to decrease train downtime and improve operation efficiency so that trains stay in service for a longer period.

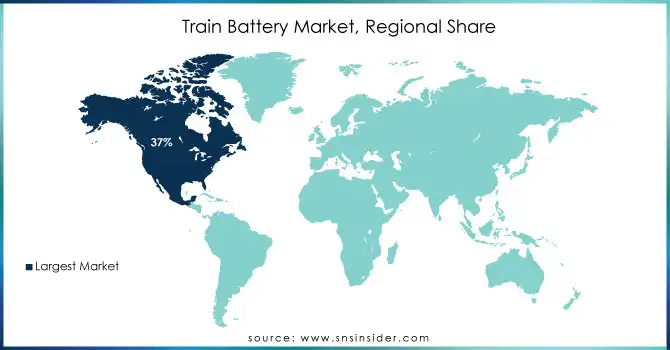

In 2023, North America led the train battery market with a share of 37%, due in part to numerous rail networks in the region and the electrification of transportation systems. Battery-powered trains are currently under development in the U.S. and Canada, much like the progress made on the California High-Speed Rail project. The project is seen to change the future of the rail system promoting the use of energy-efficient trains equipped with high-capacity lithium-ion battery technologies to boost performance while assisting in controlling environmental degradation. Reducing carbon footprints has been one of the key regions because the region owes high market share with cities such as New York and Toronto investing in metro systems powered with efficient battery systems.

Asia Pacific is projected to experience the fastest growth with a CAGR from 2024 to 2032, as the region has been implementing massive investments in high-speed rail as well as metro networks. One clear example is the quickly-growing high-speed rail network in China, which is one of the largest in the world. Asia has fully embraced a more sustainable rail transportation future, as evidenced by the country's quick transition to battery-electric trains, including the likes of CRRC Corporation's battery-powered trains. In the same turn, Japan, long known for its state-of-the-art Shinkansen high-speed trains, has turned its attention towards adding batteries and hybrid systems to improve the energy efficiency of high-speed rail. These trends highlight the fact that Asia Pacific is leading the way in the future of train battery market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Train Battery Market are:

Hitachi Rail Limited (Lithium-ion batteries, Lead-acid batteries)

BorgWarner Akasol AG (Lithium-ion batteries, Hybrid power systems)

Shuangdeng Group Co., Ltd. (Lead-acid batteries, Nickel-cadmium batteries)

Toshiba Corporation (Lithium-ion batteries, Lithium titanate oxide batteries)

Exide Batteries (Lead-acid batteries, VRLA batteries)

GS Yuasa Corporation (Lead-acid batteries, Lithium-ion batteries)

Amara Raja Batteries Ltd. (Lead-acid batteries, Lithium-ion batteries)

HBL Power Systems Limited (Lead-acid batteries, Nickel-cadmium batteries)

Enersys (Lead-acid batteries, Lithium-ion batteries)

East Penn Manufacturing Company (Lead-acid batteries, VRLA batteries)

BAE Systems (Lead-acid batteries, Lithium-ion batteries)

Saft (A TotalEnergies Company) (Lithium-ion batteries, LiFePO4 batteries)

3M (Lithium-ion batteries, Conductive adhesives)

Leonardo DRS (Lithium-ion batteries, Hybrid battery systems)

L3Harris Technologies (Lead-acid batteries, Nickel-cadmium batteries)

Axis Communications AB (Lithium-ion batteries, Battery monitoring solutions)

Envision AESC (Lithium-ion batteries, Solid-state batteries)

ABB Ltd. (Lithium-ion batteries, Hybrid power systems)

Siemens Mobility (Lithium-ion batteries, Hybrid systems)

Alstom (Lithium-ion batteries, Hydrogen-powered solutions)

Mitsubishi Materials

Umicore

Glencore

BASF

Sumitomo Corporation

Panasonic

LG Chem

SK Innovation

Contemporary Amperex Technology Co. Ltd. (CATL)

Samsung SDI

In September 2024, Hitachi Rail leads a new partnership with Innovate UK, the University of Birmingham, and DB ESG to develop advanced battery technology for trains. The £1.4 million project aims to accelerate rail decarbonization and enhance UK battery expertise.

In June 2024, Skoda Group presented its new innovative product the first battery-electric single-deck train of the RegioPanter family.

