Thermoplastic Polyurethane (TPU) Market Size:

Get More Information on Thermoplastic Polyurethane (TPU) Market - Request Sample Report

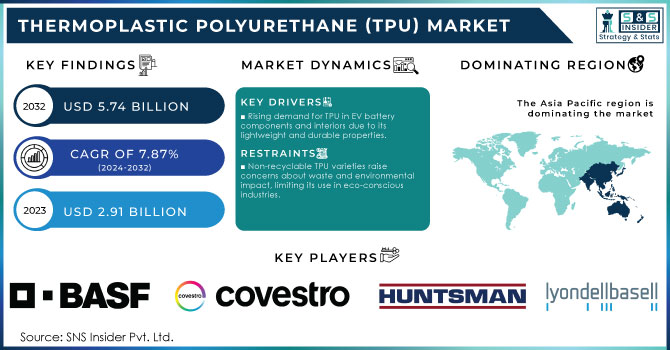

The Thermoplastic Polyurethane (TPU) Market was valued at USD 2.91 billion in 2023 and is expected to reach USD 5.74 Billion by 2032, growing at a CAGR of 7.87% from 2024-2032.

Strong demand for various product attributes and potential applications integrated in numerous microwaves are committing to the development of strong and sustainable growth within the global thermoplastic polyurethanes (TPU) market. TPU is widely used in applications such as automotive components, medical products, footwear and other consumer goods, consumer electronics and industrial equipment because of its flexibility, durability and chemical resistance properties. Demand drivers include a growing automotive and transportation demand for lower-emission, lighter materials that improve fuel efficiency. The increasing penetration of electric vehicles (EVs) is additionally propelling TPU consumption in battery components and interiors with lightweight and durable products being essential. TPU is increasingly being integrated into consumer electronics such as wearables, smartphones and protective cases offering superior impact resistance and durability. TPU is particularly well-suited for smartphone and tablet covers due to its flexibility and protective qualities. Also, the market is accelerating due to footwear segment owing its elasticity and abrasion resistance properties that improve performance and comfort. TPU continues to drive product innovation, with North America boasting a greater than USD 100 billion global athletic footwear market by 2023.

Another significant market driver is the continual trend towards sustainability whereby more and more industries are opting for materials that have less of an impact on the environment. As manufacturers are trying to reduce their ecological impact, recyclable TPUs are gaining more and more popularity. Focusing on the latest trends of sustainability, Covestro (Leverkusen, Germany) a notable TPU manufacturer recently launched bio-based TPUs for low-carbon emitting production processes to meet increasing demands. TPU is also being expanded in scope to be used more often in the medical work by utilizing its biocompatibility and flexible virtual prototyping making it useful properties for such uses as catheters and tubing. The increasing healthcare infrastructure, especially in the developing region will create an inclination towards TPU for medical applications which is set to have a positive impact in 2024. Due to the growing demand for it in multiple sectors and technological advancements in its production processes, TPU market will keep thriving.

Market Dynamics

Drivers

Rising demand for TPU in EV battery components and interiors due to its lightweight and durable properties.

Increasing use of lightweight materials to improve fuel efficiency and reduce emissions in the automotive sector.

Increased use of TPU in wearables, smartphones, and protective cases due to its flexibility and impact resistance.

Thermoplastic Polyurethane (TPU), with its excellent balance of rigidity/flexibility, durability and resistance to impact, is increasingly being utilized in wearables, smartphones and protective cases. TPU is popular in consumer electronics due to its availability of hardness while being elastic.

For its flexibility, TPU is widely used in wearables including smartwatches and fitness trackers where the material can be comfortably fitted on to the wrist for bands and straps. The resistance to oil, sweat and environmental exposure adds longevity to the slate even with regular use. And, it is non-allergic to skin which is perfect for wearables as they stay on the body day in and day out. TPU is now one of the best choices for protector cases for smartphones or tablets as it absorbs most impact from a short fall and therefore reducing damage to electronic devices. That visibility enables makers to create the kind of crystal clear cases that can highlight the look of a device while still providing adequate protection. TPU is also scratch resistant, and isnill yellow not easy to turn from a clear colour cover into a doggy egg again, so its still as well loved material for durable phone case.

The versatility of TPU allows the material to take on complex shapes for use in electronics protection where it tightly molds the device and provides superior drop and physical impact protection. With the rapid growth of foldable devices and the higher penetration rate of 5G smartphones, TPU is expected to become even more popular due to its flexible design while still providing toughness needed for newer technologies.

