Get More Information on Tire Pressure Monitoring System Market - Request Sample Report

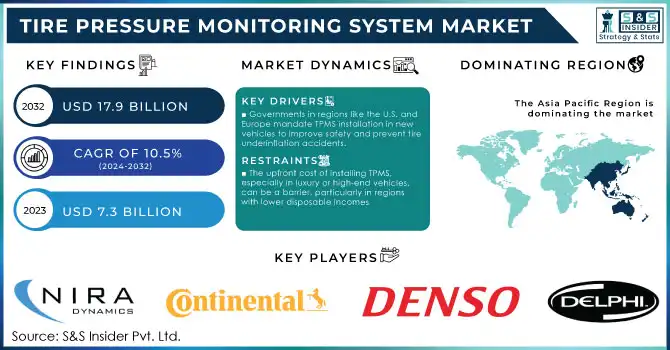

The Tire Pressure Monitoring System (TPMS) Market Size was valued at USD 7.3 Billion in 2023 and will reach USD 17.9 Bn by 2032, growing at a CAGR of 10.5% during the forecast period of 2024 -2032.

The rising number of government regulations and stringent safety regulations to prevent road accidents due to under-inflated tires is primarily driving the global tire pressure monitoring system (TPMS) market. TPMS Installation in Vehicles Governments globally, more so in North America and Europe, have imposed strict regulations for the installation of TPMS in vehicles for overall better safety and fuel savings. For example, because of not properly inflating tires, The National Highway Traffic Safety Administration (NHTSA) has a record of nearly 11,000 car crashes in the United States and more than 200 deaths, annually. It assists in alerting the driver about under-inflated tires and enhances vehicle safety and fuel efficiency.

All light vehicles weighing under 10,000 pounds (including passenger cars and light trucks) sold in the U.S. have had to be equipped with TPMS since 2007, per NHTSA regulations. In Europe, by 2014 the European Commission laid down regulations enforcing TPMS in every new car, which also drives the market potential for the TPMS system in Europe. The demand for TPMS is driven by government initiatives toward road safety and fuel efficiency which has prompted the adoption of TPMS in passenger vehicles as well as commercial fleets. Secondly, the TPMS market is supported as rising environmental awareness amongst customers is driving demand for tire pressure monitoring systems, helping improve fuel efficiency and reduce CO2 emissions by maintaining correct tire pressure. As such, government initiatives have played a major role in promoting mass TPMS adoption across the world, with some nations looking towards stricter regulations to maximize the benefits of TPMS for road safety.

Drivers

Governments across various regions, including the U.S. and Europe, mandate the installation of TPMS in all new vehicles to enhance safety and reduce accidents caused by tire underinflation.

Growing awareness about the importance of maintaining optimal tire pressure for better fuel efficiency, reduced wear, and increased safety has led to higher adoption of TPMS, especially in consumer vehicles.

The rising number of road accidents due to under-inflated tires has accelerated the demand for TPMS, as it is a critical safety feature that can prevent accidents.

Regulatory safety mandates are one of the significant driving factors for the growth of the Tire Pressure Monitoring System (TPMS) market. To enhance safety while driving, governments all over the world in particular the U.S. and Europe enforced rigorous requirements on all new passenger vehicles to be fitted with a Tire Pressure Monitoring System (TPMS). For example, the U.S. National Highway Traffic Safety Administration (NHTSA) ruling from 2007 requiring TPMS (tire pressure monitoring systems) on nearly every passenger vehicle and light truck a ruling that drove widespread adoption of that technology. The need for this regulation comes from the fact that tire underinflation is a leading factor in tire-related accidents.

The European Union has similarly mandated TPMS for all new passenger cars, with the regulation coming into effect in 2014. These regulations help to lower the chances of an accident caused due to tire failure, lower fuel consumption, and increase overall vehicle safety. Consequently, the TPMS adoption rate increased in these areas, with TPMS being featured in the majority of new vehicle models by most car manufacturers. These safety regulations do not just minimize the damage in road accidents, but they also contribute to various global movements for improving automotive safety. According to the NHTSA, about 10 percent of all motor vehicle crashes are the result of tire-related incidents. Hence, regulatory mandates remain a major driver, with the evolution of TPMS being one of the essential forces shaping automotive safety systems.

Restraints:

Retrofitting older vehicle models with TPMS can be challenging due to compatibility issues, which limits the market potential for aftermarket TPMS solutions.

