Get More Information on Tilt Sensor Market - Request Sample Report

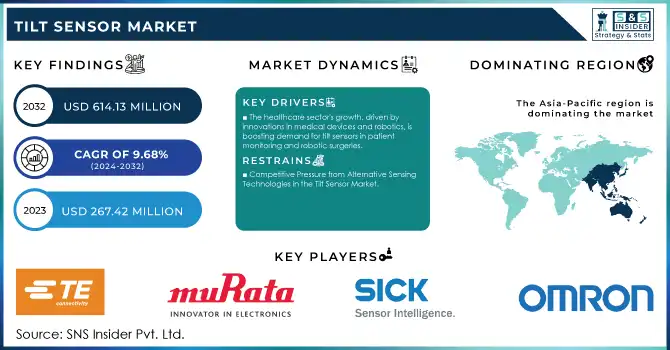

The Tilt Sensor Market Size was valued at USD 267.42 Million in 2023 and is expected to reach USD 614.13 Million by 2032 and grow at a CAGR of 9.68% over the forecast period 2024-2032.

The tilt sensor market is advancing rapidly, driven by its pivotal role in smart cities and infrastructure development initiatives. These sensors are crucial for structural health monitoring (SHM), enabling real-time tracking of inclinations and movements in bridges, dams, and buildings, ensuring safety and maintenance. Smart cities increasingly rely on IoT-powered sensors, such as tilt sensors, for diverse applications including smart grids, transportation systems, and healthcare. For instance, Japan's smart city projects use tilt sensors for disaster monitoring and intelligent transportation, underscoring their growing relevance. The Internet of Things integrates billions of devices into smart city ecosystems, facilitating cost-efficient, real-time data collection and management. Cities like Singapore leverage IoT for waste management and environmental sustainability, while Helsinki’s smart grid achieved a 15% reduction in energy consumption. IoT also enhances disaster preparedness, with 23 UN countries using early warning systems that protected 93.63% of at-risk populations.

The combination of IoT and Artificial Intelligence amplifies the utility of tilt sensors, enabling predictive analytics, efficient resource management, and anomaly detection. AI-powered insights derived from tilt sensor data ensure better urban planning and risk mitigation. Integration with IoT networks supports comprehensive urban analytics, as seen in Berlin's mobility services fostering sustainable transportation. Smart city projects align with global sustainability goals, contributing to the UN Sustainable Development Goals like SDG 11 for sustainable communities. Tilt sensors, supported by advancements in IoT and AI, are integral to this transformation, reinforcing their role in creating adaptive, resilient urban environments. These trends highlight the tilt sensor market's promising trajectory in diverse and innovative applications.

Drivers

The healthcare sector's growth, driven by innovations in medical devices and robotics, is boosting demand for tilt sensors in patient monitoring and robotic surgeries.

The rapid expansion of the healthcare sector is a major driver for the tilt sensor market. Tilt sensors are becoming increasingly integral in medical devices, including patient monitoring systems, robotic surgical instruments, and prosthetics, where they enhance precision and functionality. These sensors are particularly important for movement detection and alignment, such as in robotic surgeries, where they monitor slight movements to improve surgical accuracy and reduce risks. Tilt sensors also play a crucial role in monitoring patient posture, ensuring timely interventions in critical care settings. The growth of smart healthcare systems, advancements in medical robotics, and the focus on patient-centered care are expected to significantly drive the demand for these sensors. Additionally, ongoing technological innovations and the increasing complexity of medical devices, such as the development of specialty pharmacy solutions and robotics, further fuel the need for highly accurate tilt sensors. As the healthcare industry grows, particularly with a focus on improving patient outcomes and operational efficiencies, the market for tilt sensors is projected to expand across various healthcare applications.

Restraints

Competitive Pressure from Alternative Sensing Technologies in the Tilt Sensor Market

The tilt sensor market faces significant challenges from competition with alternative sensing technologies, such as MEMS sensors, accelerometers, and gyroscopes, which offer similar motion-sensing capabilities at lower costs. These technologies are increasingly adopted across industries like automotive, robotics, and industrial automation due to their compactness and affordability. For instance, MEMS tilt sensors are being integrated into applications like Tilt Tray Sorters, where traditional tilt sensors once dominated. Additionally, hybrid sensing solutions that combine tilt detection with other functionalities like acceleration and orientation are gaining popularity, offering a more cost-effective and versatile option in fields like mobile devices and robotics. The rise of electrolytic tilt sensors with thin-film technology also contributes to cost reductions and improved accuracy, intensifying the competition for traditional tilt sensors. These factors pressure manufacturers to innovate, focusing on increasing precision, durability, and lowering production costs to stay competitive in the market.