Advantages of TPU

|

Feature |

Benefit in Wearables |

Benefit in Smartphones/Protective Cases |

|

Flexibility |

Comfortable fit for wristbands and straps |

Enables snug fitting and flexible phone cases |

|

Impact Resistance |

Protects against daily wear and tear |

Absorbs shock, protecting devices from damage |

|

Durability |

Resistant to sweat, oils, and environmental factors |

Long-lasting protection from scratches and drops |

|

Hypoallergenic Properties |

Suitable for prolonged skin contact |

Safe for regular handling by users |

With these advantages, TPU’s use in wearables, smartphones, and protective cases will continue to grow as consumer electronics become more integrated into daily life. Its versatility and protective features make it a material of choice for companies seeking durable, flexible, and aesthetic solutions for their products.

Restraints

Non-recyclable TPU varieties raise concerns about waste and environmental impact, limiting its use in eco-conscious industries.

TPU can degrade or lose its properties when exposed to high temperatures, restricting its use in high-heat environments.

Raw material shortages or logistical challenges can affect TPU production and availability in global markets.

Raw material shortages and logistical issues significantly affect the production and availability of Thermoplastic Polyurethane (TPU) in global markets. TPU's versatility stems from its composition, primarily consisting of polyols and diisocyanates, which are critical raw materials. Disruptions in the supply chain for these components can lead to production delays and increased costs, ultimately impacting the availability of TPU products. One major cause of raw material shortages is the fluctuation in global demand for polyols and diisocyanates. These materials are also used in various applications, such as coatings, adhesives, and elastomers, which can create supply strain during periods of high demand. For example, during economic recovery or post-pandemic periods, surges in demand for construction and automotive parts can intensify competition for the same raw materials, resulting in shortages for TPU manufacturers.

Logistical challenges, including transportation delays and rising shipping costs, further exacerbate these shortages. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, leading to disruptions caused by port congestion, labor shortages, and container availability. These logistical hurdles can result in longer lead times for TPU manufacturers, forcing them to either delay production or raise prices to maintain profit margins. Moreover, these challenges may hinder manufacturers' ability to meet contractual commitments, potentially resulting in lost business and strained relationships with clients. Companies may need to find alternative suppliers or materials, which could compromise product quality or performance.

To address these risks, TPU manufacturers are increasingly diversifying their supplier networks, investing in local sourcing, and implementing effective inventory management strategies to ensure a steady supply of raw materials. However, navigating these complexities remains a challenge in the ever-evolving global marketplace, influencing the overall growth trajectory of the TPU market.

Segment Analysis

By Type

In 2023, the polyester segment led the thermoplastic polyurethane market. Polyester-based thermoplastic polyurethane is extensively used in applications that necessitate resistance to water, oils, and fuels. Its excellent transparency makes it especially favored in the construction and engineering sectors. The increasing demand for polyether types in the automotive industry is anticipated to drive growth in this segment throughout the forecast period.

The polycaprolactone segment of the Thermoplastic Polyurethane (TPU) market is expected to experience significant growth driven by its superior toughness, abrasion resistance, and biodegradability. Increasing applications in biomedical fields, particularly in bone tissue engineering and drug delivery systems, are fueling demand. The rising emphasis on sustainable materials also supports polycaprolactone's adoption. Future forecasts indicate that advancements in processing techniques and expanding application areas will further enhance market opportunities, leading to a robust growth trajectory for the polycaprolactone segment in the coming years.

By Application

The footwear segment led the thermoplastic polyurethane market in 2023. Increasing adoption of TPU in athletic and casual footwear due to a growing demand for lightweight, flexible, and durable materials is driving the growth of the segment. With its combination of excellent abrasion resistance and comfort that improves shoe performance, it is a go-to for manufacturers. Moreover, increasing inclination towards green and sustainable products is driving the brands to use TPU as it can be recycled. Technological advances in manufacturing are adding further support to the growth of the segment.

The automotive segment is projected to experience the fastest CAGR during the review period, driven by a growing demand for TPU in various parts and components, such as rocker panels, body-side trim cladding, and ditch covers.

In the construction sector, the increasing demand for thermoplastic polyurethane as an insulator to improve the aesthetics and durability of buildings will facilitate market growth. TPU's exceptional tensile strength and shock absorption characteristics have led to a heightened preference for the polyester type in engineering applications. Additionally, the rising need for thermoplastic polyurethane tubes, hoses, and pipes in consumer goods is expected to drive growth in the hose and tubing segment. Furthermore, the rapidly advancing electronics industry is likely to enhance the use of TPU in wire and cable applications throughout the forecast period.