The upfront cost of installing TPMS, especially in luxury or high-end vehicles, can be a barrier, particularly in regions with lower disposable incomes

Compatibility issues with older vehicles are one of the major restraints for the growth of the Tire Pressure Monitoring System (TPMS) market. Installing TPMS in vehicles that were not made with the system can be a time-consuming and expensive process. Ideally, you would need the sensors or the wiring to it, as many older cars do not have these systems, and retrofitting it can be difficult. Vehicle owners may still incur new costs in the form of more sensors, wiring, or even software updates for the integration of the sensors into the vehicle’s existing systems. In addition, in old vehicles in which the advanced TPMS solutions had no infrastructure, there is no wide adoption of the aftermarket segment. This issue is more prominent in regions where older vehicle fleets are common, reducing the overall market potential for retrofitting solutions.

By Type

In 2023, the direct TPMS (dTPMS) held the largest market share with a share of 59%. The growing consumer need for more accurate and reliable tire pressure monitoring systems is primarily responsible for the dominance of this segment. The Direct TPMS does not calculate tire pressures through wheel speed sensors like the Indirect TPMS (iTPMS) that derives tire pressure from rotational differences, instead, it has a pressure sensor in each tire offering direct, real-time & accurate tire pressure readings to the Vehicle driver. This use of technology gives direct TPMS an edge over indirect TPMS and thus, is favored by manufacturers in safety regulations-intensive regions. The NHTSA mandates direct TPMS for cars over 10,000 pounds in the U.S., and this has propelled the growth of the direct TPMS market. Another reason direct systems are chosen is due to advancements in sensor technology lower costs and better system reliability.

The direct TPMS's capability to immediately alert the driver to tire pressure changes ensures greater safety, particularly in critical driving conditions. According to government statistics, TPMS has proven to be a key factor in reducing accidents and improving fuel efficiency, which aligns with the global push for automotive safety innovations. The research by the U.S. NHTSA revealed that direct TPMS has decreased tire-related crashes by as much as 55%. This has subsequently led to an increased adoption of direct TPMS by automakers for both new and repowered vehicle models, thus establishing direct TPMS as the dominant type of TPMS in the market.

By Vehicle Type

In 2023, the TPMS market was led by the passenger vehicle segment with a 69% share. The passenger vehicle segment held the largest share within the global tire pressure monitoring systems because of the higher sales of passenger cars, and government mandates for TPMS as a standard feature in passenger vehicles. As an example, the National Highway Traffic Safety Administration (NHTSA) requires every light vehicle (like passenger cars) sold in the U.S. to include a tire pressure monitoring system or TPMS. Moreover, the rising knowledge of consumers regarding vehicle safety along with the health of tires further plays a key factor in driving passenger vehicle demand across the global TPMS market.

With the increasing concern related to fuel efficiency and carbon dioxide (CO2) emissions, governments worldwide are underscoring the impact of tire management on total fuel use. Under-inflated tires are among the top three causes of fuel inefficiency and with TPMS offering up to 3% fuel improvement in studies, it is a good selling point with consumers who want to cut their fuel expense levels. In addition, the increasing number of consumers purchasing luxury vehicles, which are mostly equipped with additional safety features inclusive of TPMS, supports the growth of the passenger vehicle segment in the TPMS market. Attracting adoption in markets such as Europe, where TPMS regulations have been operating for almost 5 years, government policies have been a key driver in the market. In addition, the regulation of a TPMS in the European Union has seen it as standard on passenger vehicles, further sustaining the dominance of the segment.

By Sales Channel

In 2023, the OEM (Original Equipment Manufacturer) segment accounted for the largest market share at 73%. The high percentage of cars equipped with TPMS and the focus on safety and fuel efficiency by automakers and regulators have contributed to this trend. Government mandates have led to the evolution of TPMS fitments in new vehicles in developed regions, particularly North America and Europe, where regulations around fitting TPMS in new vehicles are already in place. The U.S. National Highway Traffic Safety Administration (NHTSA) reports that installing TPMS in new vehicles since 2007 has improved road safety by helping drivers be alert to low tire pressure. Furthermore, vehicle manufacturers are making it a point to offer TPMS with every fleet as a part of the standard safety package, boosting the dominance of the VOEM segment.

Moreover, automakers are still working on improving the TPMS technology by fusing it with other advanced driver-assistance systems (ADAS) which will provide a broader safety solution making TPMS a major selling point in new vehicles. With more OEMs tying up with TPMS suppliers for the seamless integration of TPMS technology during the production process, the OEM segment is holding the greater share of the TPMS market. These factors will keep the OEM segment to retain its position in the TPMS market in the coming years.

