Thermoplastic Polyolefin (TPO) Market Report Scope & Overview:

Get more information on Thermoplastic Polyolefin (TPO) Market - Request Sample Report

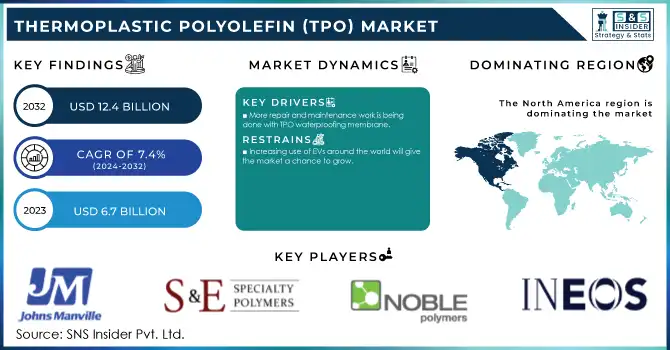

The Thermoplastic Polyolefin (TPO) Market Size was valued at USD 6.7 billion in 2023 and is expected to reach USD 12.4 billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032

The Thermoplastic Polyolefin (TPO) market is driven by evolving supply chain dynamics, regulatory frameworks, and sustainability efforts. Our report explores the industry's shift towards eco-friendly manufacturing through the circular economy, while addressing how consumer demand influences TPO applications. We also examine intellectual property trends, the economic impact of TPO across sectors, and the stringent quality control standards that maintain product consistency. These insights offer a comprehensive understanding of the current market landscape.

Market Dynamics

Drivers

-

Increasing Adoption of Thermoplastic Polyolefins (TPO) in Automotive and Construction Sectors Fuels Market Growth

Increased uptake of Thermoplastic Polyolefin (TPO) materials in automotive and construction markets is the driving force behind growth in the market. The very good properties, such as being lightweight, with durability, and resistant to weathering and UV, make Thermoplastic Polyolefin (TPO) an ideal solution for automotive applications such as bumpers, dashboards, and trim, besides roofing and cladding in the construction industry. With the rising demand for sustainable and cost-effective materials, Thermoplastic Polyolefin (TPO) is an alternative material with a recyclable property and significantly less environmental footprint compared to other materials such as PVC. Material preference is shifting with both industries looking to adopt more eco-friendly solutions. In addition, Thermoplastic Polyolefin (TPO)'s design flexibility, offering the ability to customize by texture, color, and finish, is an additional factor in the increasing usage in these sectors and further drives the market forward.

Restraints

-

Limited Awareness and Understanding of Thermoplastic Polyolefin (TPO) Benefits in Emerging Markets Impeding Market Penetration

Despite the numerous advantages of Thermoplastic Polyolefin (TPO), its adoption in emerging markets remains relatively limited due to a lack of awareness and understanding of its benefits. Many of the developing regions' industries are still working with traditional materials because they remain the most familiar and cost-efficient options in the short term. This material often lacks access to information about the performance, recyclability, and long-term cost benefits of Thermoplastic Polyolefin (TPO)s, which makes its exploration as an alternative material by manufacturers or other businesses somewhat thwarted. Furthermore, emerging markets may not have the necessary infrastructure for the wide-scale adoption of advanced materials such as Thermoplastic Polyolefin (TPO), which can limit its growth. In overcoming such restraint, educational and awareness programs and strategic collaborations with local producers will help encourage the uptake of Thermoplastic Polyolefin (TPO)s in such areas.

Opportunities

-

Growth in the Electric Vehicle Market Presents Lucrative Opportunities for Thermoplastic Polyolefin (TPO) Applications in Automotive Parts

With the rise of the electric vehicle (EV) market, the Thermoplastic Polyolefin (TPO) market is experiencing a substantial level of growth. The properties such as excellent weather resistance, lightweight, and durability of Thermoplastic Polyolefin (TPO) enable it to be an ideal material for electric vehicle components. With the rise of EVs, there is a need for lightweight job materials that require, they are more in demand nowadays, especially with the demand for energy-efficient, low-emission vehicles. TPP is increasingly used in various parts of an EV, such as bumpers, exterior panels, dashboards, and trim inside the vehicle, giving Thermoplastic Polyolefin (TPO) suppliers a huge amount of opportunity in the EV. With the worldwide shift towards electric vehicles gaining momentum, so too will the demand for high-performance, environmentally responsible materials such as Thermoplastic Polyolefin (TPO), ensuring its status as a game-changing material in the automotive market.