by Housing Material Type

In 2023, the metal housing segment captured the largest share of the tilt sensor market, accounting for around 63% of the revenue. This significant market share is driven by the superior durability, strength, and ability of metal materials to endure extreme conditions. Metal tilt sensors are highly valued in sectors such as automotive, aerospace, industrial automation, and geophysical monitoring due to their resilience to mechanical stress, vibrations, and temperature variations. The metal casing ensures long-term operational reliability in harsh environments, which is essential for precise measurements in critical applications like surveying equipment and machine tool leveling. Moreover, metals are easily machinable, allowing for customized shapes and sizes, ensuring that these sensors maintain high performance in demanding conditions, making them ideal for complex industrial applications.

by Technology

In 2023, the MEMS segment dominated the tilt sensor market, capturing around 59% of the revenue. This dominance is driven by the compact size, low power consumption, and high precision of MEMS-based tilt sensors. MEMS sensors combine accelerometers and gyroscopes to offer reliable motion detection and are widely used in automotive, robotics, and consumer electronics applications. Their small form factor and affordability make them ideal for applications requiring integration into space-constrained devices such as smartphones, wearables, and drones. Furthermore, MEMS technology is integral in providing high-performance solutions for industries like geophysics, industrial automation, and medical devices. With the increasing demand for miniaturized and cost-effective sensing solutions, MEMS tilt sensors continue to lead the market, ensuring their strong growth trajectory in the coming years.

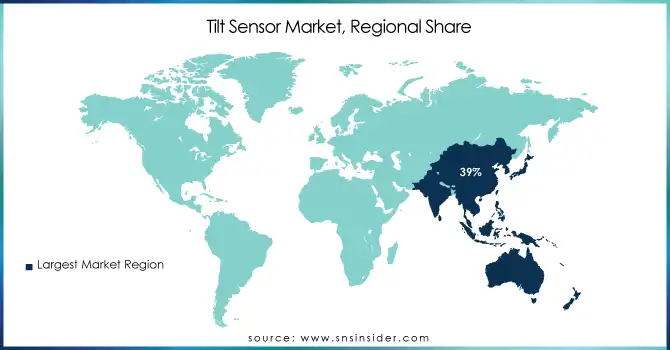

In 2023, Asia-Pacific dominated the tilt sensor market, capturing around 39% of global revenue. Driven by rapid industrialization, technological advancements, and increasing demand in sectors like automotive, robotics, and consumer electronics. Countries like China, Japan, and India have witnessed substantial growth, particularly in automotive applications, where MEMS-based tilt sensors are widely used for vehicle stability and navigation systems. The region's strong manufacturing capabilities in MEMS sensors further contribute to the market's expansion. Additionally, government initiatives to build smart cities, along with rising investments in robotics and automation, have fueled market growth. With advancements in IoT and industrial automation, the demand for precision and reliable tilt sensors is expected to continue growing across the region.

North America is the fastest-growing region in the tilt sensor market, expected to maintain strong growth through 2032. The United States leads in this development, driven by advancements in MEMS technology and increasing demand across sectors such as automotive, aerospace, and construction. Tilt sensors play a key role in automotive safety systems, industrial automation, and smart city infrastructure. The growing adoption of Internet of Things (IoT)-enabled sensors and wireless technologies in various applications, including robotics and autonomous vehicles, is also fueling market growth. As key players in the region innovate with high-precision tilt sensors, North America continues to dominate due to its technological advancements, with significant investments supporting the market's expansion.

Need any customization research on Tilt Sensor Market - Enquiry Now

Some of the major players in Tilt Sensor with their product:

TE Connectivity (MEMS and Fluid-Filled Tilt Sensors)

Murata Manufacturing Co., Ltd. (MEMS Tilt Sensors)

SICK AG (Inclination Sensors)

Omron Corporation (MEMS Tilt Sensors)

Bosch Sensortec GmbH (MEMS Inertial Sensors)

Analog Devices, Inc. (Force Balance Tilt Sensors)

Jewell Instruments (Electrolytic Tilt Sensors)

Fredericks Company (Electrolytic Tilt Sensors)

Honeywell International Inc. (Industrial Tilt Sensors)

Balluff GmbH (Industrial MEMS Tilt Sensors)

Pepperl+Fuchs (Inclination Sensors for Industrial Applications)

Kübler Group (Tilt Measurement Systems)

Level Developments Ltd. (Precision Tilt Sensors)

Rieker Inc. (Mechanical Tilt Indicators)

Parallax Inc. (Digital MEMS Tilt Sensors)

Elmos Semiconductor SE (Automotive Tilt Sensors)

STMicroelectronics (3-Axis MEMS Tilt Sensors)

MEMSIC Inc. (Accelerometer-Based Tilt Sensors)

Leuze electronic GmbH (Inclination Sensors)

POSITAL FRABA (Tiltix Inclinometers)

Infineon Technologies (XENSIV TLE49SR)

Key Raw Materials and Suppliers

1. Silicon Wafers (for MEMS Tilt Sensors)

Used for fabricating MEMS sensors.