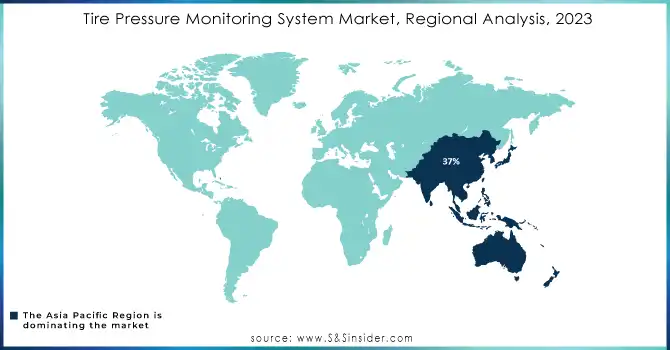

The Asia Pacific region led the global Tire Pressure Monitoring Systems (TPMS) market in 2023 with a considerable 37% revenue share. This prevalence is linked to the automotive sector with impressive growth in major markets such as China, India as well as Japan with decades of growing the production as well as sales of vehicles. The increasing demand for TPMS in the region is further fueling demand because of consumer awareness towards vehicle safety and fuel efficiency, along with stringent government regulations. Specifically, China, the world's biggest automotive market is a key driver in TPMS take-up spurred by the government's push for increased vehicle safety and fuel efficiency. China implements automotive safety regulations which is stricter and more mandatory for installing TPMS in new cars. This regulation is accelerating the domestic automakers and international brands in China for TPMS adoption. Similarly, the Indian government too, has been moving towards setting realistic and stringent vehicle safety standards considering even the promotion of installing TPMS in vehicles.

Additionally, as the automotive industry in the Asia Pacific region continues to grow, the increasing number of vehicle sales, especially passenger vehicles, has bolstered the demand for advanced safety features such as TPMS. Countries such as India and South Korea are witnessing a significant shift in consumer preference for vehicles with new technologies like TPMS due to the increasing middle-class population and rising disposable income.

The North American region is expected to register a lucrative growth rate during the forecast period. The growth of the advanced tire pressure monitoring system is due to stringent regulatory mandates, particularly in the United States where TPMS became mandatory for all new passenger vehicles in 2007. Domestic vehicle production and sales remain high, making the U.S. a crucial market for the TPMS market. In addition, the rising emphasis on automotive safety and on-road fuel economy coupled with the growing awareness regarding tire-related accidents has projected market growth. The U.S. NHTSA has consistently reiterated that the integration of TPMS will enhance vehicle safety and reduce the number of tire-related accidents, and this has boosted the growth of the market in the region.

Need Any Customization Research On Tire Pressure Monitoring System Market - Inquiry Now

In June 2024, Continental AG increased its TPMS production capacity at its Bangalore facility in India, expanding it to meet the growing demand for passenger car safety. The company also unveiled an advanced generation of Tire Pressure Monitoring Systems designed to enhance both safety and sustainability. This initiative aligns with Continental’s broader commitment to its Vision Zero goal, which aims for zero fatalities, zero injuries, and zero accidents in road traffic.

Key Service Providers/Manufacturers:

Delphi Automotive (TPMS sensors, Tire Pressure Monitoring System ECU)

DENSO Corporation (Direct TPMS Sensors, Wireless TPMS)

Continental AG (Direct TPMS, Tire Pressure Monitoring System ECU)

NXP Semiconductors (TPMS Sensors, Automotive Microcontrollers)

NIRA Dynamics AB (Indirect TPMS, Tire Data Analytics Solutions)

Valor TPMS (TPMS Sensors, TPMS Kits)

Pacific Industrial (TPMS Sensors, TPMS ECU)

ZF Friedrichshafen AG (TPMS sensors, Vehicle Safety Solutions)

ATEQ (TPMS diagnostic tools, TPMS sensors)

Sensata Technologies, Inc. (Direct TPMS, Wireless TPMS)

Ford Motor Company

General Motors

BMW Group

Volkswagen Group

Toyota Motor Corporation

Honda Motor Co. Ltd.

Nissan Motor Co. Ltd.

Hyundai Motor Company

FCA (Fiat Chrysler Automobiles)

Kia Motors Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.3 Billion |

| Market Size by 2032 | USD 17.9 Billion |

| CAGR | CAGR of 10.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicle, Commercial Vehicle) • By Sales Channel (OEM, Aftermarket) • By Type (Direct TPMS, Indirect TPMS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Delphi Automotive, DENSO Corporation, Continental AG, NXP Semiconductors, NIRA Dynamics AB, Valor TPMS, Pacific Industrial, ZF Friedrichshafen AG, ATEQ, Sensata Technologies, Inc. |

| Key Drivers | • Governments across various regions, including the U.S. and Europe, mandate the installation of TPMS in all new vehicles to enhance safety and reduce accidents caused by tire underinflation. • Growing awareness about the importance of maintaining optimal tire pressure for better fuel efficiency, reduced wear, and increased safety has led to higher adoption of TPMS, especially in consumer vehicles. |

| Restraints | • Retrofitting older vehicle models with TPMS can be challenging due to compatibility issues, which limits the market potential for aftermarket TPMS solutions. |

Ans. The projected market size for the Tire Pressure Monitoring System Market is USD 17.9 Billion by 2032.