In June 2024, Siemens Mobility plans to build battery-powered trains in Goole, Yorkshire, to replace aging diesel fleets on Britain’s railways. The project aims to save £3.5bn and cut 12 million tonnes of CO2 emissions over the next 35 years.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 383.7 Billion |

| Market Size by 2032 | USD 603.16 Billion |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type (Lead Acid Battery, Nickel Cadmium Battery, Lithium Ion Battery) • By Technology (Conventional Lead Acid Battery, Valve Regulated Lead Acid Battery, Gel, Tubular Lead Acid Battery, Sinter/PNE Ni-Cd Battery, Pocket Plate Ni-Cd Battery, Fiber/PNE Ni-Cd Battery, Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO), Others) • By Application (Metros, High-speed Trains, Light Rails/Trams/Monorails, Passenger Coaches) • By Type (Starter Battery, Auxiliary Function Battery) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi Rail Limited, BorgWarner Akasol AG, Shuangdeng Group Co., Ltd., Toshiba Corporation, Exide Batteries, GS Yuasa Corporation, Amara Raja Batteries Ltd., HBL Power Systems Limited, Enersys, East Penn Manufacturing Company, BAE Systems, Saft (A TotalEnergies Company), 3M, Leonardo DRS, L3Harris Technologies, Axis Communications AB, Envision AESC, ABB Ltd., Siemens Mobility, Alstom. |

| Key Drivers | • Advancements in Lithium and Silicon Batteries Boosting Performance and Longevity for High-Speed Rail Systems • Enhancing Rail Efficiency with Low Maintenance Batteries and Cost Savings in Modern Train Operations |

| RESTRAINTS | • Overcoming Challenges of Battery Power Efficiency Safety and Environmental Impact in the Train Battery Market |

Ans: The Train Battery Market is expected to grow at a CAGR of 5.18% during 2024-2032.

Ans: Train Battery Market size was USD 383.7 billion in 2023 and is expected to Reach USD 603.16 billion by 2032.

Ans: The major growth factor of the Train Battery Market is the increasing demand for sustainable and energy-efficient solutions to replace diesel-powered trains, driven by environmental regulations and the push for rail decarbonization.

Ans: The Valve Regulated Lead Acid Battery segment dominated the Train Battery Market in 2023

Ans: North America dominated the Train Battery Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Train Battery Technological Adoption and Trends (2023)

5.2 Train Battery Performance Metrics (2023)

5.3 Train Battery Cost-per-Kilowatt-Hour (kWh)

5.4 Train Battery Environmental Impact

5.5 Train Battery Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Train Battery Market Segmentation, By Battery Type

7.1 Chapter Overview

7.2 Lead Acid Battery

7.2.1 Lead Acid Battery Market Trends Analysis (2020-2032)

7.2.2 Lead Acid Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Nickel Cadmium Battery

7.3.1 Nickel Cadmium Battery Market Trends Analysis (2020-2032)

7.3.2 Nickel Cadmium Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Lithium Ion Battery

7.3.1 Lithium Ion Battery Market Trends Analysis (2020-2032)

7.3.2 Lithium Ion Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Train Battery Market Segmentation, By Technology

8.1 Chapter Overview

8.2 Conventional Lead Acid Battery

8.2.1 Conventional Lead Acid Battery Market Trends Analysis (2020-2032)

8.2.2 Conventional Lead Acid Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Valve Regulated Lead Acid Battery

8.3.1 Valve Regulated Lead Acid Battery Market Trends Analysis (2020-2032)

8.3.2 Valve Regulated Lead Acid Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Gel Tubular Lead Acid Battery

8.4.1 Gel Tubular Lead Acid Battery Market Trends Analysis (2020-2032)

8.4.2 Gel Tubular Lead Acid Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Sinter/PNE Ni-Cd Battery

8.5.1 Sinter/PNE Ni-Cd Battery Market Trends Analysis (2020-2032)

8.5.2 Sinter/PNE Ni-Cd Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Pocket Plate Ni-Cd Battery

8.6.1 Pocket Plate Ni-Cd Battery Market Trends Analysis (2020-2032)

8.6.2 Pocket Plate Ni-Cd Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Fiber/PNE Ni-Cd Battery

8.7.1 Fiber/PNE Ni-Cd Battery Market Trends Analysis (2020-2032)

8.7.2 Fiber/PNE Ni-Cd Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Lithium Iron Phosphate (LFP)

8.8.1 Lithium Iron Phosphate (LFP) Market Trends Analysis (2020-2032)

8.8.2 Lithium Iron Phosphate (LFP) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Lithium Titanate Oxide (LTO)

8.9.1 Lithium Titanate Oxide (LTO) Market Trends Analysis (2020-2032)

8.9.2 Lithium Titanate Oxide (LTO)Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Others

8.10.1 Others Market Trends Analysis (2020-2032)

8.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Train Battery Market Segmentation, By Application