Regional Analysis

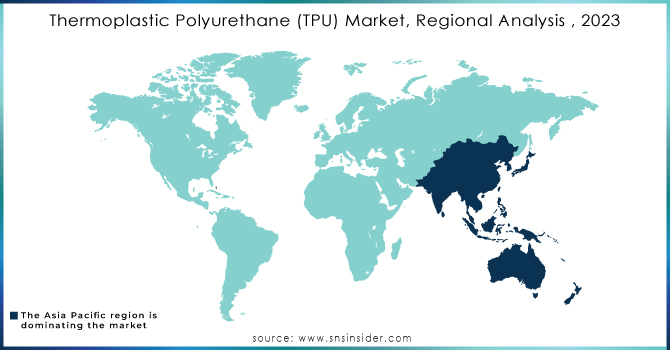

The Asia Pacific dominated the market in 2023, with countries like China and India experiencing significant industrialization and urbanization. This rapid development, along with industry consolidations and population growth, has spurred innovation, positioning Asia Pacific as a global industrial hub. The increasing demand for high-performance materials has driven the need for thermoplastic polyurethane in sectors such as automotive, construction, and consumer goods. Additionally, ongoing infrastructure projects and the rising demand for insulating materials in construction are expected to further boost growth in China's thermoplastic polyurethane market.

In North America, the growing emphasis on sustainable and eco-friendly materials has resulted in a significant rise in demand for bio-based and recycled thermoplastic polyurethane formulations that offer better environmental performance. The increasing need for polyester-based products in the electronics sector is also likely to strengthen the market in this region.

In Europe, the rapidly growing automotive industry in countries like Germany, France, and the U.K. is anticipated to drive market expansion. Furthermore, technological advancements by manufacturers aimed at improving product characteristics such as UV resistance, chemical resistance, and flame retardancy will open up a wider array of application opportunities.

Need Any Customization Research On Thermoplastic Polyurethane (TPU) Market - Inquiry Now

Key Players

The major key players are

BASF SE - Elastollan TPU

Covestro AG - Desmopan TPU

Huntsman Corporation - Irogran TPU

Wanhua Chemical Group Co., Ltd. - YUANFENG TPU

Mitsubishi Chemical Corporation - MCH TPU

LyondellBasell Industries N.V. - Amdel TPU

Eastman Chemical Company - Eastman TPU

Kraton Corporation - Kraton G TPU

PolyOne Corporation (now Avient Corporation) - Versaflex TPU

Teijin Limited - Teijin TPU

RTP Company - RTP 2000 TPU

Hexpol AB - HEXPOL TPE

China National Chemical Corporation (ChemChina) - ChemChina TPU

DOW Inc. - Adiprene TPU

Lubrizol Corporation - Estane TPU

Albis Plastic GmbH - ALBIS TPU

SABIC (Saudi Basic Industries Corporation) - SABIC TPU

Rohm and Haas Company (a subsidiary of Dow) - DOW TPU

Tosoh Corporation - Tosoh TPU

Kraiburg TPE GmbH & Co. KG - KLINGERSIL TPU

Raw Material Supplier

BASF YPC Company Ltd.

Bayer AG

BASF SE

Mitsui Chemicals, Inc.

SABIC

Huntsman Corporation

Kraton Polymers

Huntsman Corporation

Mitsubishi Gas Chemical Company, Inc.

BASF SE

Evonik Industries AG

SABIC

Covestro AG

LyondellBasell Industries N.V.

Dow Inc.

Mitsubishi Chemical Corporation

Huntsman Corporation

Recent Developments

In February 2023, Covestro AG revealed its plans to build its largest thermoplastic polyurethane manufacturing plant in Zhuhai, South China. The expansion will occur in three phases, with the initial phase slated for completion by late 2025. Upon full operation, the facility will have a production capacity of 20,000 tons of TPU per year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.91 Billion |

| Market Size by 2032 | USD 5.74 Billion |

| CAGR | CAGR of 7.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyester, Polyether, Polycaprolactone and Others) • By Application (Automotive, Construction, Engineering, Footwear, Hose & Tubing, Wire & Cable, Medical, Synthetic Leather and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Covestro AG, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Mitsubishi Chemical Corporation, LyondellBasell Industries N.V., Eastman Chemical Company, Kraton Corporation, PolyOne Corporation (now Avient Corporation),Teijin Limited |

| Key Drivers | • Rising demand for TPU in EV battery components and interiors due to its lightweight and durable properties. • Increasing use of lightweight materials to improve fuel efficiency and reduce emissions in the automotive sector. |

| RESTRAINTS | • Non-recyclable TPU varieties raise concerns about waste and environmental impact, limiting its use in eco-conscious industries. • TPU can degrade or lose its properties when exposed to high temperatures, restricting its use in high-heat environments. |