Challenge

-

Competition from Alternative Materials with Superior Properties and Lower Costs Limiting Thermoplastic Polyolefin (TPO) Market Share

With numerous alternative materials emerging that provide competitive properties or greater cost savings than Thermoplastic Polyolefin (TPO)s, its penetration in specific application areas may remain limited. An example of an alternative material used in place of Thermoplastic Polyolefin (TPO) or at a comparative cost is that of polyvinyl chloride, thermoplastic elastomers, and polypropylene, depending on the degree of benefit wanted. In high-price sensitivity areas, manufacturers would tend to select alternative materials that do not go for Thermoplastic Polyolefin (TPO), even if there are long-term benefits in favor of Thermoplastic Polyolefin (TPO). This competition would lead to restrictions in Thermoplastic Polyolefin (TPO) growth in cases where cost-cutting is desired at any cost, rather than improving material performance. The way out for this challenge lies in the differentiation offered through innovative product improvement and sustainability aspects.

Segmental Analysis

By Type

In the year 2023, the Compounded Thermoplastic Polyolefin (TPO) segment dominated the Thermoplastic Polyolefin (TPO) market with approximately 60% market share. This is due to Compounded Thermoplastic Polyolefin (TPO)'s mechanical properties such as better tensile strength and impact resistance enabling its wide usage in high-demand applications. For instance, Compounded Thermoplastic Polyolefin (TPO) is used widely in automotive presents in geometric components like bumpers and dashboards, where both appearance and durability are a must. Furthermore, what adds to its versatility and performance-based advantages is its use in roofing membranes and cladding systems as well as other sectors across the construction vertical. Expandability with compounding processes to customize the material properties is another reason for its wide usage in different industrial sectors.

By Application

The Injection Molding application segment dominated the Thermoplastic Polyolefin (TPO) market in 2023 with approximately 45% market share. The need for Thermoplastic Polyolefin (TPO) in this context is because of this material's injection molding capability whereby extremely complex parts having intricate geometries with high precision and quality standards can be achieved economically. Automotive and consumer goods industries own the capability and produce components with functions such as interior panels, connectors, and housings. Thermoplastic Polyolefin (TPO) is often used for injection molding and offers good flexibility for optimized properties, good surface finishes, and performance requirements in a wide range of applications. This fueled the increase in demand for Thermoplastic Polyolefin (TPO) in injection molding applications owing to the growing demand for lightweight and durable components across these sectors.

By End-use Industry

The Automotive industry dominated the Thermoplastic Polyolefin (TPO) market with an approximate share of 55% in 2023. Automotive is the segment with the largest share as it is one of the predominant applications of Thermoplastic Polyolefin (TPO) for a variety of purposes, including many exterior parts as well as several interiors. With an emphasis on reducing weight for cost-effectiveness, Thermoplastic Polyolefin (TPO) is used in a multitude of function-critical applications, as the automotive industry evolves to focus on fuel and efficiency. Moreover, weather resistance, UV resistance, and chemical resistance of the Thermoplastic Polyolefin (TPO) increase the lifespan and durability of automotive parts; hence, Thermoplastic Polyolefin (TPO) will be the first choice in material selection. The shift toward electric vehicles and the demand for lightweight materials, which improve battery functionality, also support the growth of Thermoplastic Polyolefin (TPO) in the automotive industry.

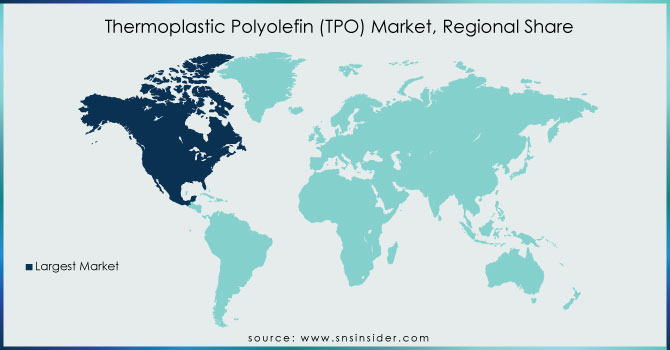

Regional Analysis

The Asia-Pacific region dominated the Thermoplastic Polyolefin (TPO) market in 2023 and holds around 45% of the total global market. This is due to the fast growth of the automotive and construction industries in countries such as China and India. In China, the automotive industry's rapid expansion has resulted in strong demand for lightweight materials like Thermoplastic Polyolefin (TPO), which are critical in producing fuel-efficient vehicles. Thermoplastic Polyolefin (TPO) owes its success to the boom in construction in India concerning both roofing membranes and waterproofing, where Thermoplastic Polyolefin (TPO) has been a pioneer material due to its relatively low cost and durability. In addition, the region's manufacturing capacity and competitive pricing strategies have solidified its status as a leading producer of consumer goods using Thermoplastic Polyolefin (TPO).