Suppliers:

Siltronic AG

GlobalWafers Co., Ltd.

SUMCO Corporation

Shin-Etsu Chemical Co., Ltd.

2. Glass (for Electrolytic Tilt Sensors)

Used for making precision components in electrolytic sensors.

Suppliers:

Corning Inc.

Nippon Electric Glass Co., Ltd.

SCHOTT AG

3. Metal Alloys (for Housings and Force Balance Sensors)

Includes aluminum, stainless steel, or titanium for durable housings.

Suppliers:

ArcelorMittal

Nippon Steel Corporation

Thyssenkrupp AG

VSMPO-AVISMA Corporation (for titanium)

4. Plastic and Polymers (for Nonmetal Housings)

Materials such as ABS, polycarbonate, or PEEK.

Suppliers:

SABIC

BASF SE

Covestro AG

5. Electrolyte Solutions (for Electrolytic Sensors)

Specialized electrolytes used in high-precision tilt sensors.

Suppliers:

Sigma-Aldrich (Merck Group)

Thermo Fisher Scientific

6. Piezoelectric Materials (for Force Balance Sensors)

Quartz or ceramic-based materials.

Suppliers:

CTS Corporation

PI Ceramic GmbH

Kyocera Corporation

7. Electronic Components (for Sensor Circuitry)

Resistors, capacitors, and integrated circuits.

Suppliers:

Murata Manufacturing Co., Ltd.

TDK Corporation

AVX Corporation

8. Adhesives and Sealants

Used for assembling and sealing sensor components.

Suppliers:

Henkel AG & Co. KGaA

3M Company

Sika AG

9. Fluid (for Fluid-Filled Sensors)

Specialty oils or liquids for damping or sensing mechanisms.

Suppliers:

Dow Chemical Company

ExxonMobil Chemical

Shell Chemicals

10. Conductive Coatings and Materials

For enhancing electrical connections and performance.

Suppliers:

Heraeus Group

Mitsubishi Materials Corporation

June 20, 2024 – TDK Corporation has launched the TAS8240, a new redundant analog TMR angle sensor designed for safety-relevant applications. This compact sensor provides precise rotor position measurements for BLDC motors in automotive systems like power steering and brake boosters, with high accuracy of ±1.0° and stability across a wide temperature range from -40 °C to +150 °C. The sensor’s four redundant outputs offer enhanced safety, supporting system safety levels up to ASIL D.

May 20, 2024 – Infineon launched the XENSIV TLE49SR, a differential Hall-based angle sensor designed for automotive applications. It offers high accuracy with less than 1-degree angle error and excellent stray field immunity, tolerating up to 8 mT. The sensor features three digital output interfaces: PWM, SENT, and SPC, and is ideal for precise measurements in chassis height, pedal position, and steering angle systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 267.42 Million |

| Market Size by 2032 | USD 614.13 Million |

| CAGR | CAGR of 9.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity, Murata Manufacturing Co., Ltd., SICK AG, Omron Corporation, Bosch Sensortec GmbH, Analog Devices, Inc., Jewell Instruments, Fredericks Company, Honeywell International Inc., Balluff GmbH, Pepperl+Fuchs, Kübler Group, Level Developments Ltd., Rieker Inc., Parallax Inc., Elmos Semiconductor SE, STMicroelectronics, MEMSIC Inc., Leuze electronic GmbH, and POSITAL FRABA |

| Key Drivers | • The healthcare sector's growth, driven by innovations in medical devices and robotics, is boosting demand for tilt sensors in patient monitoring and robotic surgeries. |

| Restraints | • Competitive Pressure from Alternative Sensing Technologies in the Tilt Sensor Market. |

Ans: The Tilt Sensor Market is expected to grow at a CAGR of 9.68%.

Ans: Tilt Sensor Market size was USD 267.42million in 2023 and is expected to Reach USD 614.13 million by 2032.

Ans: Advancements in Sensor Technology and increased demand for Safety and Stability Systems are a few key drivers of the Tilt Sensor Market.

Ans: Limited Awareness in Developing Economies is a major restraint on the growth of the Tilt Sensor Market.