Ans- Thermoplastic Polyurethane (TPU) Market was valued at USD 2.91 billion in 2023 and is expected to reach USD 5.74 Billion by 2032, growing at a CAGR of 7.87% from 2024-2032.

Ans- the CAGR of Data Annotation Tools Market during the forecast period is of 7.87% from 2024-2032.

Ans- In 2023, Asia Pacific led the Thermoplastic Polyurethane (TPU) Market, capturing a significant revenue share.

Ans- one main growth factor for the Thermoplastic Polyurethane (TPU) Market is

Ans- challenges in Thermoplastic Polyurethane (TPU) Market are

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Thermoplastic Polyurethane (TPU) Market Segmentation, by Application

7.1 Chapter Overview

7.2 Automotive

7.2.1 Automotive Market Trends Analysis (2020-2032)

7.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Construction

7.3.1 Construction Market Trends Analysis (2020-2032)

7.3.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Engineering

7.4.1 Engineering Market Trends Analysis (2020-2032)

7.4.2 Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Footwear

7.5.1 Footwear Market Trends Analysis (2020-2032)

7.5.2 Footwear Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Hose & Tubing

7.6.1 Hose & Tubing Market Trends Analysis (2020-2032)

7.6.2 Hose & Tubing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Wire & Cable

7.7.1 Wire & Cable Market Trends Analysis (2020-2032)

7.7.2 Wire & Cable Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Medical

7.8.1 Medical Market Trends Analysis (2020-2032)

7.8.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Synthetic Leather

7.9.1 Synthetic Leather Market Trends Analysis (2020-2032)

7.9.2 Synthetic Leather Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Others

7.10.1 Others Market Trends Analysis (2020-2032)

7.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Thermoplastic Polyurethane (TPU) Market Segmentation, by Type

8.1 Chapter Overview

8.2 Polyester

8.2.1 Polyester Market Trends Analysis (2020-2032)

8.2.2 Polyester Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Polyether

8.3.1 Polyether Market Trends Analysis (2020-2032)

8.3.2 Polyether Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Polycaprolactone

8.4.1 Polycaprolactone Market Trends Analysis (2020-2032)

8.4.2 Polycaprolactone Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Thermoplastic Polyurethane (TPU) Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10. Company Profiles

10.1 BASF SE

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Covestro AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Huntsman Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Wanhua Chemical Group Co., Ltd

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Mitsubishi Chemical Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 LyondellBasell Industries N.V.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Eastman Chemical Company

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Kraton Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 PolyOne Corporation (now Avient Corporation)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Teijin Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Polyester

Polyether

Polycaprolactone

Others

By Application

Automotive

Construction

Engineering

Footwear

Hose & Tubing

Wire & Cable

Medical

Synthetic Leather

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Wax Emulsion Market was valued at USD 1.95 Billion in 2023 and is expected to reach USD 2.93 Billion by 2032, growing at a CAGR of 4.66% from 2024-2032.

Coating Additives Market was valued at USD 8.94 Billion in 2023 and is expected to reach USD 13.09 Billion by 2032, growing at a CAGR of 4.33% from 2024-2032.

Graphene Market Size was valued at USD 366.5 Million in 2023 and is expected to grow to USD 4997.1 Million by 2032, exhibiting a CAGR of 33.2% from 2024-2032.

The Low Dielectric Materials Market was USD 1.61 billion in 2023 and is expected to reach USD 2.81 Bn by 2032, growing at a CAGR of 6.44% by 2024-2032.

Plastic Antioxidants Market size was USD 4.16 billion in 2023 and is expected to reach USD 6.93 billion by 2032, growing at a CAGR of 5.84% from 2024-2032.

The Semiconductor Gases Market size was USD 10.38 billion in 2023 and is expected to Reach USD 19.72 billion by 2032, at a CAGR of 7.39% from 2024-2032.

Hi! Click one of our member below to chat on Phone