Regionally, it is projected that the Asia-Pacific region will be the fastest-growing Thermoplastic Polyolefin (TPO) market, with a significant CAGR during the forecast period. This has been driven by ongoing industrialization and urbanization in developing countries. As an example, expect rapid infrastructure development from China's Belt and Road Initiative, which will create demand for Thermoplastic Polyolefin (TPO) in construction applications. India's growing government support for electric vehicles is likely to lead to increased consumption of lightweight materials such as Thermoplastic Polyolefin (TPO) in the automotive sector. Moreover, the emphasis on sustainable and recyclable materials in the region complements Thermoplastic Polyolefin (TPO)'s environmental benefits, further accelerating its penetration into diverse sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Highlights

-

April 2024: Versalis, Eni's chemical subsidiary, completed the acquisition of Tecnofilm S.p.A., an Italian company specializing in functionalized polyolefins and thermoplastic compounds for footwear and technical goods.

-

March 2024: McClarin Plastics LLC integrated Materia Inc.'s polyolefin thermoset molding facilities, enhancing its capabilities in high-performance composites and molded thermosets with Materia's innovative resin technology.

Key Players

-

Arkema SA (Pebax, Rilsan, Orgasol)

-

Borealis AG (Borstar, Borlink, Borealis Thermoplastic Polyolefin (TPO))

-

Dow Inc. (Dowlex, Affinity, Engage)

-

Exxon Mobil Corporation (ExxonMobil Thermoplastic Polyolefin (TPO), Vistamaxx, Exact)

-

Formosa Plastics Corporation (Formolon, Thermoplastic Polyolefin (TPO) Resin, Formolene)

-

INEOS Olefins & Polymers (INSTA, INFUSE, INEOS Thermoplastic Polyolefin (TPO))

-

LyondellBasell Industries N.V. (Hostalen, Lupolen, Thermoplastic Polyolefin (TPO)flex)

-

Mitsui Chemicals, Inc. (Arpro, Thermoplastic Polyolefin (TPO)-M, TAFMER)

-

SABIC (Lexan, Noryl, Sabic Thermoplastic Polyolefin (TPO))

-

Sumitomo Chemical Co., Ltd. (Sumitomo Thermoplastic Polyolefin (TPO), Sumitomo PA, Duracon)

-

A Berkshire Hathaway Company (Johns Manville Thermoplastic Polyolefin (TPO), ThermalGuard, Thermoplastic Polyolefin (TPO) Roofing Membrane)

-

Alphagary Limited (Alphathene, Alphathene Thermoplastic Polyolefin (TPO), Alphagary Thermoplastic Polyolefin (TPO) Compounds)

-

Asahi Kasei (Asaclean, Zylon, Asahi Thermoplastic Polyolefin (TPO))

-

Elastron (Elastron Thermoplastic Polyolefin (TPO), Elastron X, Elastron TF)

-

GAF (EverGuard, EverGuard Extreme, EverGuard Thermoplastic Polyolefin (TPO))

-

Hexpol AB (Hexpol Thermoplastic Polyolefin (TPO), Hexpol Compound, TPE Masterbatches)

-

Kraton Corporation (Kraton Polymers, Kraton TPE, Kraton G)

-

Mitsubishi Chemical Holding Corporation (TPS, Sunprene, Mitsubishi Thermoplastic Polyolefin (TPO))

-

Noble Polymers (Noble Thermoplastic Polyolefin (TPO), Noble Polymers Compounds, NobleMasterbatch)

-

Polyone Corporation (Versaflex, Geon, Versalloy)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.7 Billion |

| Market Size by 2032 | USD 12.4 Billion |

| CAGR | CAGR of 6.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (In-situ TPO, Compounded TPO, Polyolefin Elastomers (POEs)) •By Application (Film & Sheet, Blow Molding, Injection Molding, Others) •By End-use Industry (Automotive, Building & Construction, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SABIC, Exxon Mobil Corporation, LyondellBasell Industries N.V., INEOS Olefins & Polymers, Dow Inc., Borealis AG, Sumitomo Chemical Co., Ltd., Arkema SA, Mitsui Chemicals, Inc., Formosa Plastics Corporation and other key players |