Ans: APAC is the dominating region in the Tilt Sensor Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Operational Metrics

5.2 Technological Metrics

5.3 Supply Chain Metrics

5.4 Regulatory Data

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Tilt Sensor Market Segmentation, by Housing Material Type

7.1 Chapter Overview

7.2 Metal

7.2.1 Metal Market Trends Analysis (2020-2032)

7.2.2 Metal Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Nonmetal

7.3.1 Nonmetal Market Trends Analysis (2020-2032)

7.3.2 Nonmetal Market Size Estimates and Forecasts to 2032 (USD Million)

8. Tilt Sensor Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Force balance

8.2.1 Force balance Market Trends Analysis (2020-2032)

8.2.2 Force balance Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 MEMS

8.3.1 MEMS Market Trends Analysis (2020-2032)

8.3.2 MEMS Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Fluid-filled

8.4.1 Fluid-filled Market Trends Analysis (2020-2032)

8.4.2 Fluid-filled Market Size Estimates and Forecasts to 2032 (USD Million)

9. Tilt Sensor Market Segmentation, by End -Use Industry

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Consumer electronics

9.3.1 Consumer electronics Market Trends Analysis (2020-2032)

9.3.2 Consumer electronics Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Industrial equipment

9.4.1 Industrial equipment Market Trends Analysis (2020-2032)

9.4.2 Industrial equipment Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Mining & construction

9.5.1 Mining & construction Market Trends Analysis (2020-2032)

9.5.2 Mining & construction Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Healthcare

9.6.1 Healthcare Market Trends Analysis (2020-2032)

9.6.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Aerospace & defense

9.7.1 Aerospace & defense Market Trends Analysis (2020-2032)

9.7.2 Aerospace & defense Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Telecommunications

9.8.1 Telecommunications Market Trends Analysis (2020-2032)

9.8.2 Telecommunications Market Size Estimates and Forecasts to 2032 (USD Million)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.2.4 North America Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.5 North America Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.2.6.2 USA Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.6.3 USA Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.2.7.2 Canada Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.7.3 Canada Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.2.8.2 Mexico Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.8.3 Mexico Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.3 Poland Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.7.3 Romania Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.8.3 Hungary Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.9.3 Turkey Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.5 Western Europe Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.3 Germany Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.7.2 France Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.7.3 France Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.8.2 UK Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.8.3 UK Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.9.3 Italy Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.10.3 Spain Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.13.3 Austria Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.4 Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.5 Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.6.2 China Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.6.3 China Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.7.2 India Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.7.3 India Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.8.2 Japan Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.8.3 Japan Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.9.2 South Korea Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.9.3 South Korea Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.10.3 Vietnam Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.11.2 Singapore Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.11.3 Singapore Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.12.2 Australia Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.12.3 Australia Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.13.3 Rest of Asia-Pacific Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.4 Middle East Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.5 Middle East Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.6.3 UAE Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.7.3 Egypt Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.9.3 Qatar Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.2.4 Africa Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.5 Africa Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.6.3 South Africa Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Tilt Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.6.4 Latin America Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.5 Latin America Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.6.6.2 Brazil Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.6.3 Brazil Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.6.7.2 Argentina Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.7.3 Argentina Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.6.8.2 Colombia Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.8.3 Colombia Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Tilt Sensor Market Estimates and Forecasts, by Housing Material Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Tilt Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Tilt Sensor Market Estimates and Forecasts, by End -Use Industry (2020-2032) (USD Million)

11. Company Profiles

11.1 TE Connectivity

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Murata Manufacturing Co., Ltd.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 SICK AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Omron Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Bosch Sensortec GmbH

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Analog Devices, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Jewell Instruments

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Fredericks Company

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Honeywell International Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Balluff GmbH

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Housing Material Type

Metal

Nonmetal

By Technology

Force balance

MEMS

Fluid-filled

By End -Use Industry

Automotive

Consumer electronics

Industrial equipment

Mining & construction

Healthcare

Aerospace & defense

Telecommunications

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 3D Display Market Size was valued at USD 123.17 Billion in 2023 and is expected to grow at a CAGR of 18.39% to reach USD 561.50 Billion by 2032.

The Inspection Analysis Device Market size was valued at USD 15.44 Billion in 2023 and is expected to grow at 6.31% CAGR to reach USD 26.78 Billion by 2032.

The Interactive Display Market Size was USD 45.06 billion in 2023 & is expected to reach USD 90.66 billion by 2032 & grow at a CAGR of 8.08% by 2024-2032.

The Tunable Laser Market Size was valued at $18.88 Billion in 2023 and it is expected to reach $54.06 Billion by 2032 at CAGR of 12.4% During 2024-2032

The Consumer Audio Market Size was valued at USD 82.19 Billion in 2023 and is expected to grow at 14.38% CAGR to reach USD 275.36 Billion by 2032.

The Power Management IC Market Size was valued at USD 36.63 Billion in 2023 and is expected to grow at a CAGR of 5.5% to reach USD 58.91 Billion by 2032.

Hi! Click one of our member below to chat on Phone