9.1 Chapter Overview

9.2 Metros

9.2.1 Metros Market Trends Analysis (2020-2032)

9.2.2 Metros Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 High-speed Trains

9.3.1 High-speed Trains Market Trends Analysis (2020-2032)

9.3.2 High-speed Trains Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Light Rails/Trams/Monorails

9.4.1 Light Rails/Trams/Monorails Market Trends Analysis (2020-2032)

9.4.2 Light Rails/Trams/Monorails Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Passenger Coaches

9.5.1 Passenger Coaches Market Trends Analysis (2020-2032)

9.5.2 Passenger Coaches Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Train Battery Market Segmentation, By Type

10.1 Chapter Overview

10.2 Starter Battery

10.2.1 Starter Battery Market Trends Analysis (2020-2032)

10.2.2 Starter Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Auxiliary Function Battery

10.3.1 Auxiliary Function Battery Market Trends Analysis (2020-2032)

10.3.2 Auxiliary Function Battery Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.2.4 North America Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.5 North America Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.6 North America Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.2.7.2 USA Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7.3 USA Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.4 USA Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.2.8.2 Canada Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8.3 Canada Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.4 Canada Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9.3 Mexico Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7.3 Poland Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8.3 Romania Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10 turkey

11.3.1.10.1 Turkey Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.5 Western Europe Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7.3 Germany Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.8.2 France Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8.3 France Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.4 France Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9.3 UK Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10.3 Italy Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11.3 Spain Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14.3 Austria Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.5 Asia Pacific Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.7.2 China Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7.3 China Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.4 China Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.8.2 India Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8.3 India Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.4 India Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.9.2 Japan Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9.3 Japan Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.4 Japan Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10.3 South Korea Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11.3 Vietnam Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12.3 Singapore Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.13.2 Australia Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13.3 Australia Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.4 Australia Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.5 Middle East Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7.3 UAE Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.2.4 Africa Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.5 Africa Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.6 Africa Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Train Battery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.6.4 Latin America Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.5 Latin America Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.6 Latin America Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7.3 Brazil Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8.3 Argentina Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9.3 Colombia Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Train Battery Market Estimates and Forecasts, By Battery Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Train Battery Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Train Battery Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Train Battery Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Hitachi Rail Limited

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 BorgWarner Akasol AG

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Shuangdeng Group Co., Ltd

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Toshiba Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Exide Batteries

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 GS Yuasa Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Amara Raja Batteries Ltd.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 HBL Power Systems Limited

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Enersys

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 East Penn Manufacturing Company

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Battery Type

Lead Acid Battery

Nickel Cadmium Battery

Lithium Ion Battery

By Technology

Conventional Lead Acid Battery

Valve Regulated Lead Acid Battery

Gel Tubular Lead Acid Battery

Sinter/PNE Ni-Cd Battery

Pocket Plate Ni-Cd Battery

Fiber/PNE Ni-Cd Battery

Lithium Iron Phosphate (LFP)

Lithium Titanate Oxide (LTO)

Others

By Application

Metros

High-speed Trains

Light Rails/Trams/Monorails

Passenger Coaches

By Type

Starter Battery

Auxiliary Function Battery

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The AC Charger for EVs Market Size was valued at USD 6.48 billion in 2023, and will reach $93.34 billion by 2032, and grow at a CAGR of 34.5% by 2024-2032

The Automotive Airbag Fabric Market Size was valued at USD 32.16 billion in 2023 and is expected to reach USD 55.98 billion by 2031 and grow at a CAGR of 7.12% over the forecast period 2024-2031.

The locomotive Market size was valued at USD 20.05 billion in 2023 and is expected to reach at USD 47.65 billion by 2032 and grow at a CAGR of 9.10% over the forecast period of 2024-2032.

The Railway Management System Market size was USD 52.38 billion in 2023 and will Reach USD 104.37 billion by 2031 and grow at a CAGR of 9% by of 2024-2031

The Off-Road Motorcycle Market Size was valued at USD 15.7 billion in 2023 and is expected to reach USD 28.14 billion by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032

Automotive Wireless EV Charging Market Size was valued at USD 78 Million in 2023 and will reach $2823.39 Mn by 2032 and grow at a CAGR of 49% by 2024-2032

Hi! Click one of our member below to chat on Phone