Thyristor Rectifier Electric Locomotive Market Report Scope & Overview:

The Thyristor Rectifier Electric Locomotive Market was valued at USD 0.91 billion in 2023 and is expected to reach USD 1.48 billion by 2032, growing at a CAGR of 5.59% over the forecast period 2024-2032. The Thyristor Rectifier Electric Locomotive market is focused on the integration of advanced technology, as the thyristor rectifiers improve the performance of the Locomotive by converting alternating current (AC) power supply into direct current (DC) for a much smoother and more reliable operation. Performance metrics emphasize running speed, load and traction, and efficiency of train running. Today, locomotives enjoy availability with up-time crucial to numeric profit margins, and utilities covering one side of the business with high-tech diagnostic tools, and extended intervals with maintenance. Electric locomotives, with their lower emissions and higher energy efficiency, are also a mainstay of energy and sustainability metrics increasingly being tracked and emphasized. Regenerative braking systems also contribute to energy recovery, making these locomotives part of sustainable transport solutions.

Get More Information on Thyristor Rectifier Electric Locomotive Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Rapid Electrification and Advanced Traction Systems Drive Growth in Thyristor Rectifier Electric Locomotive Market

Globally, the electrification of rail networks is occurring at a rapid pace, fueling the growth of the Thyristor Rectifier Electric Locomotive Market. To save carbon emissions as well as energy, governments as well as railway operators are spending an increasing amount of money on green transport. The rising demand for freight transportation and the development of countries such as emerging economies are enhancing the throughput of electric locomotives with new and advanced traction systems. Also, GTO thyristors are being quickly replaced by IGBT modules for high efficiency, better power control, and lower maintenance costs, which, in turn, is projected to boost market growth over the forecast period. Improvements in high-power semiconductor devices and regenerative braking systems are further enabling locomotive efficiency and growing their use in freight and passenger applications.

Restrain:

-

Challenges in Adopting CMMS Technology Hinder Growth of Thyristor Rectifier Electric Locomotive Market Expansion

Lack of technical experts and less proficiency in CMMS technology are some of the factors anticipated to hurt the growth of the global Thyristor Rectifier Electric Locomotive (CMMS) market over the forecast period. For numerous enterprises, especially within traditional industries such as manufacturing or government locations, continued dependencies upon manual mechanisms have been the norm for decades, as organizations resist the shift towards various digital channels for maintenance tracking. Since many employees have never worked with CMMS software before, especially if they are older, they are not aware or familiar with the digital tools, which may lead to non-usage resistance and other change management-related issues. For this reason, CMMS solutions are often complex to implement particularly if large enterprises with many facilities are being integrated. Adoption is also hampered by compatibility issues with legacy systems and ERP platforms, which makes it impossible to automate maintenance without totally disrupting operational excellence.

Opportunity:

-

Opportunities in High-Speed Rail and Smart Maintenance Drive Growth in Thyristor Rectifier Electric Locomotive Market

With high-speed rail projects and urban transit networks expanding notably in Asia-Pacific and Europe regions, here is where a lot of the opportunity exists. Locomotive reliability and subsequent operational efficiency will be significantly enhanced with the use of a predictive maintenance system that can be integrated into smart monitoring systems using IoT and AI thus providing new opportunities for market players. Apart from this, the growing need for hybrid and battery-electric locomotives offers opportunities for manufacturers to produce next-gen traction systems. Further growth in the market in the forthcoming years could be attributed to the implementation of strategic partnerships between governments and railway manufacturers to rejuvenate old rail infrastructure.

Challenges:

-

Expanding High-Speed Rail and Smart Maintenance Systems Create Growth Opportunities in Electric Locomotive Market

With high-speed rail projects and urban transit networks expanding notably in Asia-Pacific and Europe regions, here is where a lot of the opportunity exists. Locomotive reliability and subsequent operational efficiency will be significantly enhanced with the use of predictive maintenance systems that can be integrated into smart monitoring systems using IoT and AI thus providing new opportunities for market players. Apart from this, the growing need for hybrid and battery-electric locomotives offers opportunities for manufacturers to produce next-gen traction systems. Further growth in the market in the forthcoming years could be attributed to the implementation of strategic partnerships between governments and railway manufacturers to rejuvenate old rail infrastructure.

Segments Analysis

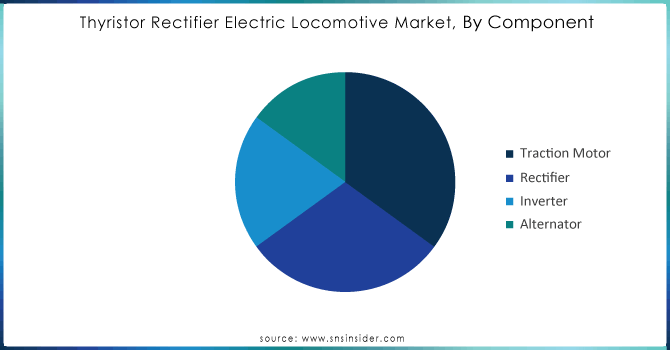

By Component

Traction Motor accounted for 37.7% of market share in 2023 and is expected to grow at the highest CAGR between 2024-2032. More efficient electric locomotives fuel interest in advanced traction motors, which help maximize power transfer while minimizing energy use. A rise in railway electrification projects, especially in regions like Asia-Pacific and Europe, is a prominent factor contributing to the growth of the market. Moreover, motor cooling technologies and lightweight materials have improved motor efficiency and longevity. Demand is also driven by the growing transition from traditional direct current (DC) motors to alternate current (AC) traction motors for higher performance and reliability, leading to lower maintenance costs. Furthermore, the incorporation of AI-based predictive maintenance systems is likely to generate additional avenues for growth in the coming years.