Ans: The Asia Pacific region dominated the Tire Pressure Monitoring System Market in 2023.

Ans. The CAGR of the Tire Pressure Monitoring System Market is 10.5% During the forecast period of 2024-2032.

And: The Passenger Vehicle Type segment dominated the Tire Pressure Monitoring System Market in 2023.

Ans:

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, by Products

5.2 Performance Benchmarks, by Products

5.3 Usage Statistics, by Region, 2023

5.4 Integration Capabilities, by Products

5.5 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Tire Pressure Monitoring System Market Segmentation, By Vehicle Type

7.1 Chapter Overview

7.2 Passenger Vehicle

7.2.1 Passenger Vehicle Market Trends Analysis (2020-2032)

7.2.2 Passenger Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Commercial Vehicle

7.3.1 Commercial Vehicle Market Trends Analysis (2020-2032)

7.3.2 Commercial Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Tire Pressure Monitoring System Market Segmentation, By Sales Channel

8.1 Chapter Overview

8.2 OEM

8.2.1 OEM Market Trends Analysis (2020-2032)

8.2.2 OEM Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Aftermarket

8.3.1 Aftermarket Market Trends Analysis (2020-2032)

8.3.2 Aftermarket Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Tire Pressure Monitoring System Market Segmentation, By Type

9.1 Chapter Overview

9.2 Direct TPMS

9.2.1 Direct TPMS Market Trends Analysis (2020-2032)

9.2.2 Direct TPMS Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Indirect TPMS

9.3.1 Indirect TPMS Market Trends Analysis (2020-2032)

9.3.2 Indirect TPMS Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.4 North America Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.2.5 North America Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.6.2 USA Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.2.6.3 USA Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.7.2 Canada Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.2.7.3 Canada Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.2.8.3 Mexico Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.6.3 Poland Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.7.3 Romania Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.5 Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.6.3 Germany Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.7.2 France Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.7.3 France Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.8.3 UK Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.9.3 Italy Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.10.3 Spain Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.13.3 Austria Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.5 Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.6.2 China Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.6.3 China Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.7.2 India Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.7.3 India Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.8.2 Japan Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.8.3 Japan Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.9.3 South Korea Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.10.3 Vietnam Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.11.3 Singapore Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.12.2 Australia Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.12.3 Australia Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.5 Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.6.3 UAE Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.4 Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.2.5 Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.4 Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.6.5 Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.6.6.3 Brazil Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.6.7.3 Argentina Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.6.8.3 Colombia Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Tire Pressure Monitoring System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 Delphi Automotive

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 DENSO Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Continental AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 NXP Semiconductors

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 NIRA Dynamics AB

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Valor TPMS

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Pacific Industrial

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 ZF Friedrichshafen AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 ATEQ

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Sensata Technologies, Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Vehicle Type

Passenger Vehicle

Commercial Vehicle

By Sales Channel

OEM

Aftermarket

By Type

Direct TPMS

Indirect TPMS

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Tire Machinery Market size was recorded at USD 2.08 Bn in 2023 and is expected to reach USD 2.90 Bn by 2032. And grow at a CAGR of 3.8% over the forecast period of 2024-2032.

The Head-Up Display Market Size was valued at USD 1.15 billion in 2023 and will reach USD 4.72 billion by 2032 and grow at a CAGR of 17% by 2024-2032

The E-bikes Market size was valued at USD 49 billion in 2023 and is expected to reach USD 72.39 billion by 2031 and grow at a CAGR of 5% by 2024-2031.

The Air Cargo Market Size was valued at USD 182.09 Billion in 2023 and is expected to reach USD 268.79 Billion by 2032 & grow at a CAGR of 4.4% by 2024-2032.

The Marine Fender Market Size was valued at USD 679.7 Million in 2023 and is expected to reach $903.8 Mn by 2032, growing at a CAGR of 3.24% over the forecast period of 2024-2032.

The Luxury Electric Vehicle Market size was valued at USD 230.6 Bn in 2023 and is expected to reach USD 1007.32 Bn by 2032, the CAGR recorded for the forecasted year 2024-2032 was 17.8%.

Hi! Click one of our member below to chat on Phone