By Technology

GTO Thyristor accounted for a 57.2% market share in 2023 as GTO thyristors are popularly used in electric locomotives owing to their high power-handling capability and efficiency in traction applications. That said, they have some inherent limitations associated with higher switching losses and response time than modern equivalents. While still the predominant market, there is a slow shift as railway operators demand smarter, more efficient energy control systems.

The IGBT Module is expected to register the fastest CAGR from 2024-2032. Owing to advantages such as high rectification capability, excellent thermal performance, switching level efficiency, low KH loss, and more compact design, the IGBT Module is increasingly becoming the cost-effective solution in power electronics. Due to the rising demand for railway electrification and high-speed rail projects, IGBT-based traction systems are gaining preference. Besides, the increasing adoption of smart power electronics and regenerative braking systems is likely to drive the adoption of IGBT during the forecast period.

By End-use

The freight segment captured a market share of 63.6% in 2023. The freight segment continues to lead with growing demand for efficient sustainable cargo transportation with higher load and traction limits and lower operation costs and carbon emissions, electrified freight locomotives are favorable over longer distances. Additionally, the rapid expansion of railway infrastructure primarily in the Asia-Pacific and North American regions is expected to further facilitate the adoption of thyristor rectifier electric locomotives among freight end users.

The Passengers segment is projected to attain the fastest CAGR from 2024-2032 owing to the growing investments in high-speed rail networks and urban transit systems. Increasing government measures to support the adoption of clean and efficient public transportation is the key driving force behind the demand for electric passenger locomotives. In addition, the adoption of smart rail technologies, advanced safety systems, and improved passenger comfort features are anticipated to drive the rapid expansion of this segment within the market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

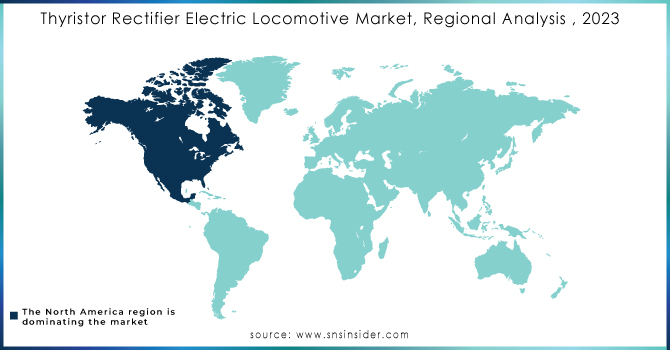

Regional Analysis

North America dominated the market share of 35.7% in 2023, due to increasing adoption of electric locomotives to reduce carbon emissions and modernization of railway infrastructure. There is also considerable investment in electrification projects and smart rail technologies in the U.S. and Canada to increase efficiencies. As a practical case, Amtrak has ordered Siemens ALC-42E hybrid-electric locomotives for passenger and freight transport to enhance sustainability. Meanwhile, Canadian Pacific Kansas City (CPKC) is increasing its hydrogen-powered locomotive number, advancing the region's move towards green train technologies.

The fastest-growing region will be the Asia-Pacific region, thanks to rapid railway electrification and high-speed rail expansion. China, India, and Japan are developing and implementing high-efficiency, sustainable, and environmentally friendly locomotives to support growing traveling and freight needs. To cite an example, China has positioned itself as the world leader in railway electrification through the development of significant megatrends, such as advanced electric locomotives for its high-speed rail network (CRRC, 2017). Indian Railways targets 100% electrification by 2030, and new electric freight corridors have intensified the need for energy-efficient thyristor rectifier locomotives, especially in India.

Key players

Some of the major players in the Thyristor Rectifier Electric Locomotive Market are:

-

Chittaranjan Locomotive Works (WAG-9)

-

Bharat Heavy Electricals Limited (WAG-7 with Regenerative Braking)

-

Alstom (TRAXX F140 AC2)

-

Siemens AG (Vectron AC)

-

Bombardier Transportation (IORE)

-

CRRC Corporation Limited (HXD1)

-

Hitachi Rail (Class 800 Azuma)

-

Kiepe Electric (Electrical Traction Equipment for LRVs)

-

ABB (BORDLINE CC1500 AC_15kV Traction Converter)

-

Mitsubishi Electric (MELCO Traction Inverter)

-

Toshiba Corporation (SCiB Battery System for Railways)

-

Hyundai Rotem (HRC-3000)

-

Kawasaki Heavy Industries (efACE)

-

Škoda Transportation (109E)

-

CAF (Construcciones y Auxiliar de Ferrocarriles) (Civity)

Recent Trends

-

In December 2024, Alstom secures contracts to supply 40 Traxx Universal electric locomotives to Polish leasing firm OnTrain sp. z o.o., with an option for 20 more.

-

In 2024, Siemens Mobility expands its electric locomotive portfolio in 2024, delivering 1,200 9000 HP locomotives to Indian Railways and securing a deal for up to 250 Vectron locomotives in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.91 Billion |

| Market Size by 2032 | USD 1.48 Billion |

| CAGR | CAGR of 5.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Inverter, Rectifier, Traction Motor, Alternator) • By Technology (IGBT Module, GTO Thyristor) • By End-use (Freight, Passengers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chittaranjan Locomotive Works, Bharat Heavy Electricals Limited, Alstom, Siemens Mobility, Bombardier Transportation, CRRC Corporation Limited, Hitachi Rail, Kiepe Electric, ABB, Mitsubishi Electric, Toshiba, Hyundai Rotem, Kawasaki Heavy Industries, Škoda Transportation, CAF (Construcciones y Auxiliar de Ferrocarriles). |